公司简介

| 多尔曼 评论摘要 | |

| 成立时间 | 2000 |

| 注册国家/地区 | 美国 |

| 监管 | NFA(未经验证) |

| 交易产品 | 期货 |

| 模拟交易 | ✅ |

| 交易平台 | Dorman Direct、ATAS、Barchart Trader等 |

| 客户支持 | 联系表单 |

| 电话:+1 800-552-7007 | |

| 传真:312-341-7898 | |

| 地址:141 W. Jackson Blvd., Suite 1900 Chicago, IL 60604 | |

多尔曼 信息

多尔曼 是一家受监管的经纪商,在Dorman Direct、ATAS、Barchart Trader等平台上提供期货交易。

优点和缺点

| 优点 | 缺点 |

| / | 未经验证的监管风险 |

| 交易产品有限 | |

| 费用结构不清晰 | |

| 支付方式有限 |

多尔曼 是否合法?

是的。多尔曼已获得NFA颁发的许可证号0264358,可提供服务。

| 受监管国家 | 监管机构 | 当前状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| 美国 | NFA (全国期货协会) | 未经验证 | 多尔曼 公司1有限公司 | 普通金融服务许可证 | 0264358 |

我可以在多尔曼上交易什么?

多尔曼 专注于期货交易。

| 交易产品 | 支持 |

| 期货 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |

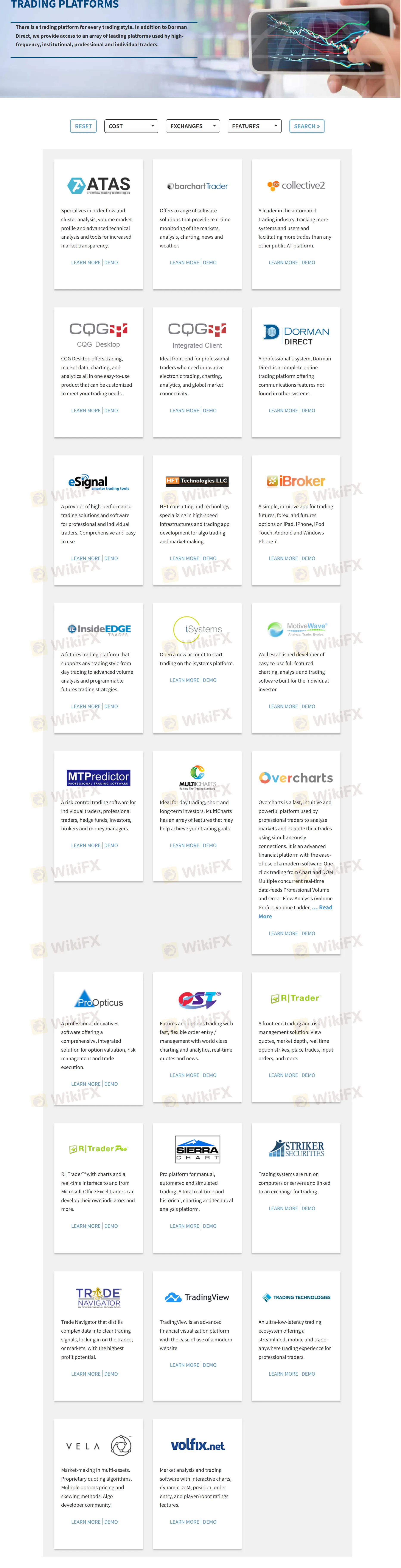

交易平台

| 交易平台 | 支持 |

| Dorman Direct | ✔ |

| ATAS | ✔ |

| Barchart Trader | ✔ |

| Collective2 | ✔ |

| CQG Desktop | ✔ |

| CQG Integrated Client | ✔ |

| eSignal | ✔ |

| 高频交易 | ✔ |

| iBroker | ✔ |

| InsideEDGE Trader | ✔ |

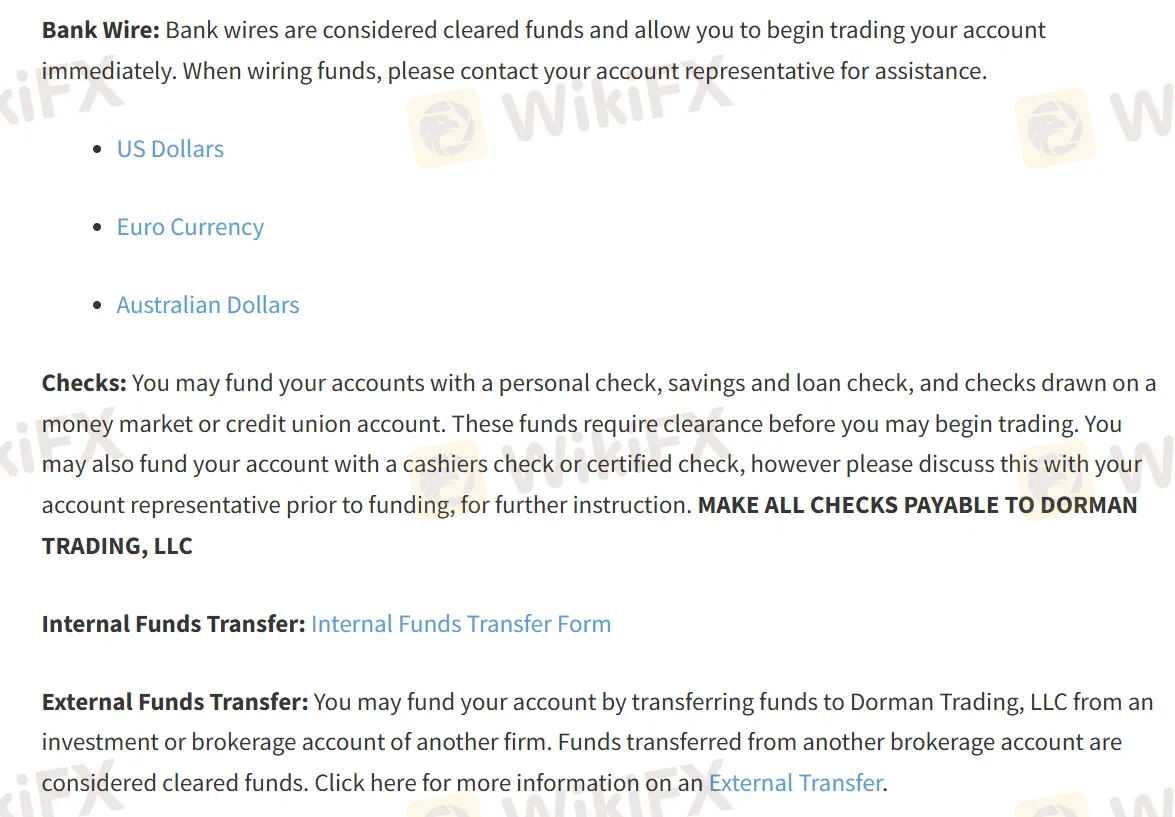

存款和取款

多尔曼 接受通过银行电汇转账和支票进行支付。但是,存款和取款处理时间以及相关的手续费等具体信息尚未披露。