简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FPG XAUUSD Market Report January 22, 2026

Sommario:On the H1 timeframe, XAUUSD (Gold) has maintained its strong bullish dominance by consistently printing new All-Time Highs over the past several trading sessions. The latest ATH was recorded near 4888

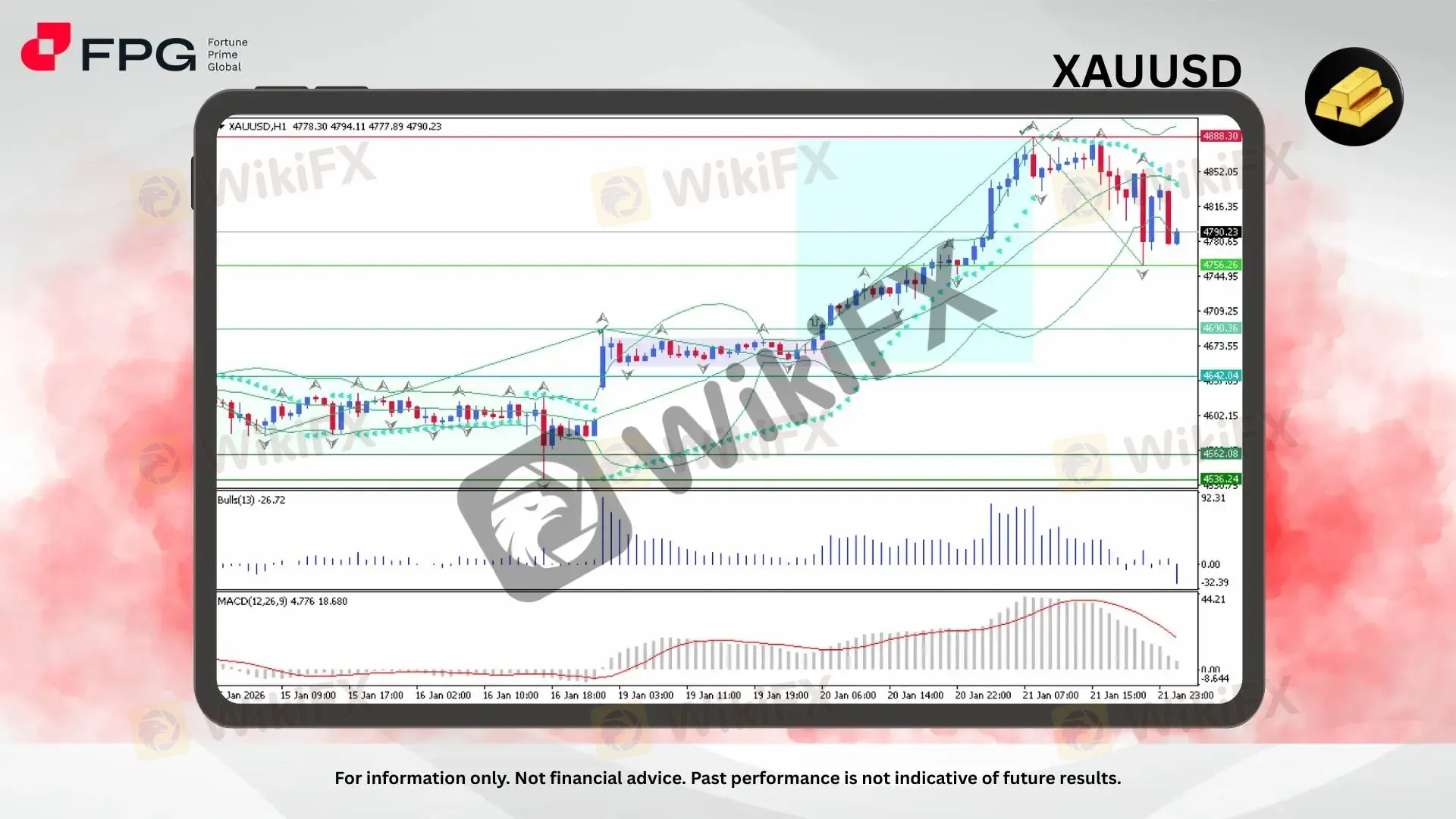

On the H1 timeframe, XAUUSD (Gold) has maintained its strong bullish dominance by consistently printing new All-Time Highs over the past several trading sessions. The latest ATH was recorded near 4888, marking the peak of an aggressive upside expansion following a prolonged consolidation phase. After moving sideways twice within a defined range, Gold finally broke higher with strong impulsive candles. However, from this recent ATH, price has entered a sharp corrective phase, characterized by long-bodied bearish candles and elevated volatility, with Gold currently trading around 4790 as the market digests recent gains.

Technically, the broader trend remains bullish despite the ongoing correction. Price is still holding above its major ascending trend structure and medium-term support zones, suggesting that the pullback is corrective rather than trend-reversing. Bollinger Bands have expanded significantly following the breakout, reflecting the surge in volatility, while current price action is retracing toward the mid-to-lower band area. The Bulls Power (13) indicator has slipped into negative territory around -26.72, indicating short-term bearish pressure after an extended bullish run. Meanwhile, MACD (12,26,9) remains above the zero line but shows a declining histogram and a rounding-over signal line, highlighting weakening bullish momentum and the potential for continued consolidation or deeper retracement before the next directional move.

Momentum has clearly cooled after the parabolic advance, shifting from strong bullish acceleration into a corrective and mean-reverting phase. Despite this, the overall outlook remains constructive as long as Gold continues to hold above its key structural supports. Fundamentally, the sustained formation of new ATHs has been underpinned by broad USD weakness and escalating global tensions toward the US. Renewed tariff-related rhetoric and increasingly uncertain geopolitical developments have reinforced Golds appeal as a primary safe-haven asset. These factors suggest that any deeper pullback could still be viewed as a potential re-accumulation phase rather than a trend exhaustion signal.

Market Observation & Strategy Advice

1. Current Position: XAUUSD is trading around 4790, correcting sharply from the recent ATH amid heightened volatility.

2. Resistance Zone: The 4888 area remains the immediate upside cap and ATH resistance.

3. Support Zone: Initial support is located around 4756, followed by a deeper structural support near 4690.

4. Indicator Observation: Bulls Power (13) at -26.72 reflects short-term bearish pressure, while MACD above zero signals the broader bullish trend remains intact. Expanded Bollinger Bands indicate unstable price conditions, favoring patience and confirmation-based entries.

5. Trading Strategy Suggestions:

Pullback Opportunity: Consider cautious buy-on-dips near 4756–4690 if bullish rejection or stabilization patterns emerge.

Breakdown Risk: A sustained H1 close below 4690 may open room for a deeper corrective move and warrants tighter risk control.

Momentum Re-entry: Bullish continuation setups become more attractive if price stabilizes and reclaims the 4816–4850 zone with improving momentum.

Market Performance:

Precious Metals Last Price % Change

XPTUSD 2,380.58 −2.58%

XAGUSD 91.0213 −2.23%

Today's Key Economic Calendar:

US: API Crude Oil Stock Change

JP: Balance of Trade

JP: Exports YoY

AU: Employment Change

AU: Full Time Employment Chg

AU: Unemployment Rate

CN: FDI (YTD) YoY

UK: CBI Distributive Trades

EU: ECB Monetary Policy Meeting Accounts

US: GDP Growth Rate & GDP Price Index QoQ Final

US: Initial Jobless Claims

CA: New Housing Price Index MoM

US: Core PCE Price Index MoM

US: PCE Price Index MoM & YoY

US: Personal Income & Personal Spending MoM

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

WikiFX Trader

Rate Calc