Buod ng kumpanya

| LIMIT PRIME Buod ng Pagsusuri | |

| Itinatag | 2017 |

| Rehistradong Bansa/Rehiyon | Montenegro |

| Regulasyon | SCMN |

| Mga Kasangkapan sa Merkado | Forex, Mga Kalakal, Mga Indise, Mga Stock, Metal |

| Demo Account | ✅ |

| Leverage | Hanggang sa 1:100 |

| Spread | Variable |

| Platform ng Paggawa ng Kalakalan | MT5 |

| Minimum na Deposito | €100 |

| Suporta sa Kustomer | Telepono: +382 68 036 998 |

| E-mail: info@limitprime.com | |

| Address: Ulica 8 marta bb, objekat 14E, Podgorica | |

| Social Media: Facebook, Instagram, LinkedIn, YouTube | |

Impormasyon Tungkol sa LIMIT PRIME

Ang LIMIT PRIME ay isang reguladong kumpanya ng brokerage na nag-aalok ng iba't ibang mga kasangkapan sa kalakalan at mga pampaluwag na opsyon sa pagbabayad, na angkop para sa mga may karanasan sa kalakalan. Ang mga bentahe nito ay kinabibilangan ng mataas na seguridad at transparent na bayad; gayunpaman, ang mga posibleng kahinaan ay maaaring ang bayad para sa hindi aktibong account at kakulangan ng isang platform na madaling gamitin para sa mga nagsisimula.

Mga Kalamangan at Kahirapan

| Kalamangan | Kahirapan |

| Maayos na Regulado | Limitadong uri ng mga account |

| Walang Komisyon | |

| Hiwalay na mga account | |

| Proteksyon laban sa negatibong balanse | |

| Mga demo account na magagamit | |

| MT5 na magagamit | |

| Iba't ibang mga paraan ng pagbabayad | |

| Iba't ibang mga instrumento sa kalakalan |

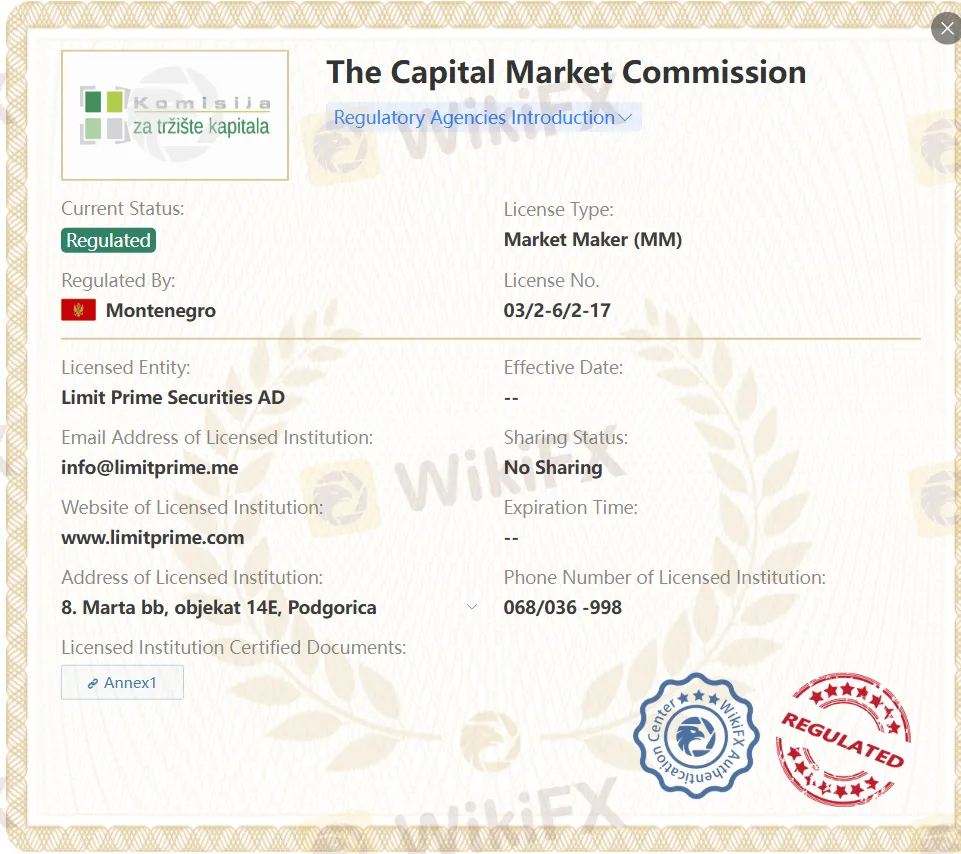

Tunay ba ang LIMIT PRIME?

Ang LIMIT PRIME ay isang reguladong kumpanya ng brokerage. Ang Limit Prime Securities ay regulado sa ilalim ng regulasyon ng MIFID II, ESMA, lisensyado at kontrolado ng Capital Markets Authority ng Montenegro.

| Reguladong Bansa | Reguladong Awtoridad | Katayuan sa Regulasyon | Reguladong Entidad | Uri ng Lisensya | Numero ng Lisensya |

| Capital Market Commission (SCMN) | Regulado | Limit Prime Securities AD | Tagagawa ng Merkado (MM) | 03/2-6/2-17 |

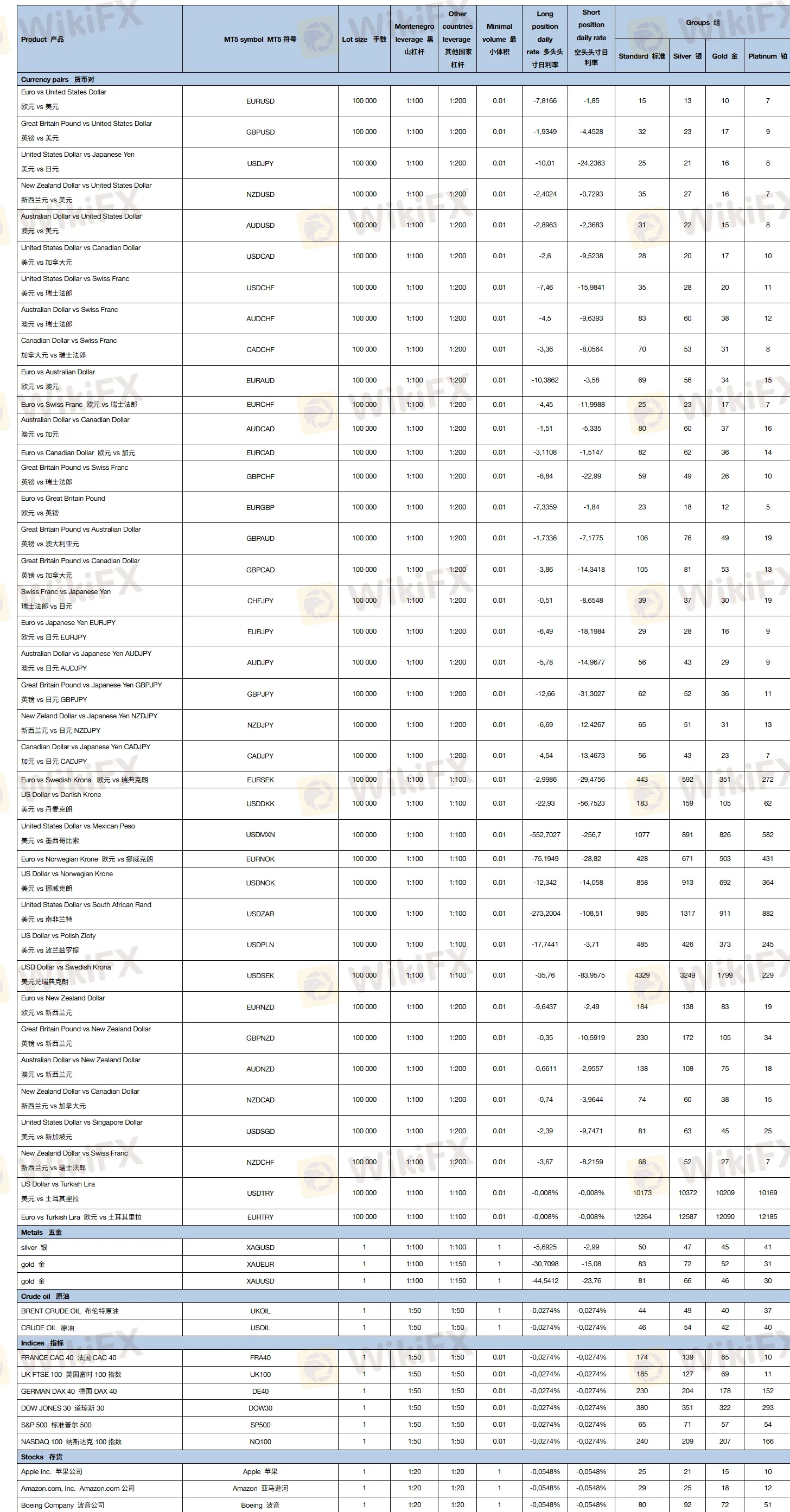

Ano ang Maaari Kong Kalakalan sa LIMIT PRIME?

Ito ang mga instrumento na maaaring i-trade sa LIMIT PRIME: 40 forex, commodities, indices, stocks, at metals.

| Trading Asset | Available |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Metals | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| Funds | ❌ |

| ETFs | ❌ |

Uri ng Account

Nag-aalok ang LIMIT PRIME ng demo account, na nagbibigay daan sa mga mangangalakal na subukan ang plataporma na ito nang hindi nagsasapanganib ng tunay na pera.

Nag-aalok ang LIMIT PRIME ng uri ng live account: Standard accounts. Kapag nagsimula ang customer sa pag-trade, kailangan nilang magbayad ng minimum na 100 euros, na awtomatikong maglalagay sa kanila sa standard trading group.

Leverage

Ang leverage ng platapormang ito ay hanggang sa 1:100. Ang leverage ay tumutukoy sa pag-utang ng pondo para sa pamumuhunan upang palakihin ang mga kita sa pamumuhunan. Ito ay nagbibigay daan sa mga mamumuhunan na makamit ang mas malaking sukat ng pamumuhunan gamit ang mas maliit na halaga ng kanilang sariling pondo, na nagbibigay sa kanila ng pagkakataon na makamit ang mas malalaking kita kapag mataas ang yield ng pamumuhunan.

Mga Bayad

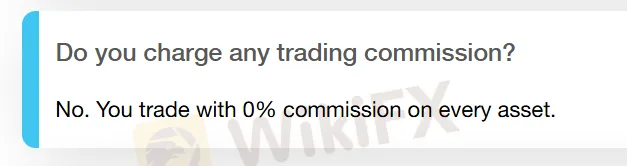

Diretso na mga gastos: Ang kumpanya ay hindi nangongolekta ng anumang bayad sa trading sa kanilang mga kliyente.

Kapag mayroong bukas na posisyon sa gabi, ang swap ay ibinabawas mula sa account ng kliyente.

Hindi direkta na mga gastos: Lahat ng mga kliyente na hindi gumawa ng anumang transaksyon at ang mga hindi gumawa ng kahit isang transaksyon sa loob ng tatlong buwan mula sa petsa ng pag-apruba ng account ay itinuturing na mga inactive account. May bayad na $20 sa bawat withdrawal para sa mga inactive account.

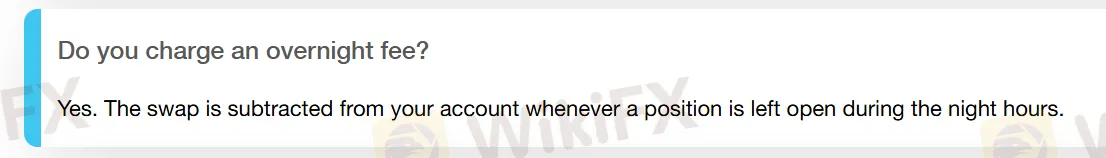

Ang LIMIT PRIME ay isang regulated na kumpanya, at ang kanilang mga kliyente ay may proteksyon laban sa negatibong balanse. Ito ay nangangahulugang ang account ng kliyente ay hindi magiging negatibo sa higit na pondo kaysa sa aktwal na meron ka.

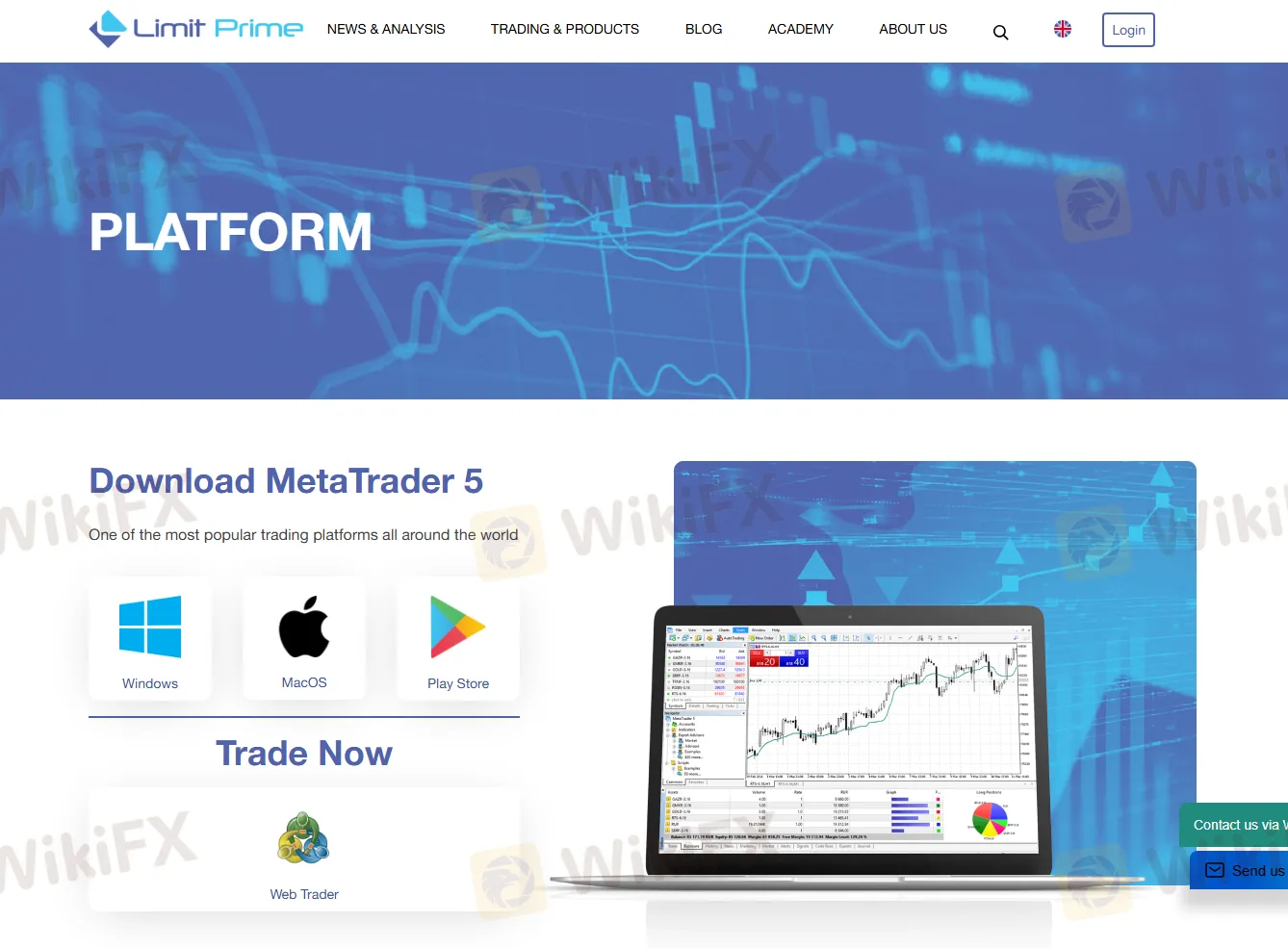

Plataporma ng Trading

Ang MT5 ay isa sa pinakasikat na mga plataporma ng kalakalan sa buong mundo. Ito ay isang advanced na plataporma na sumusuporta sa kalakalan ng maraming produkto sa pinansyal, nagbibigay ng isang automated trading system, mga teknikal na tool, at mga function ng copy trading.

| Plataporma ng Kalakalan | Sumusuporta | Available Devices | Angkop para sa |

| MT5 | ✔ | Desktop, Mobile, Web | Mga may karanasan na mangangalakal |

| MT4 | ❌ | / | Mga nagsisimula |

Deposito at Pag-withdraw

LIMIT PRIME ay nag-aalok ng mga sumusunod na paraan ng pagbabayad: Bank Transfer, Mastercard, Skrill, Neteller, Visa, at American Express.