Buod ng kumpanya

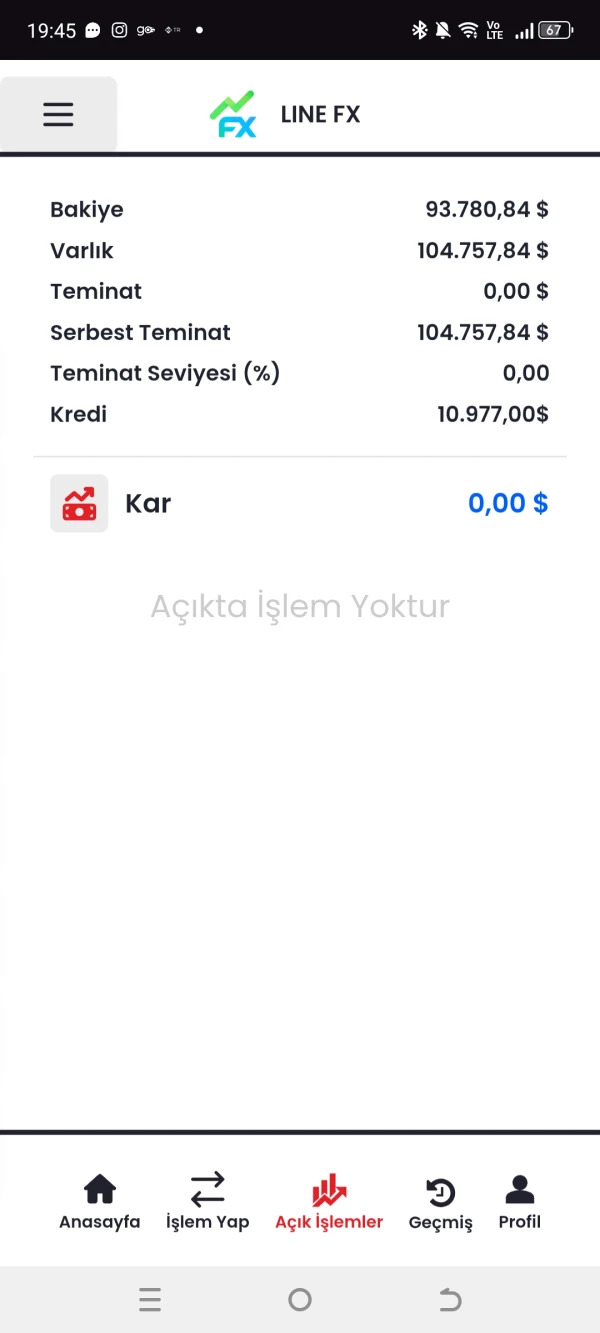

| LINE FX Buod ng Pagsusuri | |

| Itinatag | 2019-04-23 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | Hindi Regulado |

| Mga Produkto | 23 pares ng salapi |

| Leverage | Hanggang 1:25 |

| Spread | Mula sa 0.3 pips |

| Plataporma ng Pagkalakalan | LINE FX(Smart Phone)/LINE FX Pro(PC)/TradingView |

| X, Line, Facebook | |

Impormasyon ng LINE FX

Nakarehistro sa Hapon, ang LINE FX ay isang kumpanya ng mga seguridad na may access sa 23 pares ng salapi na walang komisyon. Ang EUR/USD core time (fixed in principle) mula 9:00 am – 5:00 am ng susunod na araw ay 0.3 pips, samantalang sa ibang oras ay 0.4-9.0 pips. Mas mababa ang spread, mas maganda ang liquidity.

Ang bayad sa transaksyon ay 0 yen. Gayunpaman, may pagkakaiba (spread) sa pagitan ng bid at ask na presyo ng mga salapi na inaalok ng LINE FX. Kapag naglalagay ng order, kinakailangan ang margin na 4% o higit pa (leverage 25 beses) para sa bawat pares ng salapi.

Totoo ba ang LINE FX?

Ang Financial Services Agency(FSA) regulates ang LINE FX na may license number 関東財務局長(金商)第3144号 at License Type Retail Forex License, kaya mas ligtas ito kaysa sa hindi regulado.

Mga Kasangkapan sa Pagkalakalan

Mga kasangkapan sa pagkalakalan para sa mga nagsisimula at mga eksperto, may kakayahan sa pag-chart ang TradingView, available ang LINE FX para sa mga smartphones, at ang LINE FX Pro ay angkop para sa PC

| Mga Kasangkapan sa Pagkalakalan | Supported | Available Devices |

| LINE FX | ✔ | Smart Phone |

| LINE FX Pro | ✔ | PC |

| TradingView | ✔ | - |

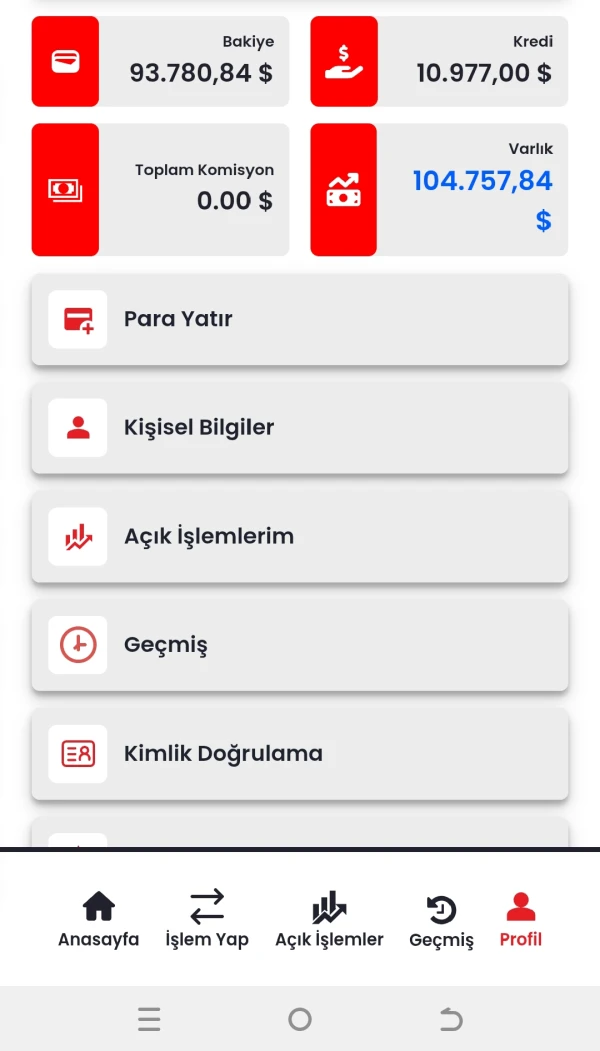

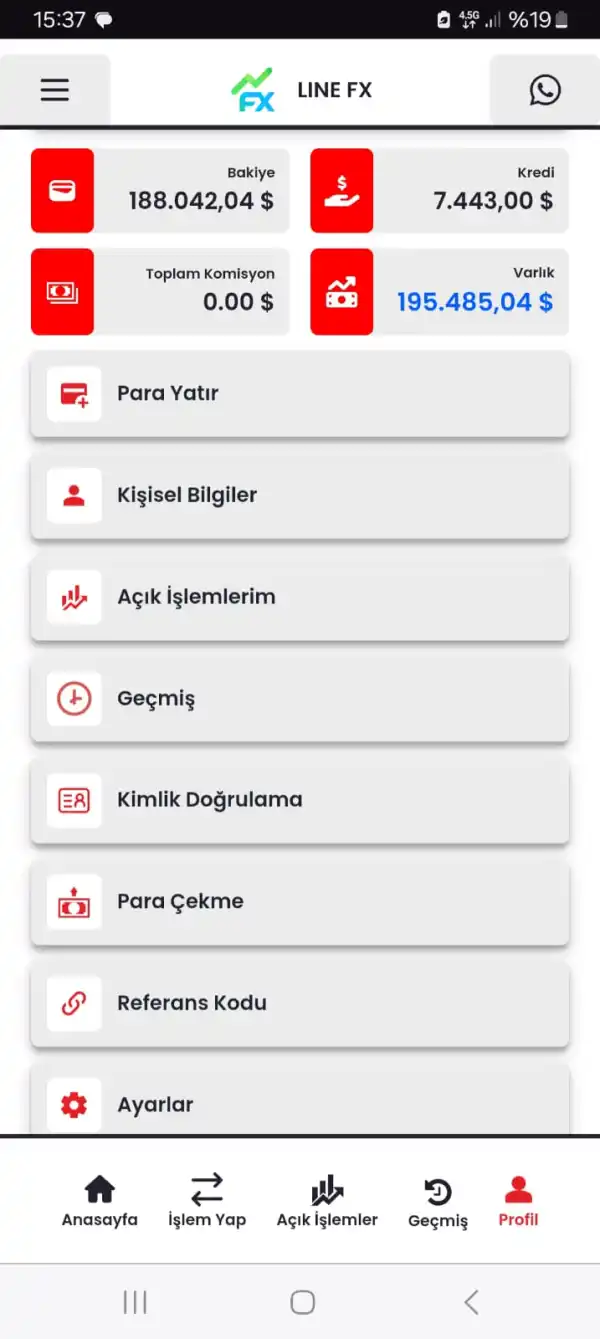

Pag-iimpok at Pagkuha

LINE FX ay tumatanggap ng bank transfers at QuickCash para sa pagbabayad at bank transfers para sa mga pag-withdraw. Ang mga pagbabayad sa pamamagitan ng bank transfer ay nangangailangan ng komisyon. Maliban sa mga pagbabayad ng QuickCash na nagtukoy ng mga institusyong pinansyal, ang iba pang mga pagbabayad ay magagamit sa lahat ng mga bangko at ang oras ng pagproseso ay karaniwan ay sa loob ng 24 na oras.

| Proseso | Mga Paraan ng Pagbabayad | Komisyon | Magagamit na mga institusyon ng pananalapi | Oras ng Negosyo |

| Pagbabayad | Bank transfer | Responsibilidad ng Customer | Lahat ng mga bangko | Karaniwan 24 na oras |

| QuickCash | libre | Mitsubishi UFJ BankSumitomo Mitsui Banking CorporationMizuho BankSumishin SBI Net BankRakuten Bank JapanPost BankPayPay Bank | ||

| Pag-withdraw | Bank transfer | libre | Lahat ng mga bangko |