公司簡介

| 宏利 檢討摘要 | |

| 成立年份 | 1897 |

| 註冊國家/地區 | 中國香港 |

| 監管機構 | SFC |

| 市場工具 | 人壽保險、儲蓄和退休計劃、健康保險、強積金及職業退休計劃條例、宏利MOVE、投資產品、可扣稅產品、一般保險 |

| 客戶支援 | 2108 1110, 2510 3941 |

宏利 資訊

宏利成立於1897年,並由香港SFC監管,提供全面的金融解決方案,包括人壽和健康保險、儲蓄和退休計劃、強積金及職業退休計劃條例、投資產品如共同基金和ILAS,以及可扣稅選項。他們還提供宏利MOVE健康計劃和各種付款方式,滿足不同客戶需求。

優缺點

| 優點 | 缺點 |

|

|

|

|

宏利 是否合法?

宏利持有由中國香港證券及期貨事務監察委員會(SFC)頒發的「從事期貨合約」牌照,牌照號碼為ACP555。

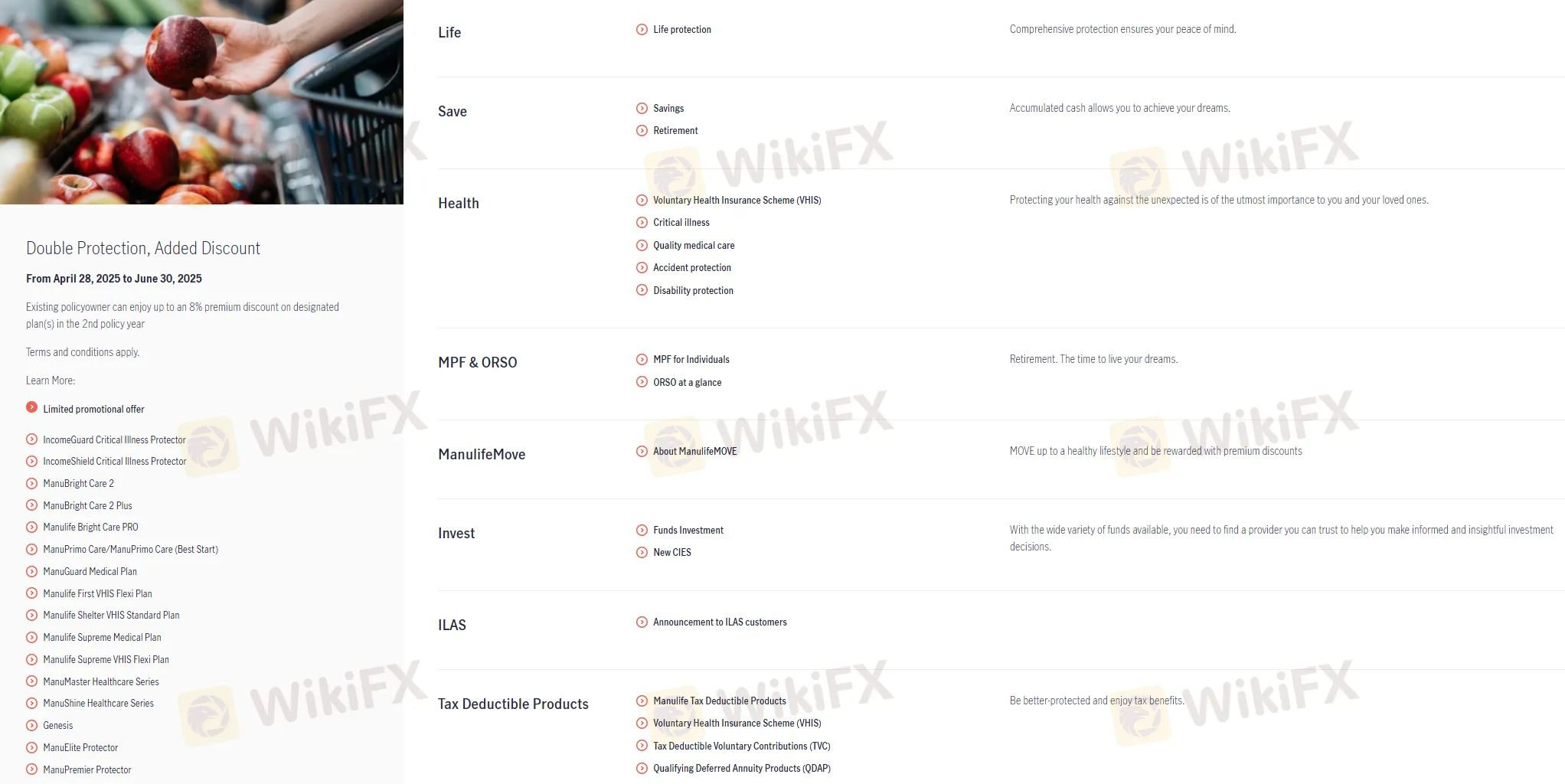

產品與服務

宏利提供全面的金融產品和服務:

- 人壽保險:宏利提供全面保護的人壽保險產品,確保您和您的愛人安心。

- 儲蓄和退休:他們的儲蓄和退休計劃幫助您隨著時間積累現金,讓您實現夢想並享受舒適的退休生活。

- 健康保險:宏利提供自顄健康保險計劃(VHIS)和重大疾病保險。他們的保險計劃包括意外和殘疾保險,確保在意外事件發生時獲得財務安全。

- 強積金及職業退休計劃條例:宏利為個人提供強制性公積金(MPF)服務,以及職業退休計劃條例(ORSO)選項,幫助您為退休做好準備,實現夢想。

- 宏利MOVE:該計劃通過追踪身體活動並獎勵參與者以獲得保費折扣,促進健康生活方式。

- 投資產品:宏利提供共同基金和投資相關保險計劃(ILAS),為投資增長和財務自由提供機會。

- 可扣稅產品:他們提供各種可扣稅產品,包括VHIS、可扣稅自願供款(TVC)和合資格遞延年金產品(QDAP),既提供保護又享有稅收優惠。

- 其他服務:宏利還提供信用卡和一般保險等服務,為滿足各種需求提供額外的金融解決方案,如旅行保險等。

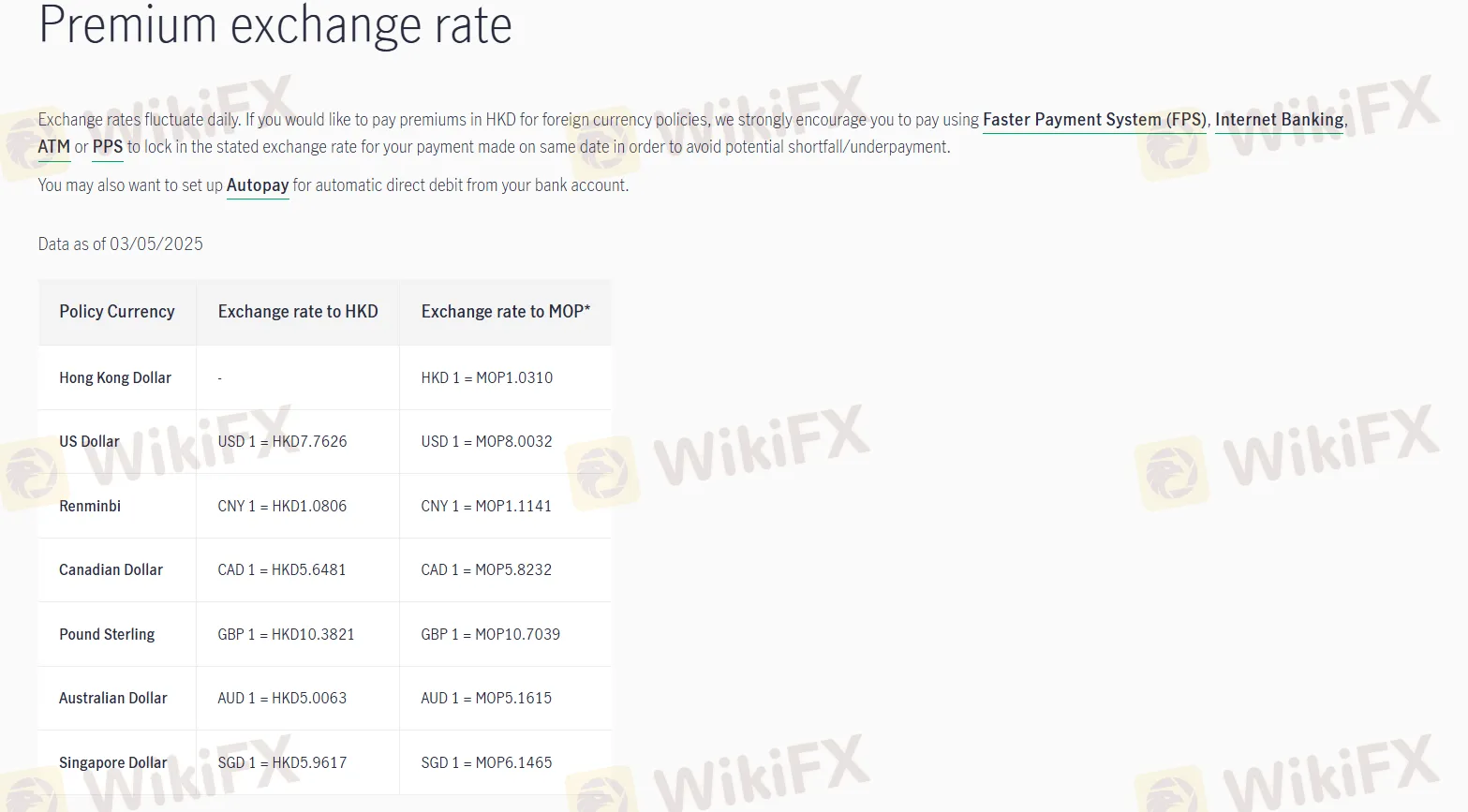

匯率

宏利 鼓勵使用FPS、網上銀行、自動櫃員機或PPS進行外幣保單的港幣保費支付,以鎖定每日匯率並避免潛在的支付不足。他們還建議設置自動付款以進行自動扣款。此數據截至2025年5月3日。

| 保單貨幣 | 兌換為港幣匯率 | 兌換為澳門幣匯率* |

| 港幣 | - | HKD 1 = MOP 1.0310 |

| 美元 | USD 1 = HKD 7.7626 | USD 1 = MOP 8.0032 |

| 人民幣 | CNY 1 = HKD 1.0806 | CNY 1 = MOP 1.1141 |

| 加拿大元 | CAD 1 = HKD 5.6481 | CAD 1 = MOP 5.8232 |

| 英鎊 | GBP 1 = HKD 10.3821 | GBP 1 = MOP 10.7039 |

| 澳大利亞元 | AUD 1 = HKD 5.0063 | AUD 1 = MOP 5.1615 |

| 新加坡元 | SGD 1 = HKD 5.9617 | SGD 1 = MOP 6.1465 |

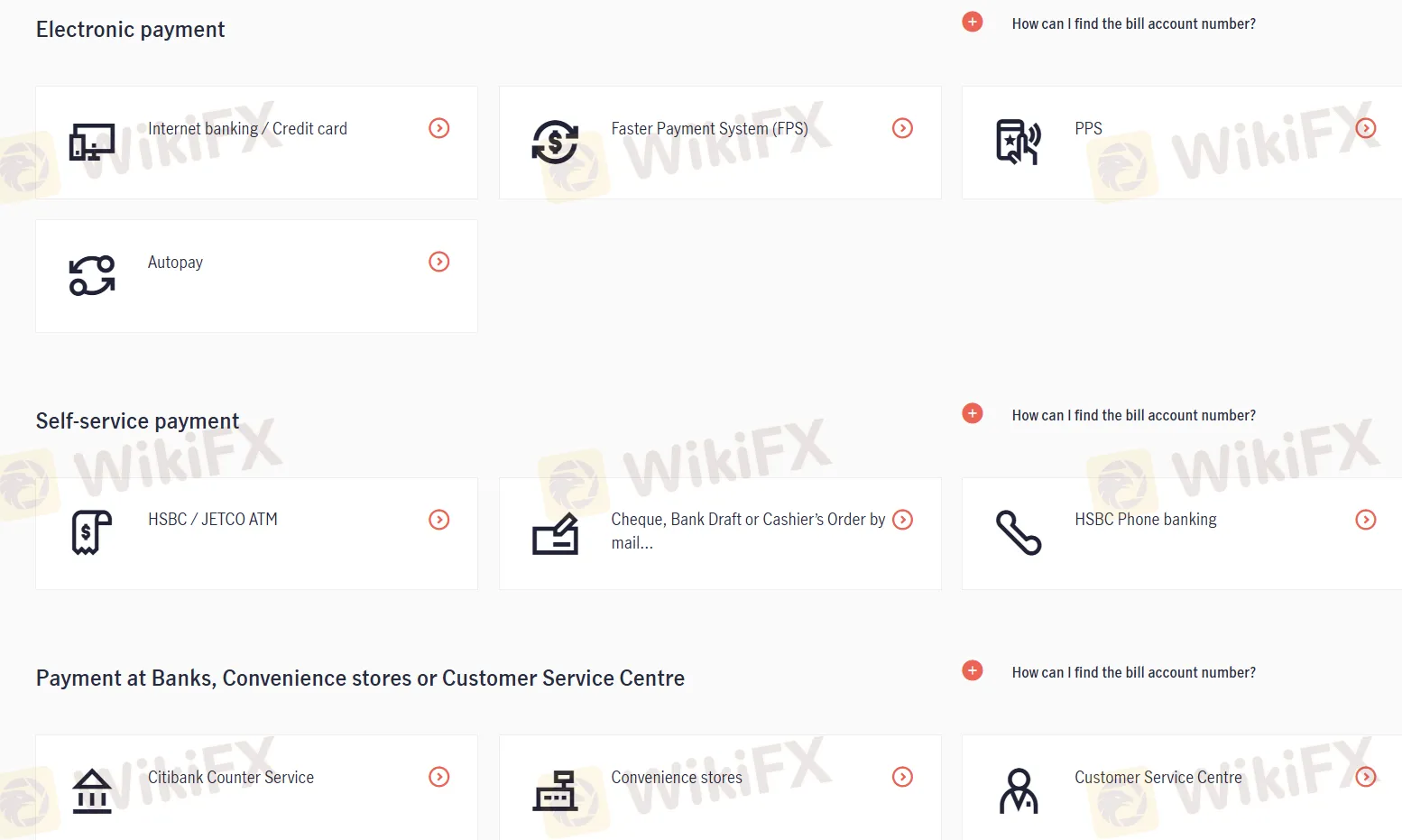

付款選項

宏利 提供多種付款方式:電子付款 包括網上銀行/信用卡、FPS、PPS和自動付款;自助付款 透過滙豐/JETCO自動櫃員機、郵寄支票/本票和滙豐電話銀行;以及在銀行、便利店或客戶服務中心付款,包括花旗銀行櫃檯。