Resumo da empresa

| FX Broadnet Resumo da Revisão | |

| Fundado | 1993 |

| País/Região Registrado | Japão |

| Regulação | Não regulamentado |

| Serviços | FX de balcão/Click 365/Ferramentas de negociação |

| Conta Demonstração | ✅ |

| Spread | A 0,2 sen (spread dólar-iene) |

| Ferramentas de Negociação | FX BroadNe (Navegador/Android/iPhone/Tablet/Mobile) |

| Suporte ao Cliente | Telefone: 0120-997-867 |

| E-mail: support@fxbroadnet.com | |

| Mídias Sociais: Facebook, Twitter | |

Informações FX Broadnet

FX Broadnet foi fundada em 1993 como uma empresa de informações que tem fornecido serviços relacionados ao mercado de câmbio há mais de vinte anos. A empresa oferece "FX Broadnet", um serviço online com negociação de spread baixo para negociação de margem de câmbio (FX) de balcão com base em tecnologia de ponta em TI, e lida com "Click 365", um serviço de negociação de margem de câmbio negociado em bolsa na Tokyo Financial Exchange. Explique isso com vídeos simples e fáceis de entender no YouTube: https://www.youtube.com/watch?reload=9&v=vYHJCADGt5k

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

FX Broadnet é Legítimo?

FX Broadnet é autorizado e regulado pela Agência de Serviços Financeiros (FSA). O número da licença é 関東財務局長(金商)第244号, o que o torna mais seguro do que corretores regulamentados.

Quais serviços FX Broadnet oferece?

FX Broadnet oferece serviços em três aspectos principais: FX de Balcão, Click 365 e Ferramentas de Negociação.

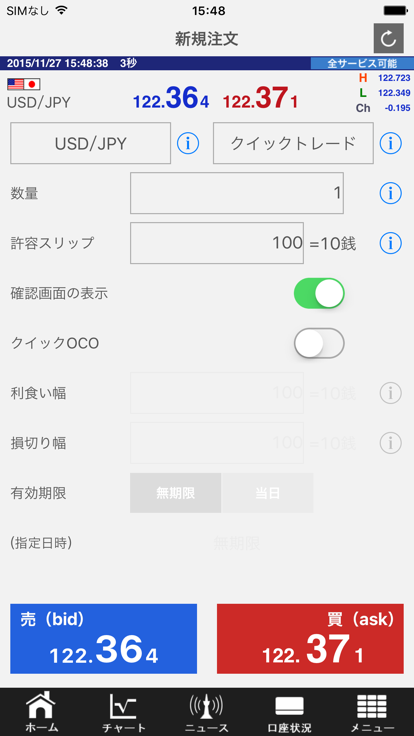

O FX de Balcão oferece transações de diferença de pontos baixos. Computadores para ferramentas de negociação dedicadas a câmbio de computadores para smartphones, rastreando transações, transações a partir de 4.000 ienes, permitindo transações para 10.000 tipos. Portanto, é adequado para iniciantes e pessoas que desejam reduzir riscos.

"CLICK 365" é a primeira negociação de depósito de câmbio estrangeiro (FX) do Japão que oferece preços preferenciais aos clientes por meio do mecanismo de métodos de negócios de mercado.

Tipo de Conta

Além da conta real para negociação de FX de balcão. FX Broadnet também oferece contas demo para se familiarizar com as plataformas e conteúdos relacionados ao aprendizado.

FX Broadnet Taxas

A força dos spreads FX Broadnet é que o spread dólar-iene é de 0,2 sen. Quanto menor o spread, mais rápida é a liquidez. O Click 365 LARGE usa 100.000 unidades monetárias, e a taxa de swap de compra cai 0,08. Para mais detalhes, consulte https://www.fxbroadNet.com/click/composition/swap/.

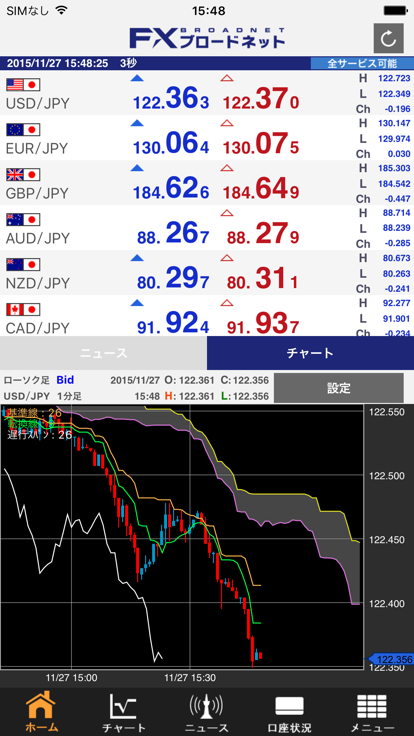

Ferramentas de Negociação

Os usuários podem baixar várias versões do FX BroadNet, incluindo Navegador, Android/iPhone, Tablet e Mobile.

| Plataforma | Suportado | Dispositivos Disponíveis |

| FX BroadNe | ✔ | Navegador/Android/iPhone/Tablet/Mobile |

Opções de Suporte ao Cliente

Os traders podem seguir a plataforma no Facebook, Twitter e mais e entrar em contato através de telefone e email. O horário de trabalho é das 9:00 às 17:00 (Excluindo feriados do mercado interbancário) de segunda a sexta-feira.

| Opções de Contato | Detalhes |

| Linha Direta | 0120-997-867 |

| support@fxbroadnet.com | |

| Redes Sociais | Facebook, Twitter |

| Idioma Suportado | Japão |

| Idioma do Site | Japão |

| Endereço Físico | 〒100-6217 東京都千代田区丸の内1-11-1 |