Profil perusahaan

| IndiaNivesh Ringkasan Ulasan | |

| Dibentuk | 2006 |

| Negara/Daerah Terdaftar | India |

| Regulasi | Tidak diatur |

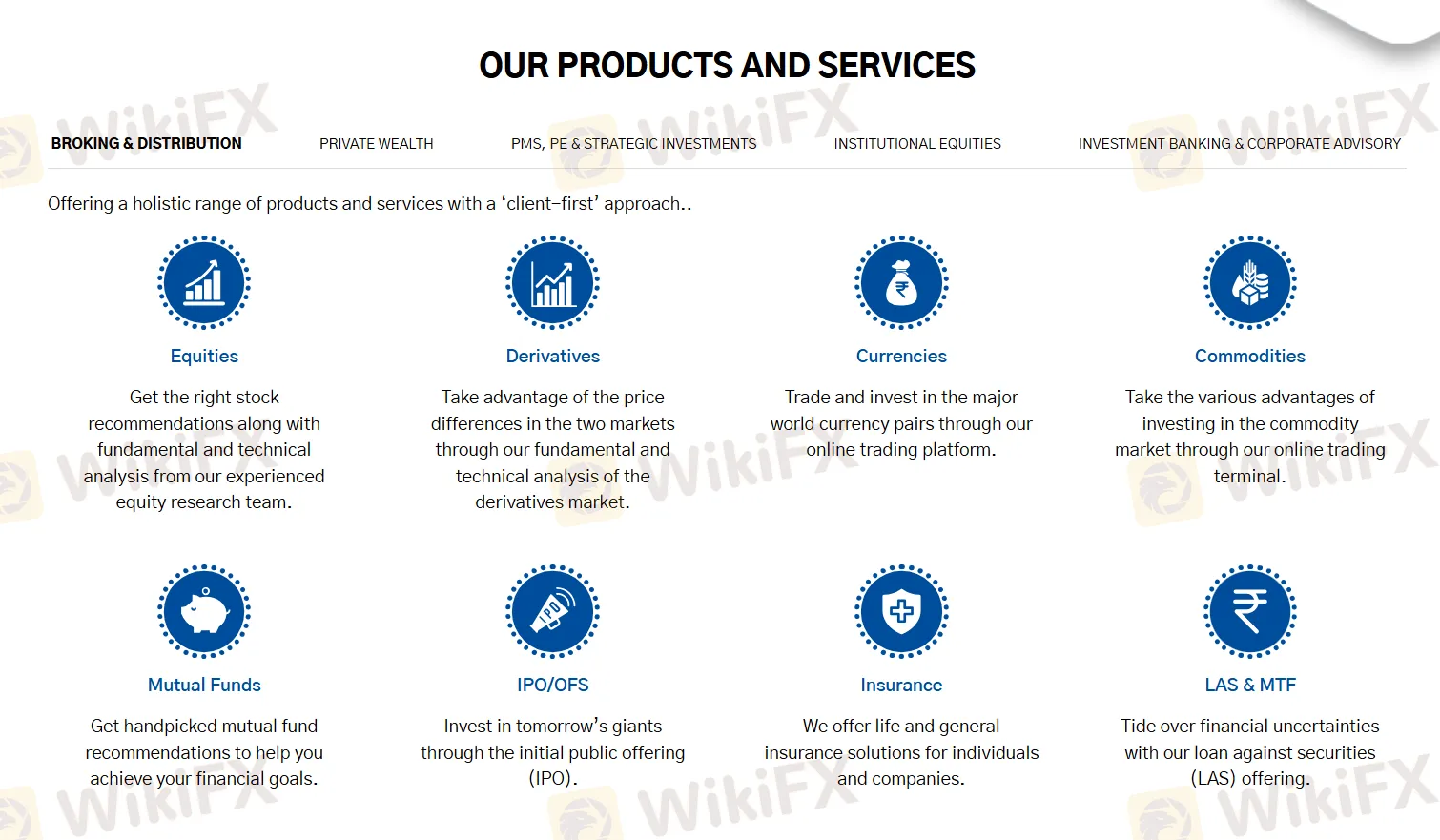

| Instrumen Pasar | Ekuitas, reksadana, derivatif, IPO, mata uang, asuransi, komoditas |

| Akun Demo | ❌ |

| Platform Perdagangan | Aplikasi IndiaNivesh |

| Dukungan Pelanggan | Tel: 022 – 62406240 |

| Media sosial: Facebook, X, Instagram, LinkedIn, YouTube | |

| Email: customersupport@indianivesh.in | |

Informasi IndiaNivesh

IndiaNivesh adalah penyedia layanan tanpa regulasi dari perantara premier dan layanan keuangan di Bursa Saham India. Menawarkan produk dan layanan pada ekuitas, reksadana, derivatif, IPO/OFS, mata uang, asuransi, komoditas, LAS&MTF, solusi yang disesuaikan, layanan manajemen portofolio, ekuitas swasta, investasi strategis, riset, penjualan dan perdagangan, peningkatan modal (ekuitas & utang), masuk India, globalisasi perusahaan India, penggabungan & akuisisi.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Waktu operasi yang panjang | Kurangnya regulasi |

| Berbagai saluran kontak | Tidak ada akun demo |

| Berbagai produk & layanan |

Apakah IndiaNivesh Legal?

Tidak. Saat ini tidak memiliki regulasi yang valid. Harap waspada terhadap risiko!

Apa yang Bisa Diperdagangkan di IndiaNivesh?

| Aset Perdagangan | Didukung |

| Saham | ✔ |

| Reksa Dana | ✔ |

| Derivatif | ✔ |

| IPO | ✔ |

| Mata Uang | ✔ |

| Asuransi | ✔ |

| Komoditas | ✔ |

| Indeks | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Aplikasi IndiaNivesh | ✔ | Mobile | / |