Buod ng kumpanya

| NINJA TRADERBuod ng Pagsusuri | |

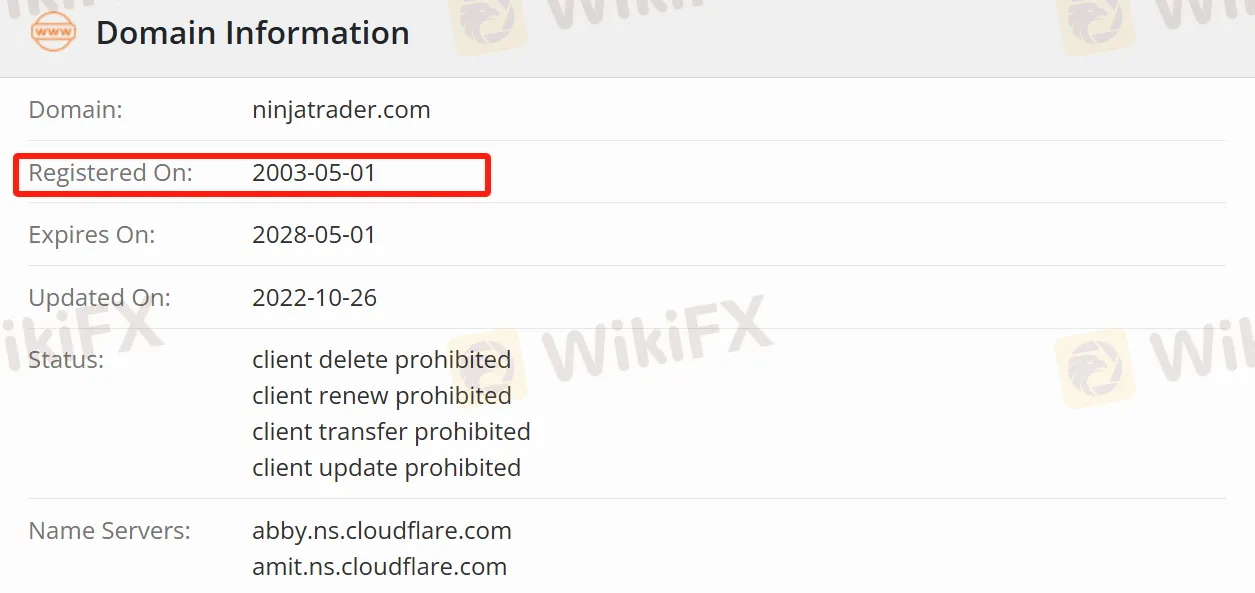

| Nakarehistro Noong | 2003-05-01 |

| Nakarehistrong Bansa/Rehiyon | Estados Unidos |

| Regulasyon | Malahayup na Clone |

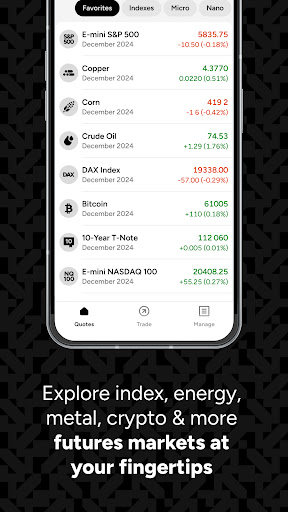

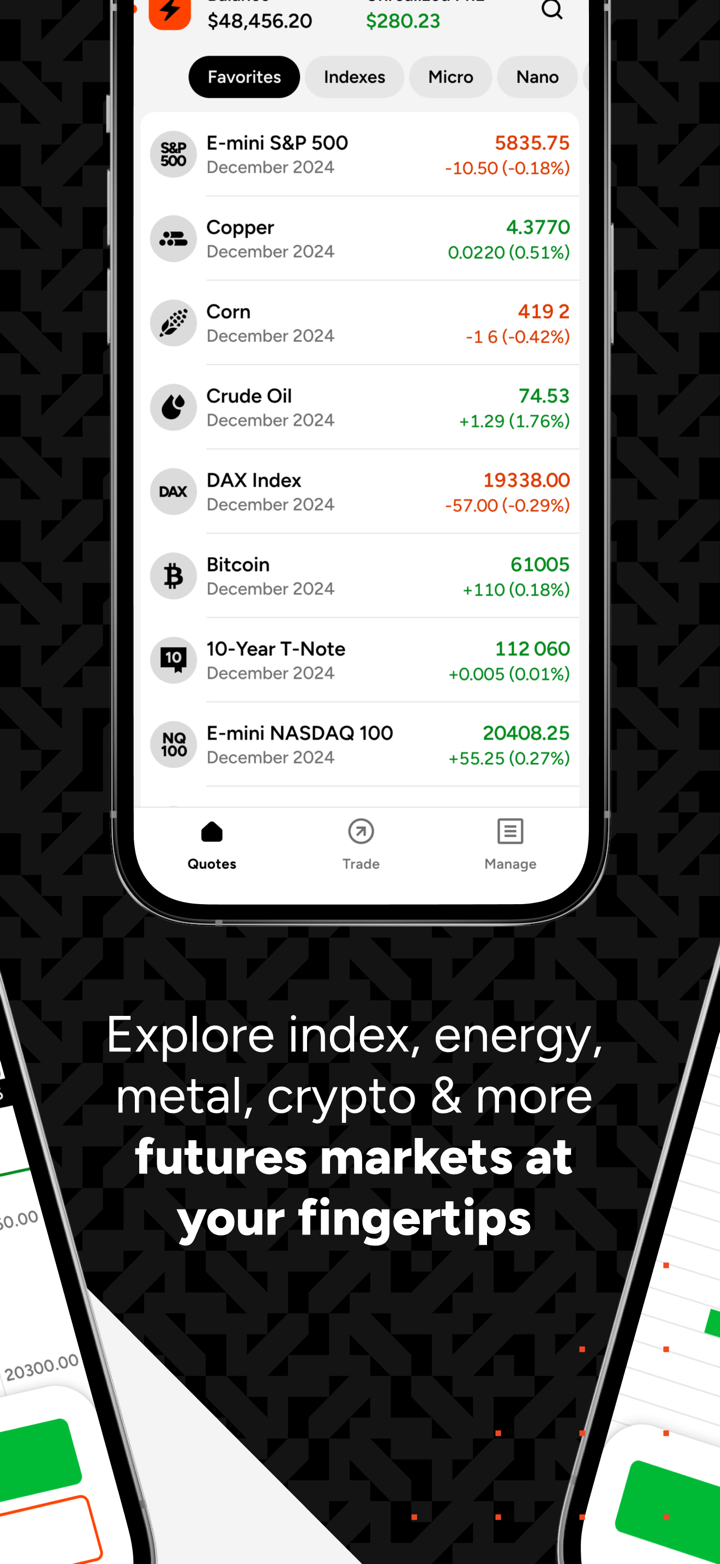

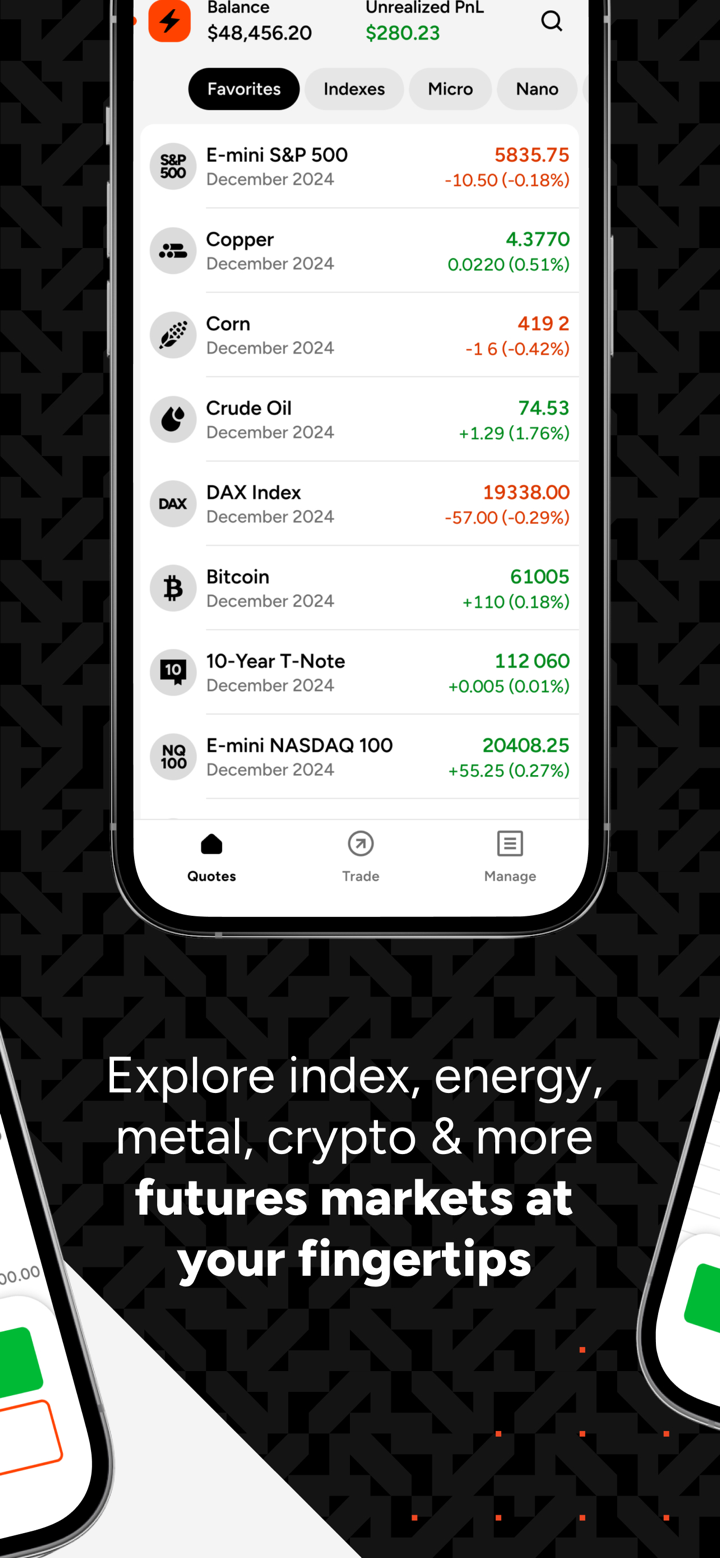

| Mga Kasangkapan sa Merkado | Kontrata ng Index futures, Kontrata ng Cryptocurrency futures, Kontrata ng Metal futures, at Kontrata ng Energy futures |

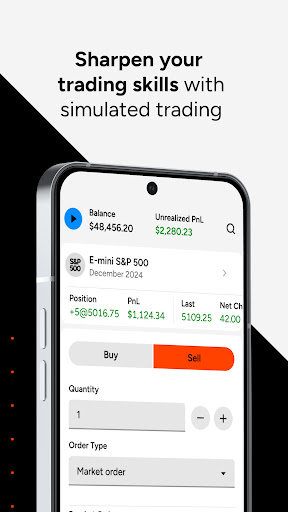

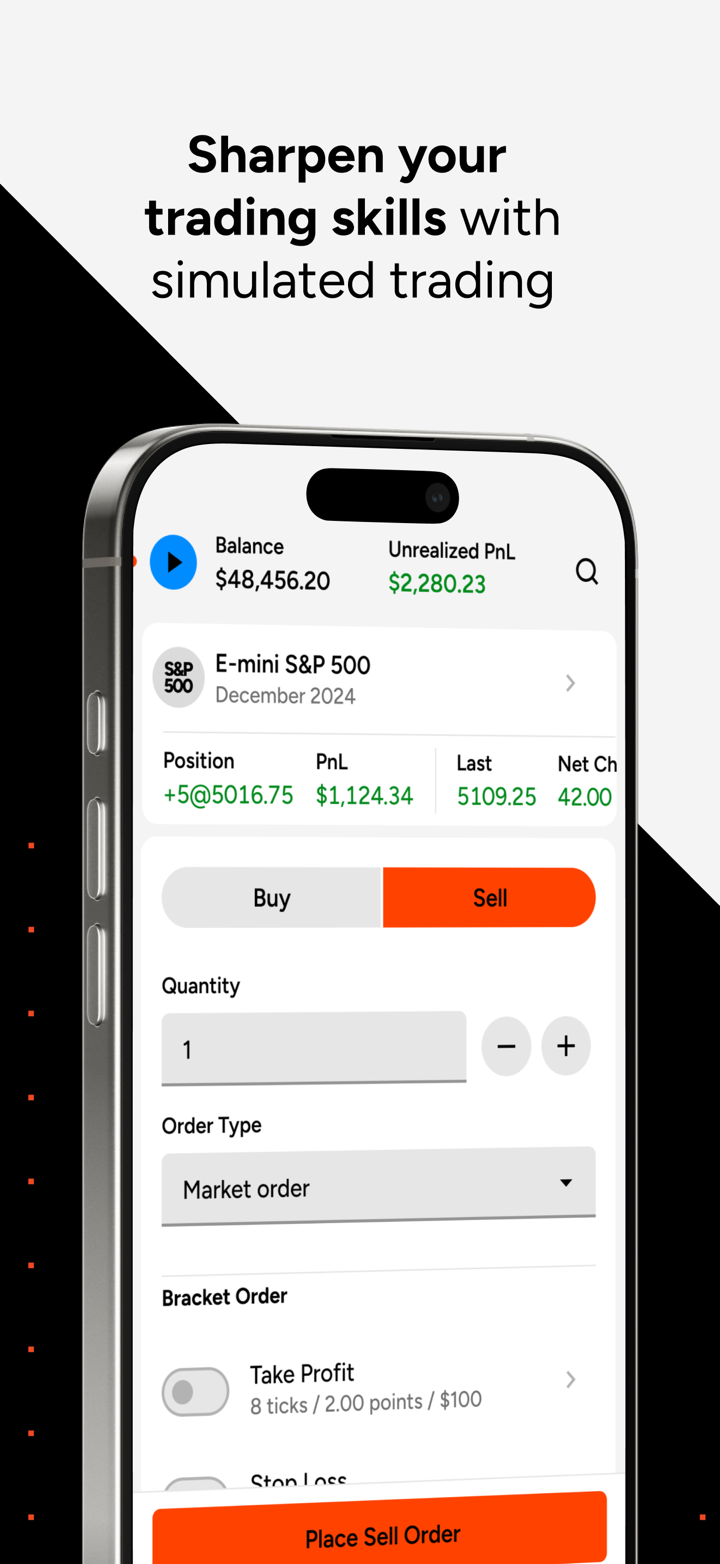

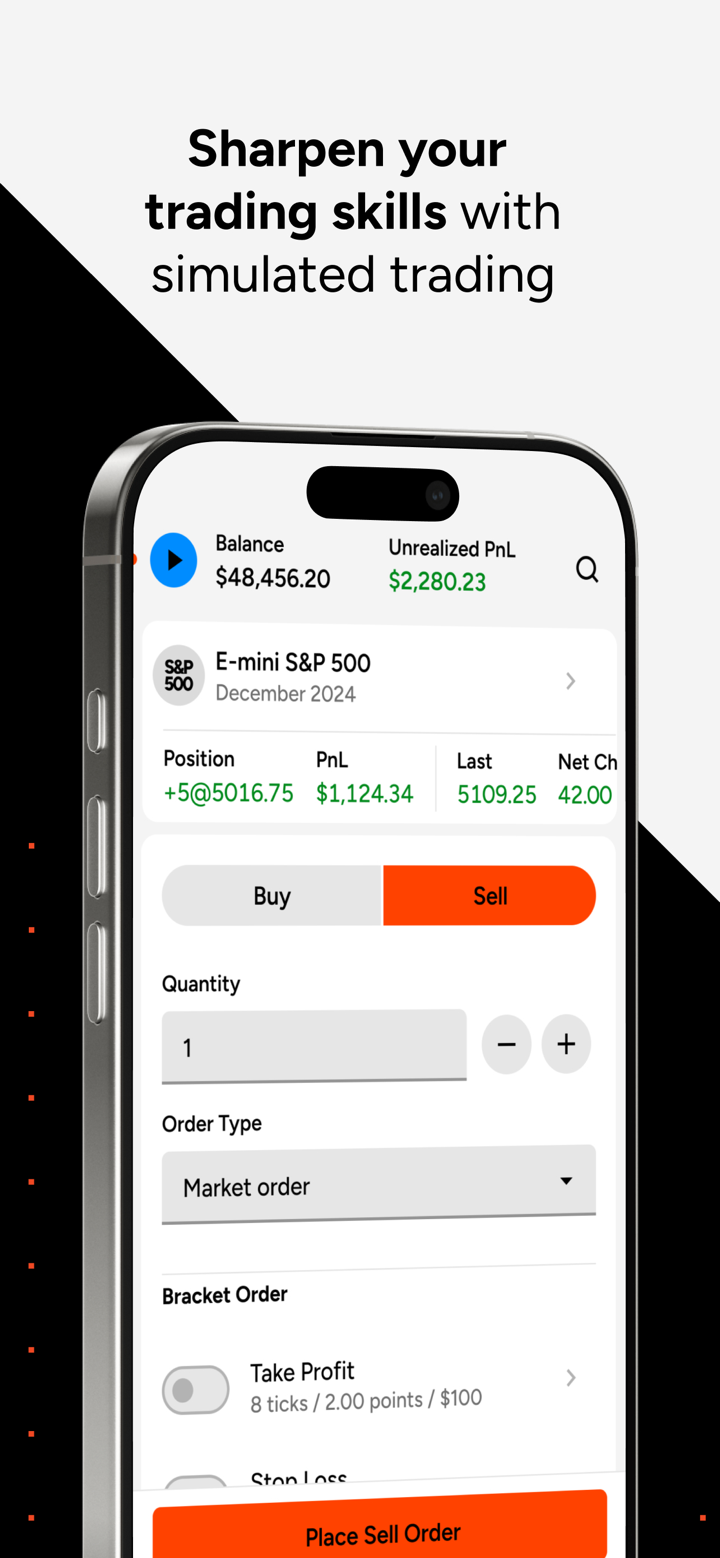

| Simulated Trading | ✅ |

| Platform ng Paggagalaw | NinjaTrader (Desktop, Web, at Mobile) |

| Minimum na Deposito | Hindi |

| Suporta sa Customer | 800-496-1683 |

| support@ninjatrader.com | |

| Live Chat | |

| Twitter, Facebook, YouTube, LinkedIn, Instagram | |

NINJA TRADER Impormasyon

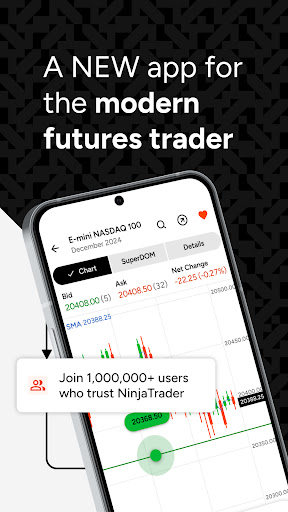

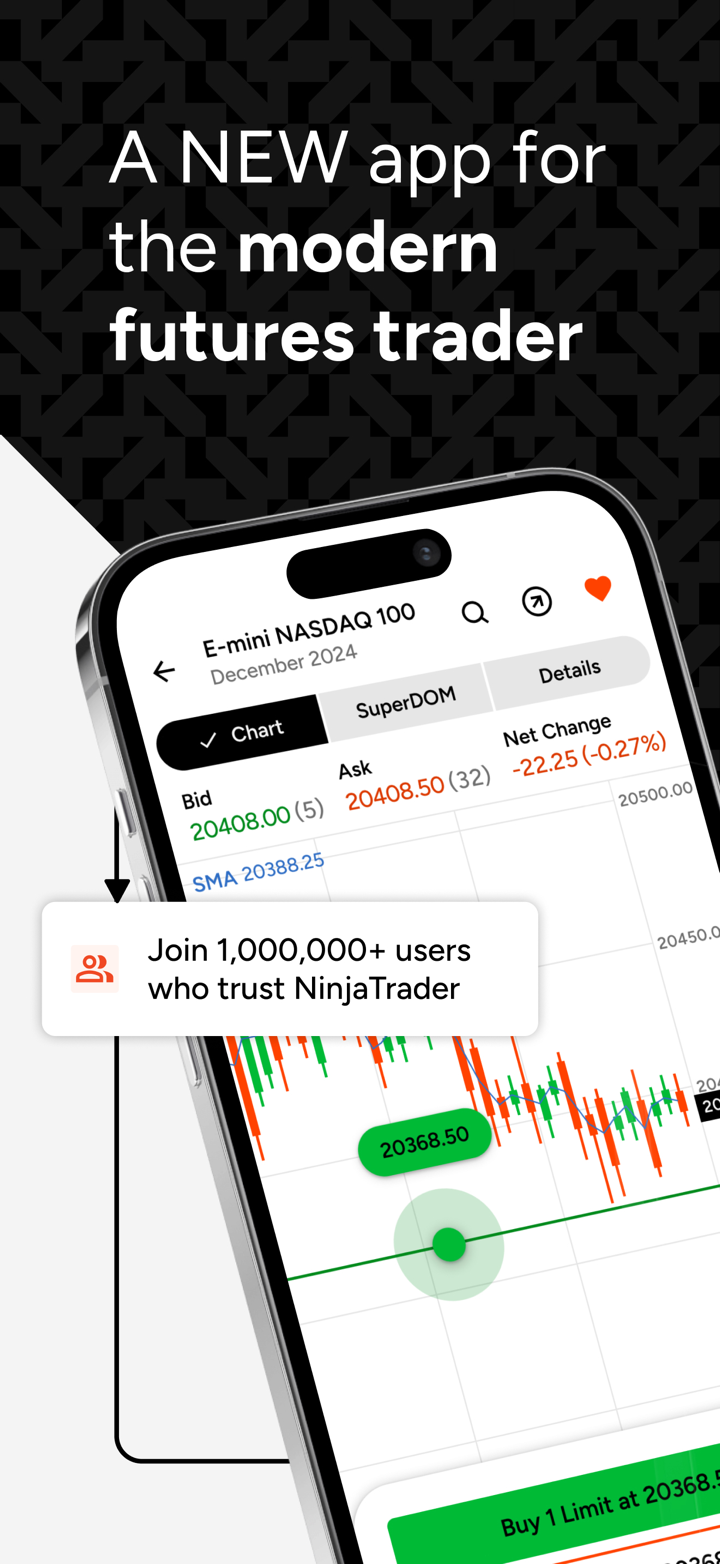

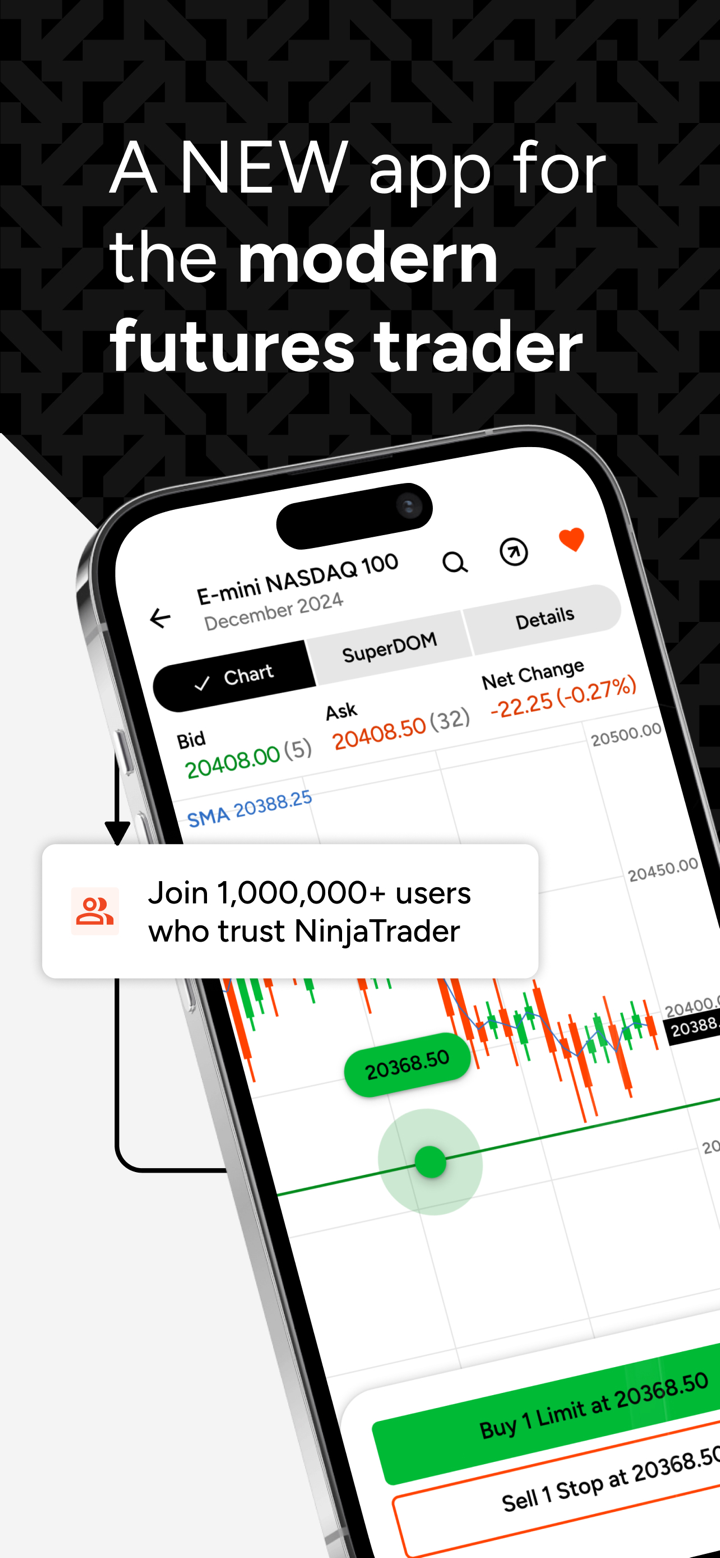

Ang NinjaTrader ay isang kumpanya ng brokerage na nagspecialize sa futures trading. Walang kinakailangang minimum na deposito, nag-aalok ng mababang margin at komisyon, at nagbibigay ng platform para sa pagsasagawa ng kalakal sa iba't ibang mga device. Sinusuportahan ng platform ang mga pangunahing global na merkado ng futures, na sumasaklaw sa higit sa 100 na kontrata ng futures tulad ng mga index, cryptocurrencies, metal, at energy.

Mga Benepisyo at Kons

| Mga Benepisyo | Kons |

| Walang kinakailangang minimum na deposito | Malahayup na Clone |

| Mabait sa mga maliliit na mangangalakal | Di-malinaw na impormasyon sa account |

| Multi-terminal integrated platform | Relatively single trading variety (futures only) |

| Libreng pagsasanay sa pag-trade | |

| Mababang Margins ($50) | |

| Mababang Komisyon ($0.09 bawat kontrata) |

Tunay ba ang NINJA TRADER?

Ang NinjaTrader ay isang sumusunod sa regulasyon na broker na nireregulate ng National Futures Association (NFA) sa Estados Unidos (NFA number: 0339976), ngunit ang kanyang status sa regulasyon ay nakalista bilang "Malahayup na Clone". Inirerekomenda na bigyang prayoridad ng mga mangangalakal ang mga broker na may mahigpit na regulasyon para sa kanilang mga aktibidad sa trading.

Ano ang Maaari Kong I-trade sa NINJA TRADER?

Nag-aalok ang NinjaTrader ng higit sa 100 na kontrata ng futures para sa trading - indices, cryptocurrencies, metals, at energy.

| Mga Tradable na Kasangkapan | Supported |

| Index futures contracts | ✔ |

| Cryptocurrency futures contracts | ✔ |

| Metal futures contracts | ✔ |

| Energy futures contracts | ✔ |

NINJA TRADER Mga Bayad

Ang mga mangangalakal ay maaaring magsimula ng kanilang kalakalan sa broker ng mga hinaharap na walang minimum na deposito, may araw-araw na margin sa kalakalan na $50 at isang komisyon na mababa hanggang $0.09 bawat mikro kontrata. Ang mga sikat na merkado ng hinaharap ay nangangailangan lamang ng margin na $500.

Mga Plano sa Presyo

| Libre | Buwanan | Buhay |

| Magbayad habang nagtetrade nang walang buwanang bayad | Bawasan ang iyong komisyon bawat trade | Pinakamababang Komisyon at Order Flow + Kasamang Add-On |

| $0.35 / Mikro$1.29 / StandardKomisyon bawat side | $0.25 / Mikro$0.99 / StandardKomisyon bawat side | $0.09 / Mikro$0.59 / StandardKomisyon bawat side |

| $0 (Walang bayad sa plano kada buwan) | $99 kada buwan | $1,499 (isang beses na bayad) |

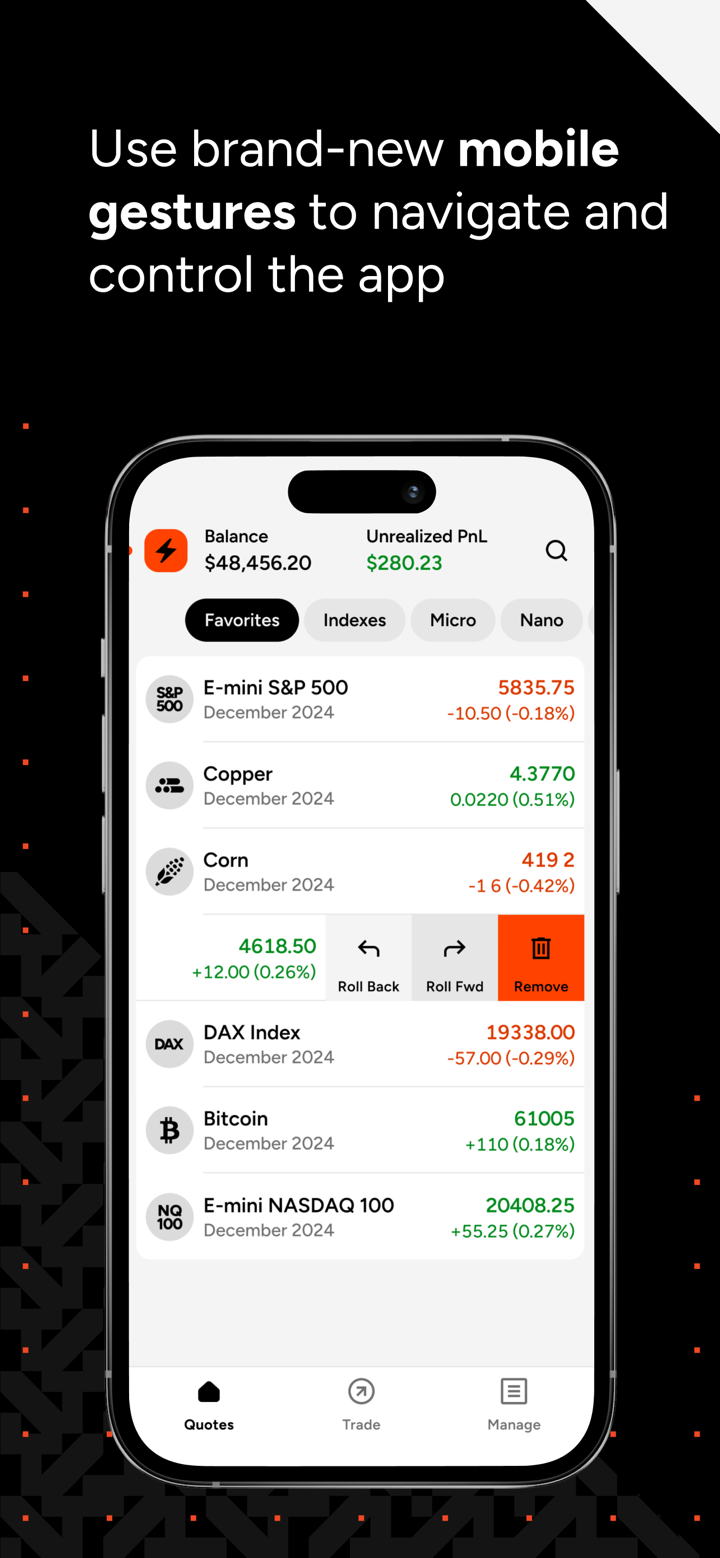

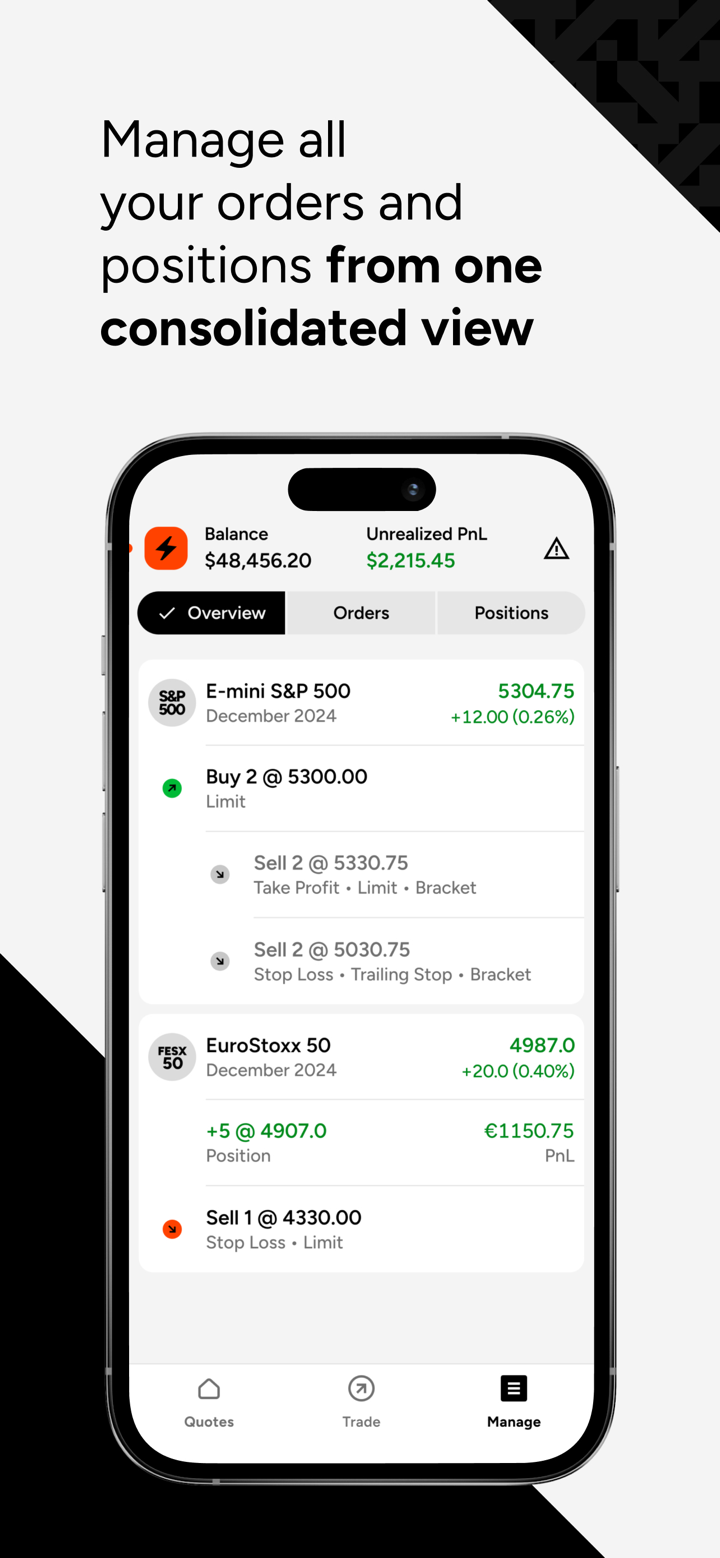

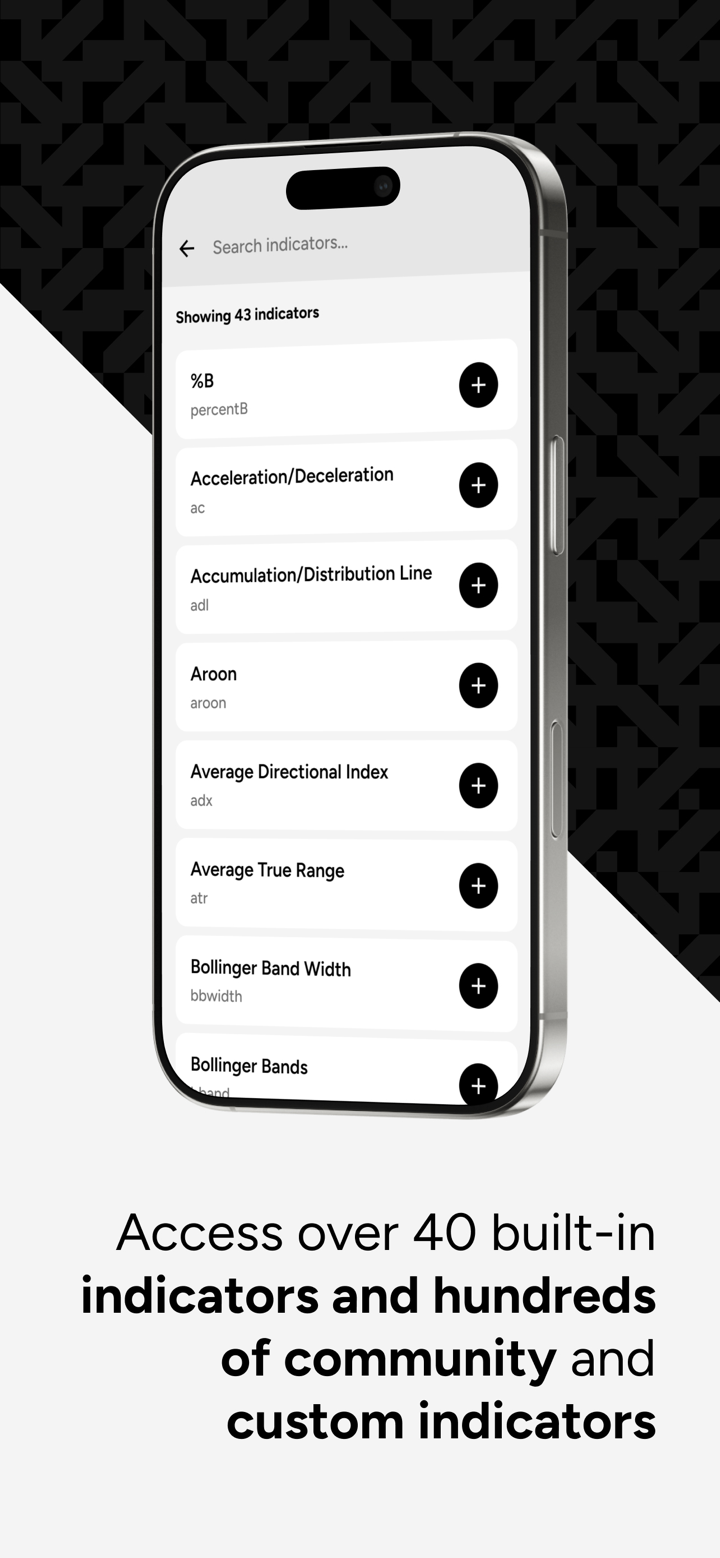

Plataforma ng Kalakalan

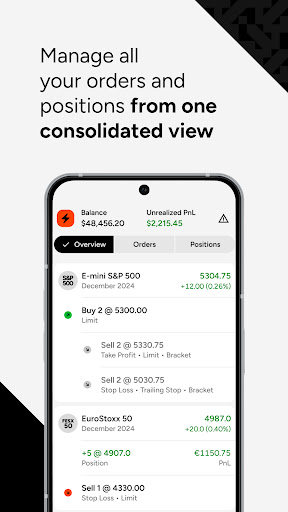

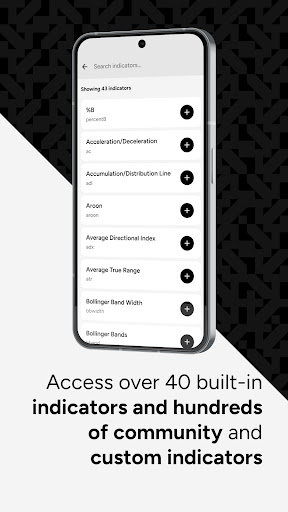

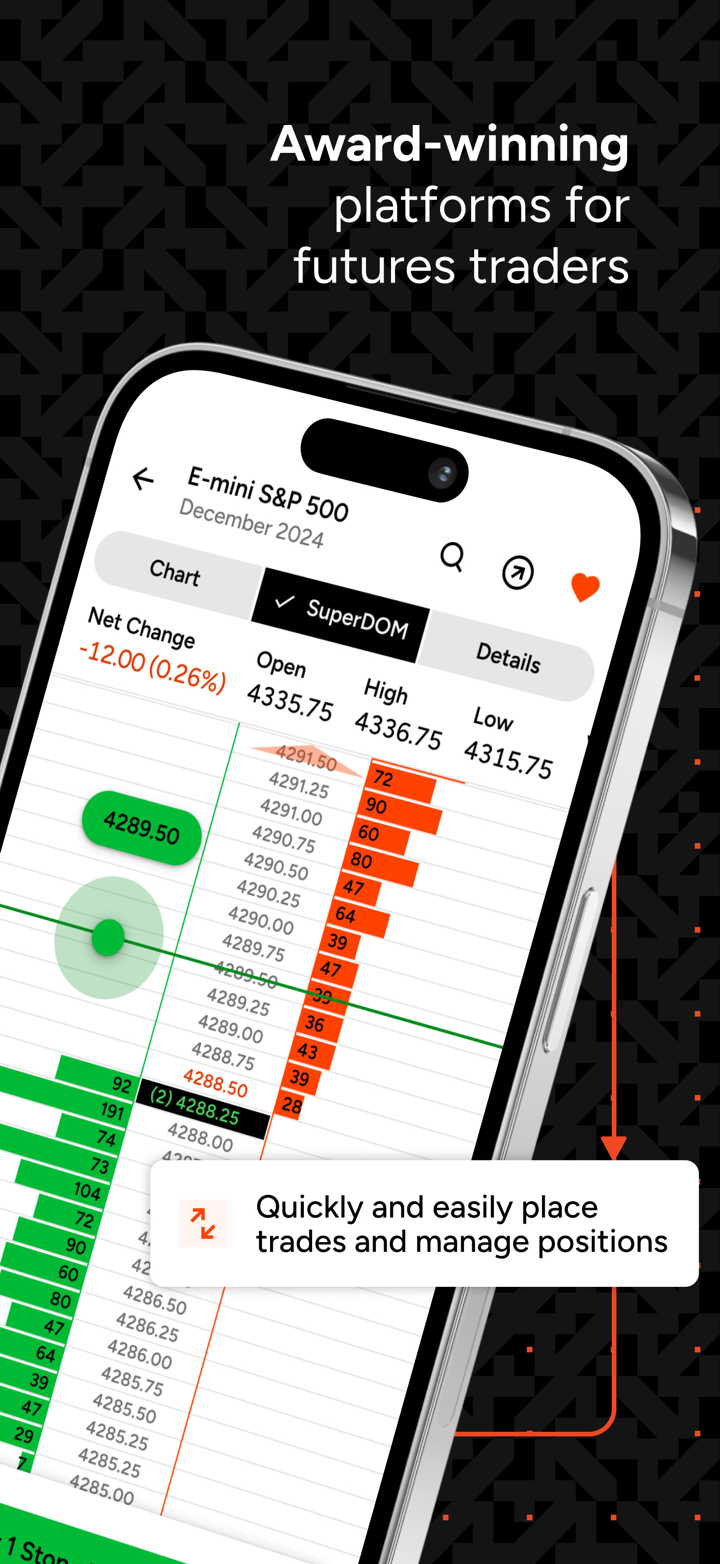

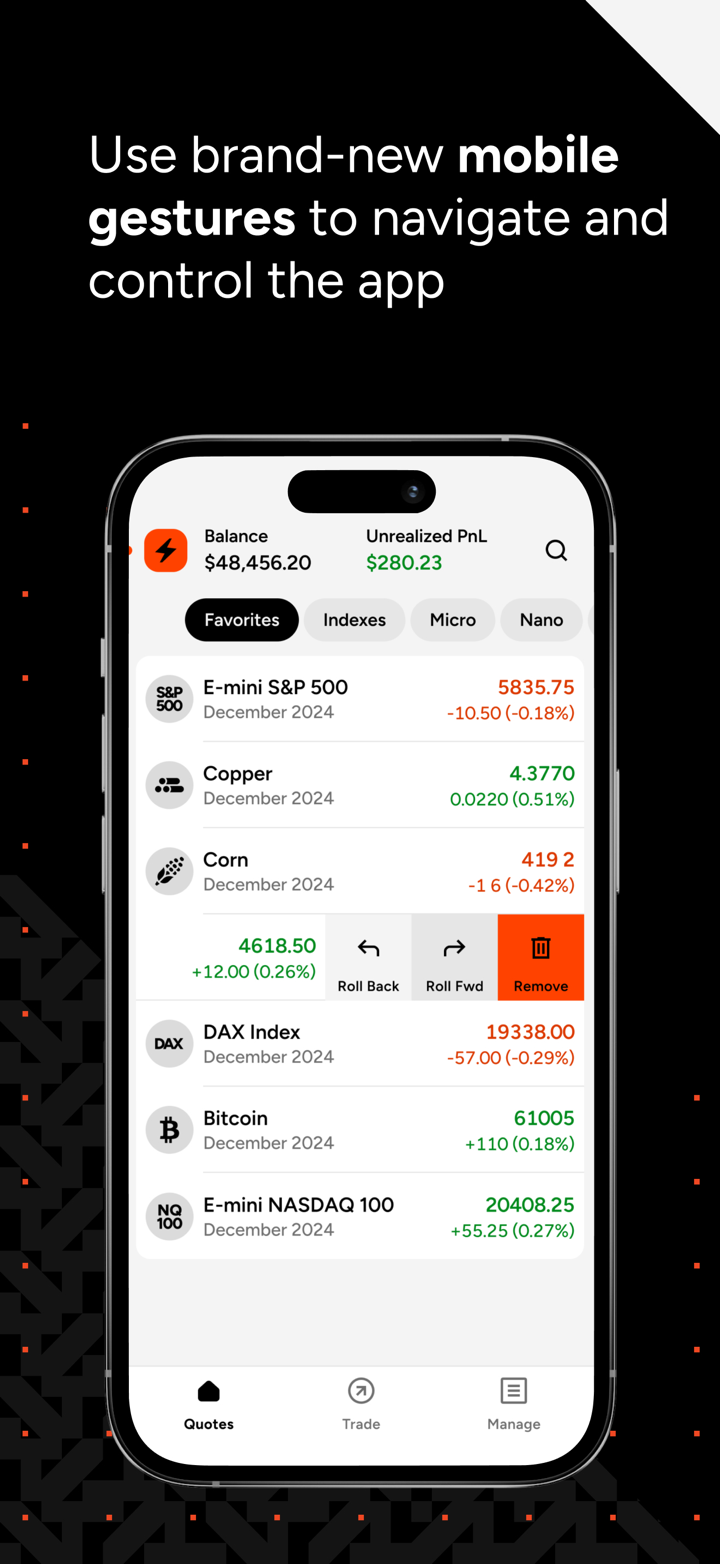

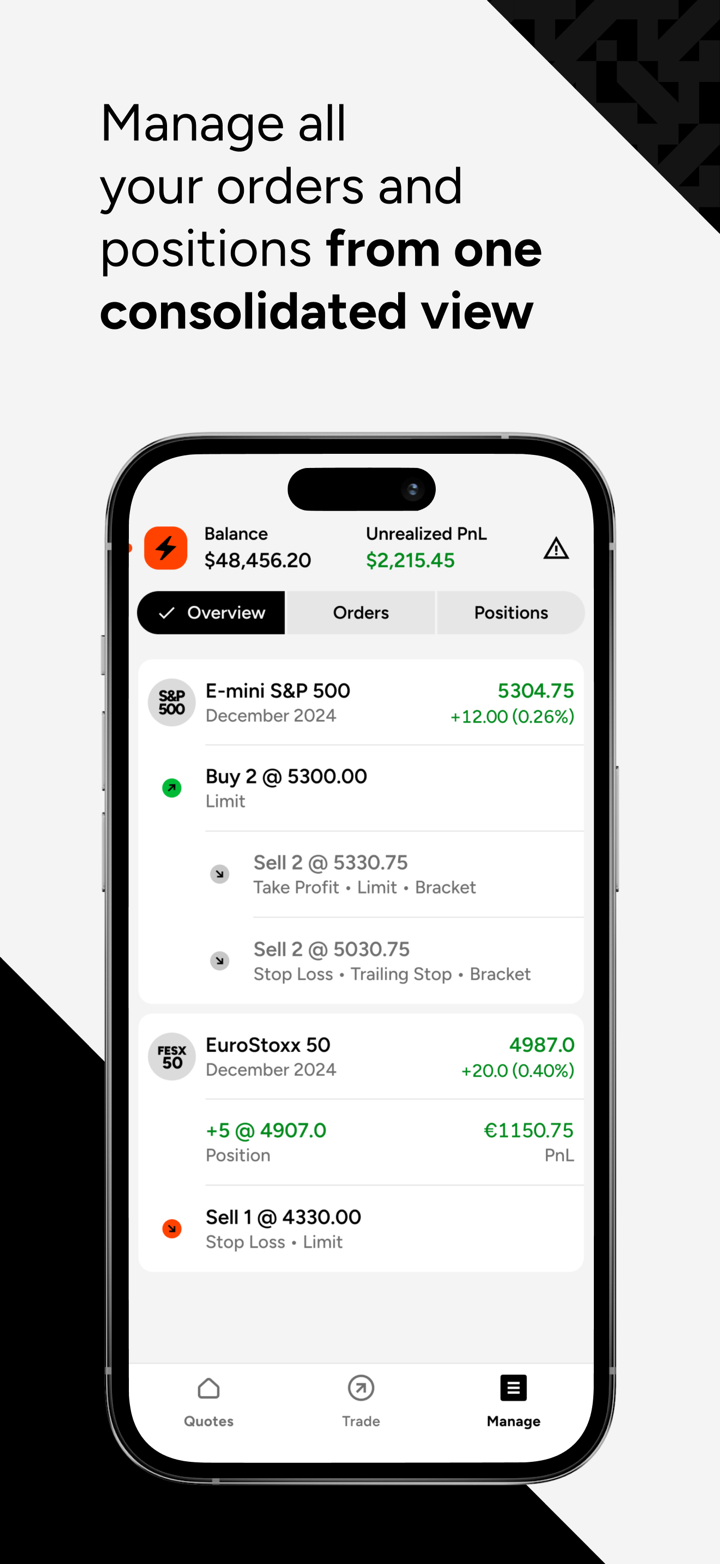

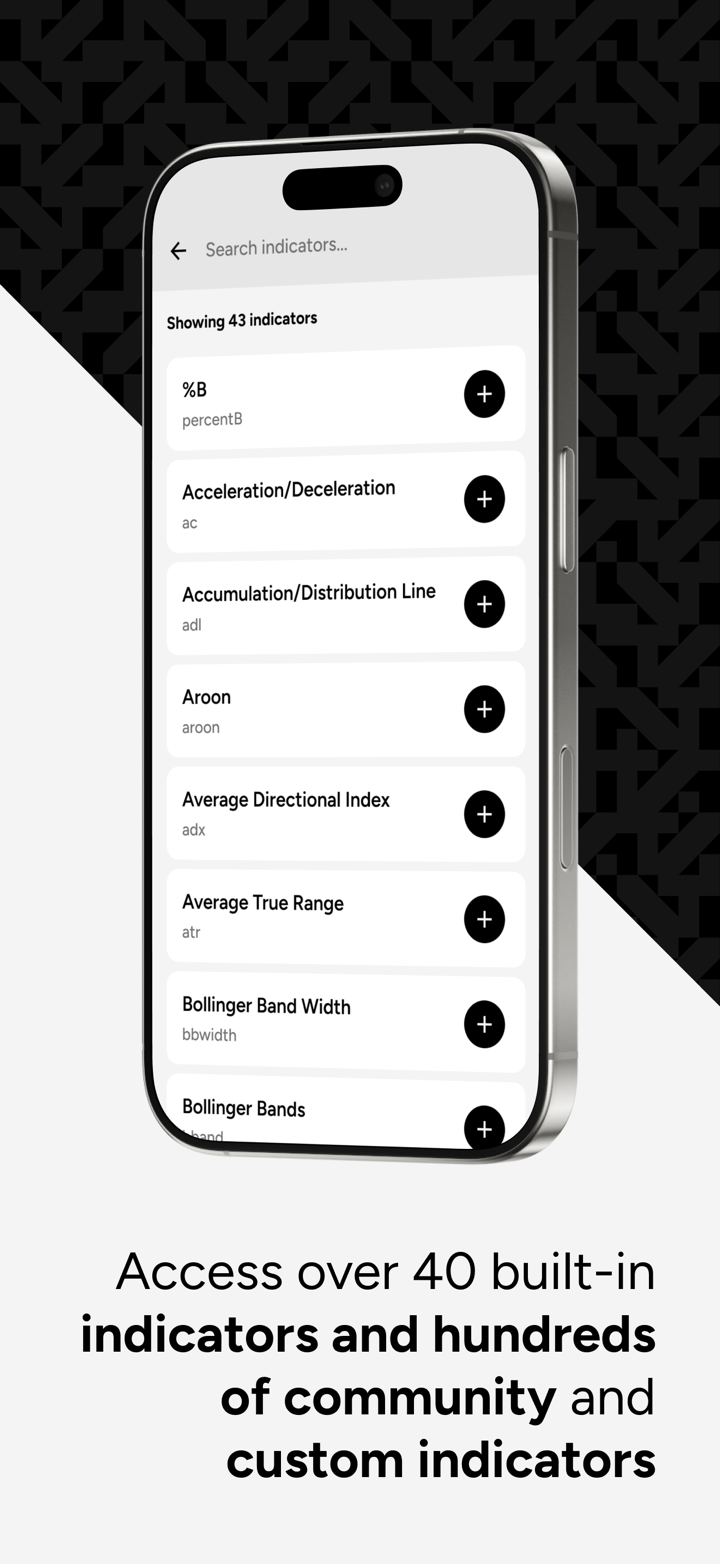

Nagbibigay ang NinjaTrader ng isang pinagsamang plataporma ng kalakalan sa tatlong terminal: Desktop, Web, at Mobile (iOS/iPhone). Ito ay angkop para sa mga baguhan at advanced na mangangalakal ng hinaharap.

| Plataforma ng Kalakalan | Supported | Available Devices | Angkop para |

| NinjaTrader | ✔ | Desktop, Web, at Mobile (iOS/iPhone) | Mga baguhan at advanced na mangangalakal ng hinaharap |