Buod ng kumpanya

| GOLDTRUSTBuod ng Pagsusuri | |

| Itinatag | 2019 |

| Rehistradong Bansa/Rehiyon | China |

| Regulasyon | Regulated by CFFEX |

| Instrumento sa Merkado | Futures |

| Demo Account | / |

| Platform ng Paggawa ng Kalakalan | Boyi cloud, Yingshun cloud, Polestar,etc. |

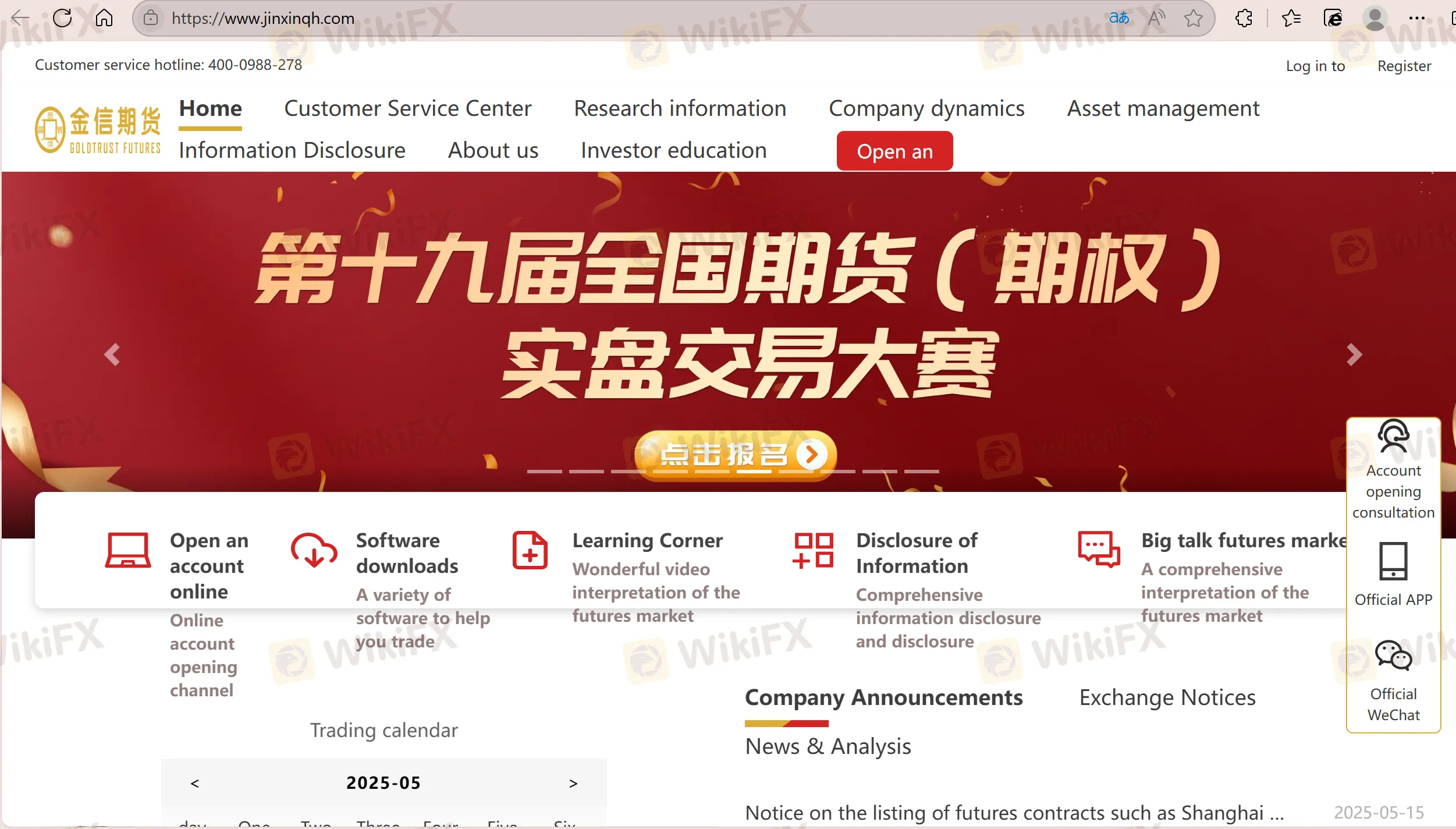

| Suporta sa Customer | |

| Tel: 400-0988-278 | |

| Email: kefu@jinxinqh.com | |

Impormasyon ng GOLDTRUST

Ang GOLDTRUST ay isang reguladong broker, nag-aalok ng mga produkto at serbisyo tulad ng commodity delivery brokerage, financial futures brokerage, futures investment consulting, asset management, at iba pa. May iba't ibang pagpipilian sa kalakalan ang broker. May iba't ibang regulasyon sa bayad para sa iba't ibang commodities.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulated by China Financial Futures Exchange | Handling fees charged |

| Nag-aalok ng iba't ibang financial services | Limitadong mga opsyon sa uri ng account |

| Iba't ibang mga paraan ng pakikipag-ugnayan |

Tunay ba ang GOLDTRUST?

Oo. Ang GOLDTRUST ay isang regulated na institusyon sa pananalapi sa China, na nagsasagawa sa ilalim ng Futures License na inisyu ng CFFEX na may lisensyang numero 0227 upang mag-alok ng serbisyo.

| Regulated Country | Regulator | Kasalukuyang Kalagayan | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| China | CFFEX | Regulated | 金信期货有限公司 | Futures License | 0227 |

Mga Produkto at Serbisyo

GOLDTRUST nag-aalok ng iba't ibang uri ng mga instrumento sa merkado, kabilang ang commodity delivery brokerage, financial futures brokerage, futures investment consulting, asset management, at iba pa.

| Mga Instrumento sa Paghahalal | Supported |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

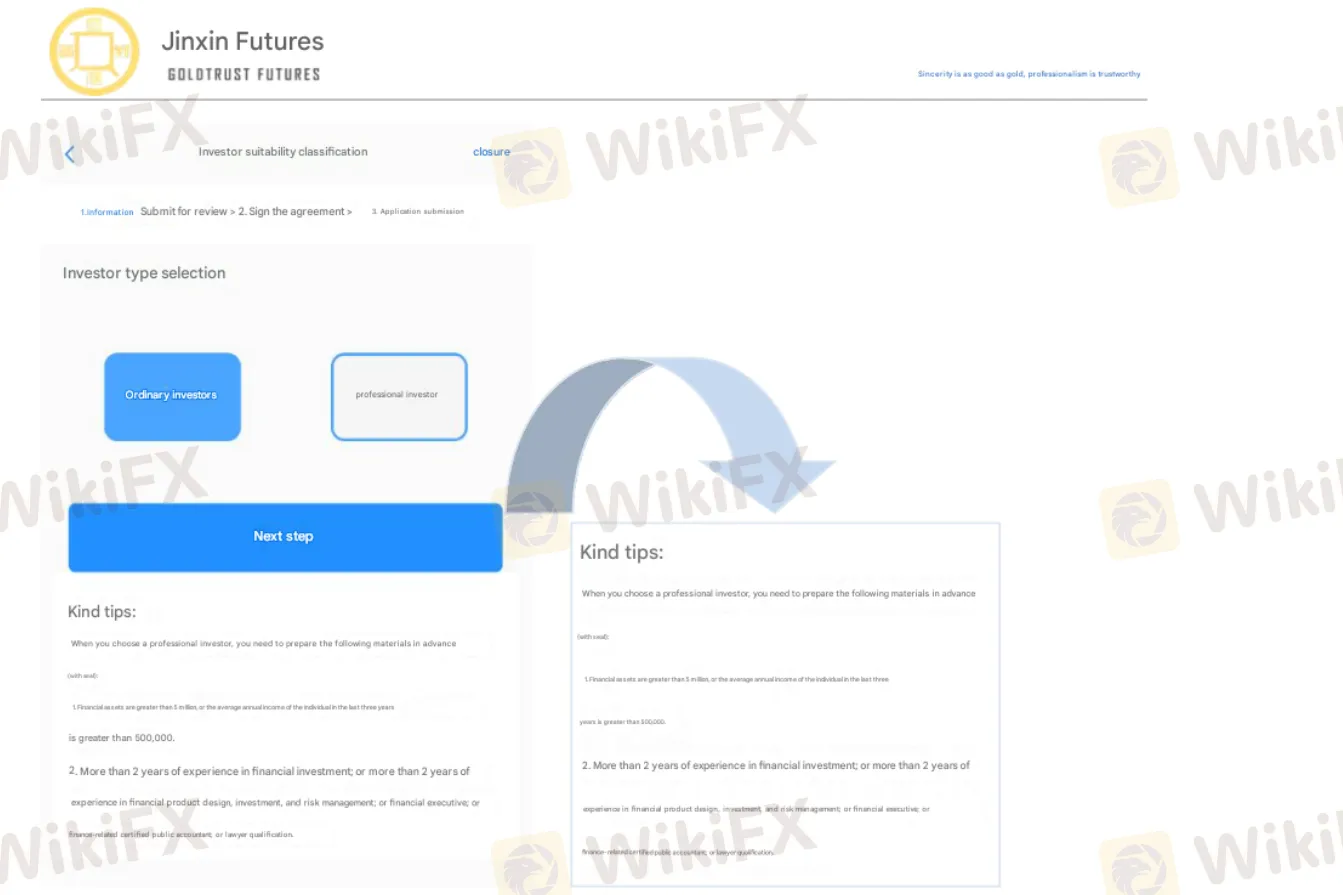

Uri ng Account

GOLDTRUST FUTURES nag-aalok ng dalawang uri ng account sa kanilang mga customer, nahahati sa regular account at professional account.

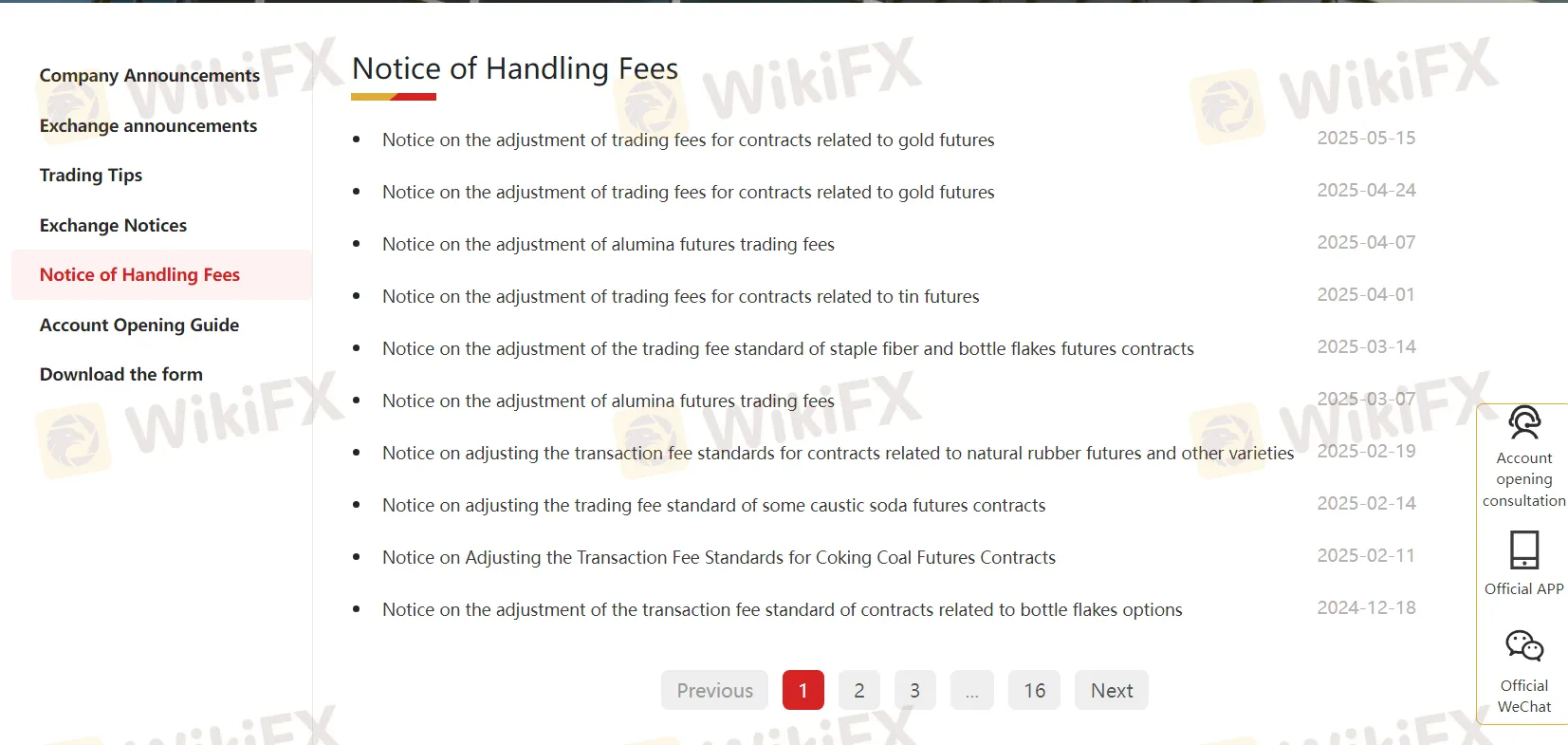

Mga Bayad ng GOLDTRUST

May iba't ibang regulasyon sa bayad para sa iba't ibang commodities, ngunit hindi inilantad ng broker ang partikular na pamantayan sa bayad.

Plataforma ng Paghahalal

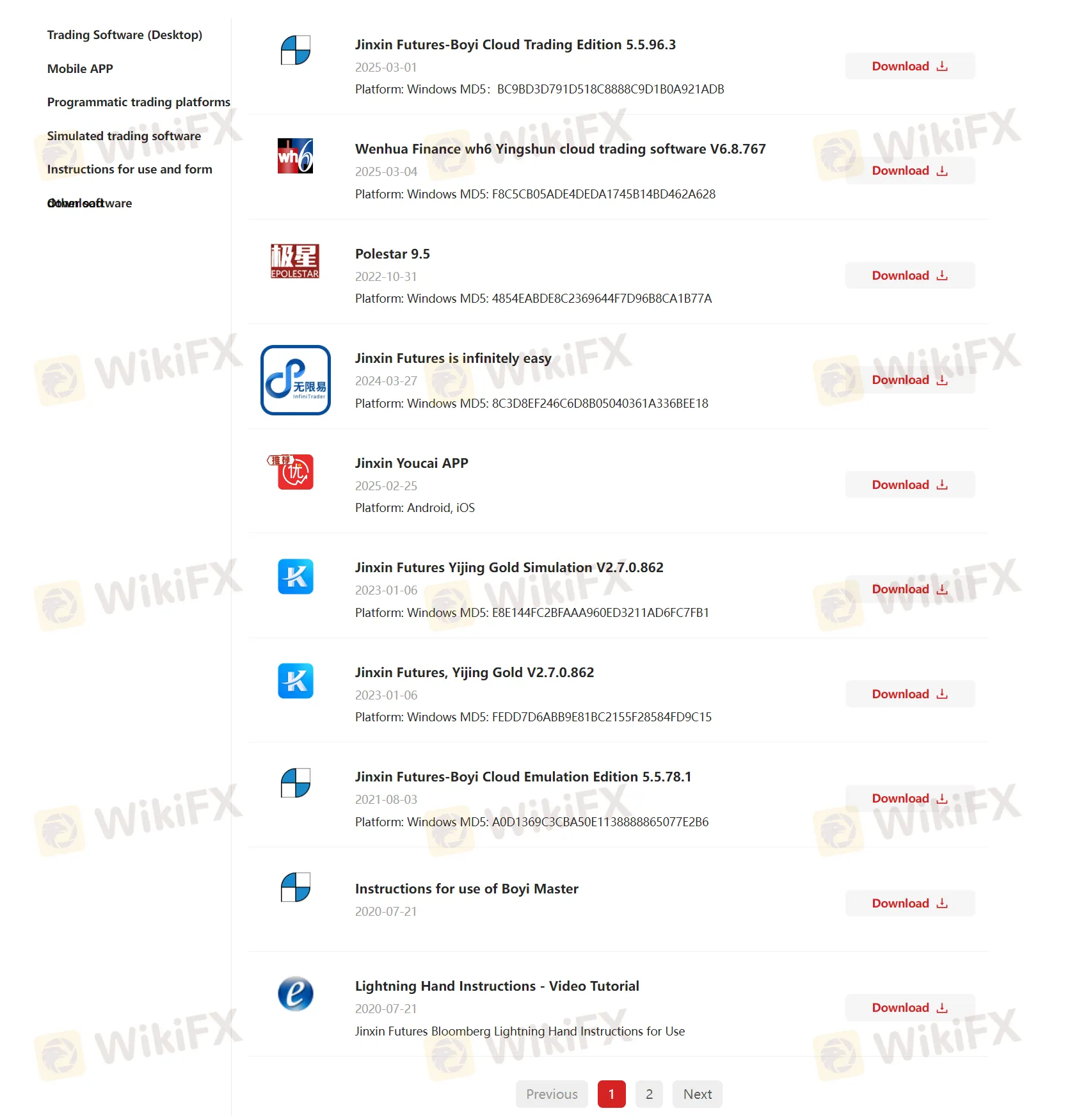

GOLDTRUST nag-aalok ng iba't ibang mga plataporma ng paghahalal, tulad ng Boyi cloud, Yingshun cloud, Polestar, at iba pa.

Pagdedeposito at Pag-Withdraw

GOLDTRUST tumatanggap lamang ng mga bayad sa pamamagitan ng bank wire.