公司简介

| 富昌金融集团 评论摘要 | |

| 成立时间 | 1999 |

| 注册地区 | 香港 |

| 监管 | SFC |

| 市场工具 | 证券、期货、期权(香港、美国、全球) |

| 模拟账户 | ❌ |

| 交易平台 | 富博理财App(手机)、富博理财终端(PC)、富博理财Web平台、富博理财Pro终端、富博理财极速交易员 |

| 客户支持 | 电话:+852 3108 3333,4001-200-899(内地) |

| 邮箱:cis@fulbright.com.hk | |

| 微信:hkfuchang | |

富昌金融集团 信息

富昌金融集团成立于1999年,总部位于香港,是一家持有香港证券及期货事务监察委员会颁发牌照的金融机构,目前仅其期货交易公司持有牌照。该公司在香港、美国和其他全球市场提供证券、期货和期权交易,提供不同的交易平台,但没有模拟账户或明确的最低存款披露。

优点和缺点

| 优点 | 缺点 |

| 受香港SFC监管 | 无模拟账户可用 |

| 提供多市场访问 | 未明确披露最低存款 |

| 多个交易平台 | 关于账户类型的信息有限 |

富昌金融集团 是否合法?

是的,富昌金融集团是一家持牌机构。然而,目前只有富博期货有来自香港SFC的有效(受监管的)期货合约交易许可证。其他两家实体的许可证已过期,因此不再有效。

| 持牌实体 | 许可类型 | 许可证号 | 生效日期 | 当前状态 | 监管机构 |

| 富博期货有限公司 | 期货合约交易 | AME963 | 2005/12/5 | 受监管 | 香港SFC |

| 富博证券有限公司 | 证券交易 | AFB820 | 2004/11/30 | 已过期 | 香港SFC |

| 富博资产管理有限公司 | 资产管理 | AYQ254 | 2012/3/22 | 已过期 | 香港SFC |

我可以在富昌金融集团上交易什么?

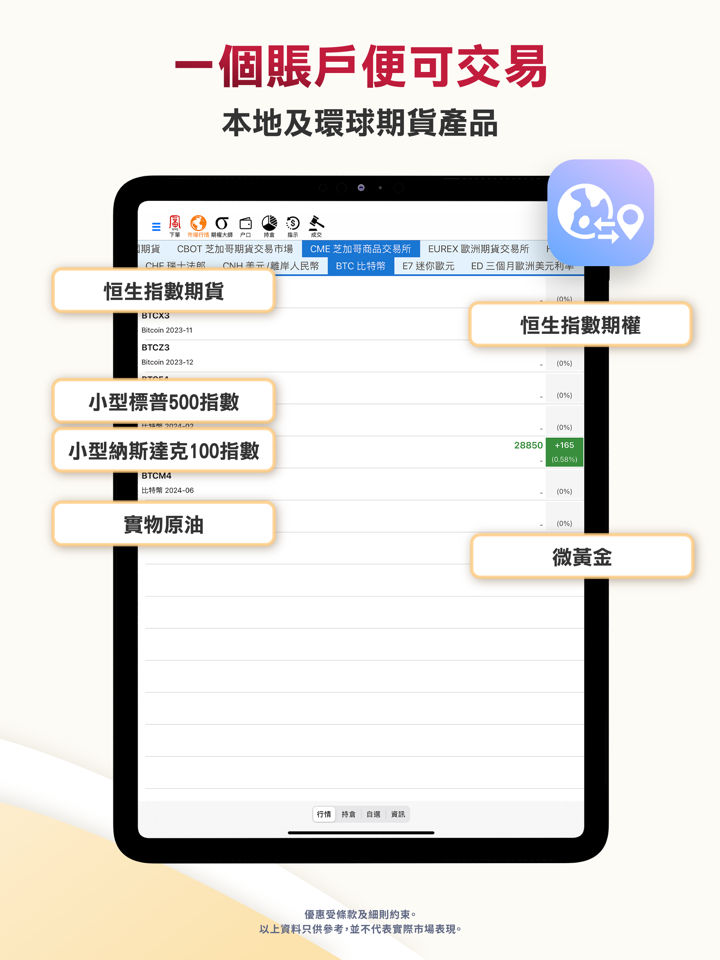

富昌金融集团 提供广泛的金融服务,包括在香港和全球范围内进行证券、期货和期权交易。

| 交易工具 | 支持 |

| 证券 | ✔ |

| 期货 | ✔ |

| 期权 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 交易所交易基金(ETFs) | ❌ |

富昌金融集团 费用

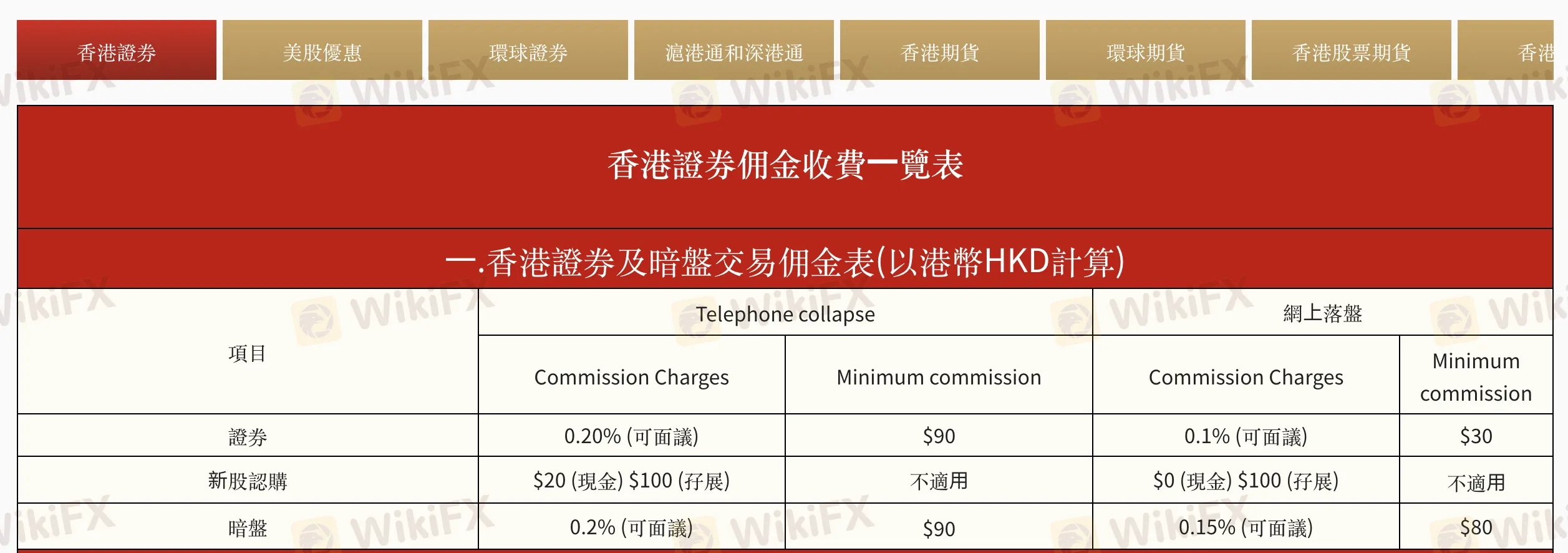

富昌金融集团的收费略低于行业标准,特别是在线交易。一些费用,如处理费和融资利息,根据客户档案而有所不同,并且可协商,这是常见的商业惯例。

| 类别 | 服务/项目 | 费用(HKD) | 备注 |

| 交易佣金 | 香港证券(电话) | 0.20%(最低$90) | 可协商 |

| 香港证券(在线) | 0.10%(最低$30) | 可协商 | |

| IPO认购(现金/保证金) | $20 / $100 | 在线现金:免费 | |

| 灰市(电话/在线) | 0.20% / 0.15%(最低$90 / $80) | ||

| 监管费用 | 印花税 | 0.10% | 最低$1 |

| SFC交易征费 | 0.00% | ||

| 交易所费(HKEx) | 0.01% | ||

| 结算费(HKSCC) | 0.005%(最低$5,最高$200) | ||

| FRC交易征费 | 0.00% | ||

| 利息费用 | 保证金账户/现金账户利息 | P+1.8%或~7.05% | 以汇丰银行基准利率为准 |

| 托管和代理服务 | 股票转让(SI/ISI) | 免费(存入),$5/手(提取,最低$500) | 适用HKSCC手续费 |

| 股票提取(实物) | $5/手 | 包括$3.5 HKSCC费 | |

| 股息收取 | 0.5%(最低$20,最高$10,000) | 包括HKSCC费0.12% | |

| 红利股/配股认购 | 免费 / $100 + $0.80/手 | 最高$10,000 | |

| IPO处理(现金/保证金) | $20 / $100 | ||

| 其他费用 | 月度报表重发/邮寄 | $50/月每项 | 自2023年9月起生效的邮寄费 |

| SFO第329条请求 | $4,000每案 |

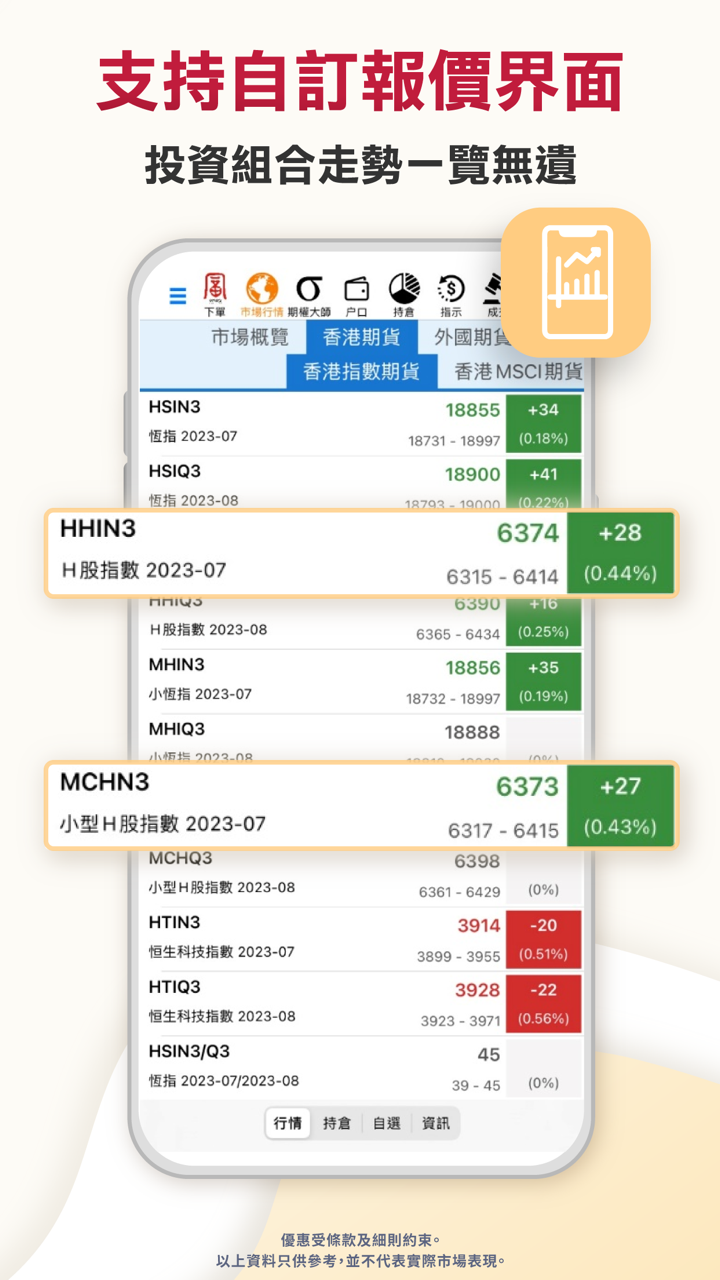

交易平台

| 平台名称 | 支持 | 可用设备 | 适用于 |

| Fulbright App(手机) | ✔ | 手机 | 初学者到中级交易者 |

| Fulbright Terminal(PC) | ✔ | PC | 中级交易者 |

| Fulbright Web平台 | ✔ | 网络浏览器 | 中级交易者 |

| Fulbright Pro Terminal | ✔ | 桌面下载 | 专业交易者 |

| Fulbright Speed Trader | ✔ | 桌面下载 | 香港高频交易者 |

存款和取款

富昌金融集团 不收取任何手续费用于存款或取款,但银行可能根据所使用的方法收取费用。它没有提及最低存款金额。

存款方式

| 存款方式 | 存款费用 | 存款时间 |

| eDDA 快速存款 | ❌ | 即时 |

| FPS(更快支付系统) | ~2小时(交易日9:00 – 17:00)* | |

| 网上银行转账 | 1–3个工作日 | |

| 支票或本票订单 | 2个工作日以上 |

取款方式

| 取款方式 | 取款费用 | 取款时间 |

| 银行转账 | ❌ | 提交时间为9:00–13:00时当天处理;否则下一个工作日处理 |

| 支票 | 在处理时间内当天发放 |