公司简介

| 苏格兰银行评论摘要 | |

| 成立时间 | 1695 |

| 注册国家/地区 | 英国 |

| 监管 | FCA |

| 产品与服务 | 个人银行、商业银行、私人银行 |

| 模拟账户 | ❌ |

| 交易平台 | 移动银行应用(iOS、Android)、网上银行(Web) |

| 客户支持 | 电话:0345 721 3141 / +44 131 337 4218 |

| 在线聊天 | |

苏格兰银行信息

苏格兰银行成立于1695年,是英国历史最悠久的金融机构之一。在FCA监管下,提供包括个人服务、企业服务和私人银行服务在内的全面金融服务。为家庭和个人提供多种账户选择,通过移动和互联网银行服务。

优缺点

| 优点 | 缺点 |

| 受英国FCA监管 | 无模拟或伊斯兰账户 |

| 全面的金融服务 | 相对较高的手续费保费账户 |

| 强大的移动和网上银行平台 | 交易工具有限 |

苏格兰银行是否合法?

是的,它受到监管。自2001年起,根据英国金融行为监管局(FCA)的规定,持有许可证号码169628的做市商(MM)许可证。

产品与服务

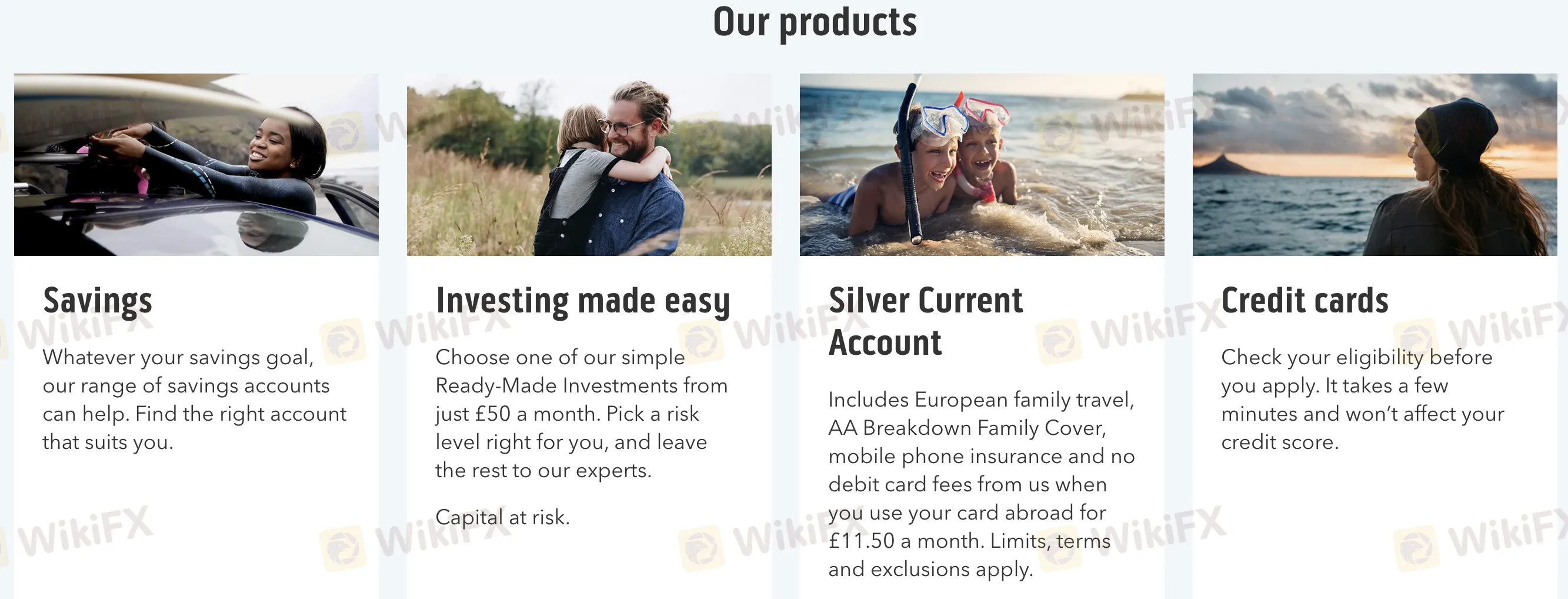

苏格兰银行提供个人服务、商业服务和私人银行服务。在个人服务方面,产品包括储蓄、贷款、信用卡、抵押贷款、保险和投资产品。

| 个人服务 | 描述 |

| 储蓄账户 | 多种账户选择,帮助实现各种储蓄目标 |

| 投资 | 每月起始金额为£50的现成投资产品 |

| 活期账户 | 包括银行卡、旅行、故障和手机保险福利的银行账户 |

| 信用卡 | 不影响信用评分的不同信用卡选择 |

| 个人贷款 | 根据财务状况提供个性化贷款优惠 |

| 抵押贷款 | 具有低利率的Halifax抵押贷款解决方案 |

| 人寿保险 | 通过苏格兰遗孀提供的高达£500,000的人寿和重疾保险 |

| 家庭保险 | 铜牌、银牌和金牌,灵活的月付选项 |

账户类型

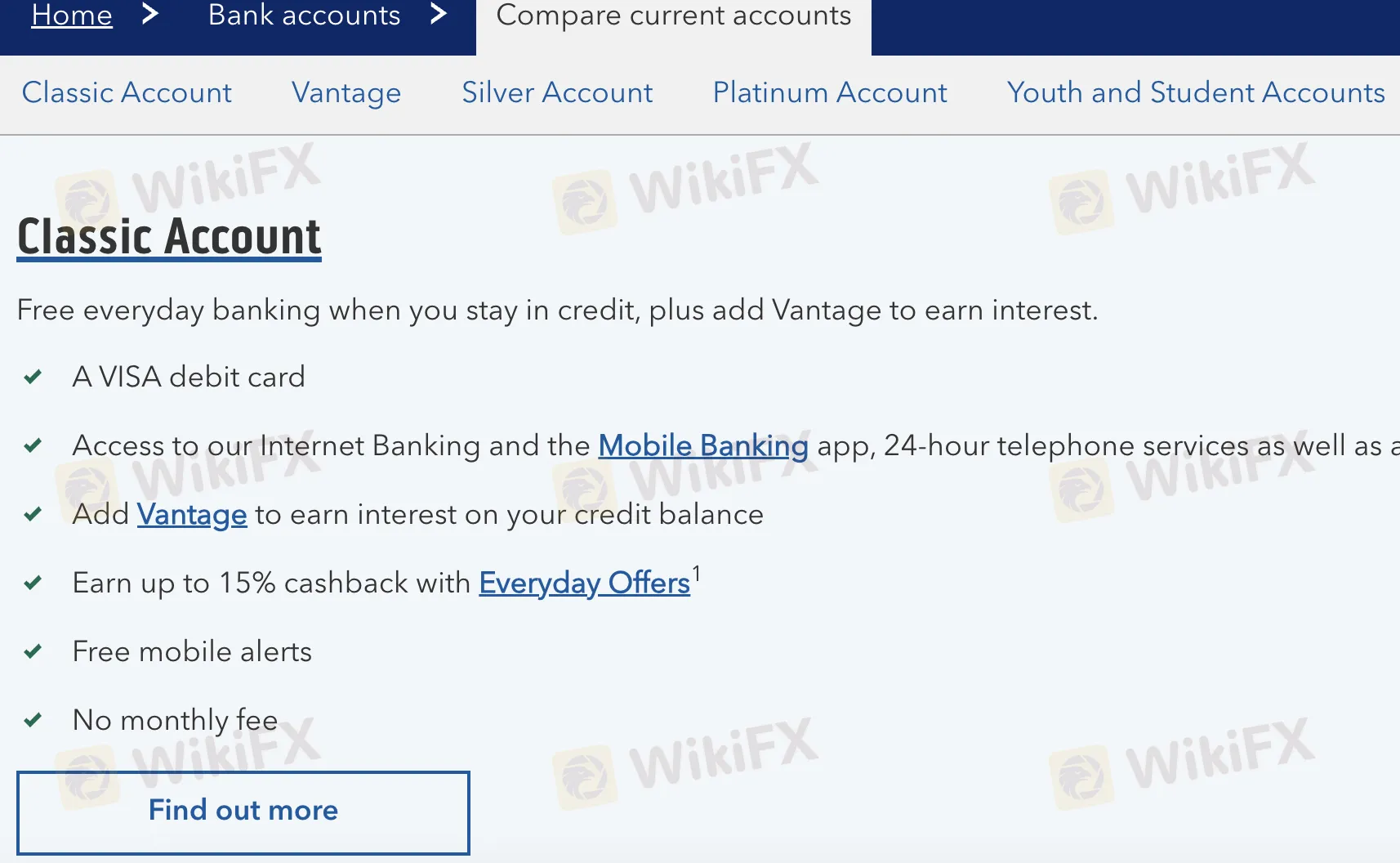

针对不同年龄群体和财务需求,苏格兰银行提供七种实时(真实)账户账户类型。不提供伊斯兰教或演示账户。从简单的银行业务到带有旅行和保险福利的高级服务,每种账户都有不同的特点。

| 账户类型 | 月费 | 主要特点 | 适用对象 |

| 经典账户 | £0 | 日常银行业务、返现、添加Vantage以获得利息 | 一般个人银行用户 |

| 银牌账户 | £11.50 | 旅行保险、手机保险,境外无卡手续费 | 旅行者和希望获得福利的用户 |

| 白金账户 | £22.50 | 增强旅行保障、AA故障援助、手机保险 | 经常旅行者和家庭 |

| 学生账户 | £0 | 免息透支、针对学生的优惠 | 全日制学生 |

| 智慧启动 | £0 | 与儿童关联的父母子账户账户,带有储蓄利息 | 11-15岁的孩子 |

| 19岁以下账户 | £0 | 有息账户、有限的网上银行服务、无透支 | 11-17岁的青少年 |

| 基本账户 | £0 | 简单账户,无透支或透支费用 | 只需基本银行服务的人 |

苏格兰银行费用

苏格兰银行的手续费一般比标准的英国零售银行要高。虽然一些基本的账户不收取月费,打包的账户(如银色和铂金)包括带有月度费用的服务捆绑包。透支和信用卡费用遵循英国行业标准范围。

| 服务/账户类型 | 费用 |

| 经典账户 | £0/月 |

| 银色账户 | £11.50/月 |

| 铂金账户 | £22.50/月 |

| 学生账户 | £0/月 |

| 19岁以下/智能启动 | £0/月 |

| 基本账户 | £0/月 |

| 透支(安排好的) | 可变(根据信用档案) |

| 外币卡使用(经典) | 2.99%交易费 |

| ATM取款(英国) | 从苏格兰银行ATM免费 |

| 逾期付款(信用卡) | 最高£12 |

交易平台

| 交易平台 | 支持 | 可用设备 | 适用于 |

| 移动银行应用 | ✔ | iOS,Android智能手机 | 每天用户随时管理财务 |

| 网上银行(Web) | ✔ | 台式机,笔记本电脑,平板电脑(通过浏览器) | 偏好网站的用户 |

| MetaTrader(MT4/MT5) | ❌ | – | 不可用 |

存款和取款

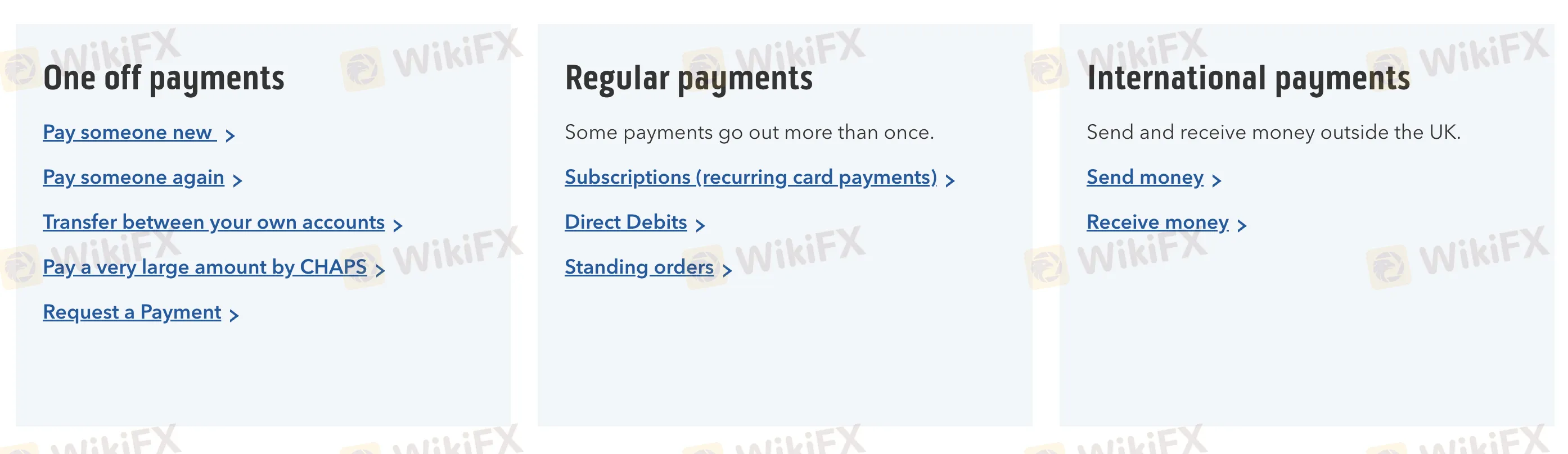

苏格兰银行支持国内和国际支付方式,包括一次性付款,定期转账和国际交易。

| 类别 | 可用操作 |

| 一次性付款 | 向新人付款,再次付款,自己之间的转账账户,CHAPS大额支付,请求付款 |

| 定期付款 | 设置定期卡付款(订阅),直接借记,定期订单 |

| 国际支付 | 向国外汇款,接收来自英国以外的款项 |