简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Powell Warns: Stock Market Valuations Are Elevated

Sommario:Federal Reserve Chair Jerome Powell delivered remarks at the Greater Providence Chamber of Commerces 2025 Economic Outlook Luncheon in Warwick, Rhode Island. During the QA session, Powell acknowledged

Federal Reserve Chair Jerome Powell delivered remarks at the Greater Providence Chamber of Commerces 2025 Economic Outlook Luncheon in Warwick, Rhode Island. During the Q&A session, Powell acknowledged that by multiple measures, equity prices are “quite high,” though he stressed that current financial stability risks have not materially increased.

Over the past month, we have repeatedly highlighted concerns around U.S. equity valuations and weakening domestic demand. Citing a Goldman Sachs report, we noted that much of the recent trading activity has been driven less by fundamentals and more by liquidity. With margin financing for equity purchases climbing sharply, we continue to caution investors to maintain a defensive mindset.

Powells comments triggered a broad retreat across asset classes, with risk assets, precious metals, and non-USD currencies all reversing lower from stretched levels.

He noted that U.S. GDP grew about 1.5% in the first half of this year, down from 2.5% last year. The slowdown primarily reflected softer consumer spending, while the housing market remains weak. However, corporate investment in equipment and intangibles has outpaced last years levels.

This aligns with our earlier commentary that growth has been disproportionately supported by corporate capex, software investment, and government defense spending—while household demand remains sluggish. The U.S. economy is currently experiencing a rare mix of low layoffs and muted hiring, a state best described as “low unemployment with low job creation.”

(Figure 1. U.S. IT Equipment Investment [Blue], Software Investment [Green], and Private Consumption [Brown]; Source: FRED)

Policy Outlook

On monetary policy, Powell struck a neutral tone. He warned that if policy easing goes too far, inflation may become difficult to control, forcing further tightening to return inflation to the 2% target. Conversely, keeping policy restrictive for too long could unnecessarily weaken the labor market. Balancing these conflicting objectives remains central to the Feds dual mandate.

That said, stimulating domestic demand via rate cuts to meaningfully boost employment will take time. We continue to believe weak consumer spending and ongoing inventory liquidation will delay restocking momentum for at least another quarter, possibly six months.

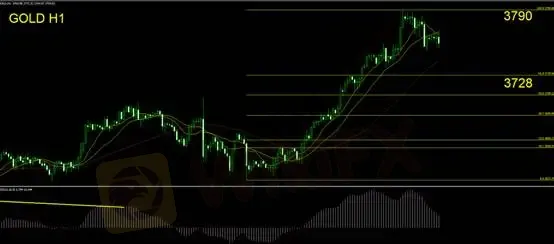

Gold Technical Analysis

Gold has ended its short-term bullish run on the hourly chart, slipping below short-term moving averages and showing minor pullbacks. On the daily timeframe, the current structure is more accurately viewed as a corrective retracement following extended gains.

Fibonacci Analysis: Yesterdays rally reached the 1.618 external retracement target near 3756, before extending to the 2.00 target around 3786. With trend momentum shifting, upside potential appears limited for the day.

Support & Resistance: Initial support sits at 3728; a break below raises the probability of testing the 3700 level. Key resistance stands at 3790.

Indicators: MACD histogram continues to contract and risks crossing below the zero line, potentially opening a broader downside move.

Trading Strategy: Maintain a bearish bias. Reduce position sizes amid heightened volatility and widen stop levels. Suggested stop loss: above 3786.

Risk Disclaimer:

The views, analysis, research, prices, and other information presented here are provided solely for general market commentary. They do not represent the official stance of this platform. All readers should assess their own risk exposure carefully before trading.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

InteractiveBrokers

FOREX.com

TMGM

octa

Vantage

FBS

InteractiveBrokers

FOREX.com

TMGM

octa

Vantage

FBS

WikiFX Trader

InteractiveBrokers

FOREX.com

TMGM

octa

Vantage

FBS

InteractiveBrokers

FOREX.com

TMGM

octa

Vantage

FBS

Rate Calc