Solotim

1-2年

How do the different account types available from Tradition compare to each other?

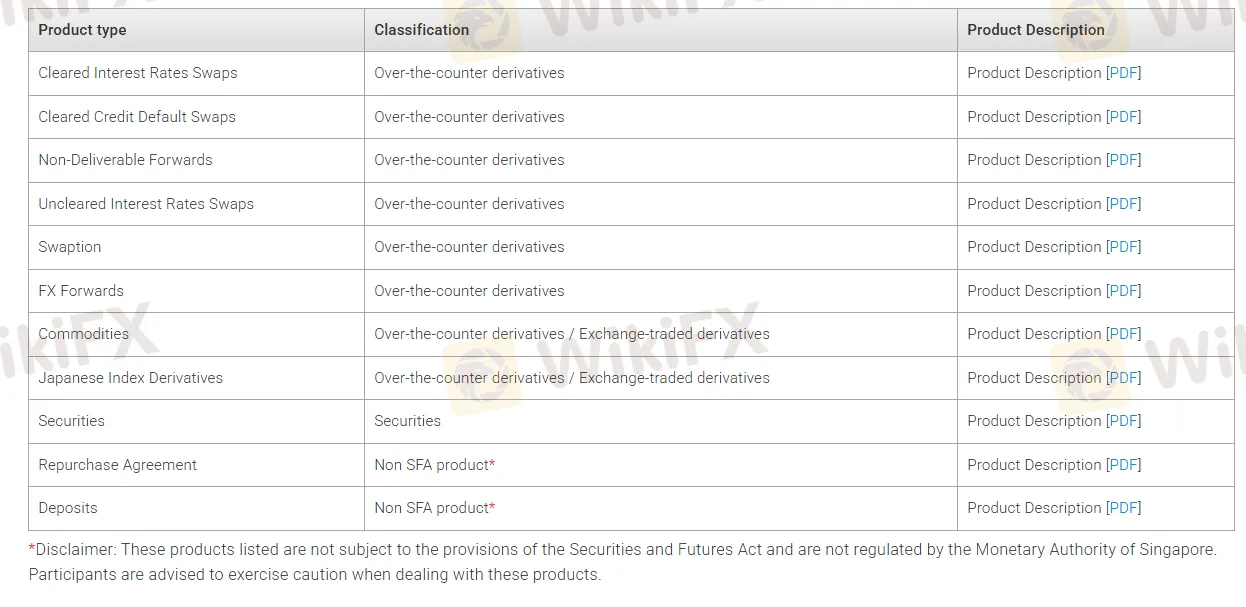

From my own experience and after carefully examining Tradition’s offerings, it appears that the broker does not provide the sort of varied account types that many retail traders might expect elsewhere. Instead, Tradition’s focus is on institutional and professional trading, with its main regulated entity—T.F.S. Derivatives HK Limited—primarily providing access to products like FX forwards, commodities, Japanese index derivatives, securities, swaption, and non-deliverable forwards. I could not find clear mention of differing account tiers or features such as “standard,” “pro,” or “VIP” accounts. Instead, access seems structured around the specific needs of the client and the instruments traded.

For me, this signals that Tradition is not targeting the everyday retail forex trader, but rather sophisticated participants who require custom solutions or high-level interdealer broking. The TRADe platform, for example, is purpose-built for certain derivatives, and not the familiar all-purpose trading platforms usually associated with multi-account setups.

The takeaway, in my view, is that here, account differentiation is not about leverage, minimum deposit, or spread differences as at retail brokers, but rather relates to institutional access and product specialization. Anyone considering Tradition should approach with clarity about their own needs and the appropriateness of such a broker for their strategy, given its emphasis on regulated, professional-grade products and less on retail account perks.

Broker Issues

Leverage

Platform

Account

Instruments

Imranali Khatri

1-2年

Based on your own experience, what would you say are the three main benefits of working with Tradition?

From my own experience as a trader who carefully evaluates brokerages, Tradition stands out in three main areas. First and foremost, its regulatory status provides genuine reassurance. Tradition is regulated by the Securities and Futures Commission (SFC) in Hong Kong, and that kind of oversight makes a real difference for me—particularly in an industry where trust and operational transparency are critical. I personally find that knowing a reputable regulator is involved helps me feel more secure about how my trades and client funds are handled, even though I always remain vigilant.

Secondly, Tradition’s extensive track record and global reach are significant advantages. The firm has operated for 15 to 20 years, and that experience in multiple major markets, including Australia, Hong Kong, and beyond, signals both stability and a deep understanding of volatile conditions. In my view, a broker’s ability to navigate diverse markets over many years usually reflects a level of reliability and professionalism that newer outfits simply can’t match.

Finally, the breadth of trading products available has been valuable for my own strategies. While Tradition doesn’t offer access to every asset class, I appreciate that it specializes in FX forwards, commodities, Japanese index derivatives, and non-deliverable forwards. In my practice, access to this specific range has allowed me to diversify according to macroeconomic trends rather than following retail fads. Still, I’d caution that anyone interested in stocks or crypto will need to look elsewhere, but for those genuinely focused on OTC derivatives, the platform aligns well with institutional and experienced traders’ priorities.

Mansuber007

1-2年

Could you break down what the total trading cost is for indices such as the US100 when trading on Tradition?

As someone who evaluates brokers with an emphasis on due diligence and risk management, I want to be clear that when it comes to Tradition, the trading costs for indices—such as the US100—are not transparent based on the current public information. My review of their details highlights that Tradition specializes primarily in over-the-counter (OTC) instruments like FX forwards, commodities, Japanese index derivatives, and other structured or bespoke financial products. Importantly, indices such as the US100 are not directly listed among their supported trading instruments, and there’s a notable lack of accessible information on typical retail trading costs, including spreads, commissions, or overnight financing fees for products like indices.

From my experience, this type of opacity requires a prudent approach, especially as Tradition’s core offering is not standardized spot index CFDs, but rather more complex products generally used in institutional or interdealer contexts. Their SFC regulation in Hong Kong is a strong point, but does not substitute for concrete, easily comparable trading cost data. For anyone specifically seeking to trade popular indices like the US100, I’ve found that engaging directly with Tradition’s support to request a detailed breakdown—potentially including negotiated brokerage fees and execution structures—would be essential before considering any commitment. In my own risk framework, I am reluctant to trade products or with firms where cost structure clarity is lacking, as unpredictable expenses can undermine even well-considered strategies. Always confirm the costs with the broker directly and proceed with caution if transparency is limited.

Broker Issues

Fees and Spreads

Aman A

1-2年

Which documents do I generally need to provide in order to process my initial withdrawal from Tradition?

Based on my knowledge of regulatory standards and my direct experience with SFC-regulated brokers like Tradition, I know that client verification is a strict compliance requirement before any withdrawals can be processed. While each broker can have slight variations in their document requests, my experience—especially with brokers under the Securities and Futures Commission of Hong Kong—has shown the process to be quite uniform.

Typically, to process your initial withdrawal, you will need to provide a valid government-issued photo ID, such as a passport or national identity card, for identity verification. Additionally, proof of address is almost always required, which is generally fulfilled by a recent utility bill or a bank statement displaying your full name and residential address, issued within the past three months. In some instances, especially when larger sums or specific jurisdictions are involved, I have also been asked to submit proof of the payment method used for deposits—such as a screenshot or statement from the originating bank or an image of the bank card (with sensitive details covered).

From a regulatory perspective, these requests are not only standard but essential for anti-money laundering (AML) and know-your-customer (KYC) compliance. In my trading experience, promptly providing these documents has ensured smooth withdrawal processing and minimized delays. Overall, I always recommend double-checking with customer support directly—via the contact details on their platform—for any broker-specific requirements or updated documentation standards before requesting your first withdrawal.

Broker Issues

Deposit

Withdrawal