公司简介

| Renaissance Capital 评论摘要 | |

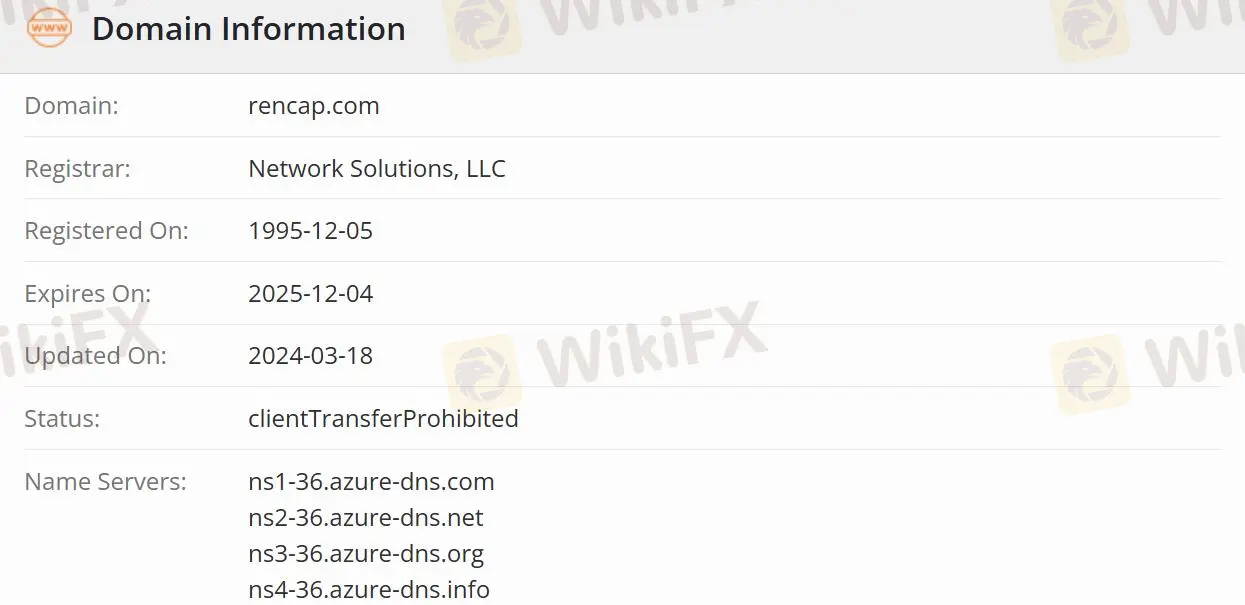

| 成立时间 | 1995-12-05 |

| 注册国家/地区 | 塞浦路斯 |

| 监管 | 受监管 |

| 业务 | 投资银行、全球市场/顶级经纪商。 |

| 客户支持 | 电话:+ 357(22)505 800 |

| 传真:+ 357(22)676 755 | |

| 电子邮件:info@rencap.eu | |

Renaissance Capital 信息

Renaissance Capital 是一家获得CYSEC许可的投资银行。该公司曾被《银行家》杂志评为“2020年度投资银行奖”的“欧洲新兴市场投资银行”和“可持续发展独立投资银行”。该公司的三个核心业务领域包括投资银行、全球市场和顶级经纪商。

Renaissance Capital 是否合法?

塞浦路斯证券交易委员会(CYSEC)根据许可证号053/04和许可证类型市场制造(MM)对Renaissance Capital进行监管,这比无监管更安全。

Renaissance Capital 做什么?

投资银行部门通过结合国际和本地专业知识,为客户提供独特的解决方案,包括并购、股权资本市场、债务资本市场和定制融资。

股权资本市场提供主要的股权和股权相关产品、货币化和结构化解决方案。

债务资本市场专注于本地和国际债券,为企业和主权客户提供债务管理、融资和对冲的咨询和债务重组解决方案,还包括为企业和主权客户提供债务管理和信用评级咨询服务。

并购专门为企业、金融投资者和股东提供大型复杂交易、并购、重组、剥离、私有化交易、管理层收购、杠杆收购等方面的咨询。

全球市场区域为法人实体、金融机构和高净值个人提供定制服务。

顶级经纪商区域允许客户使用公司的全球市场能力,以及专门为与Renaissance Capital开设经纪账户的客户提供的额外福利。

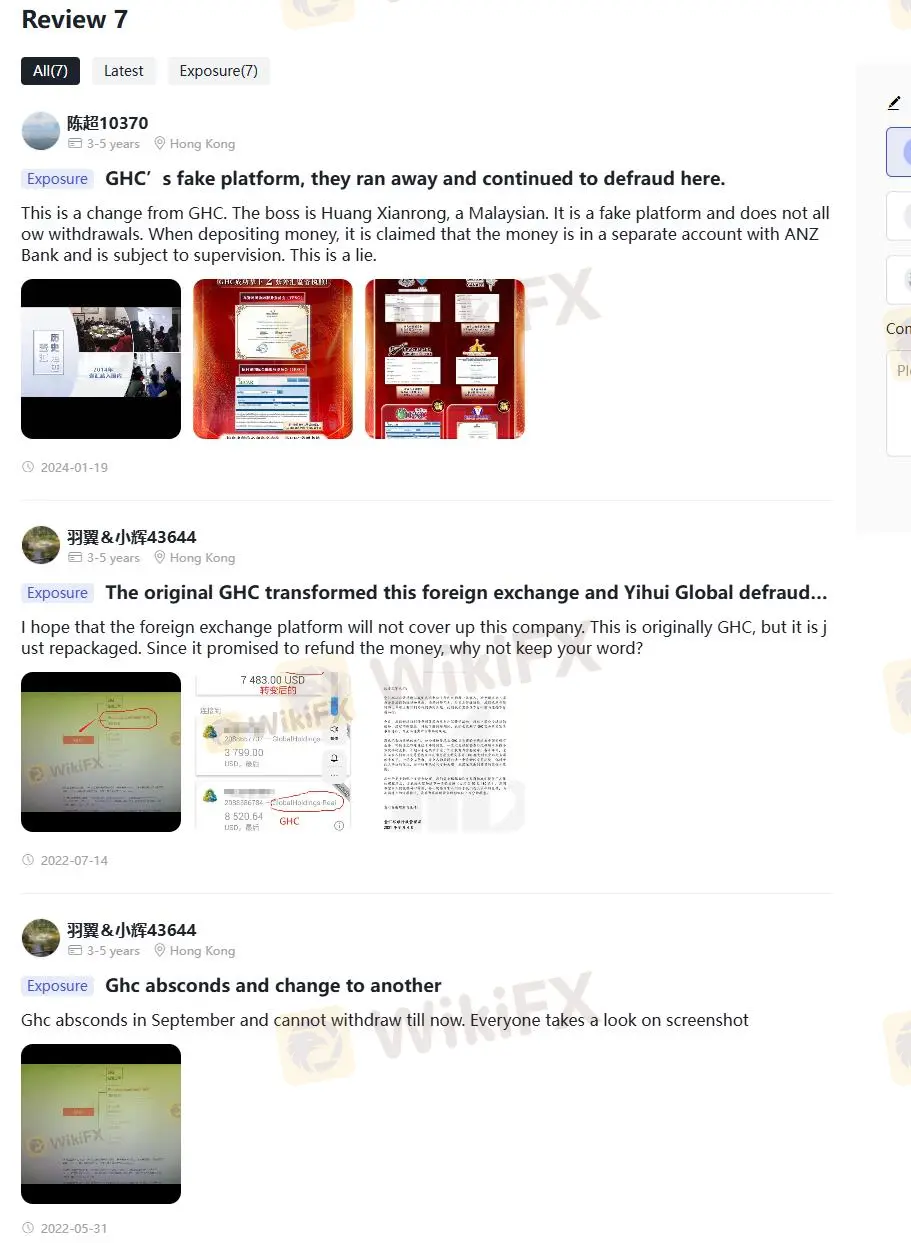

WikiFX 上关于 Renaissance Capital 的负面评论

在WikiFX上,“曝光”是用户的口碑信息。

客户在交易无监管平台之前必须审查信息并评估风险。请咨询我们的平台以获取相关详细信息。在我们的曝光栏目中举报欺诈经纪商,我们的团队将努力解决您遇到的任何问题。

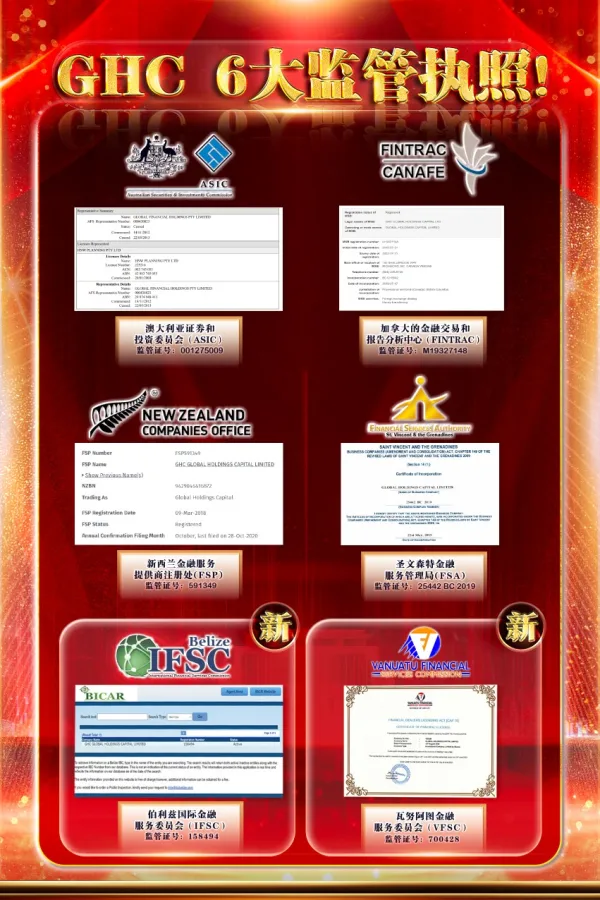

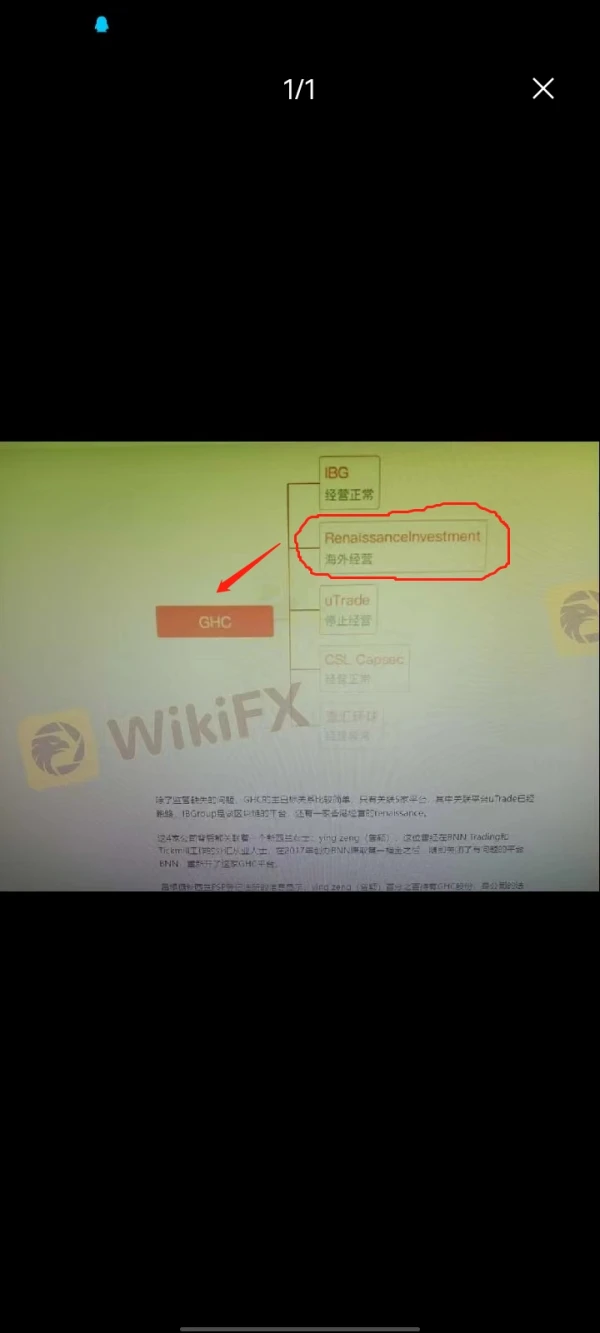

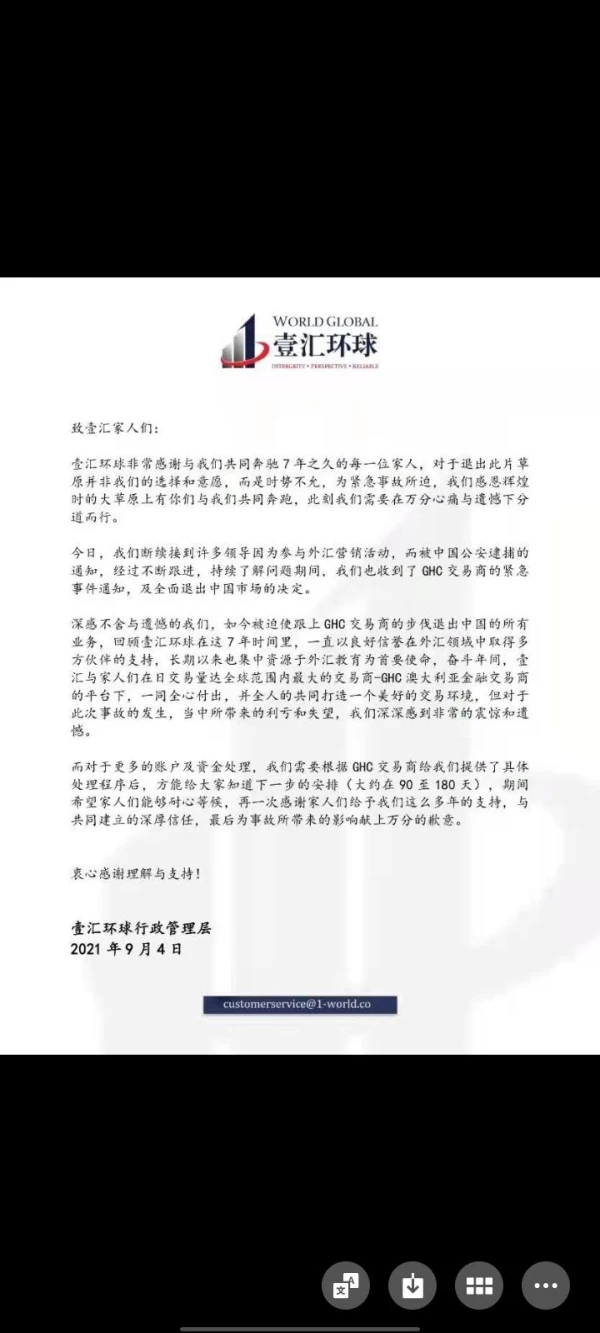

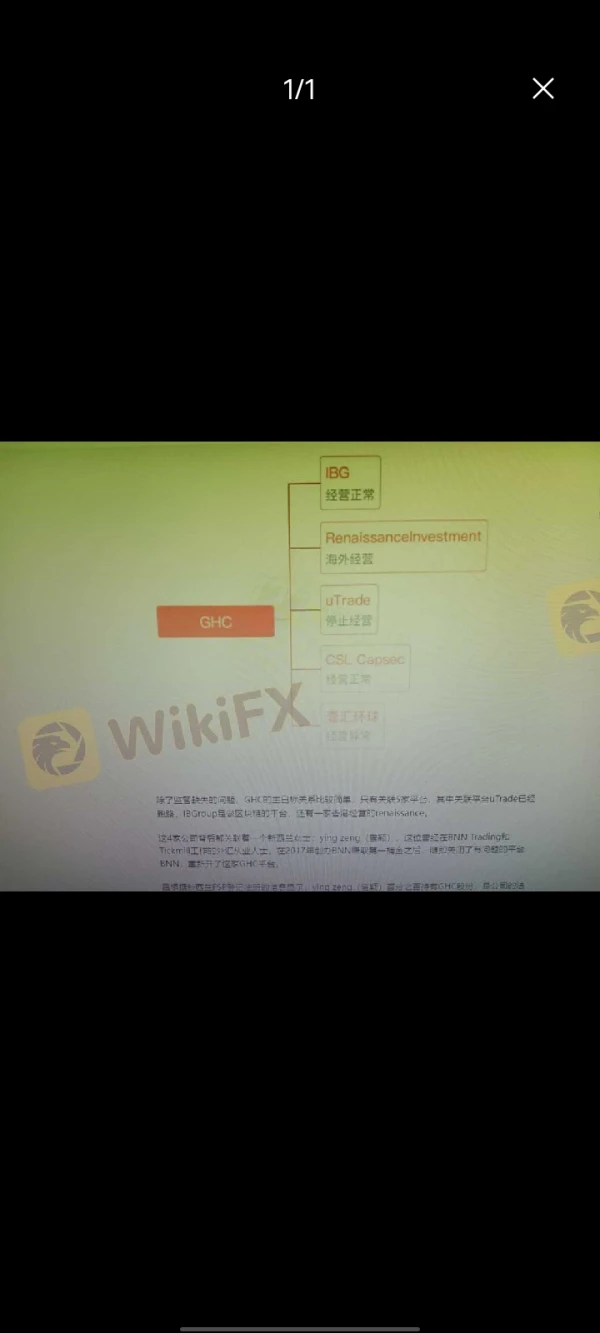

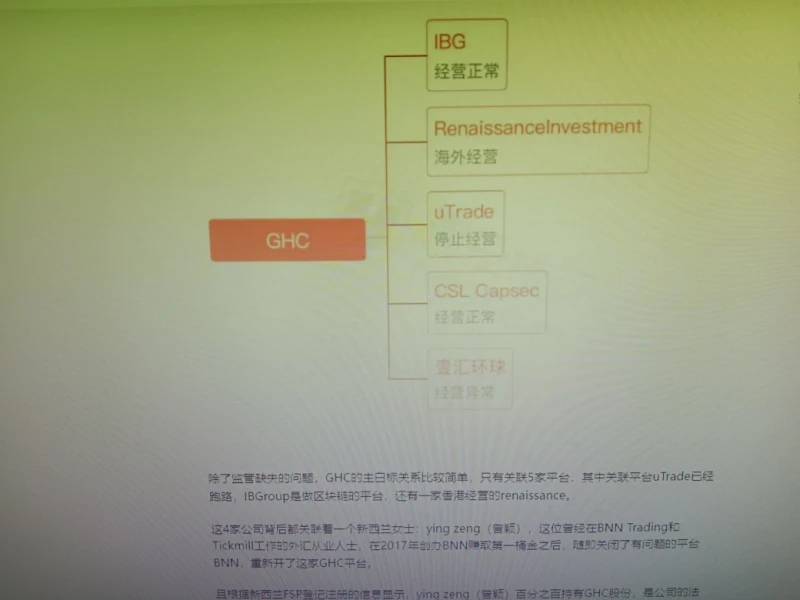

多位用户表示,该公司与GHC有相同的所有者。GHC欺骗了他们,无法提取资金。这将引起一些安全关注。您可以访问:https://www.wikifx.com/en/comments/detail/202401199212973915.html https://www.wikifx.com/en/comments/detail/202207146672596195.html https://www.wikifx.com/en/comments/detail/202205315752526357.html。

陈超10370

香港

是GHC转变来的,老板是黄贤荣,马来西亚人,假平台,不让出金,入金的时候宣称钱在澳新银行独立账户上,受监管,都是骗人的

曝光

壞丫头

香港

换了马甲的骗子。。就是之前的GHC。。

曝光

A天蓝蓝(牙医)

香港

从GHC又变成这个交易商,骗子还在继续骗,坑死了中国的投资者,

曝光

羽翼&小辉43644

香港

希望外汇平台不要包庇这家公司,这原本就GHC,只是从新包装一下,既然承诺退钱为什么不承诺。

曝光

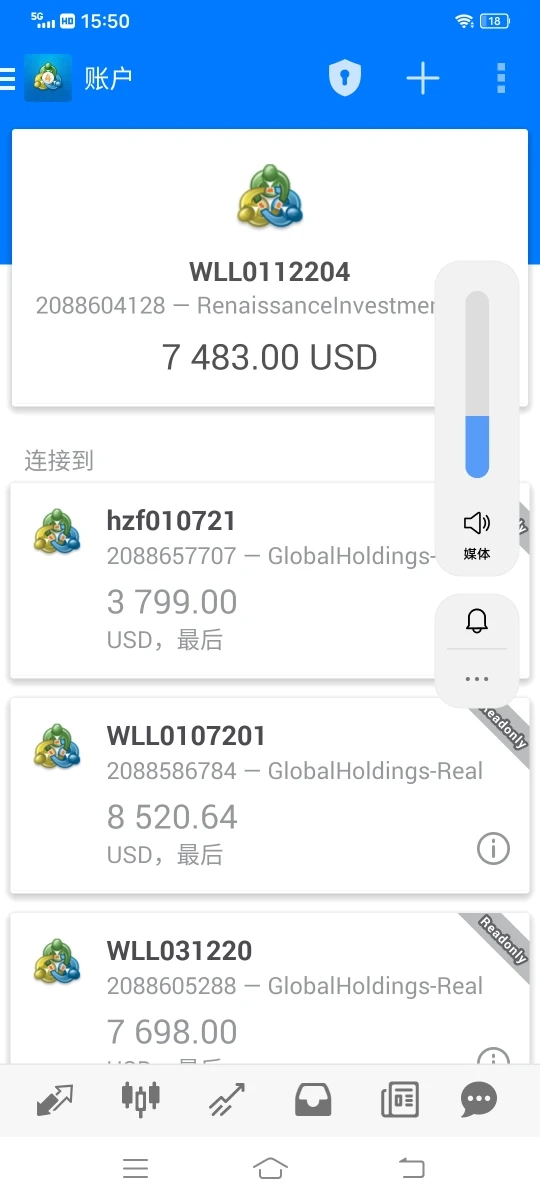

羽翼&小辉43644

香港

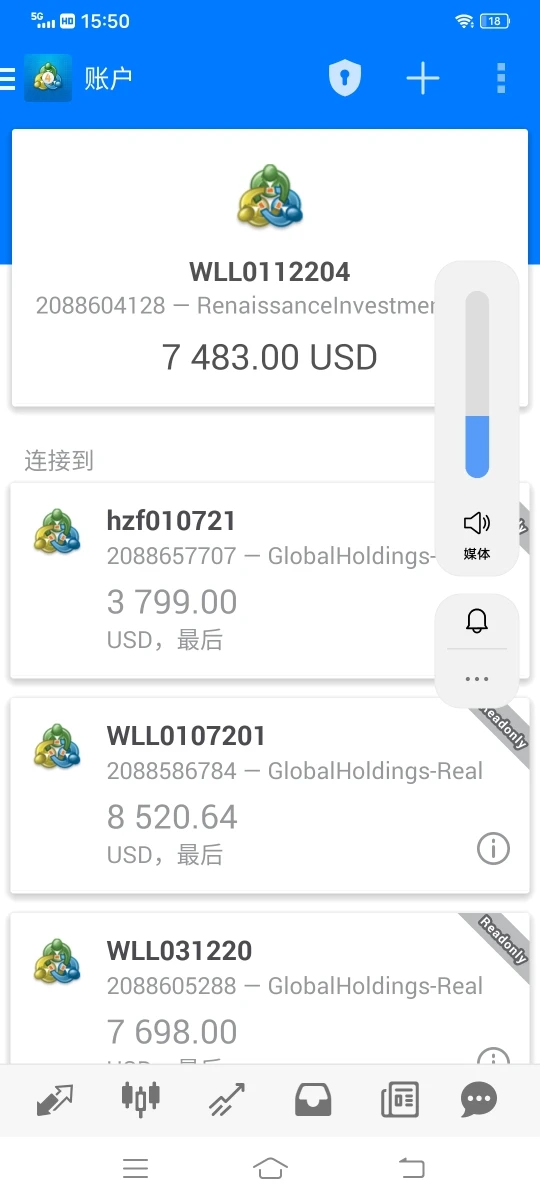

GHC去年9月跑路 到现在无法出金,大家看看截图。

曝光

羽翼&小辉

香港

都说你跟GHC 有关联 确实 骗了那么多人钱

曝光

A天蓝蓝(牙医)

香港

9月四号同时网站打不开,紧接着GHC就变成了这个交易商,骗子

曝光