公司简介

| Olive Tree Capital Markets 评论摘要 | |

| 成立时间 | 2000 |

| 注册国家/地区 | 塞浦路斯 |

| 监管机构 | 塞浦路斯证券交易委员会 |

| 市场工具 | 固定收益、股票、衍生品、结构化产品、另类投资和外汇 |

| 模拟账户 | ❌ |

| 杠杆 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | 电话:+357 22 222 332;+357 22222305 |

| 电子邮件:info@otcm.eu | |

| 实际地址:塞浦路斯尼科西亚市Methonis Tower, 73 Makarios Avenue, 7th Floor, Office 701, 1070 | |

Olive Tree Capital Markets 是一家于2000年在塞浦路斯成立的投资公司,正式受塞浦路斯证券交易委员会监管,并且也是伦敦证券交易所的成员。该公司提供一系列投资产品,包括固定收益、股票、衍生品、结构化产品、另类投资和外汇。

优点和缺点

| 优点 | 缺点 |

| 长期运营历史 | 无模拟账户 账户 |

| 受塞浦路斯证券交易委员会监管 | 交易条件信息有限 |

| 多种投资产品 |

Olive Tree Capital Markets 是否合法?

是的,Olive Tree Capital Markets 是一家合法的经纪商。它获得了塞浦路斯证券交易委员会的许可,许可号为 104/09。

此外,Olive Tree Capital Markets 还是伦敦证券交易所的交易会员。

| 监管国家 | 监管机构 | 当前状态 | 监管实体 | 许可类型 | 许可号 |

| 塞浦路斯证券交易委员会 | 已监管 | Olive Tree Capital Markets 有限公司(前身为 Atonline Ltd) | 做市商(MM) | 104/09 |

产品和服务

Olive Tree Capital Markets 提供广泛的投资服务,包括交易和执行服务、保管(托管和相关服务,如现金/抵押品管理)、投资研究和财务分析、回购和保证金融资和投资基金。

它还提供各种产品,包括固定收益、股票、衍生品、结构化产品、另类投资和外汇 交易所(与金融工具交易相关的提供建议的连接)。

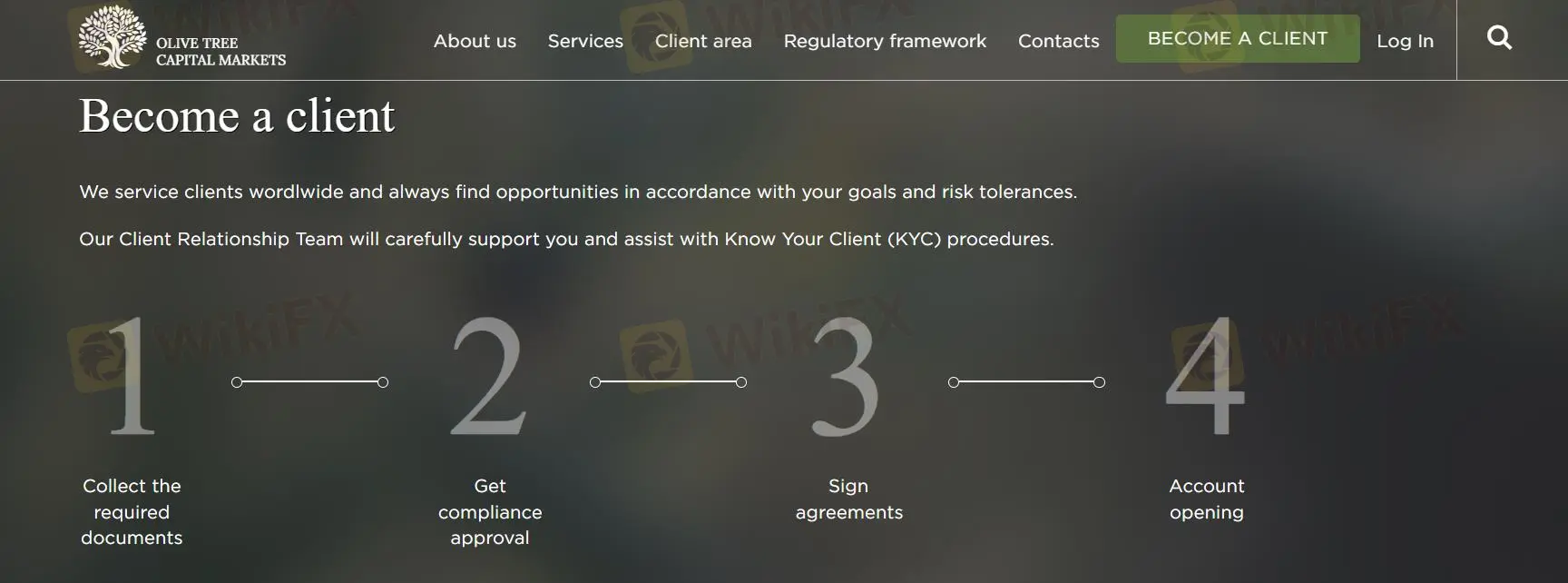

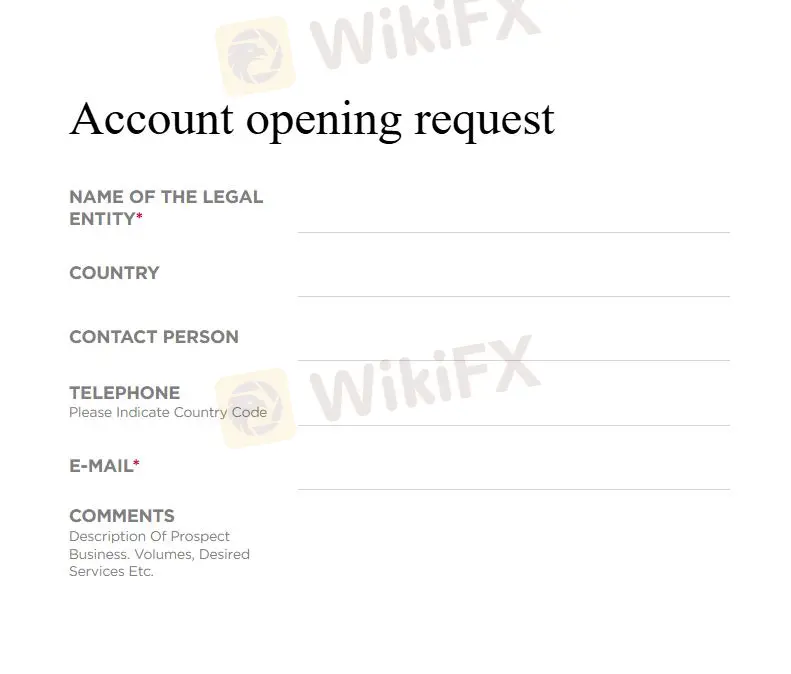

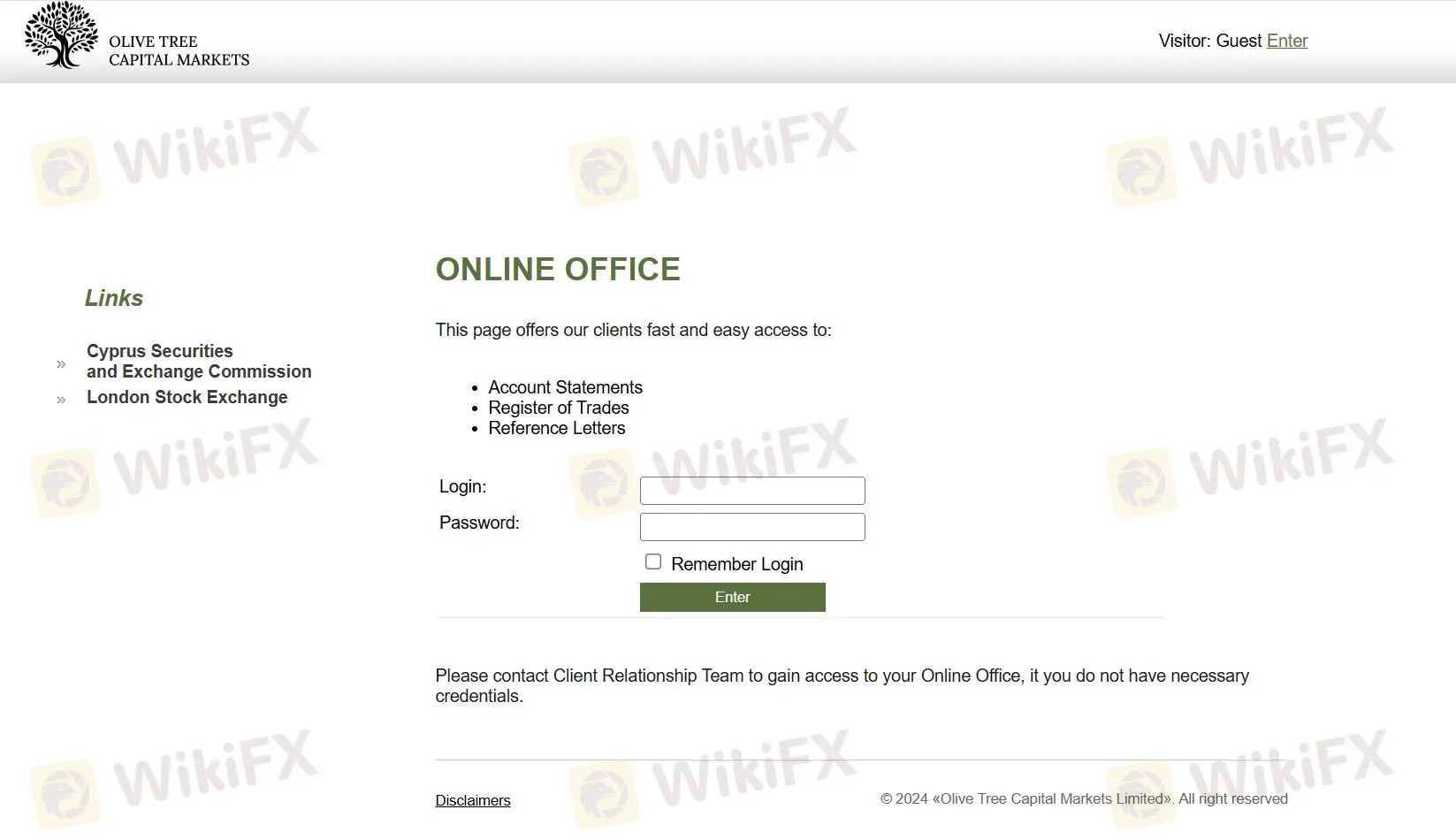

如何在Olive Tree Capital Markets上开户?

在Olive Tree Capital Markets上开设账户相当复杂。首先,您必须填写“账户开设申请”表格以获得批准。此外,您需要收集必要的文件并签署与账户开设相关的协议。完成这些步骤后,您可以通过输入账号和密码来最终开设您的账户。