公司简介

天眼评分

爱尔兰 | 5-10年 |

爱尔兰 | 5-10年 |https://www.degiro.ie/

官方网址

评分指数

影响力

B

影响力指数 NO.1

爱尔兰 6.14

爱尔兰 6.14  外汇监管

外汇监管 暂无外汇交易类牌照,请注意风险!

爱尔兰

爱尔兰  degiro.ie

degiro.ie  荷兰

荷兰

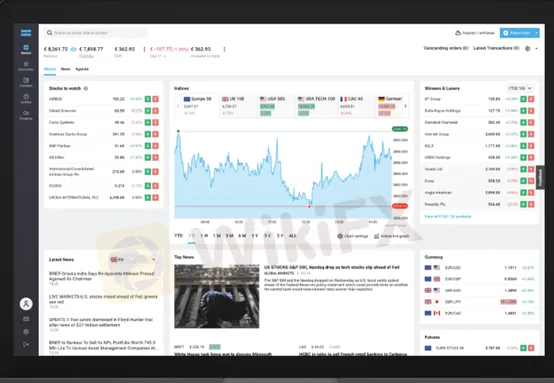

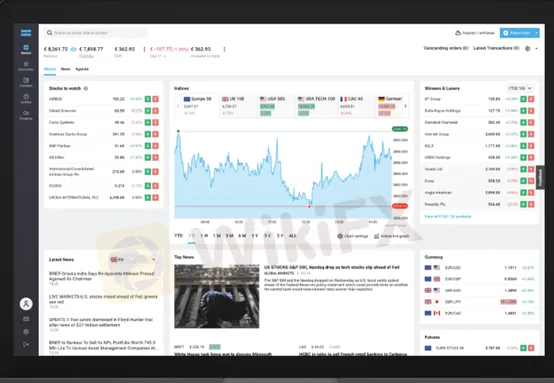

Based on my direct review and hands-on experience with DEGIRO, I found that their trading environment is entirely proprietary—they do not offer access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. Instead, DEGIRO has developed its own in-house trading platform, which can be accessed either through the web or via their dedicated mobile application. For me as a trader, this means there is a trade-off: while their platform is user-friendly and offers quick order windows, streaming quotes, and access to global markets, it lacks features I often rely on, such as automated trading tools and advanced technical analysis typically found with MT4, MT5, or cTrader. This limitation has a significant impact on my workflow, especially when considering strategies that depend on custom indicators or trading bots, which are simply not available with DEGIRO. Their platform does provide basic functionalities for placing various order types, tracking portfolio news, and managing investments, and I find it suitable for straightforward investing in stocks, ETFs, and other securities. However, for active forex trading or algorithmic strategies, the absence of more sophisticated third-party trading solutions is a real drawback and something I approach with caution. In my opinion, traders with advanced needs or a strong preference for widely accepted trading tools may find this restriction limiting. Always ensure your trading requirements match the broker's offerings before committing substantial funds.

In my experience as a trader who prioritizes both platform functionality and regulatory safety, I’ve found that DEGIRO’s offering is not built for automated trading with Expert Advisors (EAs). Their proprietary platform does not support MetaTrader 4 or 5, which are the industry standards for running EAs and algorithmic strategies in forex and CFD trading. Instead, DEGIRO’s focus is on facilitating manual trading of a wide selection of securities—stocks, ETFs, bonds, options, and more—using their web-based interface or phone orders. For someone like me who values automation for efficiency or strategy execution, this is a significant limitation. The absence of MT4/MT5 also means that importing or running custom scripts and EAs simply isn’t an option here. I see this as a potential drawback for algorithmic traders or anyone wanting that extra degree of control and customization in how trades are executed. Another aspect I cannot ignore is DEGIRO’s lack of verified regulatory oversight, as noted by various risk indicators and warnings. This further heightens my caution when considering any advanced trading strategies, automated or not, on their platform. Ultimately, for reliable EA integration, I would personally seek out a broker with clear regulatory status and robust third-party platform compatibility.

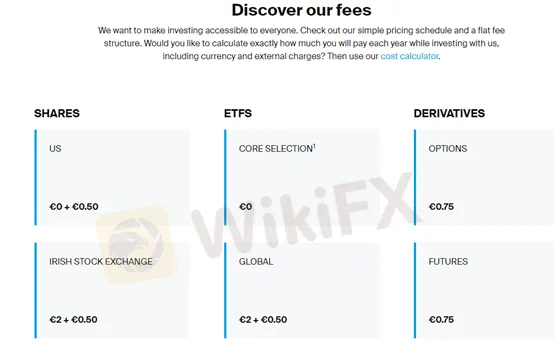

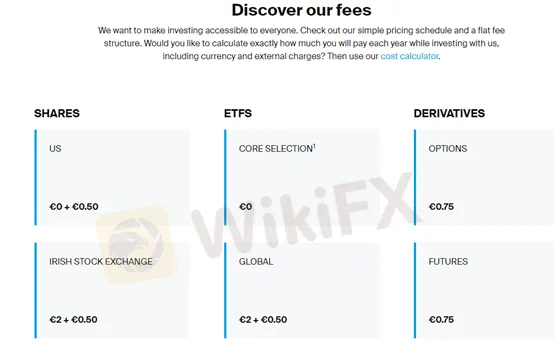

As someone who’s spent years evaluating various brokers, I approach platforms like DEGIRO with careful scrutiny, especially regarding fees, because they can have a meaningful impact on long-term trading outcomes. In my experience, DEGIRO stands out for its cost structure, particularly for those interested in equities and certain ETFs. They do not charge a commission for US shares and selected ETF trades, but there is an external handling cost of €0.50 per US stock trade, which is worth factoring into even small positions. Additional costs—such as currency conversion fees of 0.25%—can add up, especially if your base currency differs from the trading instrument’s currency. From what I’ve observed in my own trading, DEGIRO does not impose fees typically seen with some brokers, like deposit, withdrawal, inactivity, or custody charges. However, they do apply other charges, sometimes less visible to new traders: for instance, spreads are part of pricing but aren’t transparently disclosed in the same way as with forex-specialist brokers. DEGIRO also applies additional charges for connectivity or external product access, though these are generally modest for most retail participants. While the low-cost model can be attractive, it is important for me to remain vigilant, since such structures may involve certain trade-offs—such as less robust trading platforms or fewer payment methods. Ultimately, I believe DEGIRO’s fees are competitive for stock and ETF traders, but anyone considering their services should carefully calculate total transaction costs, especially if trading across currencies or non-core products.

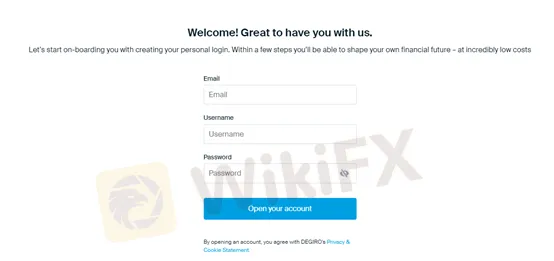

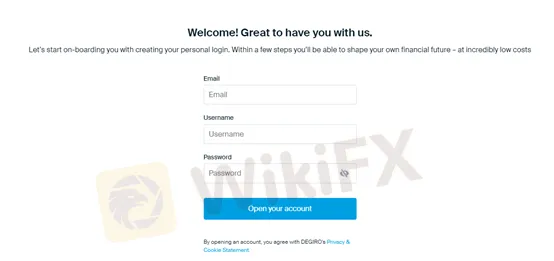

As an experienced trader who’s relied on a variety of brokers over the years, I am always attentive to the security and flexibility of deposit options. With DEGIRO, my direct experience—and a careful review of their official processes—makes it clear that cryptocurrency deposits such as Bitcoin or USDT are not supported. In my case, all funding had to be done through a traditional bank transfer directly from a registered bank account in my name. This method, while slower than some more modern alternatives, adds a layer of traceability and security that is especially important given the high risks associated with unregulated brokers. Additionally, DEGIRO’s infrastructure is built around transparency and compliance, even as it faces issues regarding regulatory clarity. The exclusive reliance on bank transfers for both deposits and withdrawals appears to be part of their risk management and customer verification protocol. While this lack of crypto support may be limiting for some, for me it signals a conservative approach that prioritizes regulatory norms and the protection of client funds—elements I consider essential, particularly with a broker that is flagged for potential risk and lacking clear regulatory oversight. Ultimately, if seamless cryptocurrency integration is important for your trading, you’ll need to look elsewhere; DEGIRO simply isn’t structured to accommodate that funding method.

请输入...

FX1264507080

突尼斯

到目前为止,这位经纪人对我的交易之旅真的很有帮助,加入这个大家庭的那天我很幸运。在其他不可靠的经纪商身上浪费了大量资金进行交易后,终于找到了 DEGIRO,我觉得他们正是其他交易者所需要的。感谢到目前为止所做的一切。

好评

丰收果

新西兰

我推荐这家经纪商的原因是他们对美国股票和精选的 ETF 收取零佣金。但是,我不得不说,他们的支持团队很烂,等了很长时间才给我答复……

中评

FX1104291322

新加坡

交易了一段时间,感觉这家公司靠谱,但是wikifx为什么说没有监管信息呢?我必须取出我所有的钱吗?

中评

野狼34238

香港

我已经与 degiro 合作了数周,事实证明我的钱安全无虞。我赚了一点,嗯,不多,但比存进银行还多。该经纪人也有缺点,例如没有 MT4-MT5,付款方式减少,但目前对我来说一切都很顺利,这些缺点并不那么严重。

好评