公司简介

| 中国银河国际评论摘要 | |

| 成立时间 | 2011 |

| 注册国家/地区 | 香港 |

| 监管 | 受监管 |

| 市场工具 | 证券期货和期权债券共同基金结构化产品 |

| 模拟账户 | ❌ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | SPTrader ProGalaxy Global Trading TerminalsSoft 代币AAStocks |

| 最低存款 | / |

| 客户支持 | 电话:(852) 3698 6750 / 400 866 8833 |

| 电子邮件:cs@chinastock.com.hk | |

| 社交媒体:微信 | |

| 实际地址:香港上环干诺道中111号永安中心20楼,香港皇后大道中36号COSCO大厦1单元,香港九龙弥敦道683-685号美美大厦8楼 | |

中国银河国际 信息

该公司于2011年在香港成立。它受香港证监会监管,提供全方位的金融服务,包括经纪和销售、投资银行、投资研究、资产管理和融资。此外,交易者可以选择5种账户类型和4种交易平台。

优点和缺点

| 优点 | 缺点 |

| 受到良好监管 | 不支持MT4/5 |

| 5种账户 | 没有账户详细信息 |

| 4种交易平台 |

中国银河国际 是否合法?

| 监管国家/地区 |  |

| 监管机构 | 香港证监会 |

| 监管实体 | 中国银河国际 国际期货(香港)有限公司 |

| 许可证类型 | 从事期货合约交易 |

| 许可证号码 | AYH772 |

| 当前状态 | 受监管 |

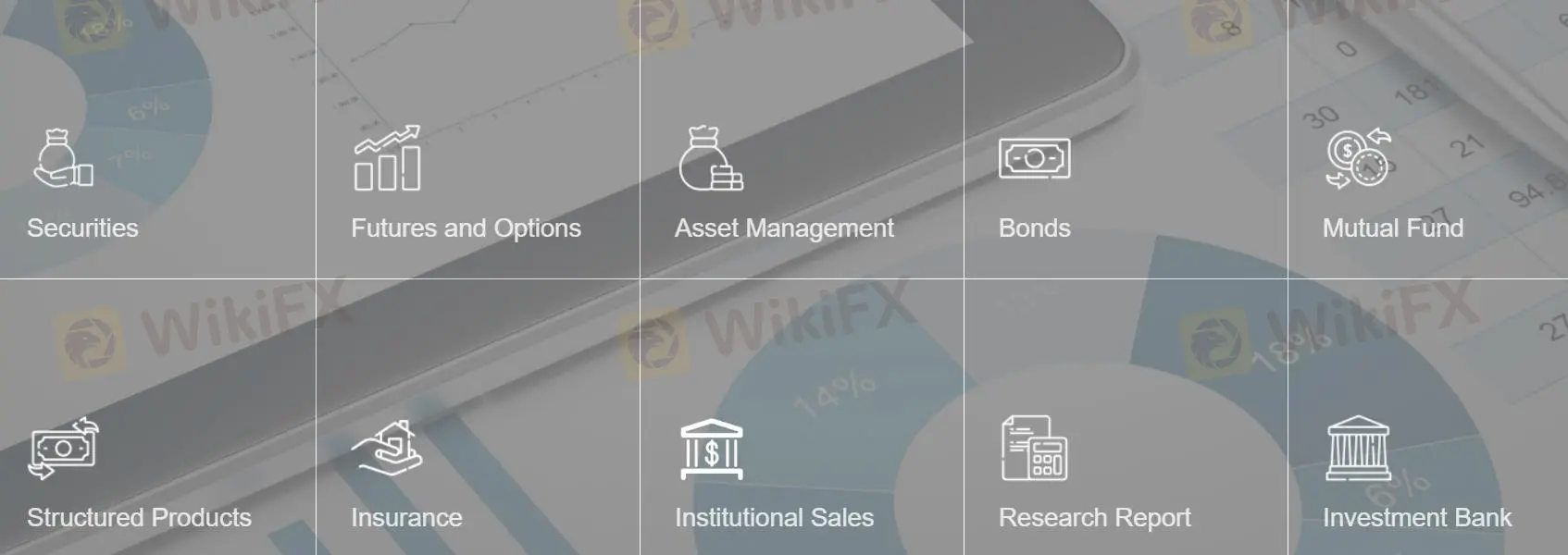

中国银河国际 可以交易什么?

交易者可以在中国银河国际上交易证券、140+期货和期权、债券、共同基金,包括股票基金、货币市场基金、债券基金、平衡基金、多资产基金、行业基金等,以及结构化产品。

| 可交易工具 | 支持 |

| 证券 | ✔ |

| 期货和期权 | ✔ |

| 债券 | ✔ |

| 共同基金 | ✔ |

| 结构化产品 | ✔ |

| 外汇 | ❌ |

| 贵金属和大宗商品 | ❌ |

| 指数 | ❌ |

| 股票 | ❌ |

| ETF | ❌ |

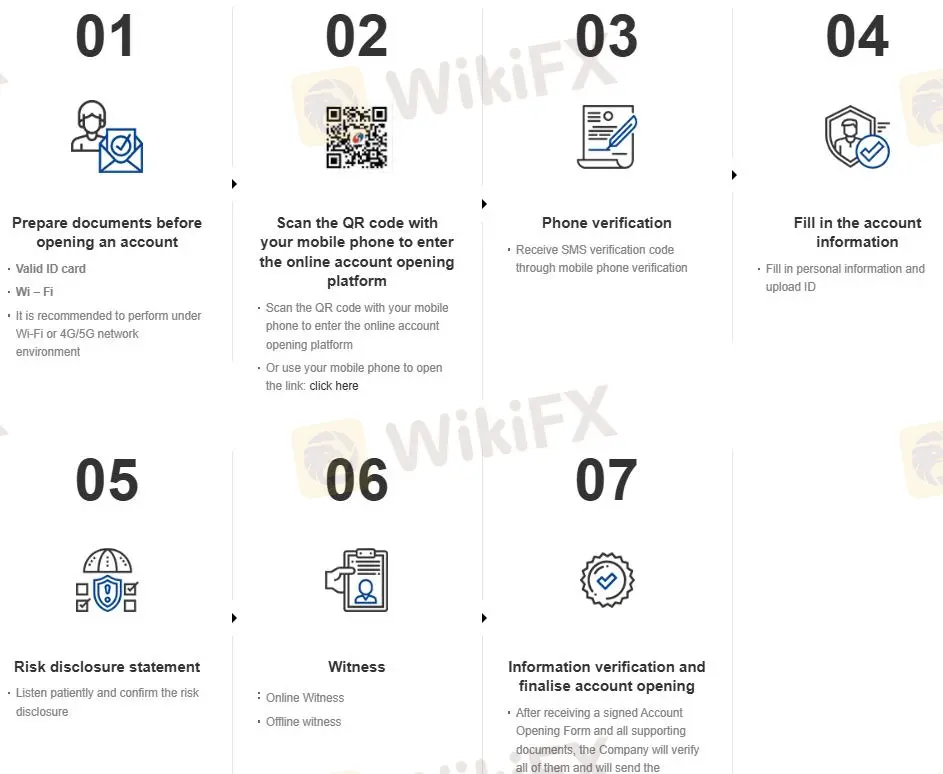

账户类型

中国银河国际表示提供证券现金账户账户、证券保证金账户账户、期货账户账户和股票期权账户账户。此外,客户还可以选择开设电子交易账户,共计5种账户类型,无需初始存款。

开设账户有2种选择:在线和移动。具体流程可参考:https://en.chinastock.com.hk/customer/process/

交易平台

中国银河国际国际的交易平台包括SPTrader Pro、Galaxy Global Trading Terminals、Soft 代币和AAStocks,可在移动设备或桌面上使用。

| 交易平台 | 支持 | 可用设备 | 适用对象 |

| SPTrader Pro | ✔ | 移动设备 | 所有交易者 |

| Galaxy Global Trading Terminals | ✔ | 桌面 | 所有交易者 |

| Soft 代币 | ✔ | 移动设备 | 所有交易者 |

| AAStocks | ✔ | 桌面 | 所有交易者 |

| MT4 | ❌ | ||

| MT5 | ❌ |

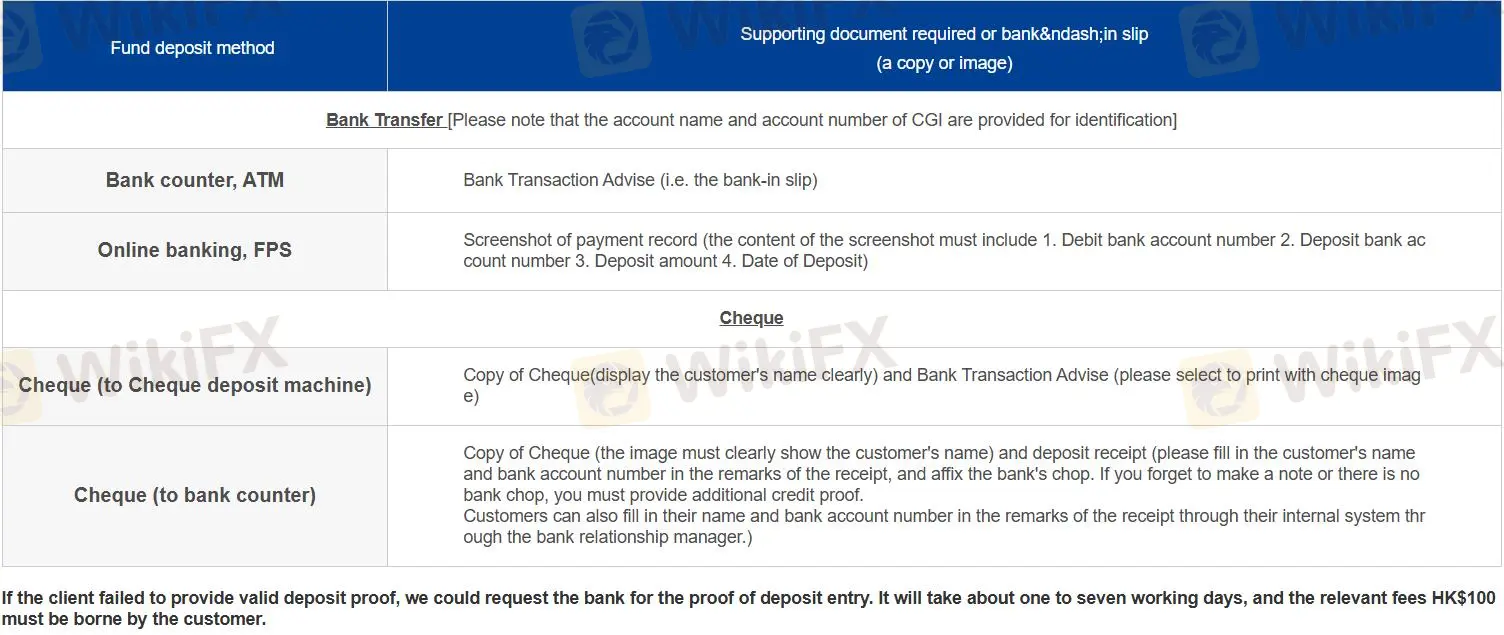

存款和取款

存款分为2类,共有4种类型:

银行柜台、ATM

网上银行、FPS

支票(存入支票存款机)

支票(到银行柜台)

对于需要提款的交易者,如果已经注册了银行账户账户,请联系AE或填写提款表格以获取指示。否则,需要填写提款表格以获取指示。

1g h jv f f f

香港

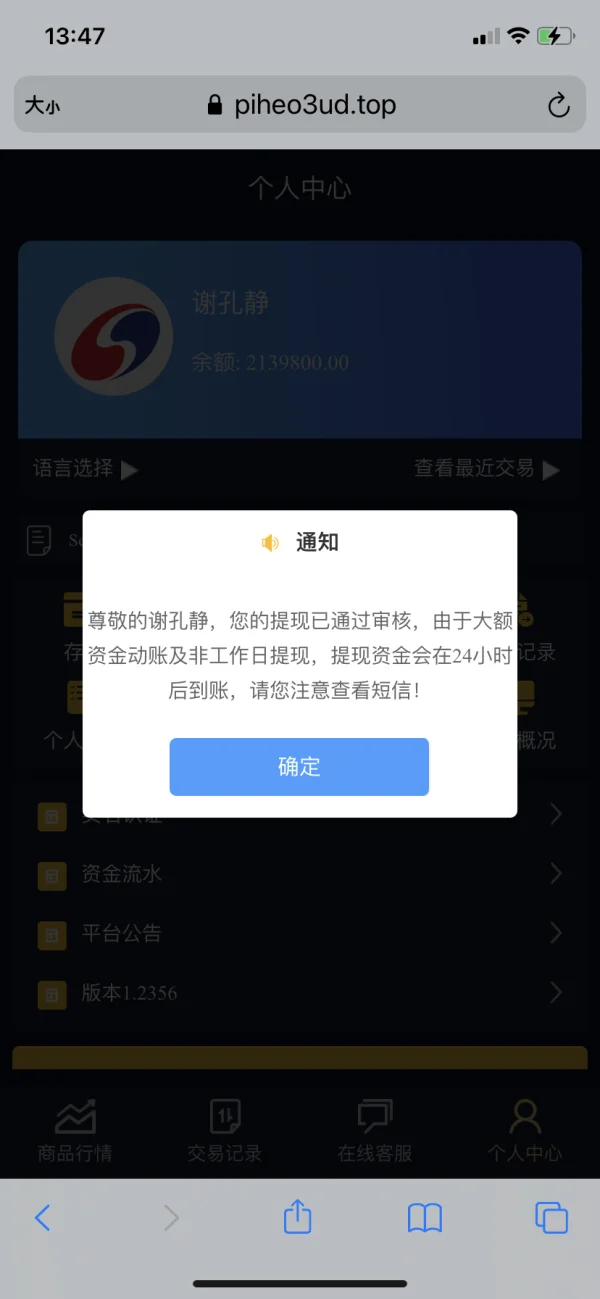

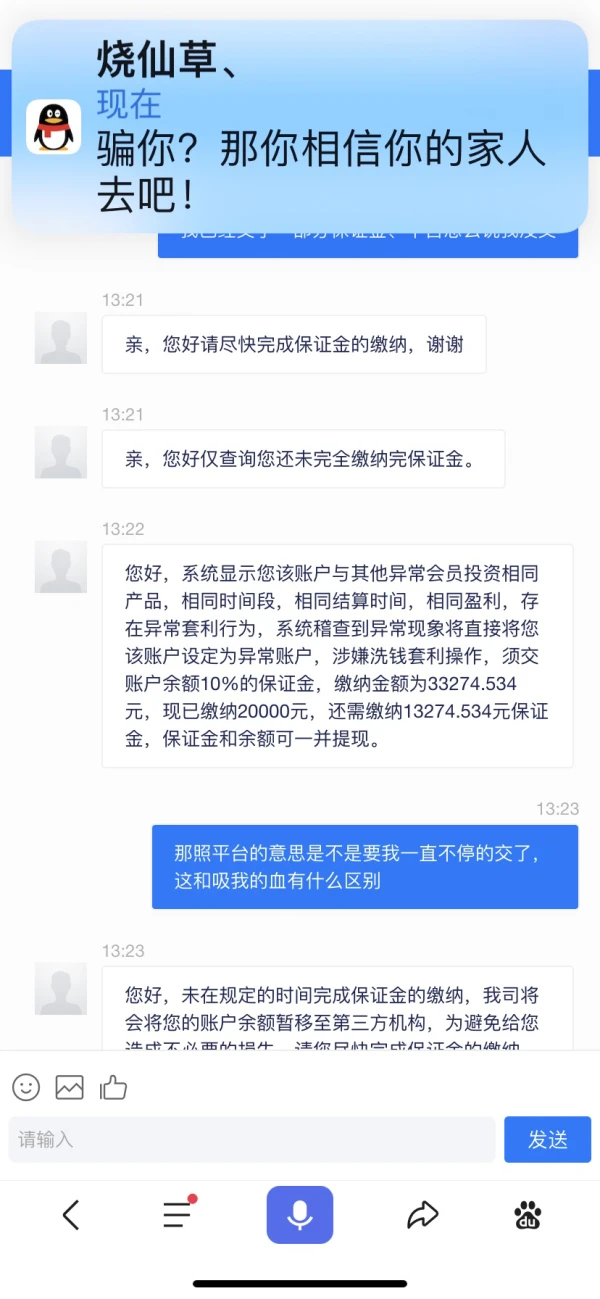

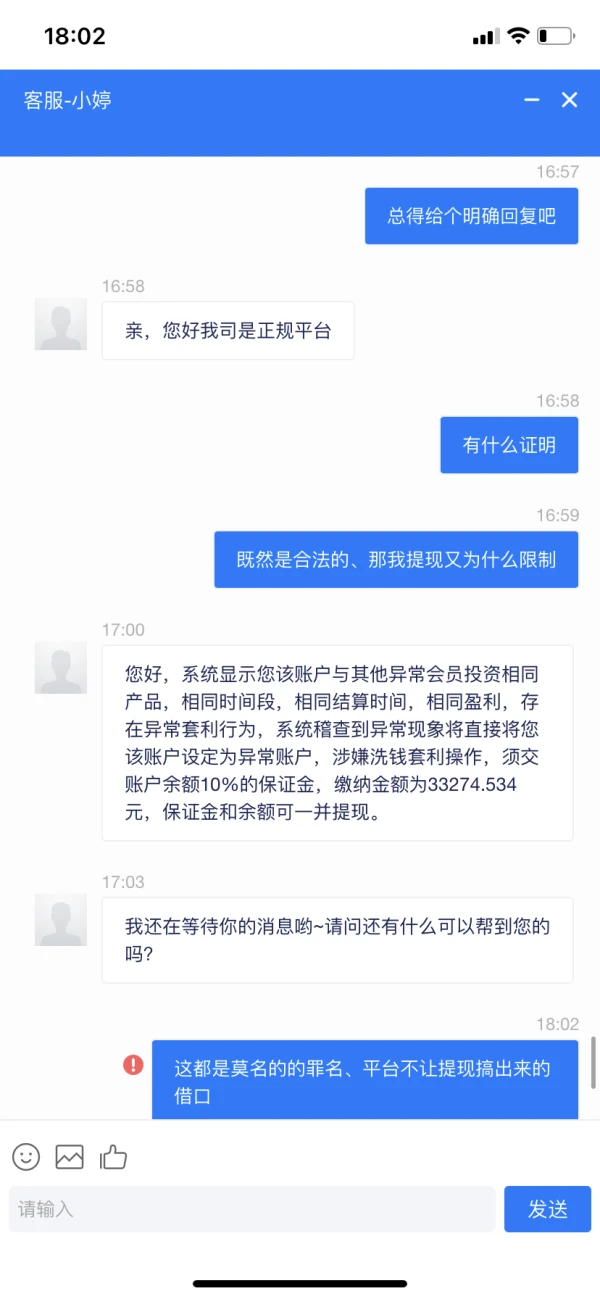

黑平台

曝光

建雷

香港

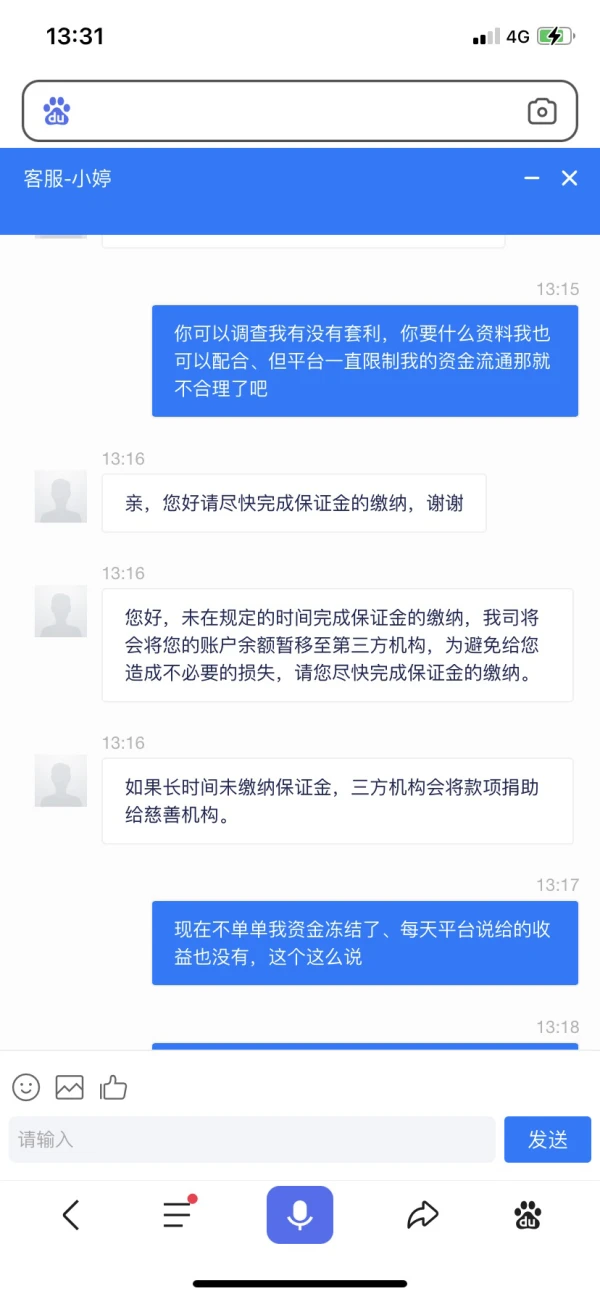

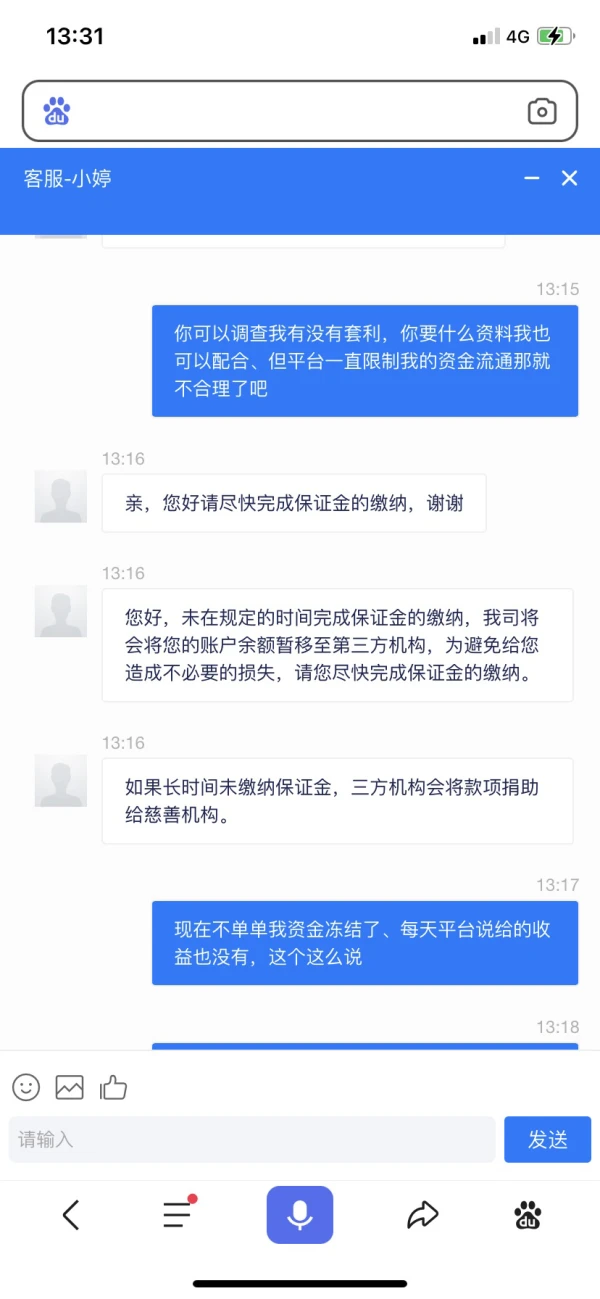

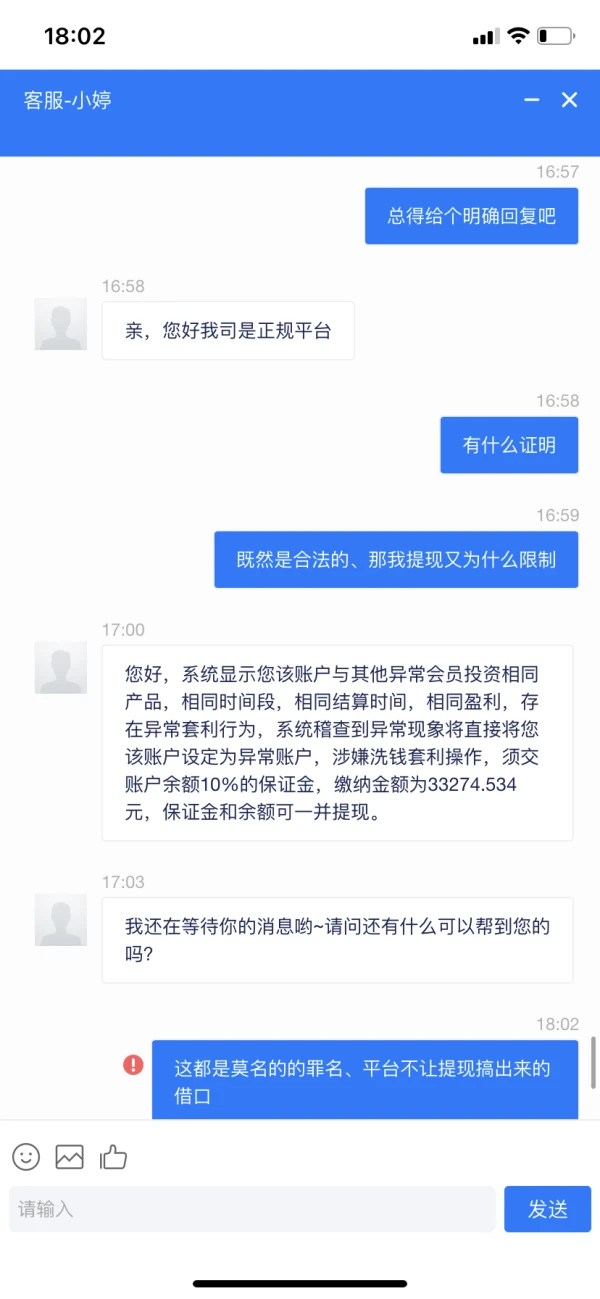

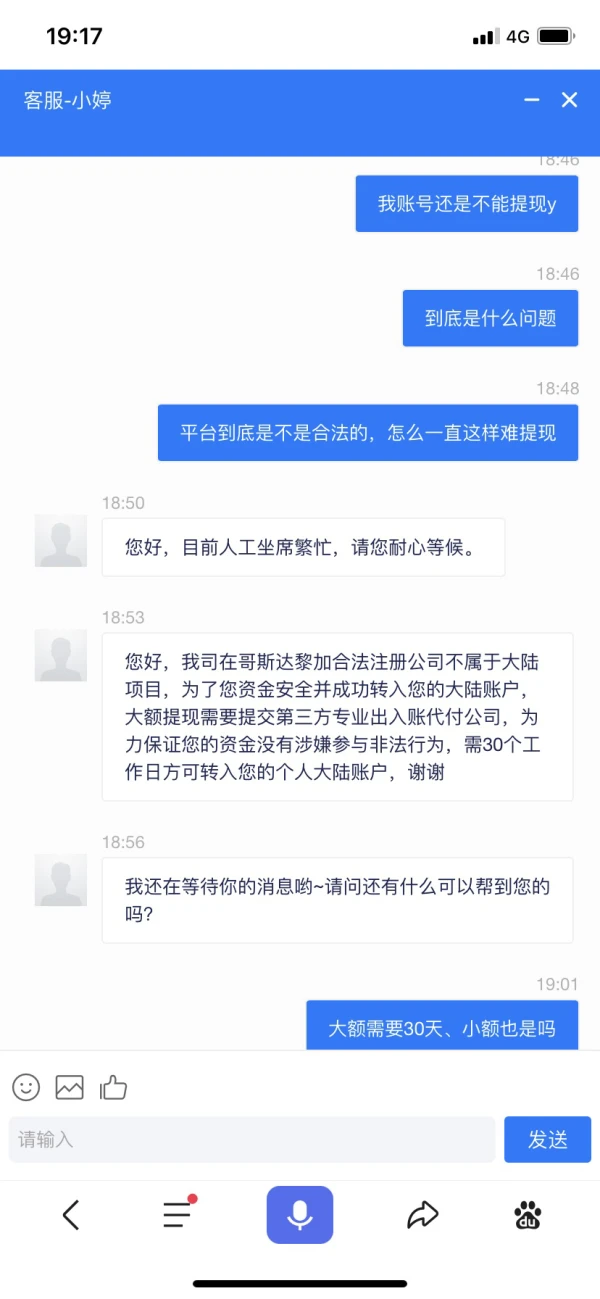

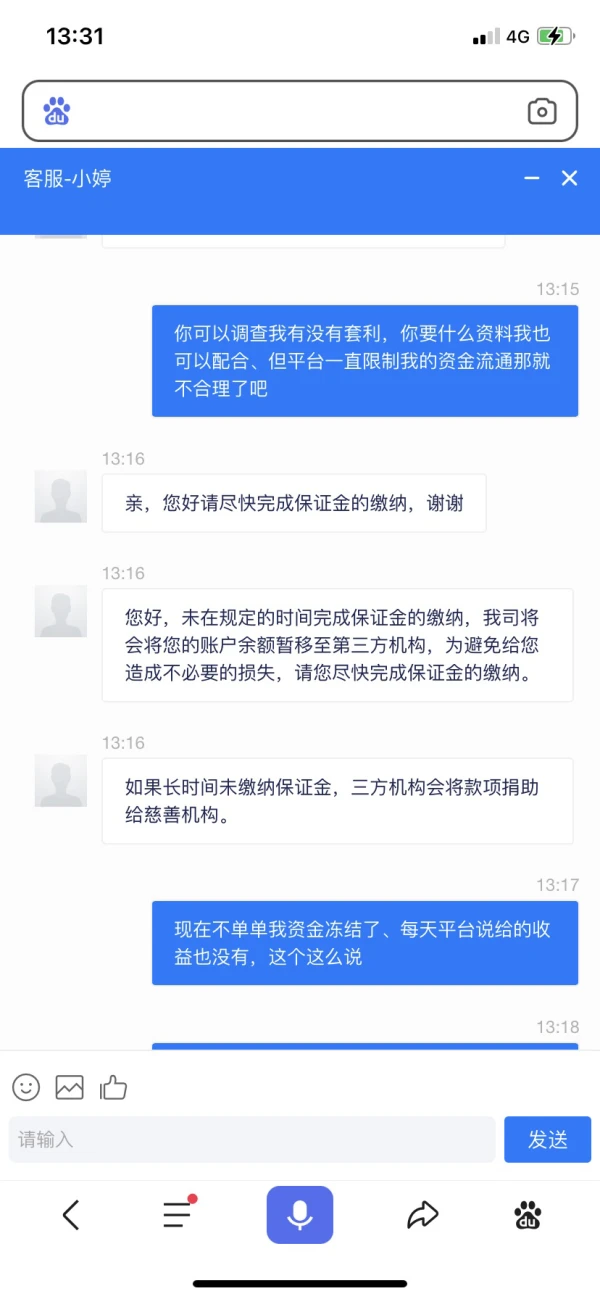

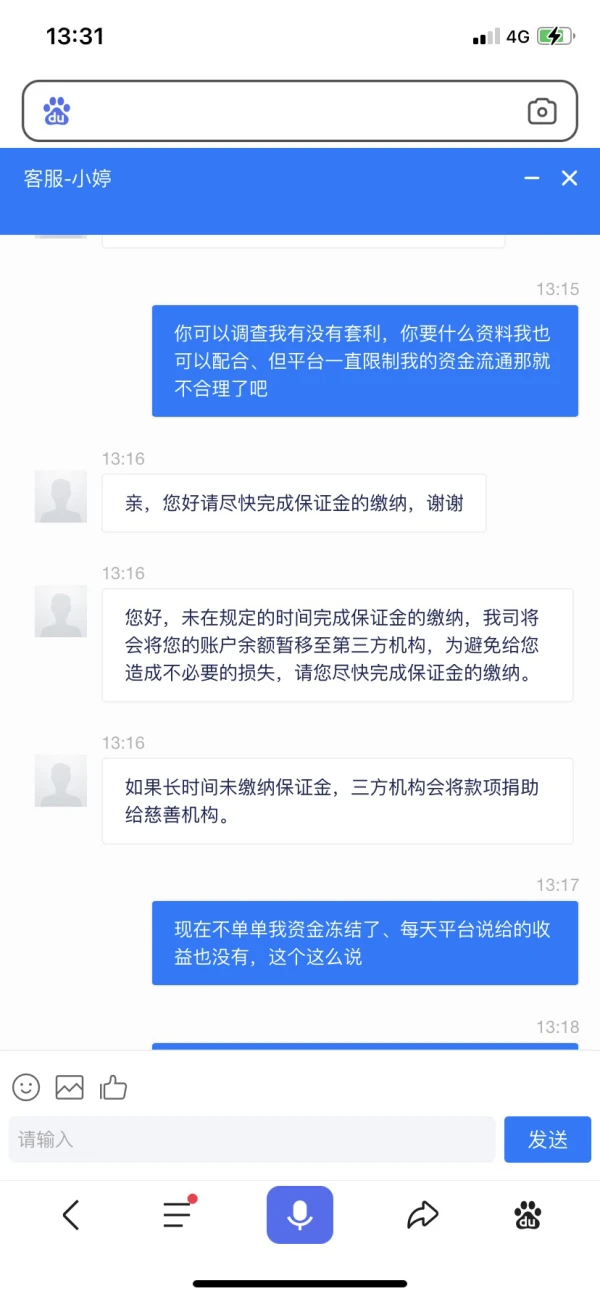

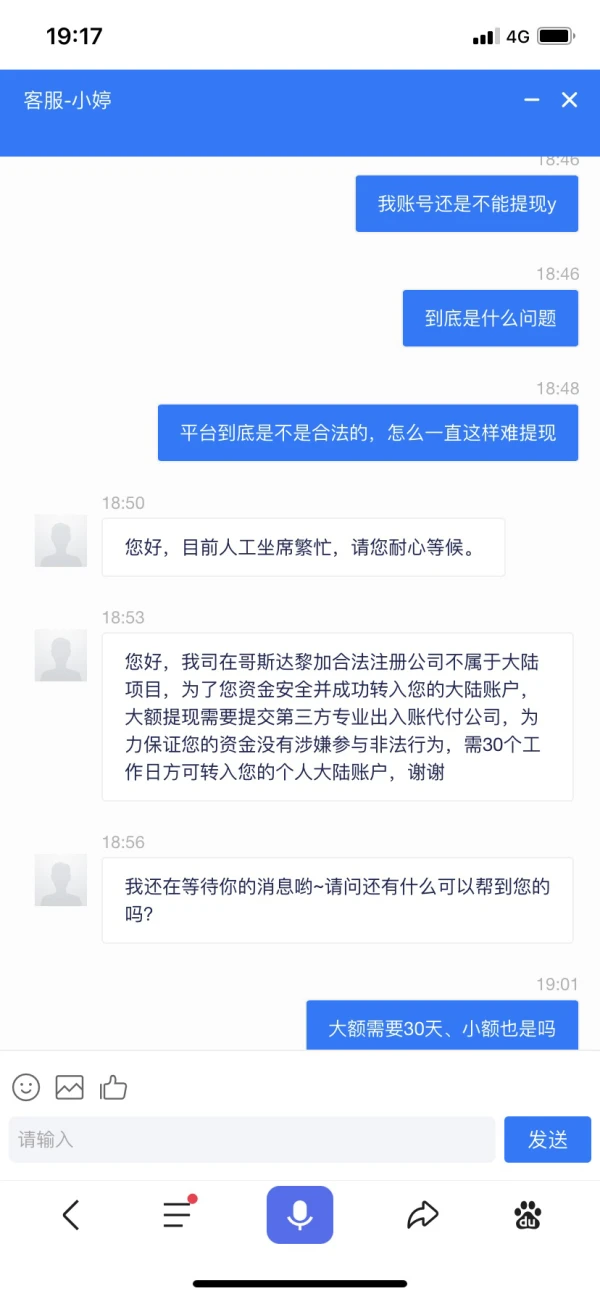

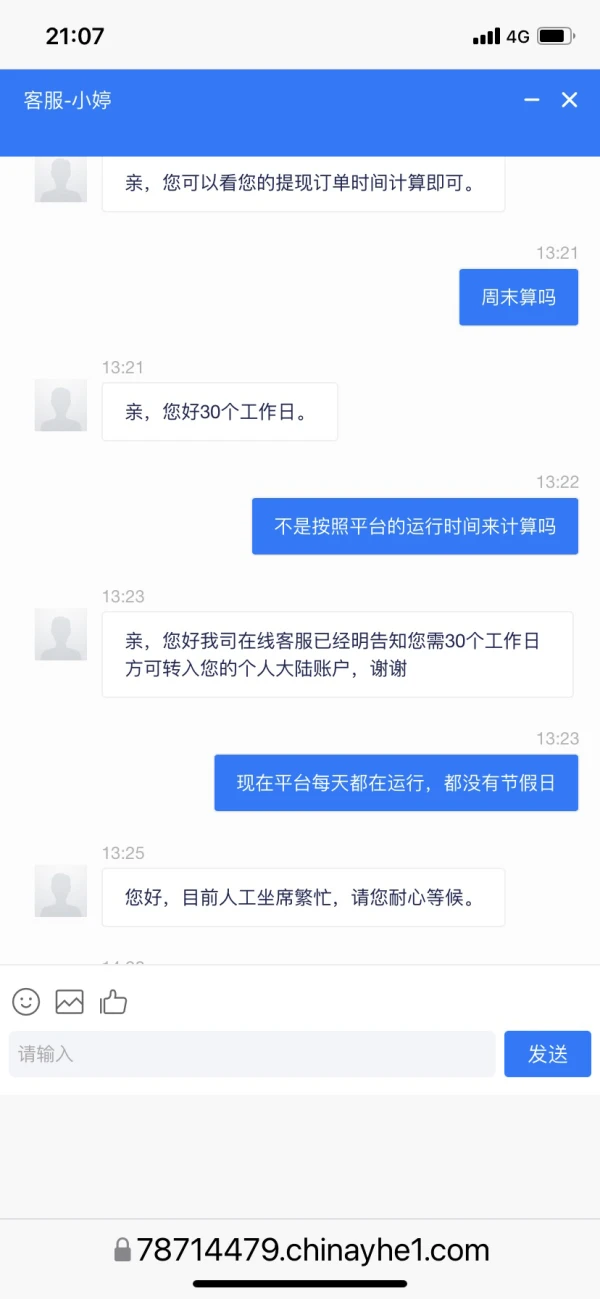

一直拒绝提现,不让提现说一大堆理由,引起大家警示

曝光

徊眸

香港

客服一直找各种借口无法出金,问其是什么问题也不说明白就是找各种理由。

曝光

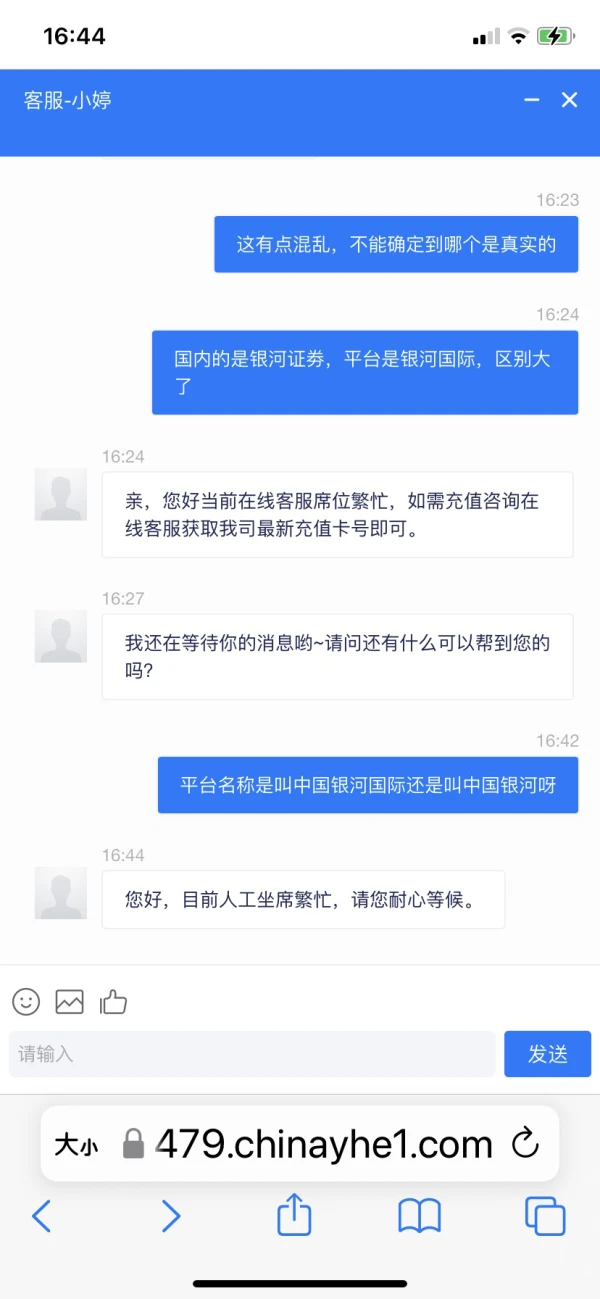

徊眸

香港

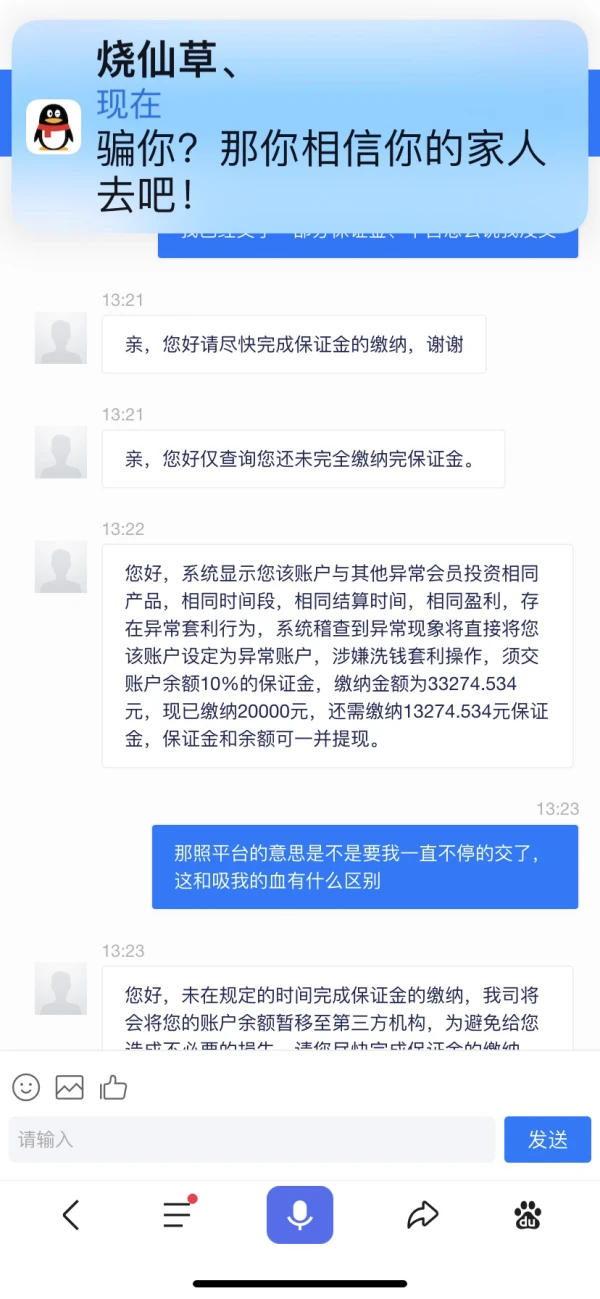

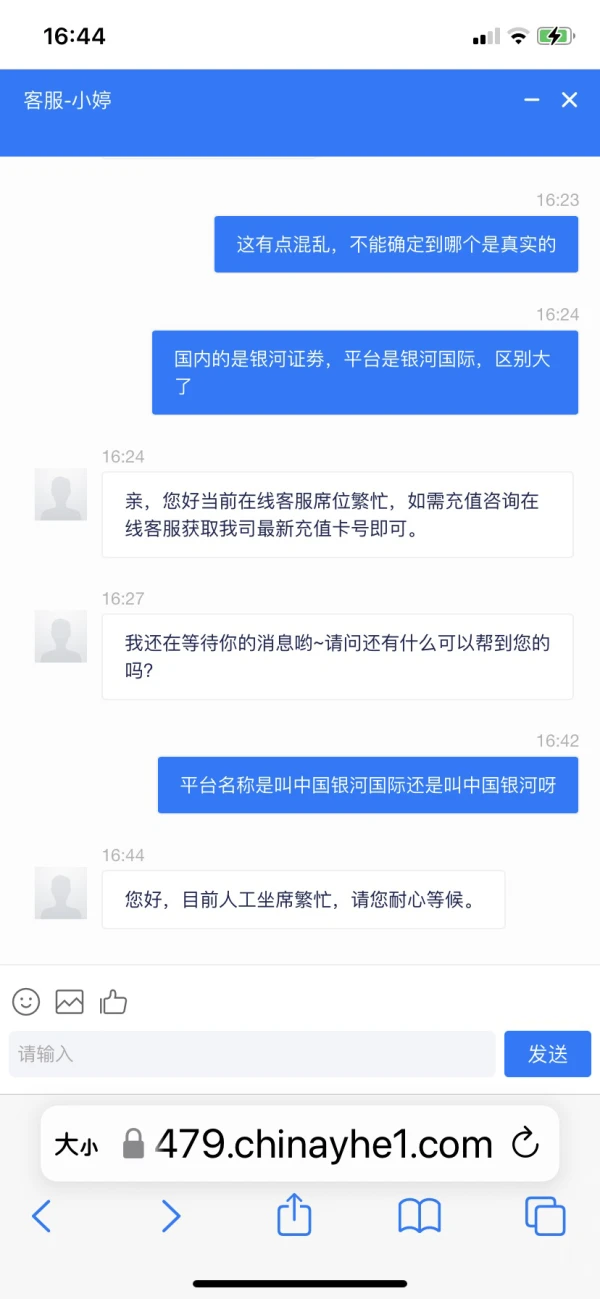

客服一直不给出金,找各种理由,不知道是不是合法平台还是套牌黑平台,网站是https://78714479.chinayhe1.com/index/login/login/token/d6b70b5b8eef4ceef2e2765b7f46dd9b.html

曝光

FX1433857007

香港

前些日子,从手机上认识了一个人,说是做外汇的。我咨询了一些事,让后做了几单,当时挺好,到了第六单就暴仓了35000元,后来他说不要急,包赔。 经过他们商量给我打到外汇帐上17500元,让我再加17500元,商量后也跟进,让后做单35000元,后这单完成,但不能提现,说要再下一单,才能提现,但我没跟。到现在帐面上还在93400元,但不敢提现。 还有跟我联系的人,以把我拉黑。谢!

曝光