Perfil de la compañía

| IFX Resumen de la revisión | |

| Establecido | 2015 |

| País/Región Registrada | Reino Unido |

| Regulación | FCA (excedido), DFSA (excedido) |

| Servicios | Soluciones de pago, cambio de divisas |

| Cuenta Demo | ✅ |

| Soporte al Cliente | Teléfono: +4402074958888 |

| Correo electrónico: private@ifxpayments.com | |

| Londres: 33 Cavendish Square Londres, W1G 0PW | |

| Dubái: Unidad 31-46 Central Park offices DIFC | |

| Amersham: Chalfont Court, 5 Hill Avenue Amersham, HP6 5BB | |

| Varsovia: WorkIN, ul. Senatorska 200‑075 Warszawa | |

Información de IFX

IFX es una empresa que se enfoca en proporcionar a los usuarios soluciones de pago y servicios de cambio de divisas integrales. Está registrada en el Reino Unido, pero sus licencias emitidas por la FCA y la DFSA están excedidas, lo que significa que los riesgos potenciales no pueden ser ignorados.

Pros y Contras

| Pros | Contras |

| Cuentas demo | Licencias excedidas |

| Larga historia |

¿Es IFX Legítimo?

IFX ha excedido las regulaciones actualmente. ¡Por favor, tenga en cuenta el riesgo!

| Estado Regulatorio | Excedido |

| Regulado por | Autoridad de Conducta Financiera (FCA) |

| Institución Licenciada | IFX (UK) Ltd |

| Tipo de Licencia | Licencia de Pago |

| Número de Licencia | 900517 |

| Estado Regulatorio | Excedido |

| Regulado por | Autoridad de Servicios Financieros de Dubái(DFSA) |

| Institución Licenciada | IFX (UK) Ltd |

| Tipo de Licencia | Licencia Común de Servicios Financieros |

| Número de Licencia | F001814 |

Servicios de IFX

IFX ofrece soluciones de pago y servicios de cambio de divisas

| Instrumentos negociables | Soportado |

| Soluciones de pago | ✔ |

| Cambio de divisas | ✔ |

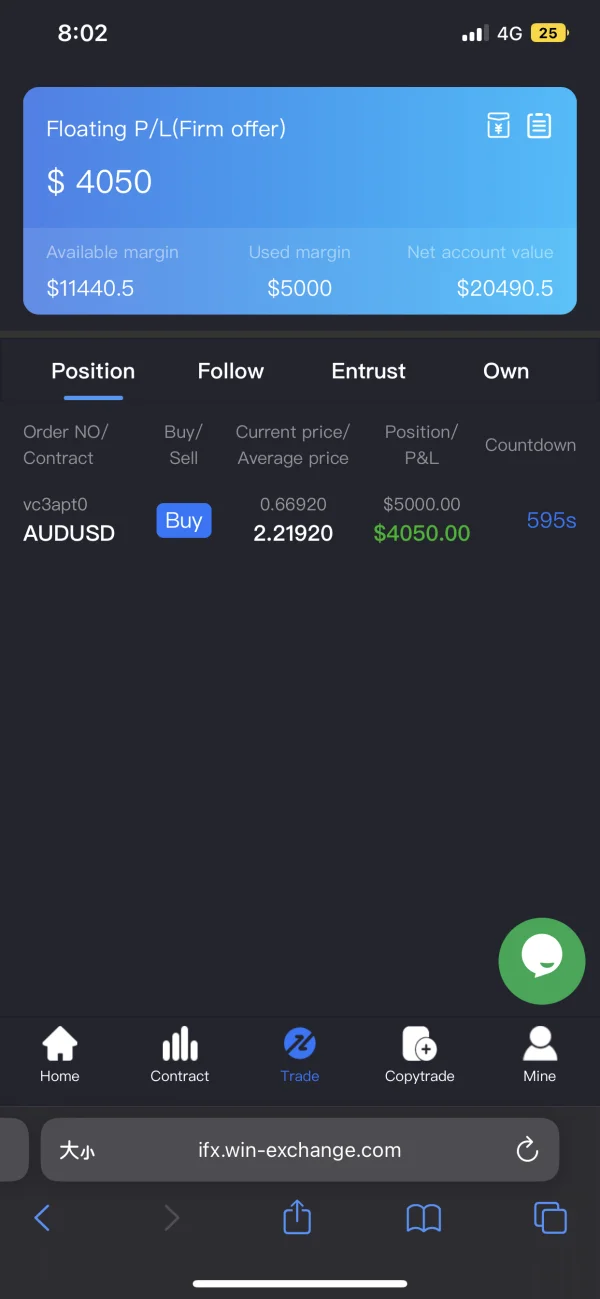

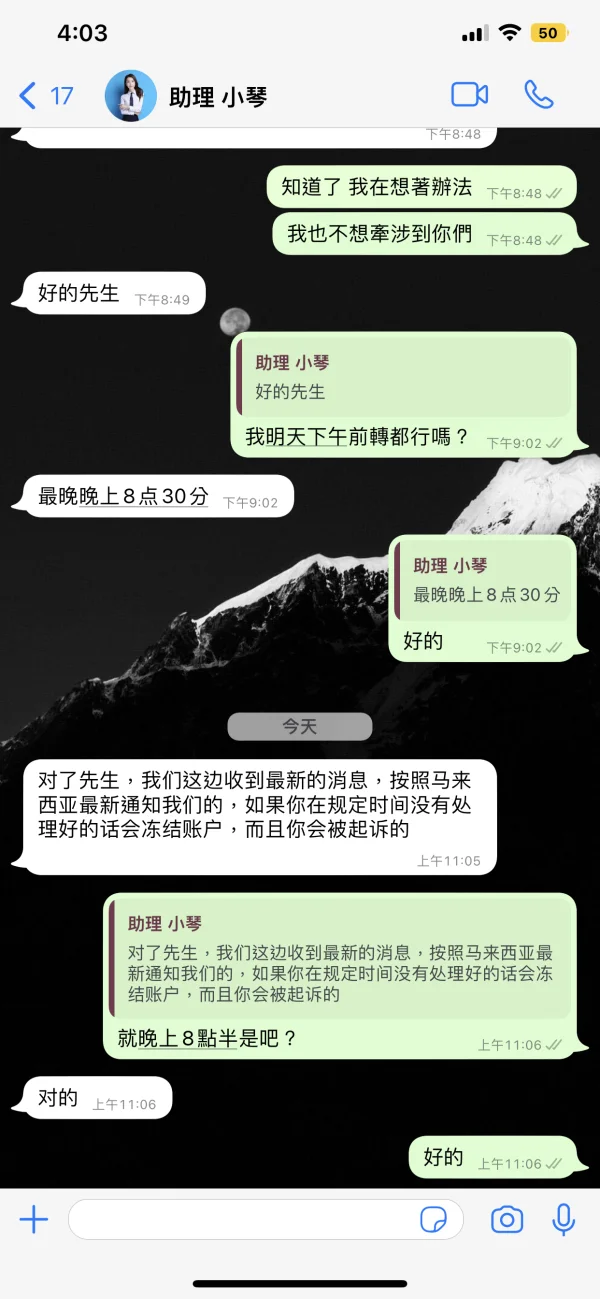

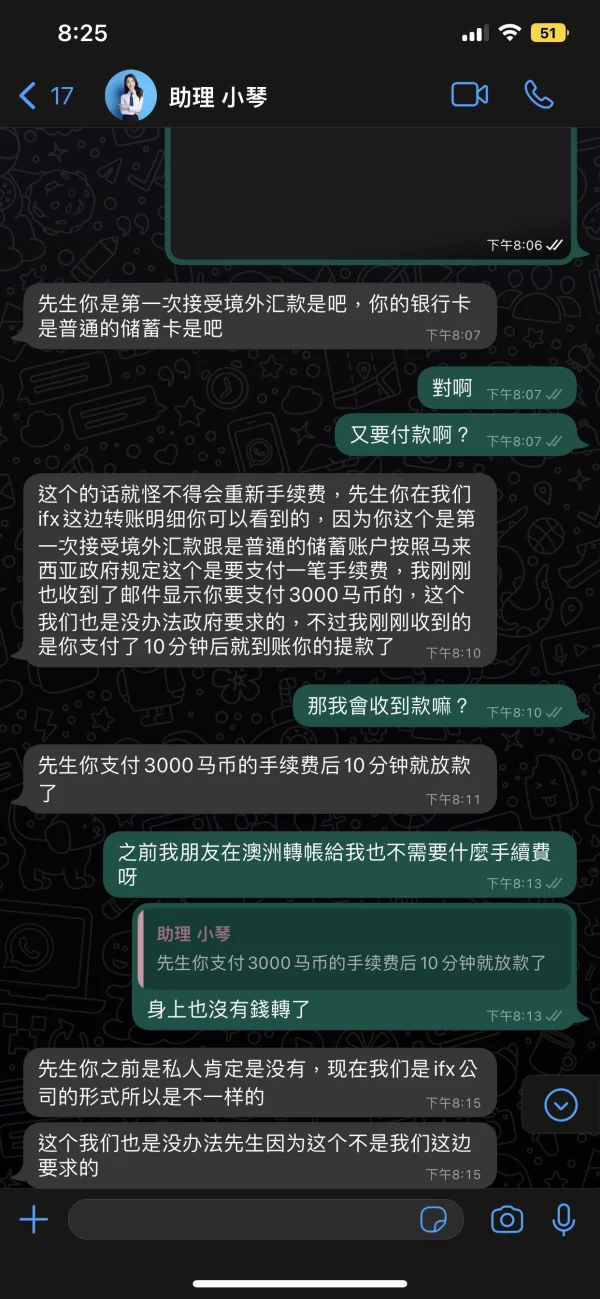

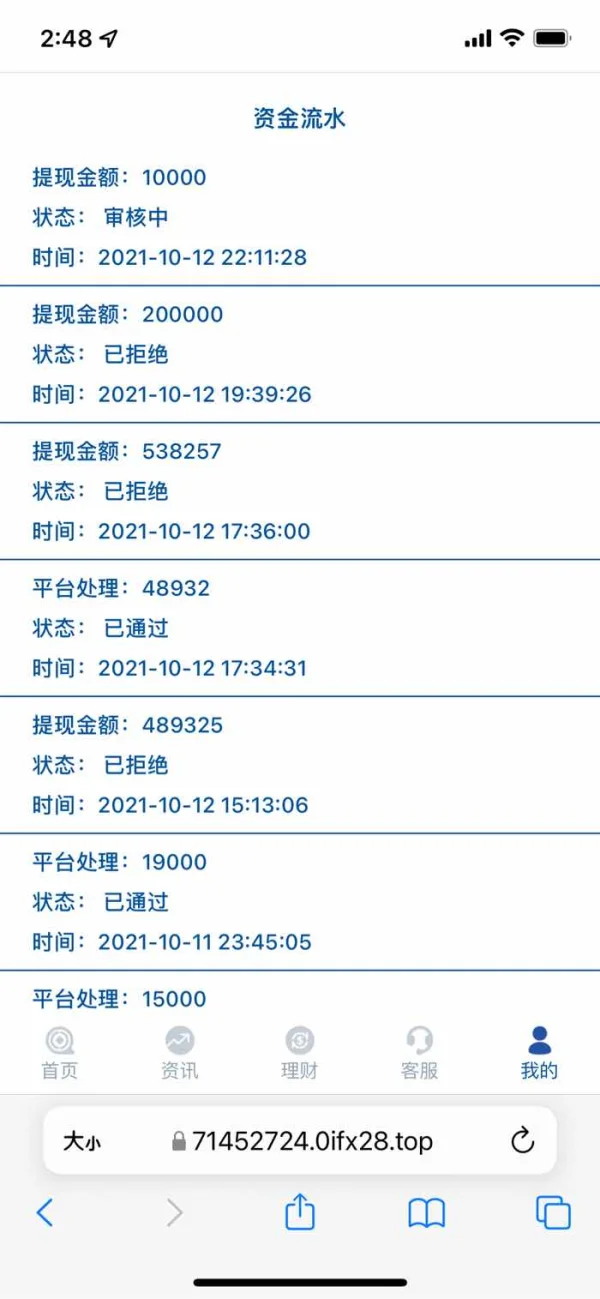

E1211

Malasia

¿La tarifa de manejo es realmente RM3000 y me demandarán si no la pago? ¿Es cierto este sitio web?

Exposición

Red Star

Hong Kong

El retiro no está disponible en IFX Después de llamar a la policía, mi cuenta fue cancelada. No me engañen.

Exposición

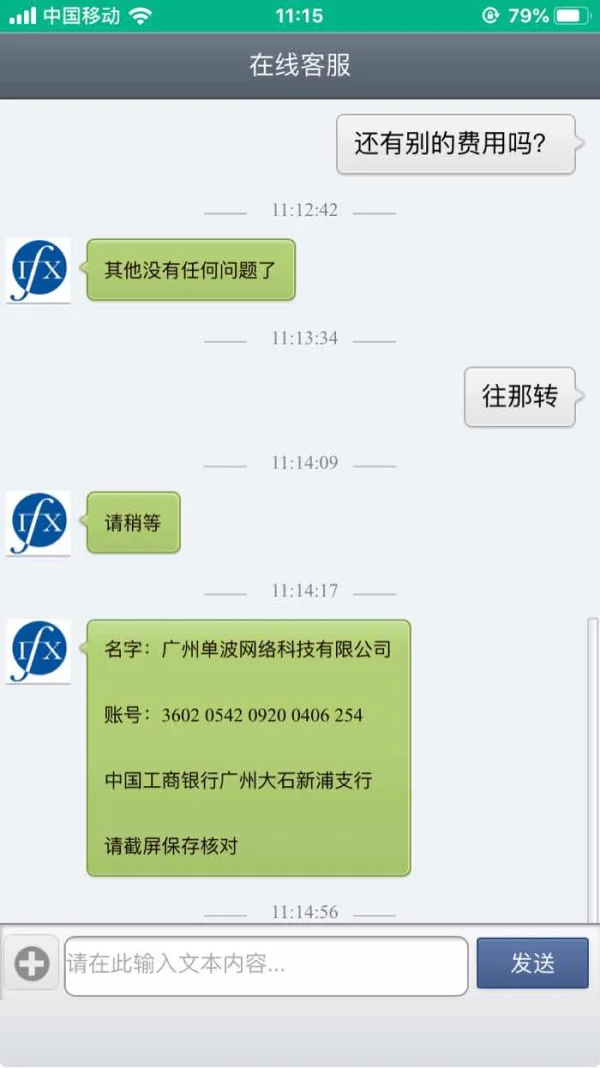

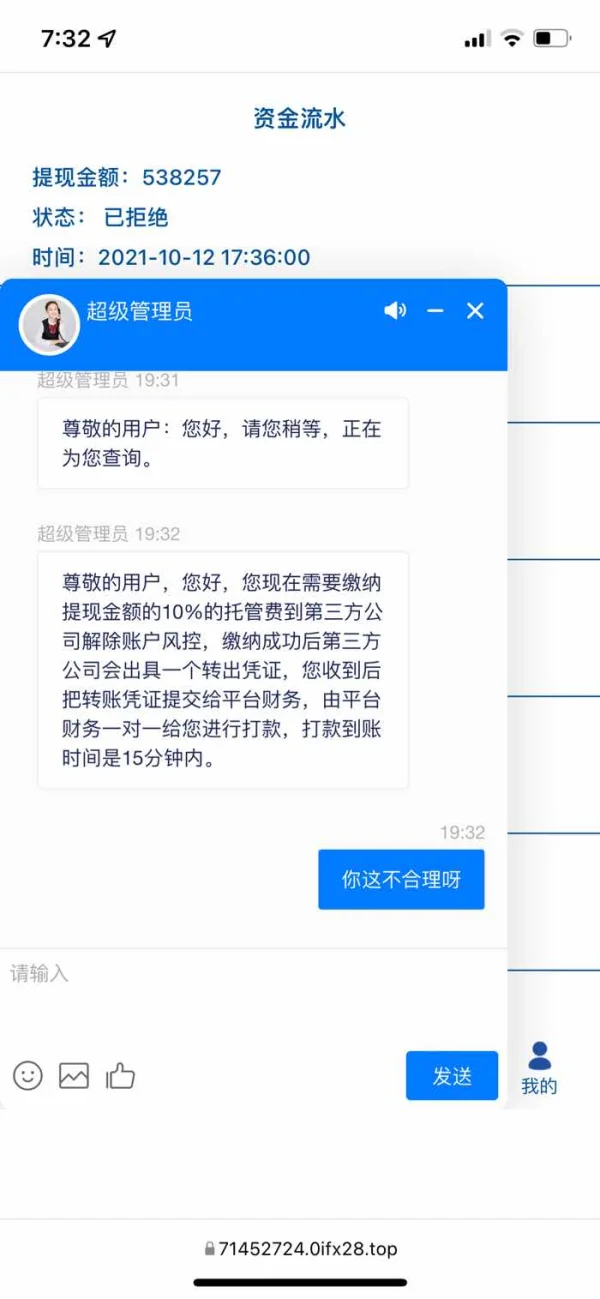

五四六一九一六六八

Hong Kong

No se puede retirar. La plataforma bloqueó las cuentas de los clientes y no dio acceso al retiro, diciendo que la información de identificación era incorrecta.

Exposición

FX1287225689

Marruecos

Honestamente, IFX es una buena plataforma para servicios de transferencia de pagos. He usado sus servicios varias veces y reconozco su gran servicio.

Positivo

A瞬间

Reino Unido

Tengo una muy buena experiencia comercial con IFX. Muchas gracias por la atención al cliente que es excelente para ayudarme cuando tengo preguntas y problemas. ¡Saludo a sus muchachos!

Positivo

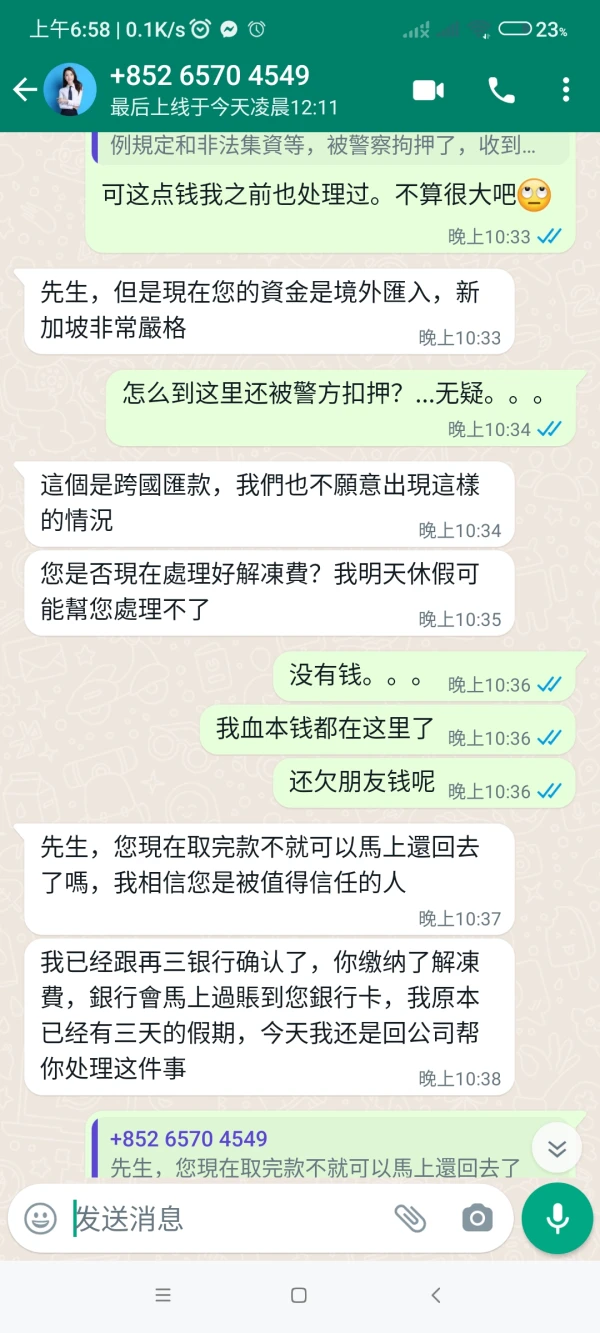

lee9022

Singapur

Fraude, el jefe quiere que pague comisión, tarifa de procesamiento, margen, impuesto sobre la renta y tarifa de descongelamiento. Hay tarifas interminables

Exposición

生死劫

Hong Kong

Sí, tuve una experiencia agradable con los pagos IFX. Sunny fue muy servicial e hizo todo lo posible para encontrarme el mejor tipo de cambio. Gran servicio y gracias.

Positivo

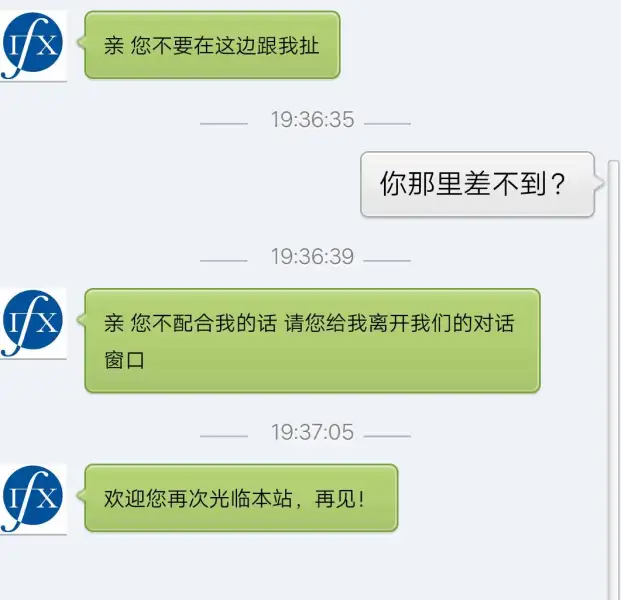

༺蜜糖༻

Hong Kong

Incapaz de retirarse. Me dijo que depositara por muchas razones. ¿Fue una estafa?

Exposición

FX4234736427

Hong Kong

IFX pediría margen con variadas excusas. Afirmando que corrigió el error, no dio acceso y se fugó.

Exposición

随风29414

Hong Kong

La plataforma de estafa no dio acceso al retiro y solicitó dinero para descongelar la cuenta.

Exposición

Red Star

Hong Kong

IFX es una plataforma de estafa que me pidió que pagara el margen al principio, y no me dio acceso al retiro, y seguía pidiendo varias tarifas. Espero que el departamento regulador se encargue de esto y recupere las pérdidas para nosotros.

Exposición