公司简介

| ACLEDA Bank评论摘要 | |

| 成立时间 | 2005 |

| 注册国家/地区 | 柬埔寨 |

| 监管 | 无监管 |

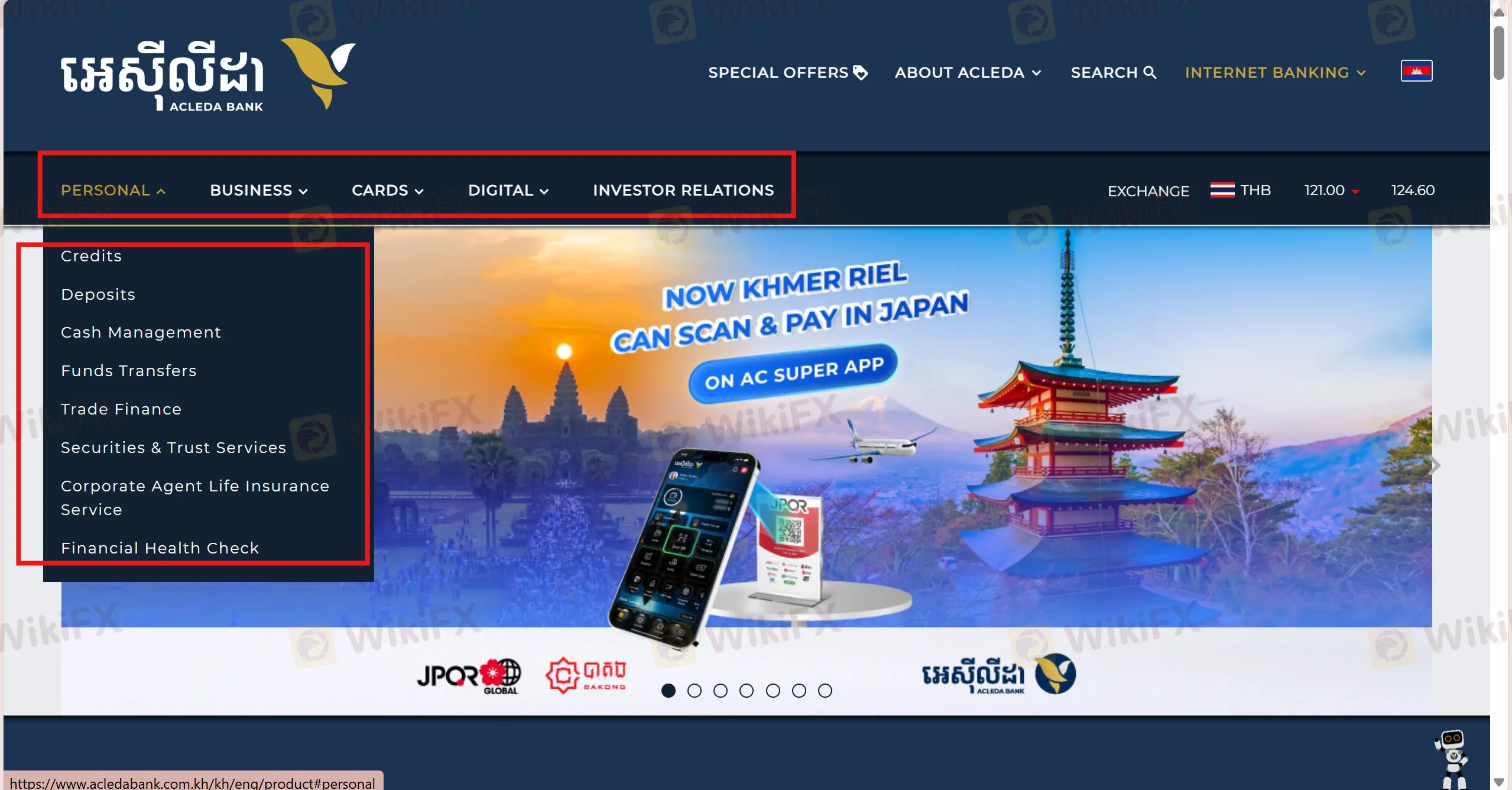

| 产品和服务 | 信用、存款、现金管理、资金转移、贸易融资、证券和信托服务、公司代理人寿险服务、财务健康检查 |

| 模拟账户 | / |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | AC SUPER APP、ACLEDA INTERNET BANKING |

| 最低存款 | / |

| 客户支持 | 电话:023 994 444,015 999 233 |

| 电子邮件:acledabank@acledabank.com.kh | |

| 传真:023 430 555 | |

| 社交媒体:Facebook、Telegram、Messenger、TikTok、YouTube、LinkedIn、Line、WeChat、WhatsApp、X | |

| 地址:柬埔寨金边市都本區沙蔗區蒙耳翁大道61号大楼。 | |

ACLEDA Bank 信息

ACLEDA Bank成立于2005年,是一家在柬埔寨注册的银行。提供各种银行服务,如信用、存款、现金管理、资金转移、贸易融资、证券和信托服务、公司代理人寿险服务以及财务健康检查。但该银行没有任何许可证。

优缺点

| 优点 | 缺点 |

| 广泛的银行服务范围 | 无监管 |

| 多种客户支持选项 |

ACLEDA Bank 是否合法?

ACLEDA Bank没有任何许可证,这意味着其客户在与该银行做生意时应更加小心。

产品和服务

像大多数银行一样,ACLEDA Bank提供了许多银行服务,涵盖信贷、存款、现金管理、资金转账、贸易融资、证券和信托服务、企业代理人寿险服务、财务健康检查。

| 产品与服务 | 支持 |

| 信贷 | ✔ |

| 存款 | ✔ |

| 现金管理 | ✔ |

| 资金转账 | ✔ |

| 贸易融资 | ✔ |

| 证券和信托服务 | ✔ |

| 企业代理人寿险服务 | ✔ |

| 财务健康检查 | ✔ |

交易平台

ACLEDA Bank的交易平台是ACLEDA Super App和ACLEDA INTERNET BANKING,支持PC、Mac、iPhone和Android上的交易者。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| ACLEDA Super App | ✔ | 移动设备 | / |

| ACLEDA INTERNET BANKING | ✔ | PC、平板电脑 | / |