Riepilogo dell'azienda

Informazioni generali e regolamento

LINE Securities Corporation(istituito nel 2018) rilasciato LINE FX il 16 marzo 2020 a tokyo – un nuovo servizio di negoziazione di margini di cambio ("forex"). è il terzo e ultimo servizio a entrare a far parte dell'omonimo servizio di investimento mobile dell'azienda. titoli di linea è autorizzato e regolamentato dall'agenzia di servizi finanziari del Giappone con il numero di licenza 6011101084363.

Strumenti di mercato

Gli utenti possono scambiare 10 coppie di valute principali, 10.000 unità di valuta alla volta, senza commissioni di transazione, in base allo spread più basso e ai punti di scambio elevati rispetto agli standard del settore.

Tipi di ordine

LINE FXoffre otto tipi di ordine: streaming, mercato, limite, stop limite, uno annulla l'altro (oco), se fatto (ifd), se fatto uno annulla l'altro (ifd-oco), e chiudi tutto. gli ordini possono anche essere eseguiti su base first-in, first-out (fifo). gli utenti possono combinare questo con i diversi tipi di ordine in base al loro stile di trading.

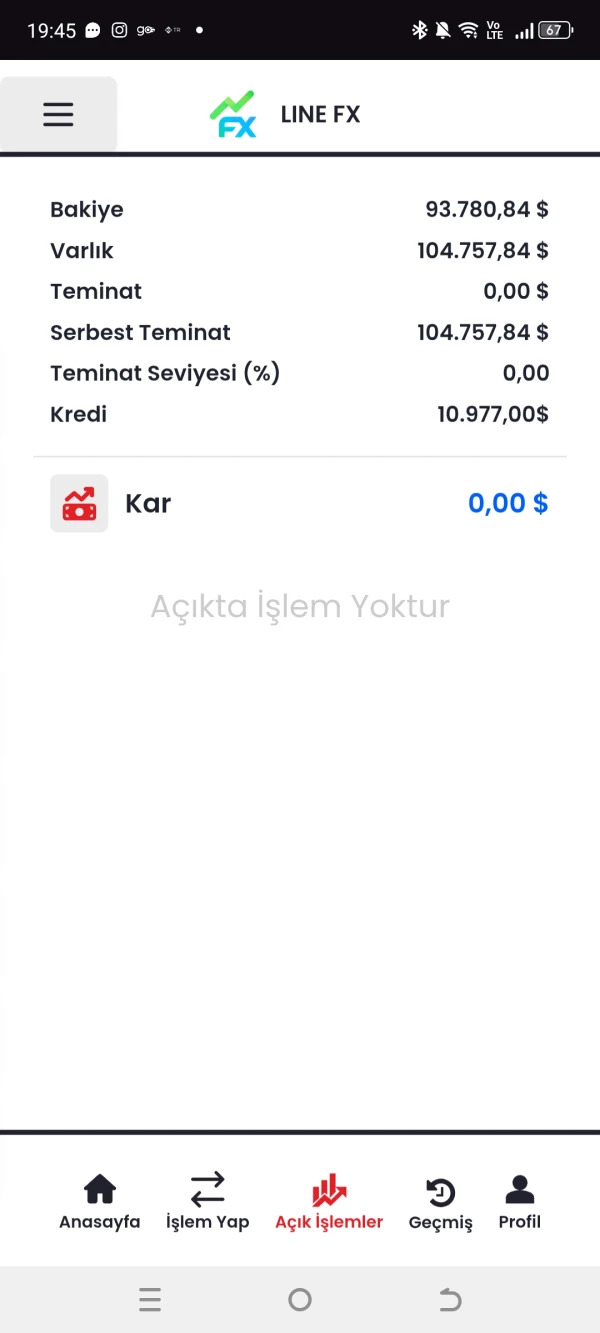

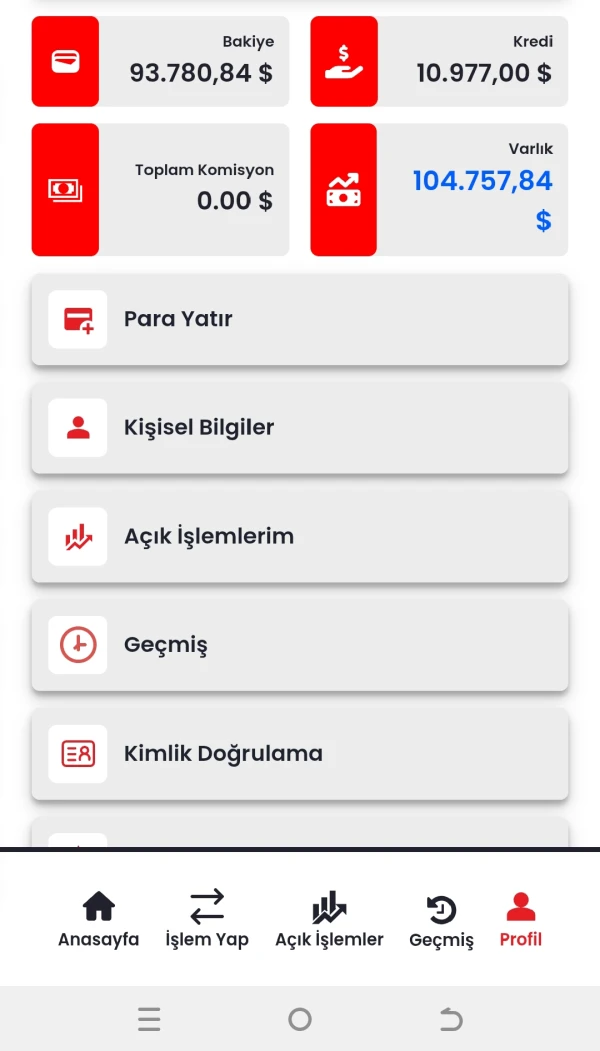

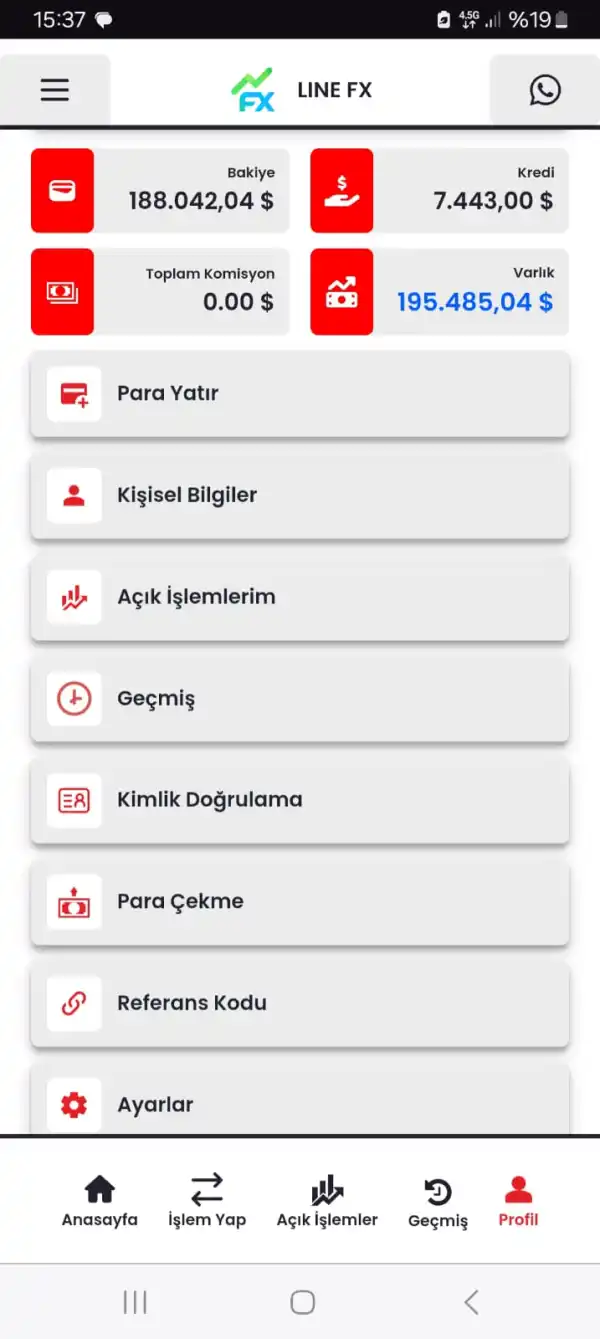

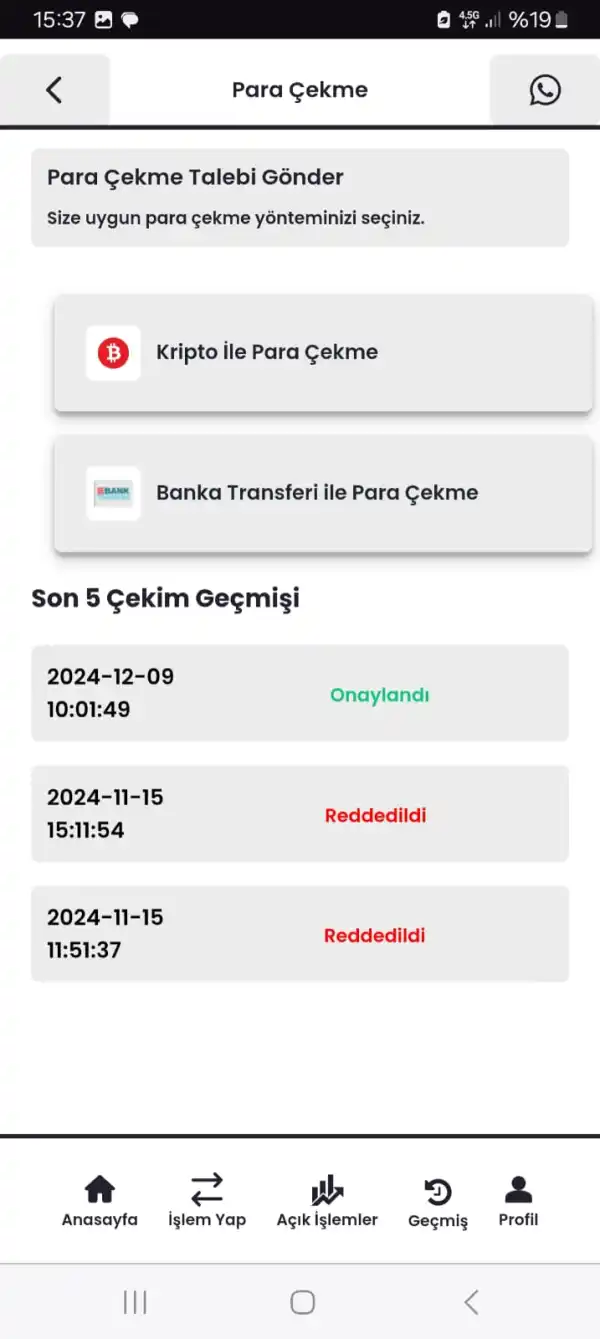

Deposito minimo

LINE FXnon richiede un deposito minimo per il forex trading, il che suona benissimo per i nuovi trader per iniziare.

Leva

Per effettuare un ordine, gli utenti devono impegnare un margine di almeno il 4% (leva 25:1) del valore commerciale per ogni coppia di valute.

Spread e commissioni

LINE FXnon addebita alcuna commissione di transazione. lo spread su eurjpy parte da 0,2 pip, eurjpy da 0,3 pip, gbpjpy da 0,5 pip, audjpy da 0,3 pip.

Tecnologia

LINE FXoffre 11 indicatori tecnici con parametri configurabili. i grafici in streaming possono essere visualizzati orizzontalmente o verticalmente e gli utenti possono mantenere i grafici in tempo reale visualizzati sullo schermo del proprio smartphone mentre fanno trading rapidamente con un semplice tocco di un pulsante. se ciò non bastasse, il servizio consente inoltre agli utenti di visualizzare rapidamente quattro grafici, modificare le coppie di valute, visualizzare una sequenza temporale diversa, tracciare una linea di tendenza e altro ancora.

Orari di negoziazione

Sessioni diurne: dalle 9:00 alle 11:20, dalle 11:30 alle 12:20, dalle 12:30 alle 14:50 Sessioni notturne: dalle 17:00 alle 21:00. Il trading di ETF è attualmente limitato alle sessioni giornaliere. Gli ordini non sono accettati nei giorni festivi o al di fuori dell'orario di negoziazione.