简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

JustMarkets Review: Regulation, Licences and WikiScore Overview

Abstract:This JustMarkets review provides an objective examination of the regulatory status, licensing framework and WikiScore of the JustMarkets broker.

Overview of JustMarkets on WikiFX

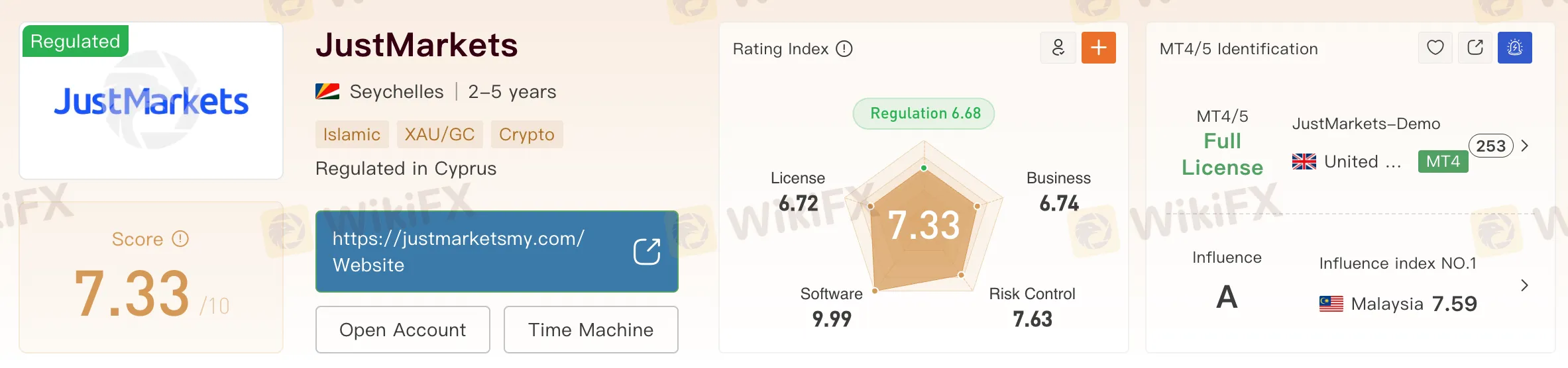

JustMarkets is an international online broker offering forex and derivative trading services to clients in multiple regions. According to WikiFX, JustMarkets currently holds a WikiScore of 7.33 out of 10. This score places the broker in the upper range compared with many brokers listed on the platform and indicates a generally stable regulatory and operational profile.

View WikiFX's full reivew on JustMarkets here: https://www.wikifx.com/en/dealer/3967603270.html

The WikiFX scoring system evaluates brokers across several dimensions, including regulatory licences, licence quality, business scale, software quality and risk exposure. The WikiScore is designed to help traders understand relative strengths and potential risks, rather than to serve as a recommendation or guarantee of safety.

For the JustMarkets broker, the score reflects its multi-jurisdiction regulatory coverage and the presence of licences issued by both onshore and offshore financial authorities.

JustMarkets Regulation Structure

JustMarkets regulation is built around four licences issued by financial regulators in Europe, Africa and offshore jurisdictions. Each licence allows the broker to operate within a defined legal framework and carries different supervisory standards and investor protection requirements.

Cyprus Securities and Exchange Commission

JustMarkets is authorised by the Cyprus Securities and Exchange Commission under licence number 401/21. This licence is categorised as a Derivatives Trading Licence using a straight-through-processing model.

CySEC is the national financial regulator of Cyprus and operates under the regulatory framework of the European Union. Firms authorised by CySEC are required to comply with European financial regulations, including rules on capital adequacy, segregation of client funds and transparency in business conduct. CySEC also supervises compliance through reporting requirements and regulatory inspections.

Within the context of this JustMarkets review, the CySEC licence represents one of the stronger regulatory elements of the brokers profile. It enables JustMarkets to provide regulated services within the European Economic Area, subject to applicable cross-border rules.

Financial Sector Conduct Authority of South Africa

JustMarkets also holds a Derivatives Trading Licence issued by the Financial Sector Conduct Authority of South Africa under licence number 51114. The FSCA is responsible for regulating market conduct in the South African financial sector and overseeing financial service providers operating within its jurisdiction.

The FSCA focuses on consumer protection, fair treatment of clients and compliance with local financial laws. Licensed entities are expected to meet conduct standards, maintain internal controls and provide clear disclosures to clients.

For the JustMarkets broker, the FSCA licence expands regulatory oversight into the African market and adds another recognised authority to its regulatory framework.

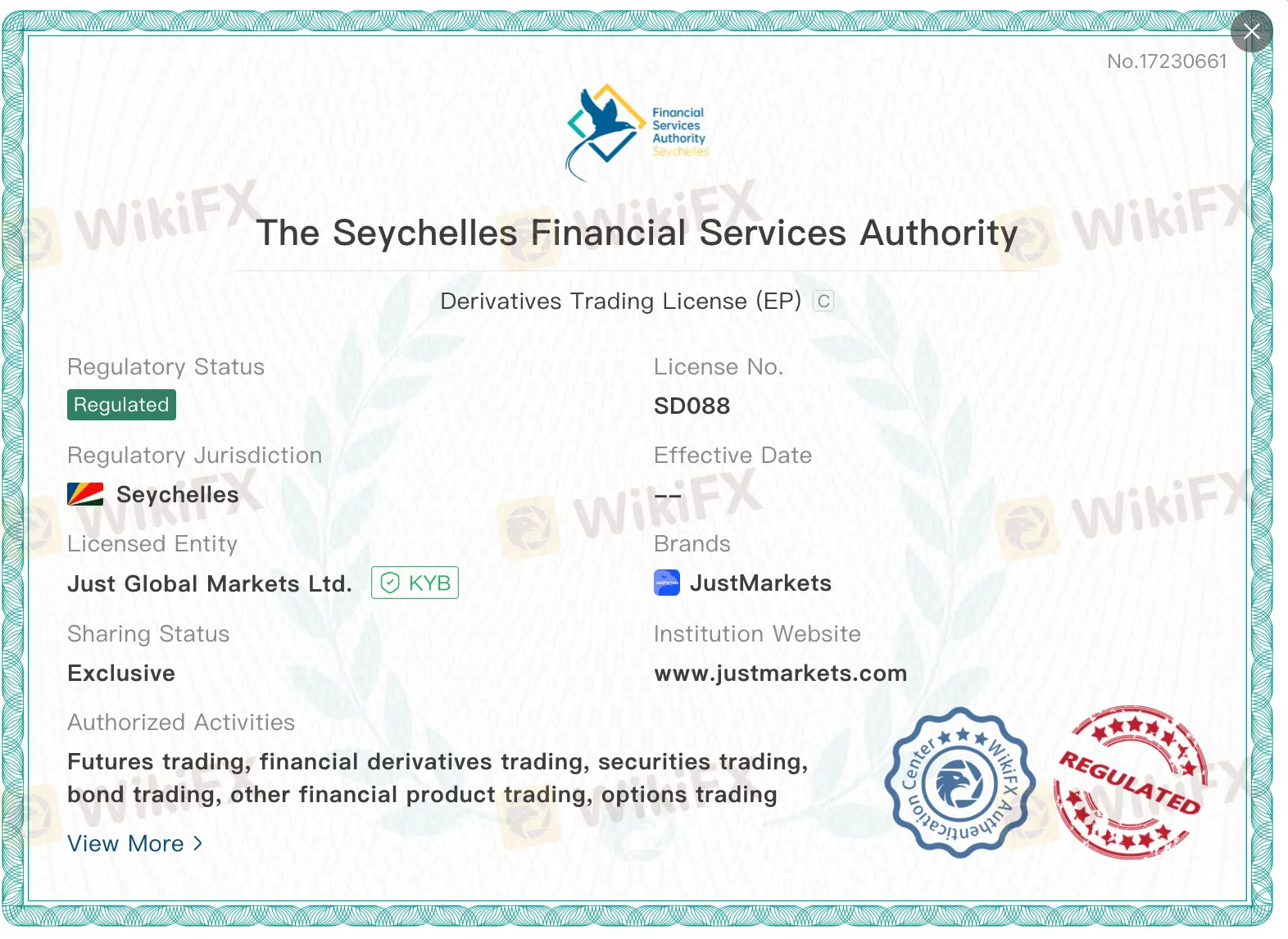

Seychelles Financial Services Authority

In addition, JustMarkets is licensed by the Seychelles Financial Services Authority under licence number SD088. This licence is classified as a Derivatives Trading Licence and is considered an offshore regulation.

The Seychelles FSA regulates non-bank financial services providers registered in Seychelles. Offshore regulators typically impose less stringent requirements than major onshore regulators, and investor protection measures may differ in scope and enforcement strength.

In terms of JustMarkets regulation, the Seychelles licence allows the broker to serve international clients in jurisdictions where European or regional licences may not apply. While it provides a legal basis for operation, it is generally regarded as offering a lower level of regulatory protection compared with authorities such as CySEC.

British Virgin Islands Financial Services Commission

JustMarkets is also authorised by the British Virgin Islands Financial Services Commission under a Market Making Licence, with licence number SIBA L 24 1177. The BVI FSC oversees financial services companies incorporated in the British Virgin Islands and regulates activities such as securities dealing and market making.

Market-making licences permit brokers to act as counterparties to client trades. The BVI FSC focuses on corporate governance, registration requirements and compliance with local securities legislation. As with other offshore jurisdictions, regulatory standards are generally lighter than those of major financial centres.

This licence contributes to the JustMarkets brokers global operational structure, particularly for international business conducted outside Europe and Africa.

Conclusion

This JustMarkets review shows a broker with a broad regulatory footprint spanning multiple jurisdictions. JustMarkets regulation includes authorisation by the Cyprus Securities and Exchange Commission, the Financial Sector Conduct Authority of South Africa, the Seychelles Financial Services Authority and the British Virgin Islands Financial Services Commission.

Each licence carries different regulatory obligations and levels of oversight, with European regulation generally regarded as more stringent than offshore supervision. The WikiScore of 7.33 positions the JustMarkets broker as moderately well rated within the global broker landscape.

As with any broker evaluation, regulatory information should be considered alongside other factors such as trading conditions, client protections and individual risk tolerance. WikiFX presents this information as a reference to support informed decision-making rather than as an endorsement.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

German Capital Flows Heavy into China, Defying Trade War Risks

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Currency Calculator