DeltaFX Scam Alert: Withdrawal Issues Exposed

DeltaFX Scam Alert: User reviews reveal fraud and withdrawal issues. Protect your capital—read the full warning.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Failed to receive unlimited leverage as promised by QuoMarkets? Witnessing higher slippage and a subsequent drop in your trading account balance? Does the forex broker withhold your profits? These have become typical of the way QuoMarkets runs its operations. In this article, we have exposed the forex broker on all these points. Keep reading different QuoMarkets reviews.

Failed to receive unlimited leverage as promised by QuoMarkets? Witnessing higher slippage and a subsequent drop in your trading account balance? Does the forex broker withhold your profits? These have become typical of the way QuoMarkets runs its operations. In this article, we have exposed the forex broker on all these points. Keep reading different QuoMarkets reviews.

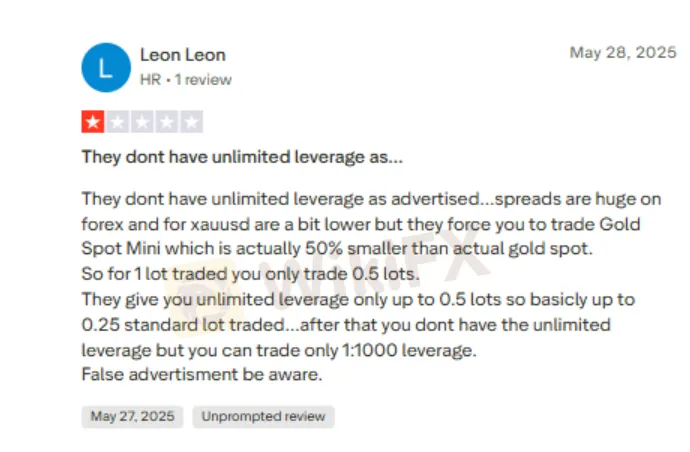

Leverage is a tool used by traders to gain a large market position for a small investment upfront. To acquire traders, QuoMarkets advertises unlimited leverage. However, that turns out to be a fake in reality. While at the same time, the high spreads do not help traders either. Here is a trader who criticized the broker sharply for failing to deliver on the leverage promise and other deficiencies.

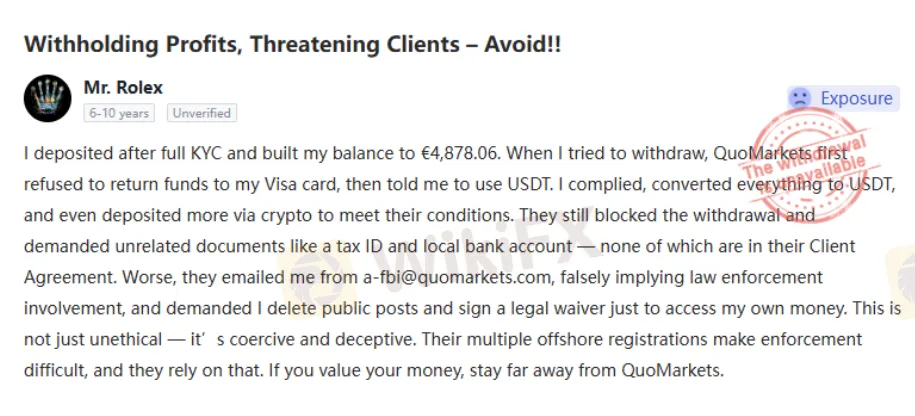

Despite maintaining a KYC-compliant trading account, traders witnessed massive profit withholding by QuoMarkets. In an incident, a trader admitted to having used USDT and deposited further as directed by the broker after being refused a withdrawal. Despite this, the company refused withdrawals and even threatened the trader with legal action after the latter posted about the trade manipulation on social platforms. Here is one startling review of QuoMarkets.

QuoMarkets is also accused of implying high slippage charges, manipulative spreads and other hidden fees to drain out the investor capital. The screenshot below explains the pain when trapped by such high and unexpected fees.

Even though regulated in the United Arab Emirates, QuoMarkets carries a score of just 2.46 out of 10 for the sheer manipulative trading activity displayed so far. The broker needs to do a lot to improve its brand image and maintain business.

Stay updated about more such forex scam updates and other financial news by joining WikiFX Masterminds.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations on joining the group.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

DeltaFX Scam Alert: User reviews reveal fraud and withdrawal issues. Protect your capital—read the full warning.

The Australian Dollar (AUD) advanced against the US Dollar on Thursday after stronger-than-expected employment data reinforced expectations that the Reserve Bank of Australia (RBA) may maintain a tighter monetary policy stance for longer. Meanwhile, the US Dollar remained steady as easing trade tensions offset reduced expectations for near-term Federal Reserve rate cuts.

When choosing a forex or CFD broker, regulation and transparency are critical factors. In this Angel Broking review, we take a close look at the broker’s background, regulatory status, trading conditions, and potential risks. According to WikiFX, Angel Broking has received a low score of 1.57/10, which raises serious concerns for traders.

Do BDFX officials mislead you with poor market advice that leads to capital losses? Do you feel they themselves cannot trade the risk management analysis perfectly? Did the Comoros-based forex broker close your forex trading account and steal your funds? Did your numerous fund withdrawal requests go in vain? These are potential forex investment scams. Many traders have highlighted these trading issues on broker review platforms. Check out some of their complaints in this BDFX review article.