天眼評分

QUESTH X

土耳其 | 1-2年 |

土耳其 | 1-2年 |https://questhxpro.com/

官方網址

評分指數

聯繫方式

外匯監管

外匯監管

暫無外匯交易類牌照,請注意風險!

- 該交易商當前暫無有效外匯監管,請注意風險!

基礎資訊

土耳其

土耳其 賬戶信息

- 交易環境--

- 貨幣--

- 最大槓桿1:500

- 支持EA

- 最低入金$1M

- 最小點差From 0.6

- 入金方式--

- 出金方式--

- 最小頭寸--

- 手續費--

- 交易品種--

瀏覽QUESTH X 的用戶還瀏覽了..

IC Markets Global

VT Markets

PU Prime

官網鑒定

questhxpro.com

104.21.30.138questhx.com

46.17.172.227

Wiki問答

Have you encountered any issues or drawbacks with Questh X's customer support or the reliability of their platform?

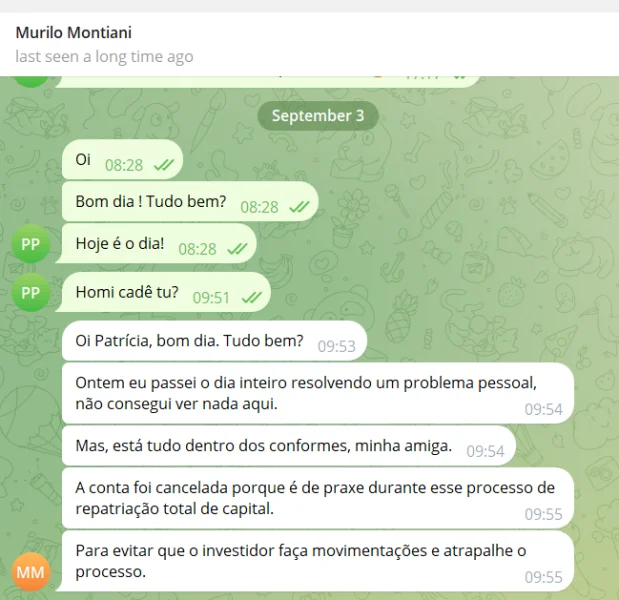

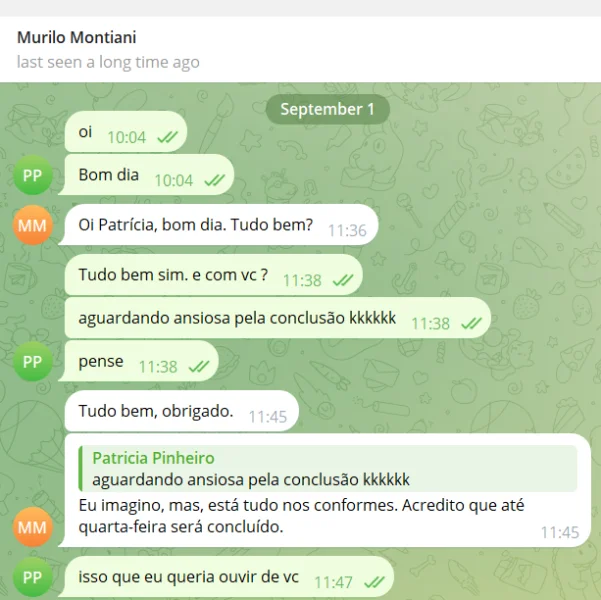

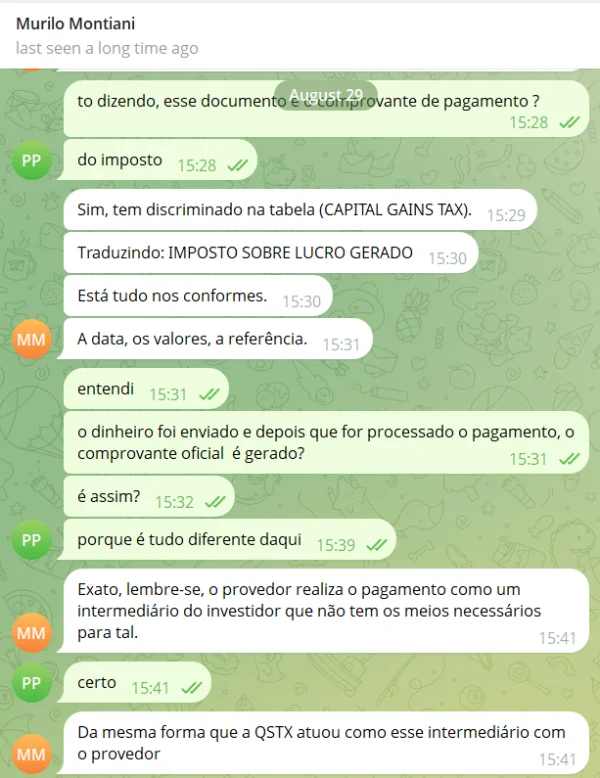

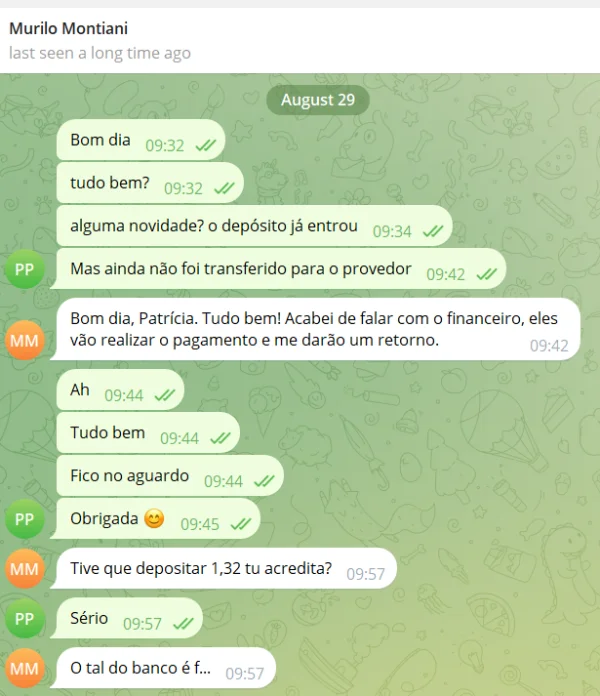

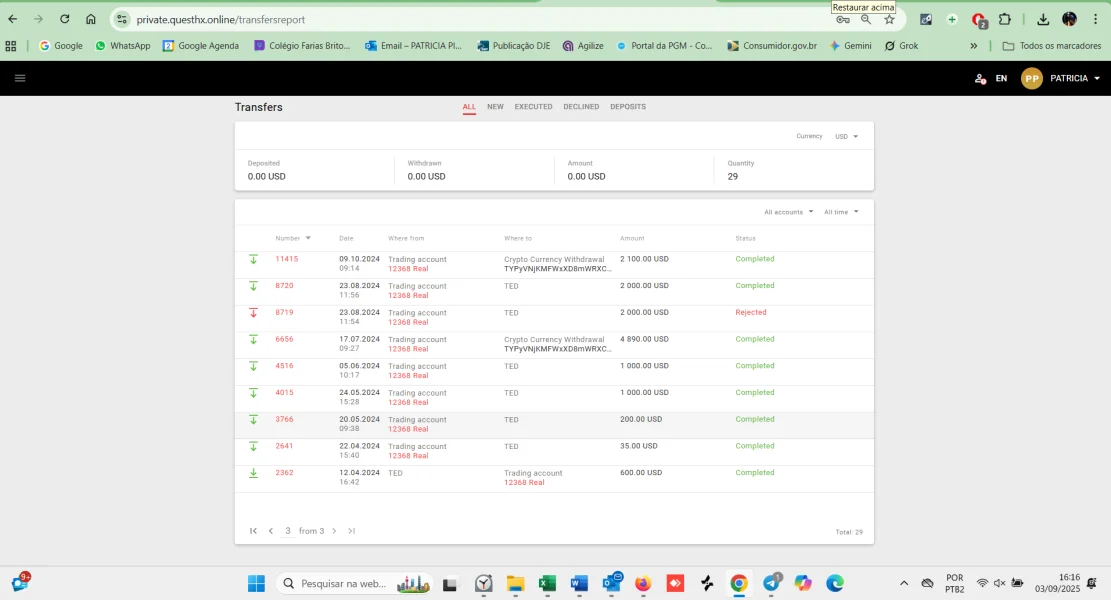

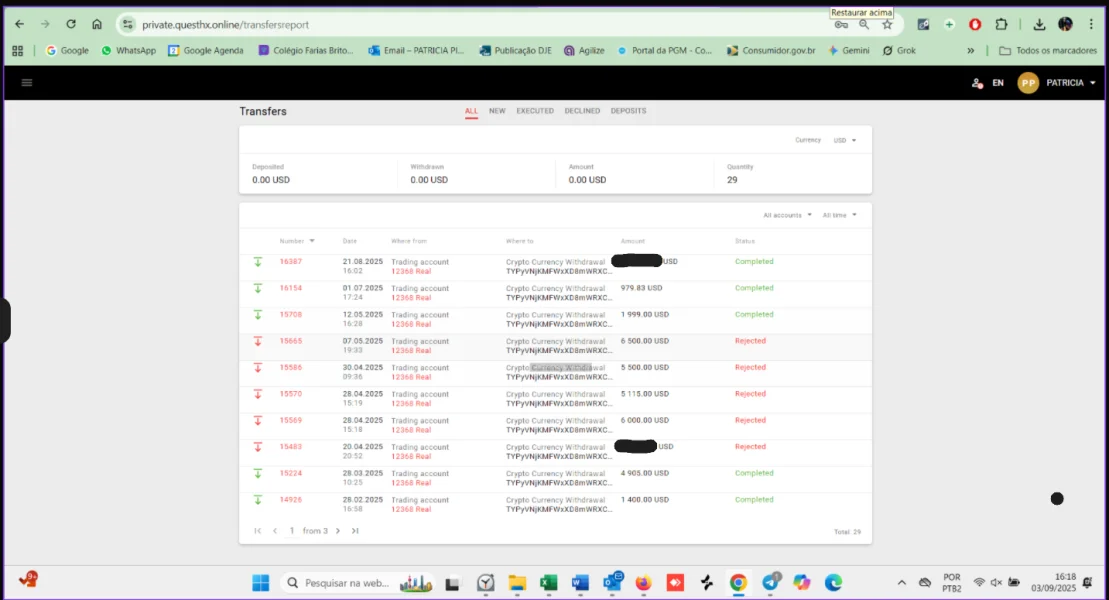

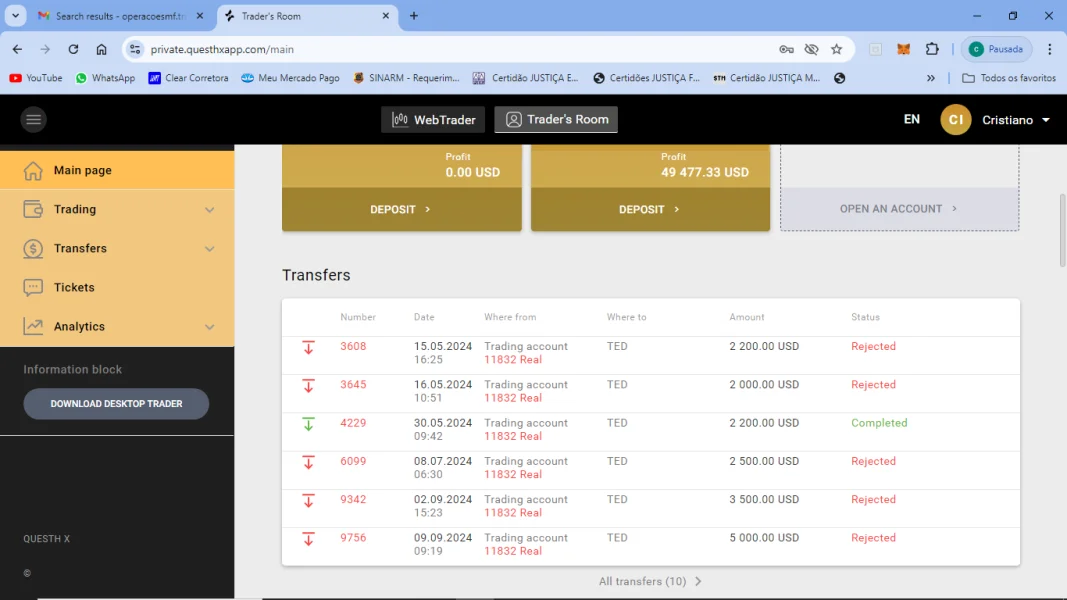

From my experience examining Questh X, several red flags immediately stood out, particularly around customer support and overall platform reliability. The most prominent concern for me was the complete lack of credible regulatory oversight—Questh X holds no valid license, which is a major risk in the forex industry. When a broker isn’t regulated, there’s very little recourse if problems arise, whether with the platform’s stability, withdrawal process, or client support. The sparse public information regarding their deposit and withdrawal methods worried me further. Reliable brokers usually provide detailed, transparent procedures for moving funds. Here, the absence of these details can indicate potential issues, especially when paired with high minimum deposit thresholds that are far above industry norms. Additionally, I discovered a concerning pattern: a user report outlined a scenario where support was initially very responsive, assisting with setup and facilitating minor withdrawals to build trust. However, after larger sums were deposited, the customer reportedly lost all contact and was unable to withdraw remaining funds. While I tread cautiously with third-party allegations, this is a risk that, in my professional judgment, cannot be ignored. Ultimately, for me, the combination of unregulated status, high deposit requirements, lack of process transparency, and credible negative user exposure all point to very real risks regarding customer support and platform reliability on Questh X. This is not a broker I would feel safe trading with.

Considering both user feedback and your own evaluation, what is your assessment of Questh X’s legitimacy?

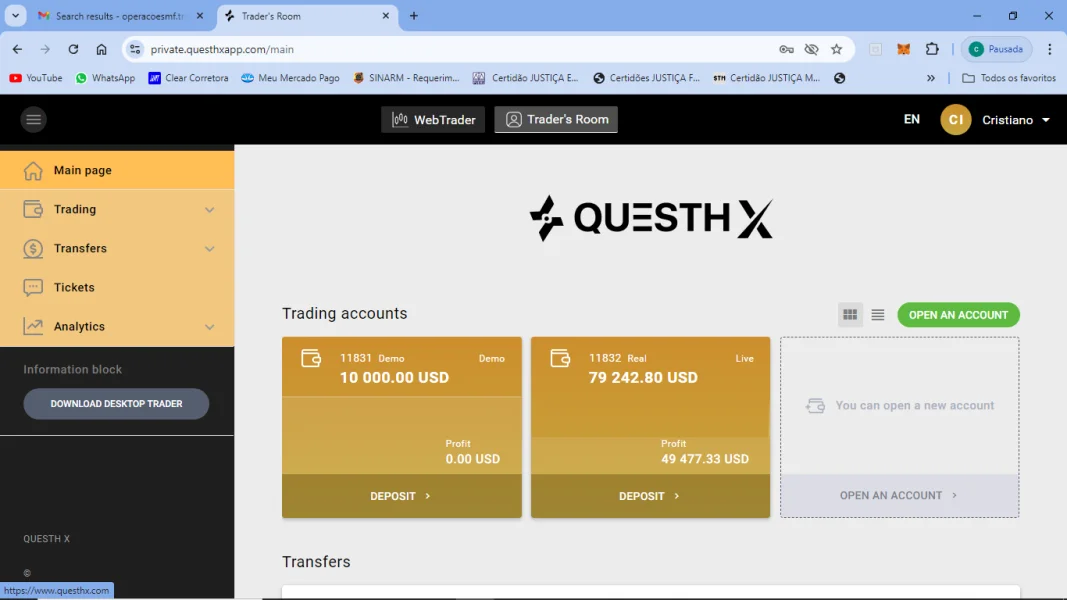

As an experienced trader, I place a premium on broker transparency, regulatory oversight, and a track record of client trustworthiness. My evaluation of Questh X raises multiple red flags and, frankly, leaves me uneasy about its legitimacy. The most fundamental concern for me is the absolute lack of valid regulatory information; the broker is marked as having a "suspicious regulatory license" and is not overseen by any recognized financial authority. This alone seriously undermines its credibility because regulation is a basic expectation for market integrity and client fund protection. Diving deeper, the minimum deposit amounts are exceptionally high—even the lowest tier requires a $10,000 commitment—which is far above industry norms and not justified by any clear competitive edge or unique offering. Coupled with unclear details on deposit and withdrawal methods, this adds a layer of opacity that experienced traders like myself try to avoid. The user feedback available is alarming. The report posted describes a classic scenario of inducement: small initial withdrawals approved to gain trust, followed by complete loss of communication and locked funds after larger deposits. This is consistent with behaviors I've seen in fraudulent operations, where manipulation and false assurance pave the way to trapping larger sums. Taking into account the risks highlighted by its low business and risk management scores, plus its inclusion on a public warning list, I have to conclude that Questh X does not meet even minimal standards of safety or legitimacy. For anyone prioritizing capital protection and transparent dealing, I would advise extreme caution—there are well-regulated alternative brokers available that offer a vastly higher degree of security and accountability.

Does Questh X charge a commission per lot for their ECN or raw spread accounts?

Based on what I found when looking into Questh X, there was no clear or transparent information available regarding their commission structure for ECN or raw spread accounts. As someone with years of trading experience, I know how important it is for a broker to state commissions and all associated costs upfront, especially for ECN or raw spread offerings where a per-lot commission is standard in the industry. For Questh X, although they advertise spreads starting from 0.6 and leverage up to 1:500, there is a striking absence of basic details about commissions, products, or even deposit and withdrawal methods. This lack of clarity is concerning for me, not only because it makes it impossible to calculate trading costs reliably, but also because transparency around fees is a core aspect of any broker’s trustworthiness. In my view, the fact that their minimum deposits range from $10,000 to $1,000,000 without clear explanation of the cost structure is a significant red flag. Until Questh X provides detailed, verifiable data on whether they charge a commission per lot—and how much—I would proceed with utmost caution and consider alternative brokers with proven regulatory status and transparent pricing.

Is Questh X overseen by any regulatory bodies, and if so, which financial authorities are responsible for its regulation?

Speaking as someone who has spent years navigating the forex landscape, regulatory oversight is always my first concern before engaging with any broker. In the case of Questh X, I found absolutely no evidence of genuine or reputable regulatory supervision. The firm’s profile indicates “No valid regulatory information,” which raises immediate red flags for me. There is mention of a “suspicious regulatory license,” and the lack of transparency over which, if any, official regulator might be overseeing their activities deeply concerns me. Even more troubling, Questh X appears on at least one official warning list of unauthorized companies, specifically noted by a European regulatory body. This signals to me, as someone who has seen countless broker setups come and go, that authorities have already marked them as untrustworthy. A regulatory index score of 0.00 confirms the absence of credible oversight. Given how central reliable regulation is for fund protection, conflict resolution, and basic market fairness, these facts alone would make me extremely cautious. For me, the lack of any clearly stated regulatory authority—and credible indications of high risk—are critical reasons I personally could not consider Questh X a safe venue for trading.

用戶評價2

你要評價的內容

請輸入...

評價 2