Sergey5

1-2年

What are the risks associated with using WK?

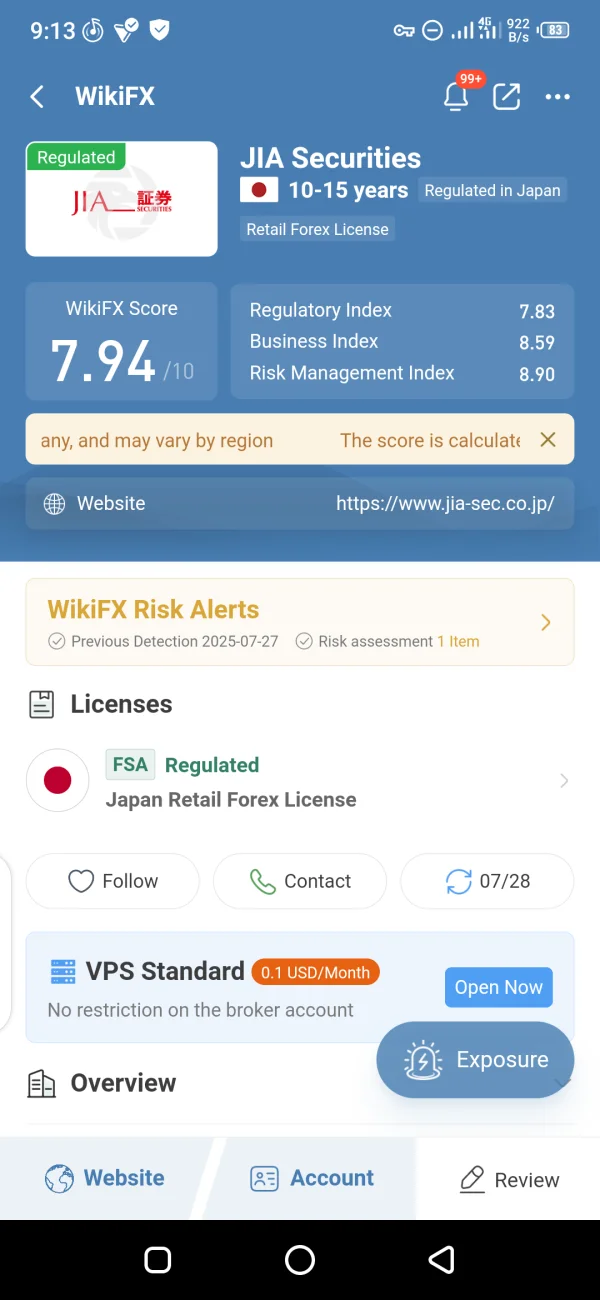

The biggest risk with WK is its unverified regulatory status. Although it is registered with the FSA, the lack of verification means there is no official confirmation that it adheres to the necessary standards of operation. Without regulatory oversight, traders may not have the same legal protections that they would have with verified brokers. In my opinion, this lack of verification creates an environment of uncertainty for traders, which can increase the risk of loss. If you're considering opening a wk account, I recommend reading WK reviews to better understand the platform's performance and user experience.

Mohammed Mazhar

1-2年

What trading instruments are available on the WK platform?

WK offers a variety of trading instruments, including bonds, stocks, investment trusts, Index Futures, Japan Operating Lease Investment Products, JIA Fund, Unlisted Company Funds, and Real Estate Small-Lot Investment Products. However, it does not appear to offer forex, commodities, or cryptocurrencies, which could limit the appeal for traders looking to diversify their portfolio globally. If you're considering a wk account, reading WK reviews could help you understand how other traders have navigated these product limitations.

Broker Issues

Leverage

Account

Instruments

Platform

Yousef47

1-2年

Are there any hidden commissions with WK?

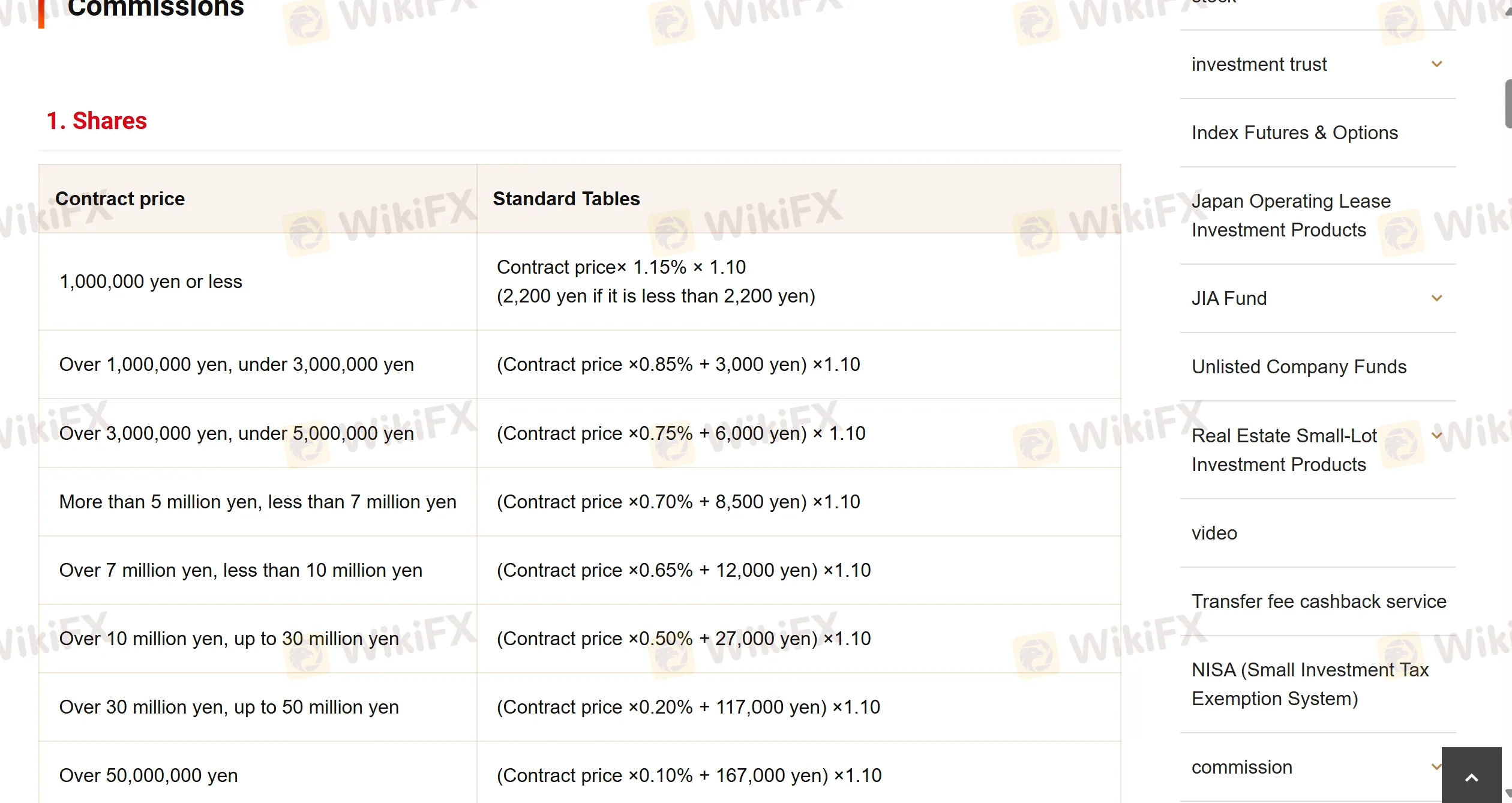

JIA Securities charges commissions based on the trading value, starting from 1.15% for shares under 1,000,000 yen and decreasing as the value increases. For bonds, commissions are also tiered depending on the value of the transaction. However, there are no indications of hidden fees for these transactions. Despite the clarity on commission rates, the lack of details about withdrawal and deposit fees is a concern. If you're considering opening a wk account, I suggest reading WK reviews to confirm whether other users have encountered unexpected charges.

Broker Issues

Fees and Spreads