Perfil de la compañía

| ADMIS Resumen de la revisión | |

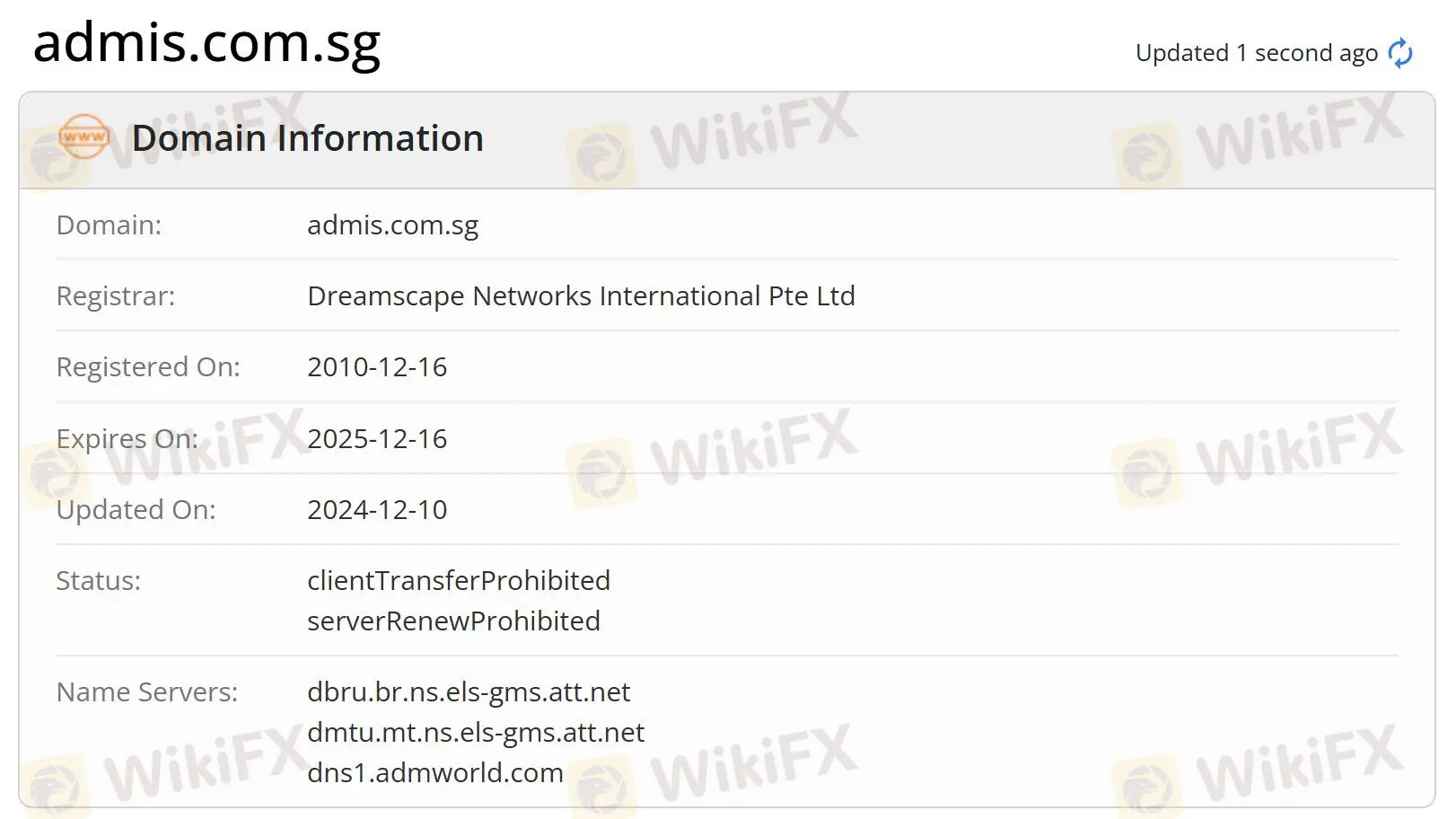

| Fundado | 2010 |

| País/Región Registrado | Hong Kong |

| Regulación | SFC |

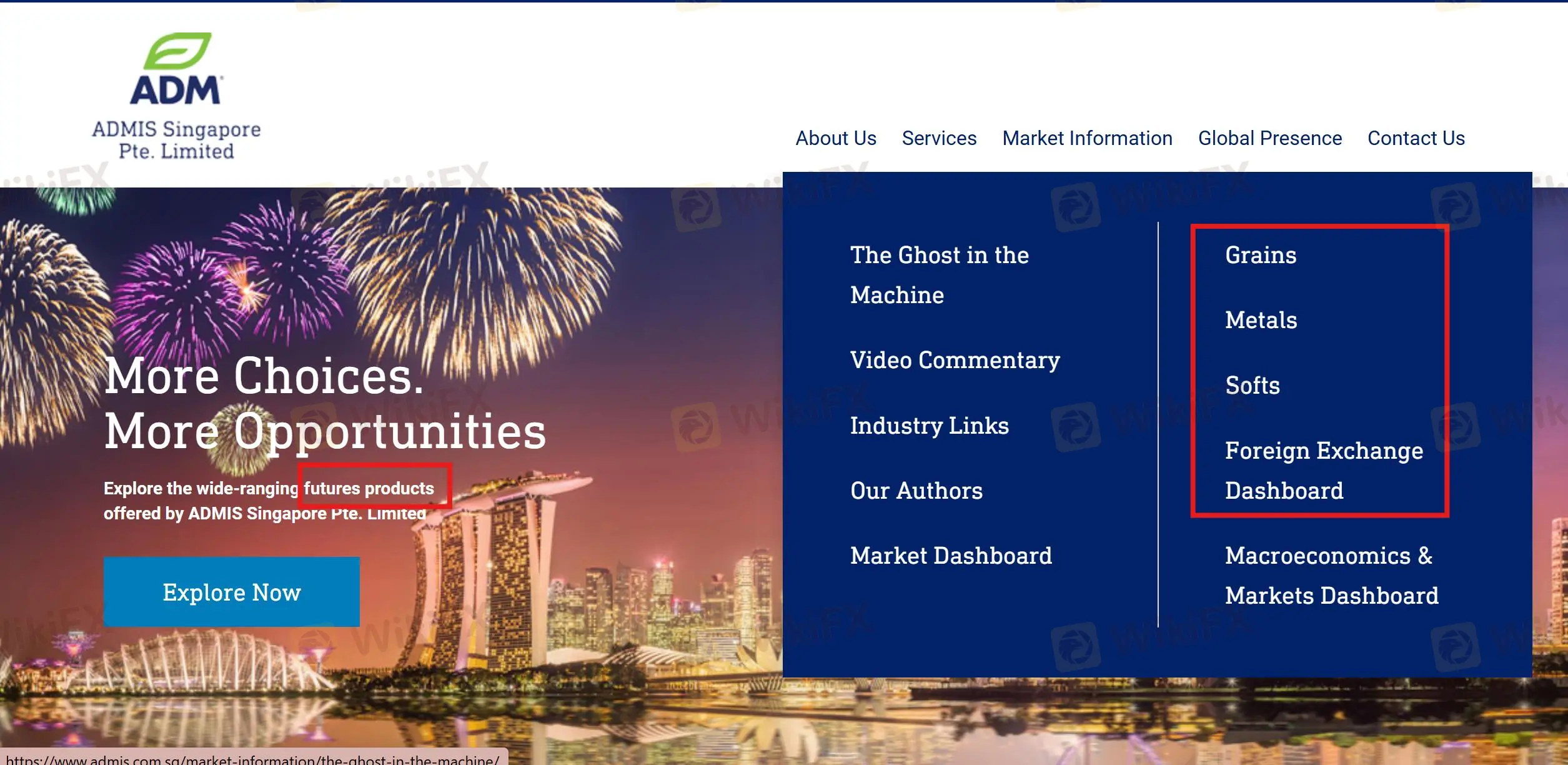

| Instrumentos de Mercado | Futuros de granos, metales, productos suaves y divisas |

| Cuenta Demo | / |

| Apalancamiento | / |

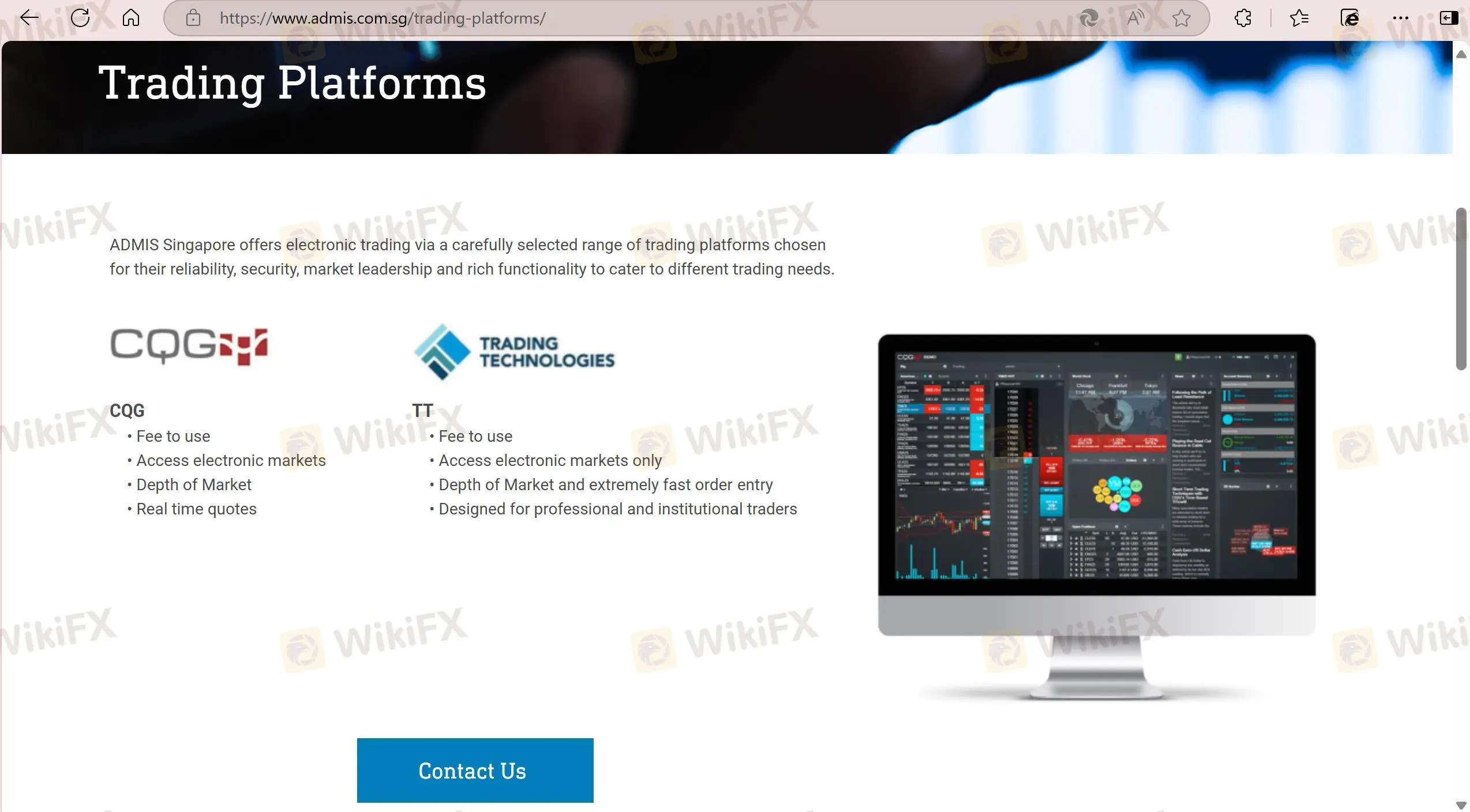

| Plataforma de Trading | CQG, TT |

| Depósito Mínimo | / |

| Soporte al Cliente | Tel: +65-6632-3000 |

| Email: sales@admis.com.sg | |

| Dirección: 230 Victoria Street Bugis Junction Towers #11-06 Singapore 188024 | |

ADMIS se registró en 2010 en Hong Kong, es un broker especializado en trading de futuros. Utiliza CQG y TT como sus plataformas de trading, y está regulado por SFC. Sin embargo, no revela mucha información sobre las cuentas y los detalles de trading.

Pros y Contras

| Pros | Contras |

| Tiempo de operación prolongado | Sin oficina física |

| Estructura de tarifas poco clara | |

| Sin MT4 o MT5 | |

| Opciones de pago desconocidas |

¿Es ADMIS Legítimo?

Sí, ADMIS está regulado por la Comisión de Valores y Futuros de Hong Kong (SFC).

| País Regulado | Regulador | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Comisión de Valores y Futuros de Hong Kong (SFC) | Regulado | ADMIS Hong Kong Limited | Operaciones con contratos de futuros | ACP509 |

Investigación de Campo de WikiFX

El equipo de investigación de campo de WikiFX visitó la dirección regulatoria de ADMIS en Hong Kong, pero no encontró su oficina física.

¿Qué puedo operar en ADMIS?

ADMIS ofrece una amplia gama de productos futuros. Además, ofrece información de mercado relacionada con granos, metales, productos suaves y divisas.

Plataforma de Trading

ADMIS utiliza CQG y Trading Technologies (TT) como sus plataformas de trading, y no admite MT4 o MT5.

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| CQG | ✔ | PC, web | / |

| Trading Technologies | ✔ | PC, web | / |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders experimentados |

hung816

Japón

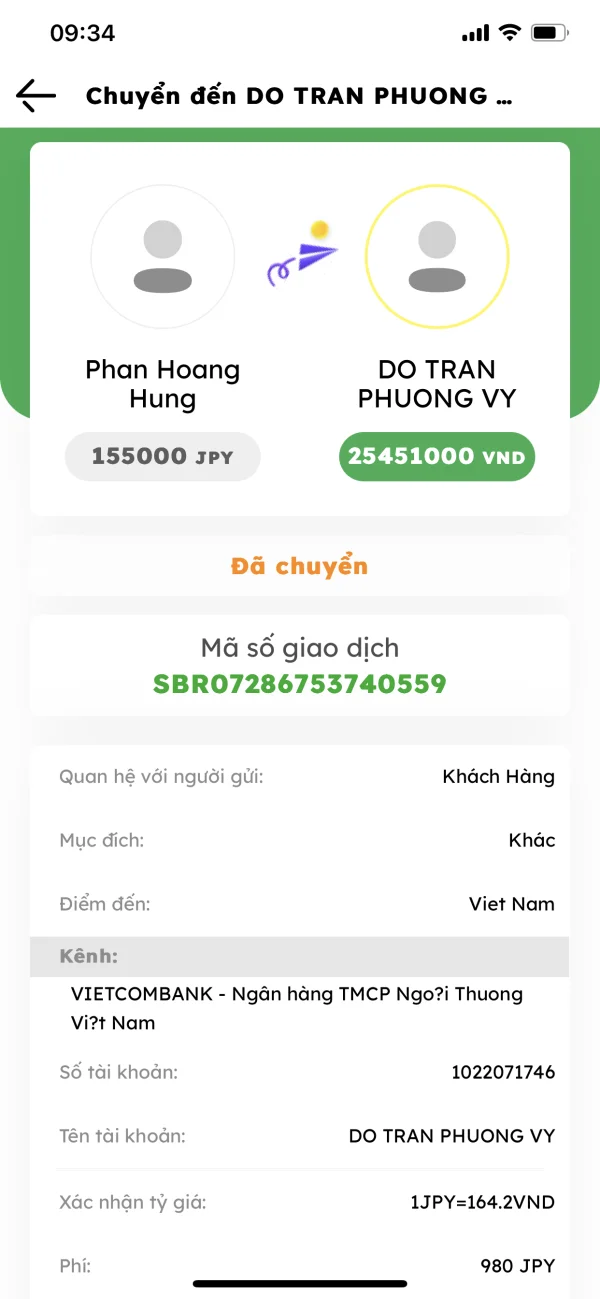

Estimado cliente, necesito responder sobre el progreso de la orden de compraventa de Vietnam Debt Trading Company Limited, con garantía del Ministerio de Finanzas del Gobierno de Vietnam. Su orden de compraventa de tesorería presenta un estado inusual debido a una transferencia de dinero (cantidad excesiva, sospecha de lavado de dinero). Vietnam Debt Trading Company Limited, con garantía del Ministerio de Finanzas del Gobierno de Vietnam, tiene como objetivo garantizar la seguridad de los fondos de la empresa y evitar cualquier riesgo oculto. Actualmente, esta orden de compraventa ha sido congelada. Para que el dinero de su empresa se transfiera de forma eficaz y segura a su cuenta bancaria, Vietnam Debt Trading Company Limited, con garantía del Ministerio de Finanzas del Gobierno de Vietnam, le solicita: Número de nota: 20230825.6192061 Sr. PHAN HOANG HUNG 1: Teléfono: 08075008346 2: Correo electrónico: hungphan3051999@gmail.com 3: NúmeroMonto del retiro: 205.643$ = 4.935.432.000 VND 4: Nombre del banco: Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) 5: Número de cuenta bancaria: 050111039736 6: Nombre del titular de la cuenta: TRAN THI KIM NGOC El monto 205.643$ = 4.935.432.000 VND ha sido sellado. Debe pagar la comisión de cambio de moneda; luego, Vietnam Debt Trading Company Limited, con la garantía del Ministerio de Finanzas del Gobierno de Vietnam, emitirá una orden de retiro para usted. - La comisión de cambio de moneda se aplica al 2%. Conversión 205.643$ = 4.935.432.000 VND x 0.02 = 98.708.640 VND Explique que, una vez completado el pago, el monto se convertirá automáticamente en una transferencia bancaria y se transferirá al Banco Estatal de Vietnam. - Solicitud del 25/08/2023 al 05/09/2023: debe abonar el importe de 98.708.640 VND. Después de abonar el importe total {{1026 VND, Vietnam Debt Trading Company Limited - Ministerio de Finanzas, con la garantía del Gobierno de Vietnam, reembolsará el importe de 98.708.640 VND 30 días después de la fecha de pago del importe total de 98.708.640 VND. Si no paga el importe total de 98.708.640 VND después del 5 de septiembre de 2023, el expediente se enviará al Departamento de Planificación y Finanzas del Ministerio de Seguridad Pública para su procesamiento y liquidación. Gracias.

Exposición

FX1519754694

Hong Kong

El servicio al cliente en ADMIS demostró ser de primera categoría. Tenía un sentido de responsabilidad que no se encuentra en ningún lado. Las respuestas fueron rápidas y las soluciones proporcionadas fueron adecuadas. Me sentí como si tuviera un aliado confiable en mi viaje comercial. Lo que también me impresionó fue la velocidad del proceso de retirada. Recibir fondos de ADMIS fue como recibir una entrega urgente, rápida y sin demoras innecesarias.

Positivo

FX7287257892

Reino Unido

tan increíble, gané 100,000$, el exchange me ayudó a retirar y depositar sin problemas. ¡gracias!

Positivo

FX1993775032

Vietnam

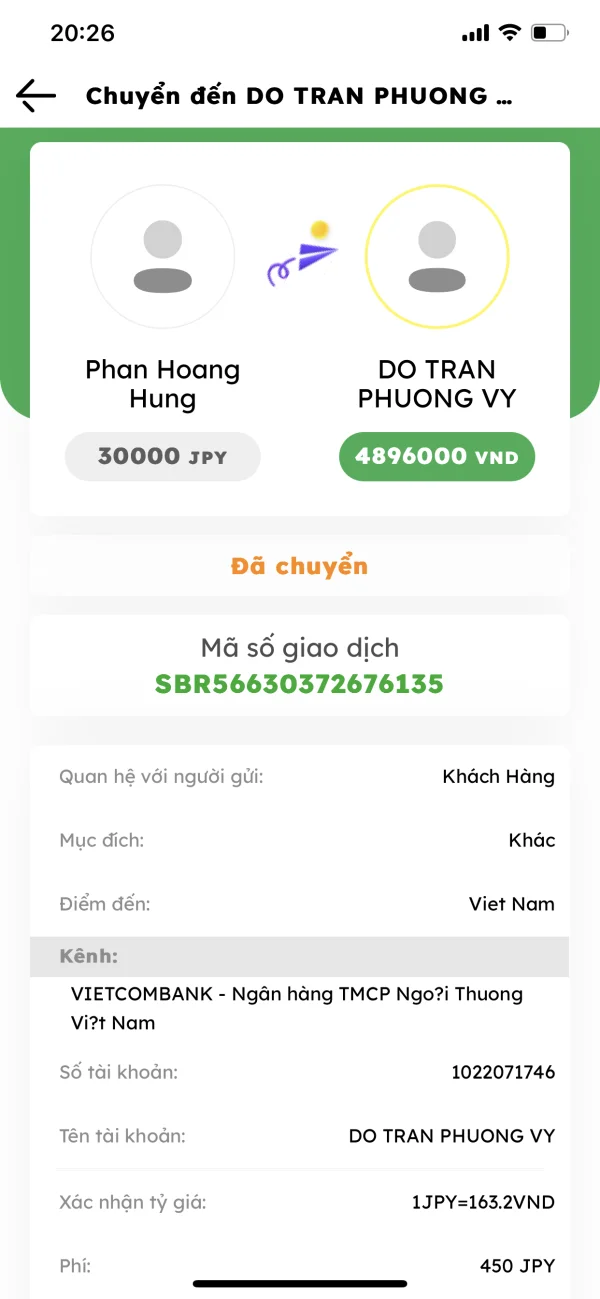

Mi percepción personal es que el servicio al cliente es entusiasta y ofrece soporte 24/7. El proceso de depósito y retiro se maneja rápidamente. La plataforma de negociación funciona bien, sin errores durante las transacciones.

Positivo

时尚阳光

Ecuador

Personalmente, creo que este ADMISI no es malo, pero vi información mala en el sitio web de wikifx y me da un poco de miedo. Esta investigación de campo muestra que no tiene una oficina en el Reino Unido. ¿Significa eso que es un estafador? ¿Debo detener la pérdida a tiempo?

Positivo

FX1023300450

Reino Unido

El soporte al cliente de este bróker no es tan profesional, y no ofrecen chat en línea. Recuerdo que les envié una consulta y nadie me respondió, lo cual es bastante extraño. Descubrí algunos problemas: falta de detalles sobre las tarifas, información poco clara sobre el depósito mínimo... ¿Quién puede decirme cómo funciona esta plataforma?

Neutral