Buod ng kumpanya

| Commerzbank Buod ng Pagsusuri | |

| Itinatag | 1870 |

| Nakarehistrong Bansa/Rehiyon | Alemanya |

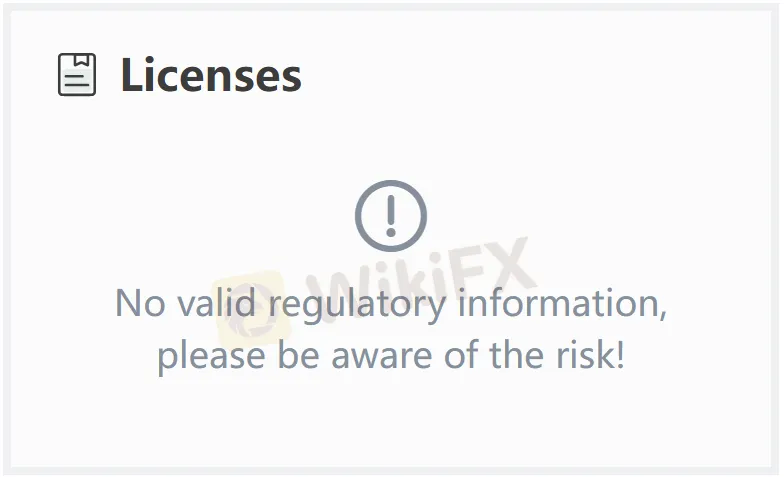

| Regulasyon | Walang Regulasyon |

| Mga Produkto at Serbisyo | Serbisyong Cash, Serbisyong Pangkalakalan, Mga Produktong Bangko, at Mga Produktong Pang-merkado |

| Suporta sa Customer | Telepono: +49 69 136-20, 0800 1010159 |

| Email: info-recruiting@commerzbank.com, info@commerzbank.com | |

| Facebook, Instagram, LinkedIn, YouTube | |

Commerzbank ay isang di-regulado na institusyon sa pananalapi na itinatag noong 1870 at naka-rehistro sa Alemanya. Nag-aalok ito ng malawak na hanay ng mga produkto at serbisyo, kabilang ang Serbisyong Cash, Serbisyong Pangkalakalan, Mga Produktong Bangko, at Mga Produktong Pang-merkado. Bukod dito, nagbibigay din ang Commerzbank ng mga serbisyo para sa pribadong kliyente, negosyong kliyente, at korporasyong kliyente.

Mga Benepisyo at Kadahilanan

| Mga Benepisyo | Kadahilanan |

| Mahabang kasaysayan | Walang regulasyon |

| Malawak na hanay ng mga produkto at serbisyo | Di-malinaw na istraktura ng bayad |

Tunay ba ang Commerzbank?

Sa kasalukuyan, ang Commerzbank ay kulang sa wastong regulasyon. Mangyaring maging maingat sa panganib!

Mga Produkto at Serbisyo

Nagbibigay ang Commerzbank ng mga serbisyo sa mga kliyente na may Serbisyong Cash, Serbisyong Pangkalakalan, Mga Produktong Bangko, at Mga Produktong Pang-merkado.