Prash_007

1-2年

Does PNB charge a commission for each lot traded on their ECN or raw spread accounts?

From my experience and careful review of the available information about PNB, it’s important to clarify that PNB operates primarily as a traditional and digital bank, not a specialized forex broker. Although they offer foreign currency accounts and some investment services, I could not find any detailed evidence that they provide true ECN or raw spread forex trading accounts in the way that major online forex brokers do. This distinction matters because, in standard forex industry practice, ECN or raw spread accounts typically charge a commission per lot traded, separate from the spread.

For PNB, there is simply no mention of a commission structure per lot or any dedicated forex trading fees that would apply to ECN or raw spread accounts. The bank’s fee structure is focused on banking operations, such as foreign currency withdrawals, remittance, and maintenance charges, but not specialized trading commissions. This absence of detailed trading commission information strongly suggests that PNB does not support direct retail forex trading through an ECN or raw spread model where commissions per lot would apply.

For me, this lack of transparency and regulatory oversight, coupled with the absence of industry-standard trading account types, makes PNB unsuitable as a primary venue for serious forex trading. I exercise caution and would recommend seeking a regulated, specialized broker if ECN trading and clear commission terms are crucial to your trading strategy.

Broker Issues

Fees and Spreads

Sanford

1-2年

How do the different types of accounts available at PNB vary from each other?

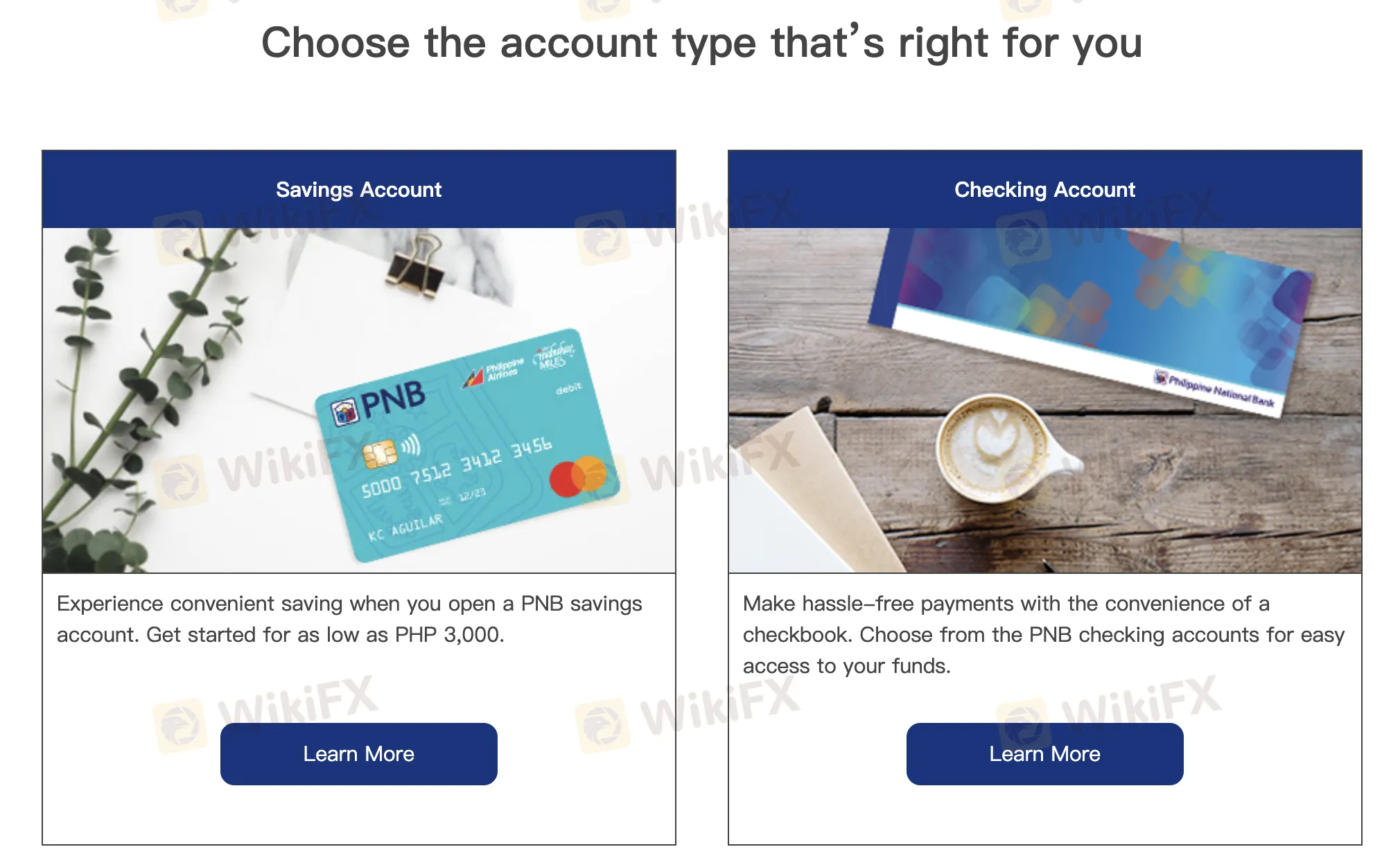

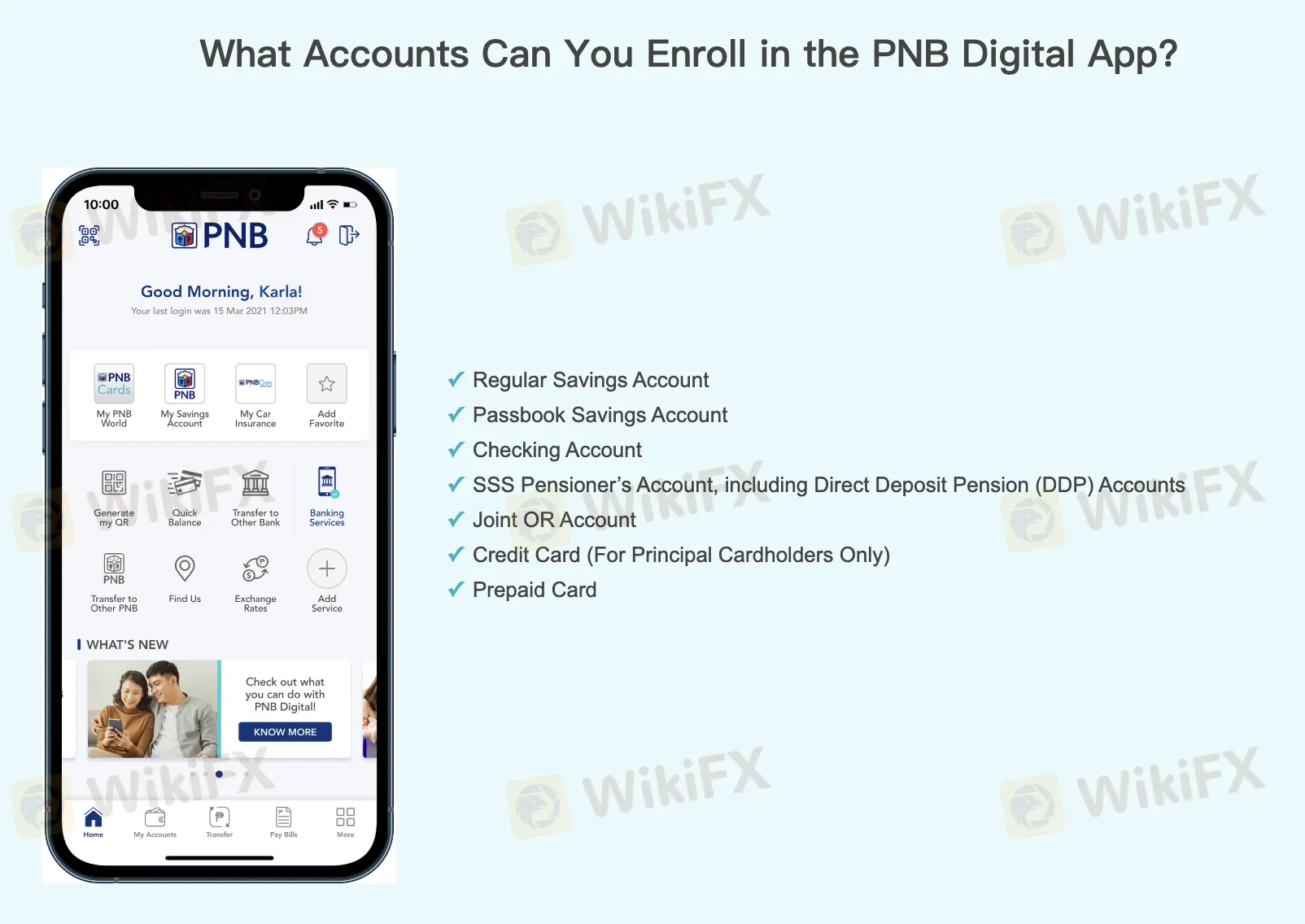

In my experience as a trader exploring financial institutions, the account types offered by PNB reflect its primary function as a traditional and digital bank, rather than a dedicated forex broker. Their account options—namely Savings, Checking, Time Deposit, and Foreign Currency Accounts—each cater to distinct financial needs. The Savings Account is best suited for everyday savers looking for basic deposit functionality with an initial deposit as low as PHP 3,000. Checking Accounts, on the other hand, provide a checkbook and added payment flexibility, which is useful for individuals or businesses that frequently write checks or handle regular payments. Time Deposit Accounts are targeted at those who prefer secure, fixed-term savings with a predetermined interest, an approach typically favored by conservative investors aiming for predictable returns.

The Foreign Currency Account stands out for me as it is specifically designed for individuals with international transaction requirements or those who want to hold funds in currencies other than the Philippine Peso. It's important to note that while these accounts serve various customer segments, none are specialized trading or margin accounts commonly found with brokers. There is also no mention of leverage or spread structures, which, from a risk and suitability perspective, indicates these offerings are not designed for active forex speculation. For traders, understanding these distinctions is critical, as the account type fundamentally defines the scope of available products, related costs, and the risk profile. I always emphasize diligence, especially given PNB’s lack of regulatory oversight, which demands extra caution and thorough understanding before engaging in higher-risk financial activities.

Broker Issues

Platform

Instruments

Account

Leverage

mohdfazlan

1-2年

Is PNB overseen by any financial regulators, and if so, which agencies are responsible?

Based on my own careful research and firsthand evaluation, PNB is not overseen by any recognized financial regulatory body, either within the Philippines or internationally. Despite its long history as a major bank in the Philippines and its broad suite of banking and financial services, there is no evidence of regulatory supervision by authorities such as the Bangko Sentral ng Pilipinas (BSP), Securities and Exchange Commission (SEC), or established global regulators like the FCA, ASIC, or CySEC. For me as a trader, the absence of regulatory oversight is a significant red flag, especially when considering any platform or institution for forex or investment activities. Regulation is critical because it provides a framework for transparency, accountability, and customer protections—elements I rely on when evaluating the trustworthiness and safety of any broker or financial entity. Without official regulation, clients carry additional risks, such as limited recourse in case of disputes or malpractices. In my experience, I stick with brokers that can clearly demonstrate active regulatory licenses, as this underpins not just legitimacy but also the fundamental safety of my capital.

Prash_007

1-2年

What documents do I need to provide in order to process my initial withdrawal with PNB?

Based on my experience as a forex trader, I always prioritize safety and due diligence when choosing financial institutions and handling withdrawals. With PNB, I approach the process with particular caution due to its lack of regulation by Philippine authorities and absence of international oversight. While PNB is an established bank offering a range of financial and investment services, there is no explicit, detailed information available in the background about the precise documentation requirements for processing an initial withdrawal, especially for those seeking to move funds internationally or through different currencies.

Generally, for a withdrawal from a bank account (as opposed to a regulated forex brokerage account), I expect to provide standard bank documents. This typically includes a valid government-issued photo ID, possibly my account number, and sometimes the original passbook or checkbook if withdrawing over the counter. If the withdrawal is being made online through the PNB Digital App, I would ensure my account and contact information are up to date, and be prepared for additional security verification.

Given the complex fee structure and potential regional branch requirements listed, I would also recommend confirming all the specifics directly with PNB customer service before attempting a withdrawal. This helps ensure there are no unexpected delays or additional requests. I never risk large sums without first clarifying withdrawal processes, especially with institutions that do not hold formal regulatory licenses. For me, cautious verification is essential to safeguard my capital.

Broker Issues

Deposit

Withdrawal