公司简介

| Alfa Capital评论摘要 | |

| 成立时间 | / |

| 注册国家/地区 | 塞浦路斯 |

| 监管 | CYSEC/FCA(已吊销) |

| 市场工具 | 外汇、金属、期权、期货 |

| 模拟账户 | / |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客服支持 | 电话:+357 22 470900 |

| 传真:+357 22 681505 | |

| 邮箱:info@alfacapital.com.cy | |

| 地址:3, Themistocles Dervis Street,Julia House, 4th Floor,1066 Nicosia, Cyprus | |

| 区域限制 | 美国 |

Alfa Capital是一家在塞浦路斯注册的公司。它提供各种市场工具进行交易,以及投资和附属服务。然而,它的许可证已被吊销。还存在区域限制,美国无法使用其服务,并且其网站无效,使其成为一个风险经纪商。

这是该经纪商官方网站的首页:

优点和缺点

| 优点 | 缺点 |

| / | 已吊销的CYSEC/FCA许可证 |

| 不接受美国客户 | |

| 有限的交易条件信息 |

Alfa Capital是否合法?

Alfa Capital的塞浦路斯证券交易委员会(CySEC)和英国金融行为监管局(FCA)的许可证已被吊销。

| 监管国家 | 监管机构 | 当前状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| 塞浦路斯 | 塞浦路斯证券交易委员会(CySEC) | 吊销 | Alfa Capital Holdings(塞浦路斯)有限公司 | 做市商(MM) | 025/04 |

| 美国 | 英国金融行为监管局(FCA) | 吊销 | Alfa Capital Holdings(塞浦路斯)有限公司 | 欧洲授权代表(EEA) | 416251 |

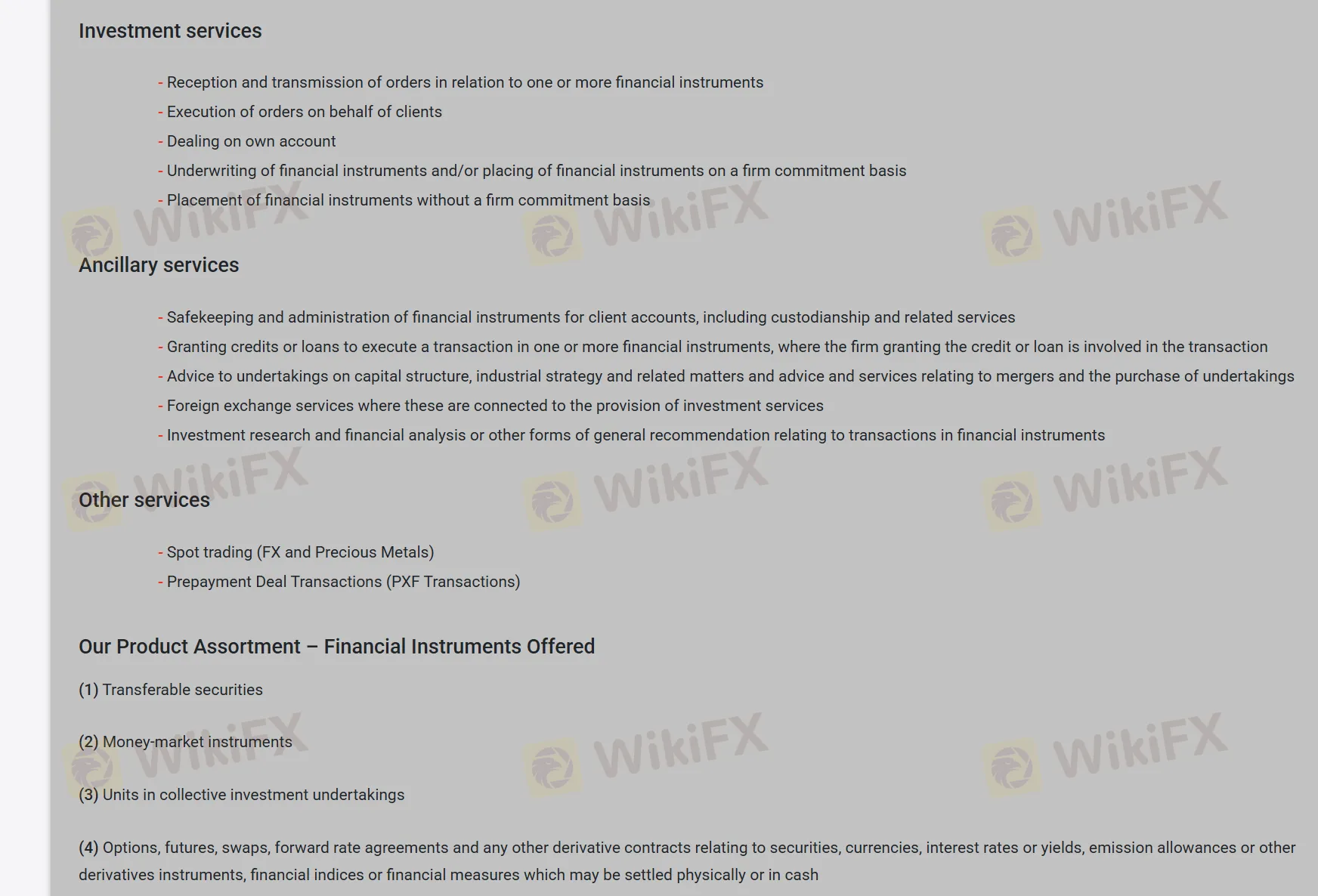

我可以在Alfa Capital上交易什么?

Alfa Capital 提供投资、附属、服务。它还提供外汇、金属、期权和期货的现货交易。

| 交易工具 | 支持 |

| 外汇 | ✔ |

| 金属 | ✔ |

| 期权 | ✔ |

| 期货 | ✔ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 交易所交易基金 | ❌ |