Global Broker Regulation Inquiry App!

Browsing History

Browsing History

WikiFX Officially Launches the “Every Review Counts” Broker Review Initiative!

In forex trading, what truly determines risk is often not market volatility itself, but whether information is authentic, transparent, and fully visible.

INFINOX Analysis Report ~MUST READ This Clear & Unfiltered Review

This comprehensive analysis report examines INFINOX, a forex and CFD broker, through a systematic evaluation of trader experiences and feedback collected from multiple independent review platforms.

WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

AVATRADE

FXCM

EC markets

GTCFX

Finalto

XM

IC Markets Global

TRADE NATION

Exness

GO Markets

fpmarkets

TRADING 212

Vantage

VT Markets

FXTRADING.com

Neex

1*CPU / 1G*RAM / 40G*SSD / 1M*ADSL

1*CPU / 1G*RAM

40G*SSD / 1M*ADSL

XM

2*CPU / 2G*RAM

40G*SSD / 20M*ADSL

FXTM

2*CPU / 2G*RAM

40G*SSD / 20M*ADSL

IC Markets Global

2*CPU / 2G*RAM

40G*SSD / 20M*ADSL

FXCM

2*CPU / 2G*RAM

40G*SSD / 20M*ADSL

Latest

Are Jack Dorsey's aggressive job cuts the start of an AI jobs apocalypse? Economists weigh in

Economists question whether such moves signal a broader shift in the labor market or simply reflect company-specific adjustments.

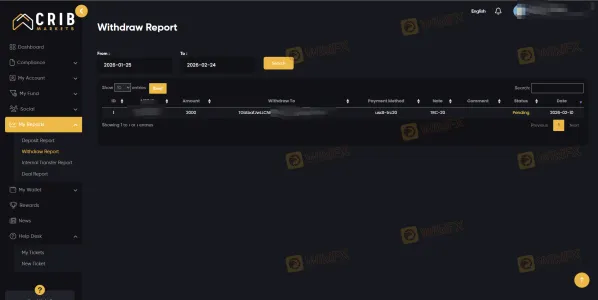

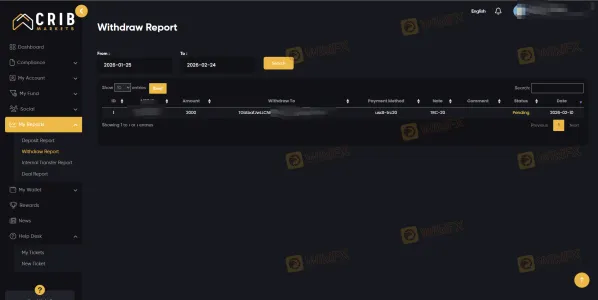

Unable to Withdraw

Unable to Withdraw Crib Markets is not honoring profits. They deleted my earnings after 2 weeks of 'processing' my withdrawal. They are only refunding deposits and seizing profits. Be careful!

Crib Markets is not honoring profits. They deleted my earnings after 2 weeks of 'processing' my withdrawal. They are only refunding deposits and seizing profits. Be careful!

Core wholesale prices rose 0.8% in January, much more than expected

The core producer price index increased a seasonally adjusted 0.8%, more than the 0.6% gain in December.

FXORO Review: Investigating Withdrawal Denial and Fund Scam Allegations

FXORO, a Seychelles-based forex broker, has been receiving quite a few negative reviews from traders. Looking at the overall complaints, traders are not happy with the way the broker handles withdrawal issues. Even more concerning is the loss due to its alleged advice of not using risk management tools. Some traders even alleged to have been taken advantage of by the broker’s officials. In this FXORO review article, we have collected a list of complaints against the broker. Keep reading to know about them.

EPFX Exposure: Examining Complaints Concerning Withdrawal Denials & Account Blocks

Lured into trading on the EPFX platform with an attractive bonus that did not come to your account? Was your profile disabled by the broker upon raising a technical query concerning a profit withdrawal request? Did the South Africa-based forex broker deny you access to withdraw your hard-earned capital from the platform? Have you faced account closure by the EPFX broker without any reason? These alleged scams have become the centre of discussion on broker review platforms. We have shared these complaints in this EPFX review article. Keep reading!

Rights Protection Center

PROREX LIMITED

PROREX LIMITED

PROREX LIMITED

PROREX LIMITED fraudster‼️

problematic broker did not pay my WD, support did not reply to email, fraudulent broker

PROMARKETS

PROMARKETS

PROMARKETS

PROMARKETS Withdrawal of 3,000 USD Not Processed

Withdrawal request of 3,000 USD submitted on February 20. No payment received. No response from support or assigned advisor. Account still active but withdrawal pending. Requesting immediate processing.

Phyntex Markets

Phyntex Markets

Phyntex Markets

Phyntex Markets USD58,271.03 Withdrawal Blocked After 50,000 paid

Broker processed a successful withdrawal of USD 50,000, confirming account legitimacy. Subsequently, the broker blocked withdrawal of the remaining wallet funds amounting to USD 58,271.03. A formal Letter of Demand was issued. No response, no specific Terms & Conditions clause, and no compliance report has been provided. The broker later alleged “toxic trading” solely based on leverage usage, which is a feature provided by the broker itself.

SPEC TRADING

SPEC TRADING

SPEC TRADING

SPEC TRADING Profitable Trader? They Will Seize Your Funds

I am writing this to warn all traders about SPEC FX.I traded profitably. I was able to withdraw $162 and $420 successfully — so I thought this broker was legit. But when my account grew and I requested to withdraw the remaining $218, they suddenly rejected my withdrawal and accused me of vague violations like "breaching trading principles" and "Negative Balance Protection rules" — without any proof or specific explanation. I asked for details. They went silent for 3 days. Then they simply removed the $250.73 from my account balance, leaving it at $0. The point is: they steal profits from successful traders. If you trade with SPEC FX and become profitable, expect the same treatment. They will find an excuse in their Terms & Conditions to take your money. I have all email conversations and screenshots as proof. Avoid this broker if you want to keep your profits.

Crib Markets

Crib Markets

Crib Markets

Crib Markets I can't get my money

My withdrawal request has been pending for a week. It's very difficult to get in touch with them.

EMAR MARKETS

EMAR MARKETS

EMAR MARKETS

EMAR MARKETS not paying.. I am waiting from 17 days

withdrawal. Amount: -236.87 USD Date: 2026-02-02 05:05 Fraud Company please be aware.. My funds has been stuck in the withdrawal. Its still pending since 9 days. And even not reply on the support ticket. 4 times i have submit my ticket but no any answer.

Neptune Securities

Neptune Securities

Neptune Securities

Neptune Securities Biggest scsm ever seen..

These people used beautiful lady and stole my money about 15.000usd...then they they removed my sccount..And lady vanished Nobody is guilty she said they "robbed our account" the most stupid thing ever heard... Typical love scam?? No i too clever to this... I swear i am still going to chase you through European, australian Police till find you behind the bars So I will catch up for my time and find you ALL be carefuL!!! See jow much money left

Fortune Prime Global

Fortune Prime Global

Fortune Prime Global

Fortune Prime Global Trade Integrity Concern – Live Trade Disappeared,

Broker Name Fortune Prime Global Ltd Account Number 87**** Platform MetaTrader (Live account, API / copy-trading environment) Complaint Details I am submitting this report to raise serious concerns regarding trade integrity, broker transparency, and client protection involving Fortune Prime Global Ltd. I participated in a copy-trading arrangement using what was represented as a live Fortune Prime Global trading account. I paid approximately USD 1,500 to access this setup. Missing Live Trade – 28 December On 28 January, a trade was: • Executed on the live account • Clearly visible on the trading platform • Personally observed by me Later the same day, the trade: • Disappeared entirely from the account history • Had no broker-generated adjustment record • Had no explanation visible on the platform When questioned, I was told the broker was: • “Changing the account to another server group for better spreads” • That the trade was “t

UltraTFX

UltraTFX

UltraTFX

UltraTFX totally scam fraud broker.

totally scam fraud broker.not giving withdrawals . now blocked my meta trade 5 account and web login page

FBS

FBS

FBS

FBS Everyone must know about

Everyone must know about the 100% rate of the notorious Stop Loss Slip/gap from this broker, this broker is a naughty broker, and must be avoided... My SL is always 200$ for each transaction but it is always 100% certain SL Gap/slip up to 250$ -350$ fbs is a serious scam, stay away from this rubbish broker

exfor

exfor

exfor

exfor Withdrawal Pending for

Withdrawal Pending for Over a Week – No Clear Communication I requested a withdrawal from my Exfor account over a week ago, and it is still showing as pending. My account is fully verified (ID and proof of address approved). I have contacted support and even spoken with a representative, but I am not receiving clear follow-up responses or a timeline for processing. I am simply requesting the release of my available balance. If there are any compliance or bonus-related conditions affecting this withdrawal, they should be clearly explained in writing. I expect transparency and timely processing of client funds. I will update this review once the issue is resolved.

ACCM

ACCM

ACCM

ACCM Subject: Formal Complaint:

Subject: Formal Complaint: ACCM Broker unauthorized profit deduction and withdrawal refusal (Account ID: [Your Account ID]) To the WikiFX Support Team, I am writing this to formally complain about the fraudulent activities of the broker ACCM. Below are the details of my case: The Incident: I have been trading with ACCM and generated a total profit of $5,621 USD. However, when I submitted a withdrawal request, the broker refused to process it. Shortly after, they arbitrarily deleted my entire profit of $5,621 from my account without any prior notice or valid explanation. Communication Efforts: I have sent multiple emails to ACCM’s support team requesting a clarification. It has been over two weeks, yet they have remained completely silent, ignoring all my inquiries and providing no explanation for their actions. My Request: I kindly request WikiFX to intervene and assist me in recovering my legitimate profits and ensuring my withdrawal is processed.

Crib Markets

Crib Markets

Crib Markets

Crib Markets Crib Markets is not honoring profits. They deleted my earnings after 2 weeks of 'processing' my withdrawal. They are only refunding deposits and seizing profits. Be careful!

Crib Markets is not honoring profits. They deleted my earnings after 2 weeks of 'processing' my withdrawal. They are only refunding deposits and seizing profits. Be careful!

MONEY plant FX

MONEY plant FX

MONEY plant FX

MONEY plant FX These people are scammers

These people are scammers; no one should fall into their trap. After I deposited my cash, they gave me a demo account to trade with instead of a real one. Their own team then traded on that account and lost the entire balance. They have cheated many people like this. The balance is 0, and two withdrawals of 3800 are pending and have not been received yet.

SeptaFX

SeptaFX

SeptaFX

SeptaFX Withdrawal Rejected Without Explanation – No Resp.

I deposited 350 USD in SeptaFX trading account After trading, my total account balance became 2330 USD. On 19 February 2026, I requested a withdrawal of 2000 USD, which was rejected without any proper written explanation. I have sent multiple emails and reminders, but I have not received any response from the broker. My account has no open trades and no compliance issues have been communicated to me. I have now submitted a withdrawal request of 350 USD (my original deposit) and I am still waiting for processing. The broker is not regulated by any recognized financial authority and is registered in Saint Lucia. I request immediate intervention and resolution of my withdrawal issue.

najm Capital

najm Capital

najm Capital

najm Capital Najm Capital Scam Alert

As I am a victim of the Najm Capital scam, I advise all investors to avoid depositing any money with Najm Capital. They earn money from investors’ deposits, they do not transfer any funds to our trading accounts, and the balances shown in the trading accounts are fake. All the money we deposit goes directly to Najm Capital, and they only show it in the fake trading account while we trade on a fake platform. They make us think we are losing from real trades, but it is not real. Even if you earn a profit, they will not transfer a single Dirham, as it is not real profit. I was trapped by my native place people names are Rahman, Alex, and Deepak and be alert any call from them. After taking your funds, they will disappear, and you cannot reach them by phone or any office in the UAE. According to records, they are not registered anywhere in the world. Therefore, please invest your funds only with UAE SCA-regulated brokerages and avoid scams like Najm Capital.

EA

Trend type PeakTaker

Income in last year +433.46%

This strategy primarily focuses on breakout trading for cryptocurrencies BTC/ETH

USD 0.99 USD 280.00PurchaseTools CopyTrading-MT5

This EA is an MT5 Copy Trading EA that enables copy trading between signal-providing and follower accounts on MT5

USD 0.99 USD 280.00PurchaseTrend type TurtleBooster

Income in last year +177.96%

This strategy is a trend-following and position-adding strategy, mainly used for interval position adding in major trending markets.

USD 0.99 USD 280.00PurchaseTrend type TrendRiser

Income in last year +775.69%

This EA is compatible with both ranging and trending markets

USD 0.99 USD 280.00Purchase

Community

- For You

- Updates

- Business

WikiEXPO

United Arab Emirates · Dubai

Wiki Finance Dubai 2026, will be held on 4 Dec 2026 and there will be 1 day exhibition events targeting both forex、crypto、Stock、fintech and blockchain businesses; and most importantly, it is the general public.

Cyprus · Limassol

Wiki Finance Cyprus 2026, will be held on 18 Sep 2026 and there will be 1 day exhibition events targeting both forex、crypto、Stock、fintech and blockchain businesses; and most importantly, it is the general public.

WikiResearch

GLOBAL FOREX MARGIN TRADING MARKET AND USER RESEARCH REPOR - MEXICO AND ARGENTINA

GLOBAL FOREX MARGIN TRADING MARKET AND USER RESEARCH REPORT-MENA

GLOBAL FOREX MARGIN TRADING MARKET AND USER RESEARCH REPORT-Japan

Japan

JapanRankings

- Total Margin

- Active Trading Ranking

- Total lots

- Stop Out

- Profit Order

- Brokers' Profitability

- New User

- Spread Cost

- Rollover Cost

- Net Deposit Ranking

- Net Withdrawal Ranking

- Active Funds Ranking

Total Margin

- 30 days

- 90 days

- 6 months

- Brokerage

- Assets%

- Ranking

- 1

XM

XM- 22.37

- 1

- 2

Exness

Exness- 18.05

- 5

- 3

Vantage

Vantage- 17.62

- 1

- 4

D prime

D prime- 9.66

- 1

- 5

FBS

FBS- 6.32

- --

- 6

VT Markets

VT Markets- 6.31

- 2

- 7

IC Markets Global

IC Markets Global- 5.22

- --

- 8

STARTRADER

STARTRADER- 4.37

- 1

- 9

TMGM

TMGM- 3.63

- 1

- 10

RockGlobal

RockGlobal- 1.63

- 2

Active Trading Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Activation rate%

- Ranking

- 1

Exness

Exness- 24.41

- 3

- 2

XM

XM- 20.81

- 1

- 3

TMGM

TMGM- 7.13

- 1

- 4

D prime

D prime- 7.01

- 1

- 5

IC Markets Global

IC Markets Global- 5.20

- --

- 6

VT Markets

VT Markets- 2.57

- --

- 7

ATFX

ATFX- 2.34

- 1

- 8

Vantage

Vantage- 1.93

- 3

- 9

RockGlobal

RockGlobal- 1.81

- 1

- 10

FBS

FBS- 1.75

- 3

Total lots

- 30 days

- 90 days

- 6 months

- Brokerage

- Trading Volume%

- Ranking

- 1

FBS

FBS- 14.11

- --

- 2

IC Markets Global

IC Markets Global- 2.61

- --

- 3

XM

XM- 1.40

- 3

- 4

FXTM

FXTM- 0.60

- --

- 5

Anzo Capital

Anzo Capital- 0.57

- 2

- 6

Exness

Exness- 0.54

- 3

- 7

Vantage

Vantage- 0.53

- 3

- 8

TICKMILL

TICKMILL- 0.42

- 11

- 9

TMGM

TMGM- 0.23

- 4

- 10

KVB

KVB- 0.19

- 3

Stop Out

- 30 days

- 90 days

- 6 months

- Brokerage

- Stop Out%

- Ranking

- 1

ATFX

ATFX- 10.32

- --

- 2

VALUTRADES

VALUTRADES- 5.24

- 32

- 3

ACY SECURITIES

ACY SECURITIES- 3.33

- 2

- 4

FXTM

FXTM- 2.73

- 2

- 5

KVB

KVB- 2.20

- 8

- 6

FBS

FBS- 1.92

- 2

- 7

FXTRADING.com

FXTRADING.com- 1.75

- 17

- 8

XM

XM- 1.09

- 2

- 9

TMGM

TMGM- 1.05

- 11

- 10

GO Markets

GO Markets- 1.00

- 29

Profit Order

- 30 days

- 90 days

- 6 months

- Brokerage

- Win rate%

- Ranking

- 1

XM

XM- 10.69

- 36

- 2

FBS

FBS- 1.08

- 3

- 3

IC Markets Global

IC Markets Global- 1.03

- 1

- 4

TICKMILL

TICKMILL- 0.62

- 8

- 5

CPT Markets

CPT Markets- 0.33

- 3

- 6

ATFX

ATFX- 0.25

- 5

- 7

FOREX.com

FOREX.com- 0.15

- 24

- 8

Axitrader

Axitrader- 0.11

- 22

- 9

FXTM

FXTM- 0.08

- 5

- 10

VALUTRADES

VALUTRADES- 0.05

- 8

Brokers' Profitability

- 30 days

- 90 days

- 6 months

- Brokerage

- Total Profit%

- Ranking

- 1

Anzo Capital

Anzo Capital- 19.98

- 2

- 2

D prime

D prime- 16.09

- 1

- 3

InterStellar

InterStellar- 5.06

- 1

- 4

TMGM

TMGM- 4.35

- 31

- 5

RockGlobal

RockGlobal- 1.77

- 33

- 6

ZFX

ZFX- 0.75

- 30

- 7

CXM

CXM- 0.50

- 7

- 8

STARTRADER

STARTRADER- 0.29

- 2

- 9

Vantage

Vantage- 0.21

- 4

- 10

AUS GLOBAL

AUS GLOBAL- 0.16

- 13

New User

- 30 days

- 90 days

- 6 months

- Brokerage

- Growth value%

- Ranking

- 1

Exness

Exness- 21.39

- 1

- 2

XM

XM- 11.93

- 1

- 3

IC Markets Global

IC Markets Global- 5.00

- --

- 4

Vantage

Vantage- 3.42

- --

- 5

D prime

D prime- 3.01

- --

- 6

TMGM

TMGM- 2.82

- --

- 7

VT Markets

VT Markets- 2.10

- 1

- 8

FBS

FBS- 1.91

- 1

- 9

FXTM

FXTM- 1.11

- --

- 10

STARTRADER

STARTRADER- 0.99

- --

Spread Cost

- 30 days

- 90 days

- 6 months

- Brokerage

- Average Spread

- Ranking

- 1

Exness

Exness- 25.10

- --

- 2

XM

XM- 10.94

- --

- 3

Vantage

Vantage- 3.75

- 4

- 4

IC Markets Global

IC Markets Global- 3.50

- 1

- 5

D prime

D prime- 3.11

- 1

- 6

VT Markets

VT Markets- 2.59

- 1

- 7

TMGM

TMGM- 2.43

- 3

- 8

STARTRADER

STARTRADER- 1.37

- 1

- 9

ATFX

ATFX- 1.34

- 1

- 10

FBS

FBS- 0.82

- 2

Rollover Cost

- 30 days

- 90 days

- 6 months

- Brokerage

- Average rollover

- Ranking

- 1

FXTRADING.com

FXTRADING.com- 21.27

- 30

- 2

STARTRADER

STARTRADER- 19.29

- 26

- 3

IC Markets Global

IC Markets Global- 2.06

- 32

- 4

Anzo Capital

Anzo Capital- 1.93

- 4

- 5

FxPro

FxPro- 1.06

- 27

- 6

FXTM

FXTM- 1.01

- 5

- 7

FXCM

FXCM- 1.00

- 18

- 8

ZFX

ZFX- 0.98

- 26

- 9

CPT Markets

CPT Markets- 0.38

- --

- 10

CXM

CXM- 0.22

- 3

Net Deposit Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Net Deposit%

- Ranking

- 1

TICKMILL

TICKMILL- 70.24

- 5

- 2

AUS GLOBAL

AUS GLOBAL- 69.78

- 1

- 3

CPT Markets

CPT Markets- 68.07

- 7

- 4

RockGlobal

RockGlobal- 67.57

- 24

- 5

WeTrade

WeTrade- 67.42

- 19

- 6

ATFX

ATFX- 67.39

- 5

- 7

STARTRADER

STARTRADER- 66.94

- 20

- 8

IC Markets Global

IC Markets Global- 66.69

- 6

- 9

FXTRADING.com

FXTRADING.com- 66.34

- 5

- 10

Pepperstone

Pepperstone- 66.33

- 5

Net Withdrawal Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Net Withdraw%

- Ranking

- 1

TICKMILL

TICKMILL- 5.00

- --

- 2

Exness

Exness- 7.00

- 1

- 3

AVATRADE

AVATRADE- 7.00

- 1

- 4

D prime

D prime- 8.00

- 9

- 5

FXTM

FXTM- 8.00

- 6

- 6

IC Markets Global

IC Markets Global- 10.00

- --

- 7

TMGM

TMGM- 11.00

- 6

- 8

AUS GLOBAL

AUS GLOBAL- 12.00

- 3

- 9

FxPro

FxPro- 13.00

- 4

- 10

KVB

KVB- 14.00

- 2

Active Funds Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Activation rate%

- Ranking

- 1

ForexClub

ForexClub- -0.82

- --

- 2

HYCM

HYCM- -0.90

- 1

- 3

FXCM

FXCM- -0.90

- 1

- 4

Alpari

Alpari- -0.90

- --

- 5

AUS GLOBAL

AUS GLOBAL- -1.01

- 2

- 6

MultiBank Group

MultiBank Group- -1.20

- 30

- 7

FXPRIMUS

FXPRIMUS- -1.40

- --

- 8

FOREX.com

FOREX.com- -2.70

- 7

- 9

Just2Trade

Just2Trade- -3.00

- 5

- 10

AVATRADE

AVATRADE- -3.02

- 4

Real-time spread comparison EURUSD

- Broker

- Accounts

- Buy

- Sell

- Spread

- Average spread/day

- Long Position Swap USD/Lot

- Short Position Swap USD/Lot

To view more

Please download WikiFX APP

Uncover Hidden Risks. Unlock Premium Benefits.

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Cooperation

Cooperation