公司简介

| 英国亨达评论摘要 | |

| 成立时间 | 2014-12-22 |

| 注册国家/地区 | 英国 |

| 监管 | 受ASIC和FCA监管 |

| 市场工具 | 差价合约(外汇、贵金属、指数、大宗商品、股票、ETF、加密货币、货币对) |

| 模拟账户 | ✅ |

| 杠杆 | 最高达1:500 |

| 点差 | 从0.1点起 |

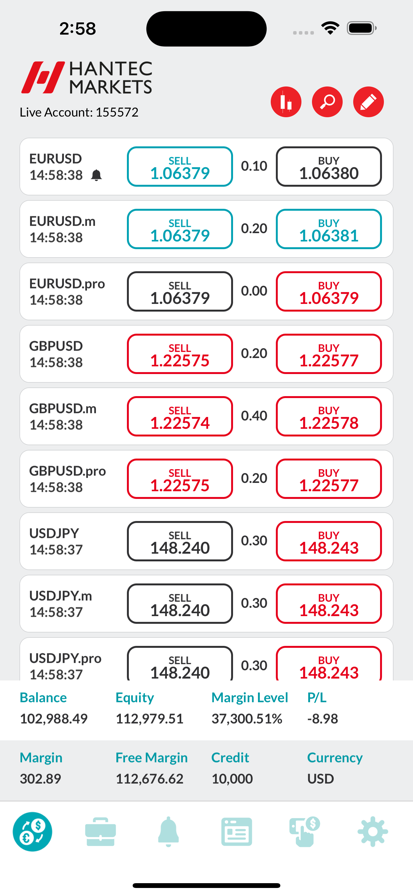

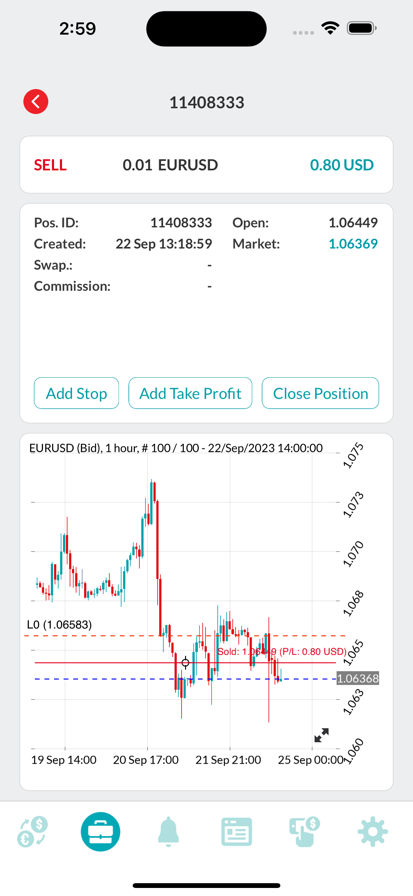

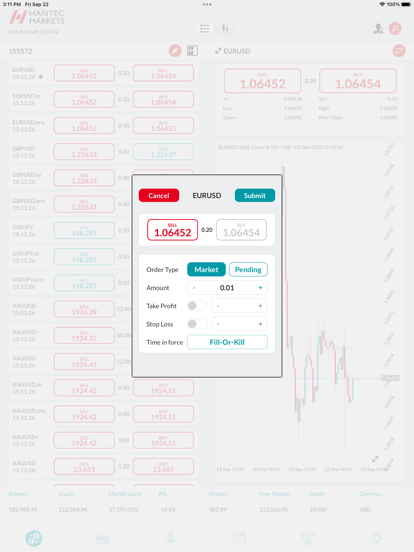

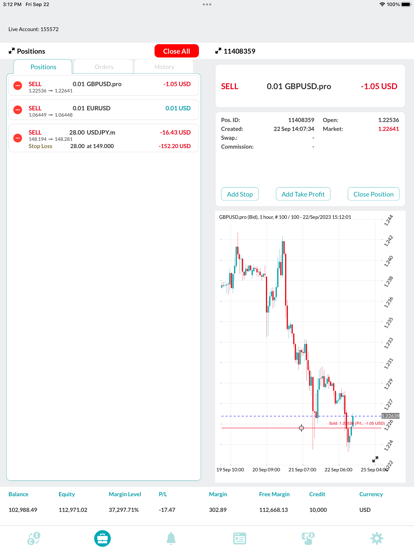

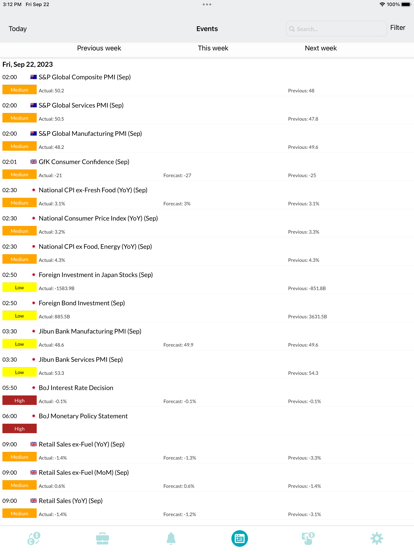

| 交易平台 | Hantec Mobile、Hantec Social(移动端)、MT4/MT5(桌面、移动端、Web)、客户门户(桌面、移动端) |

| 最低存款 | $10 |

| 客户支持 | 邮箱:info-mu@hmarkets.com |

| 电话:+41-22-551-0215 | |

| 在线聊天 | |

| 社交媒体:Facebook、Twitter、LinkedIn、Instagram、YouTube、Line | |

英国亨达 信息

英国亨达 是一家专门帮助投资者构建多样化投资组合的在线经纪商。英国亨达 提供超过2,650种工具,涵盖广泛的差价合约,包括外汇差价合约、贵金属差价合约、指数差价合约、大宗商品差价合约、股票差价合约、ETF差价合约、加密货币差价合约、货币对差价合约等。英国亨达 还提供高达500倍的杠杆、模拟交易账户和专业交易平台MT4/MT5。

优点和缺点

| 优点 | 缺点 |

| 受ASIC和FCA监管 | 没有24小时客户支持 |

| 杠杆高达1:500 | 一些负面评论:欺诈行为 |

| 提供模拟账户 | |

| 提供MT4/MT5 | |

| 点差从0.1点起 |

英国亨达 是否合法?

投资者在受监管实体进行金融活动相对较安全。该经纪商的监管信息如下:

| 受监管国家 | 监管机构 | 受监管实体 | 许可证类型 | 许可证号码 | 当前状态 |

| ASIC | 英国亨达 (Australia) Pty Limited | 做市商(MM) | 000326907 | 受监管 |

| FCA | 英国亨达 Limited | 做市商(MM) | 502635 | 受监管 |

英国亨达可以交易什么?

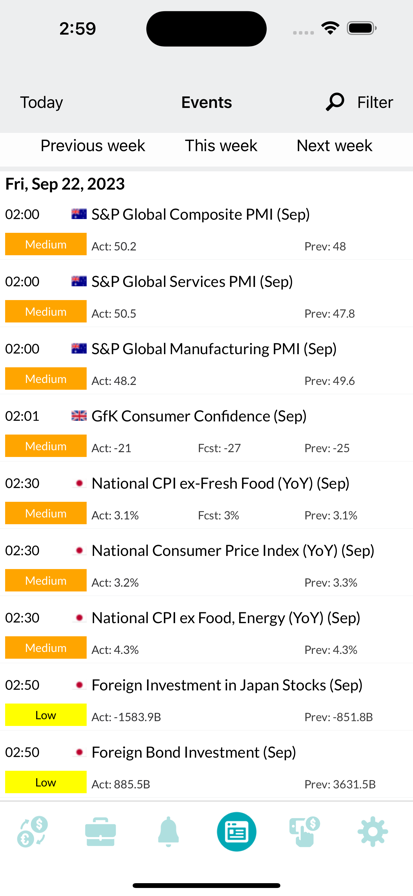

交易者可以选择不同的投资方向,因为该经纪商为交易者提供了外汇、贵金属、指数、大宗商品、股票、ETF、加密货币和货币对的差价合约交易。

| 可交易工具 | 支持 |

| 外汇差价合约 | ✔ |

| 贵金属差价合约 | ✔ |

| 指数差价合约 | ✔ |

| 大宗商品差价合约 | ✔ |

| 股票差价合约 | ✔ |

| ETF差价合约 | ✔ |

| 加密货币差价合约 | ✔ |

| 货币对差价合约 | ✔ |

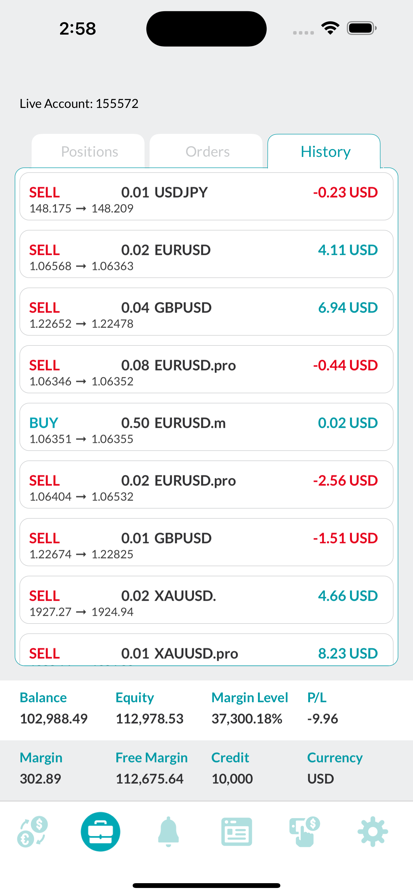

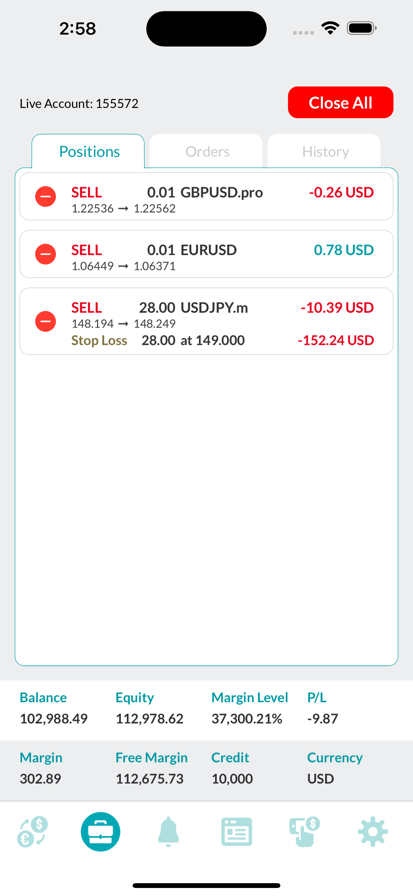

账户类型

英国亨达提供Hantec Global账户用于全球市场访问,Hantec Pro账户供专业交易者使用,Hantec Cent账户降低市场敞口。英国亨达提供90天免费模拟账户,虚拟资金为$10,000。

| 账户类型 | Hantec Global账户 | Hantec Pro账户 | Hantec Cent账户 |

| 最低存款 | $10 | $10 | $10 |

| 最低交易量 | 0.01手 | 0.01手 | 0.01手 |

| 佣金 | 0 | 低 | 低 |

| 点差 | 紧凑 | 超紧 | 紧凑 |

英国亨达费用

点差为0.1点。 点差越低,流动性越快。

杠杆

最大杠杆比例为1:500 ,意味着利润和损失以及收益都会被放大。

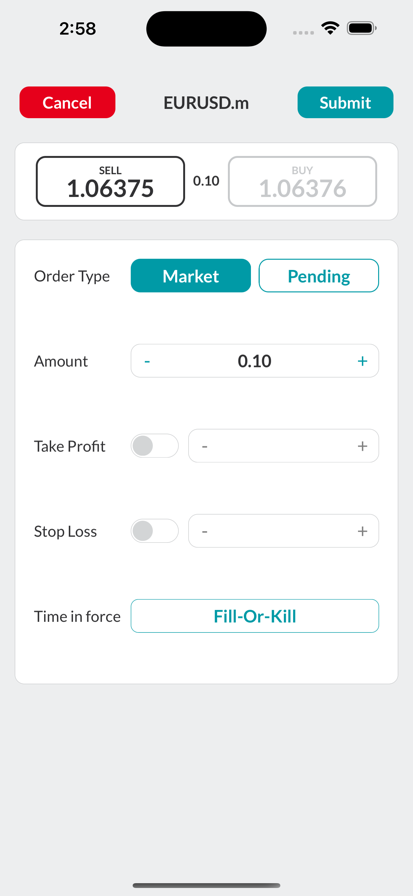

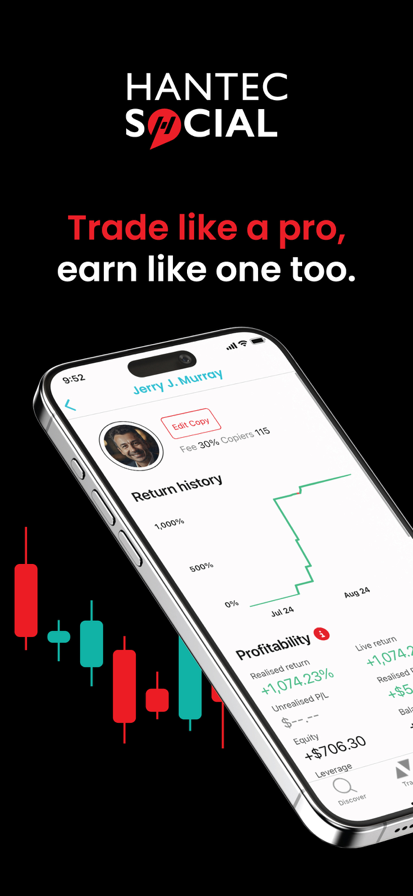

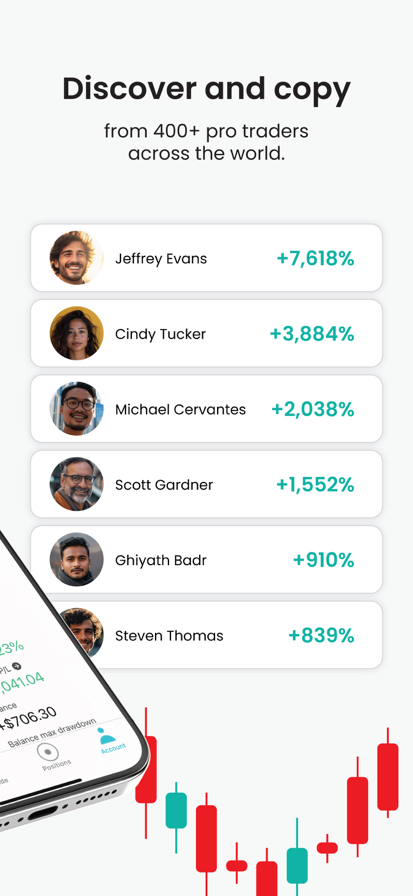

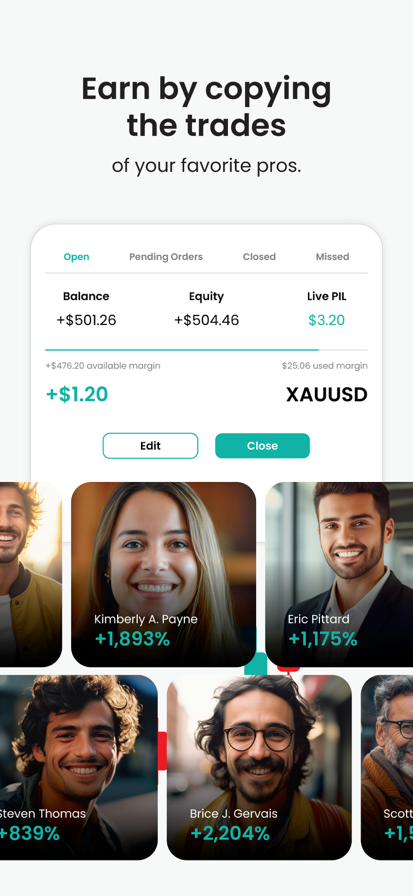

交易平台

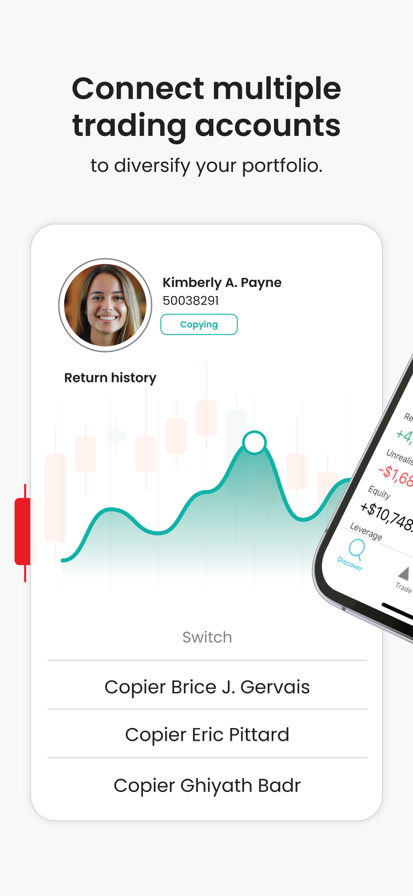

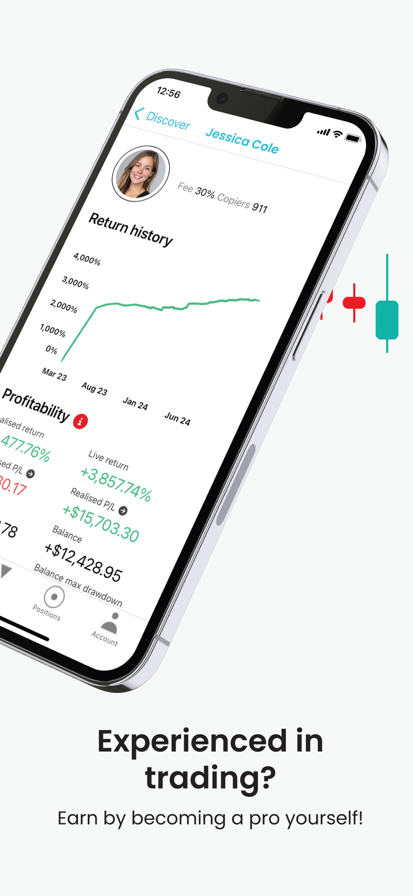

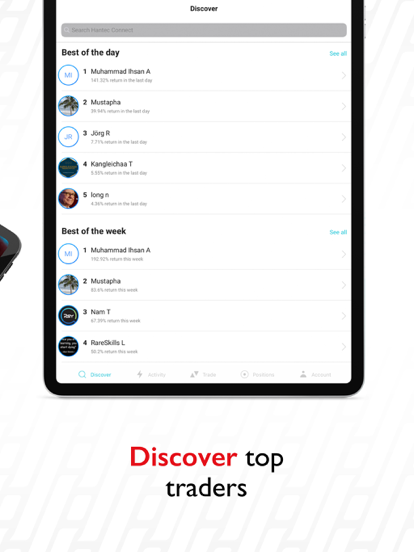

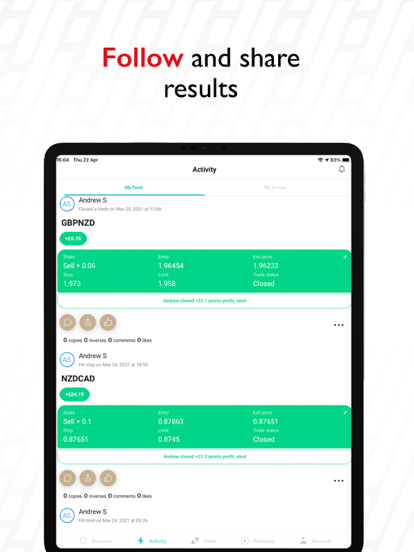

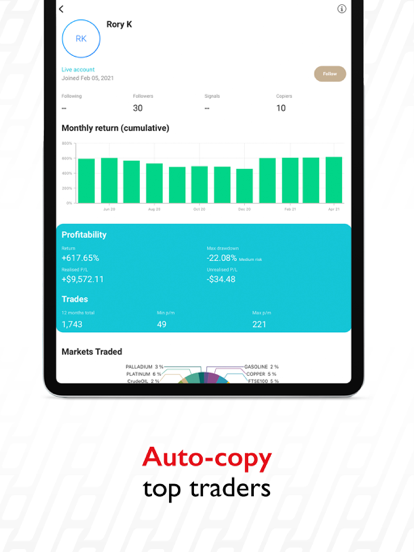

英国亨达 提供多种交易平台。从使用Hantec Social进行复制交易,到在Hantec Mobile上进行移动交易,以及访问MetaTrader平台,您可以在手机、台式机或网络上方便地进行交易。

| 交易平台 | 支持 | 可用设备 | 适用对象 |

| Hantec Mobile | ✔ | 手机 | 所有人 |

| Hantec Social | ✔ | 手机 | 所有人 |

| MT4/MT5 | ✔ | 台式机、手机、网络 | 所有人 |

| 客户门户 | ✔ | 台式机、手机 | 所有人 |

存款和取款

最低账户存款额为$10,Hantec支持VSA、万事达卡和银行电汇等支付方式。存款会立即处理,取款时间根据您选择的取款方式可能只需5分钟。此外,Hantec Financial的保险政策将在公司破产时为交易者提供高达$500,000的资金赔偿。