kennis2244

1-2年

Is it possible to deposit funds into my GEX account using cryptocurrencies such as Bitcoin or USDT?

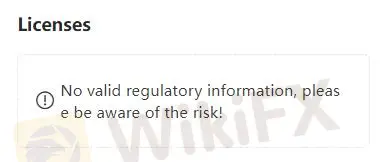

As an experienced trader, one of my first considerations with any broker is their regulatory status and transparency around essential features like funding methods. With GEX, I immediately noticed the absence of clear information on their official channels regarding deposit options—including whether they accept cryptocurrencies like Bitcoin or USDT. This lack of published detail raises a significant red flag for me, especially given that GEX operates without any regulatory oversight. In my own trading journey, I've learned that unregulated firms frequently present higher potential risks around fund security, transaction processes, and dispute resolution—areas where clear, public policies are crucial.

When a broker doesn’t spell out its deposit processes or accepted payment methods, I personally find that quite concerning. Funding an account with digital assets demands robust security protocols, and there is no evidence that GEX has instituted such measures. The absence of regulatory supervision compounded with limited website information means I cannot verify if crypto deposits are possible, safe, or protected under any client safeguards. For me, these unknowns are enough reason to exercise maximum caution and to avoid proceeding until I receive reliable, direct clarification from their official support channels—if at all. My advice is to never assume cryptocurrency deposits are available or secure without detailed, official confirmation, especially from a broker in GEX’s position.

Broker Issues

Deposit

Withdrawal

Darren Ross

1-2年

How do the different account types provided by GEX compare to one another?

Based on my careful examination, GEX does not actually provide any clear information about distinct account types for trading purposes. As someone who relies on a broker’s transparency and regulatory standing when considering where to place my funds, this absence immediately raises red flags. In my experience, reputable brokers will outline their account structures—including details like minimum deposit, spread options, leverage, and the types of financial products offered—so traders can make informed comparisons and decisions. With GEX, not only is this information missing, but the firm as a whole operates without any recognized regulatory oversight.

I find this particularly concerning, because trustworthy brokers should demonstrate strict adherence to regulatory protocols, and clear, detailed documentation about what each type of account offers. The only services I could find mentioned pertain to financial advisory and capital raising rather than to actual forex or CFD trading accounts. Without regulated trading accounts or a published fee structure, comparing account types quickly becomes impossible.

For me, this lack of disclosure gives the strong impression that GEX’s offerings are not on par with standard forex brokers. Until GEX can provide comprehensive, transparent information about account types and submits to regulatory supervision, I would advise extreme caution. For those seeking a reliable trading environment, it’s vital to prioritize regulated brokers who lay out all account options clearly and are subject to industry oversight.

Broker Issues

Instruments

Account

Leverage

Platform

RichN

1-2年

Have you encountered any downsides with GEX's customer support or noticed issues with the stability of their platform?

From my direct experience researching and evaluating GEX, I have a number of concerns, particularly relating to customer support and platform stability. To start, GEX is not regulated by any recognized authority, and there is very limited information about its operational transparency and client protections. For me, regulation is a foundational aspect for trust—without it, if anything goes wrong, there’s little recourse or external oversight to enforce fair practices.

When it comes to customer support, while GEX does provide a phone number and a physical address in Singapore alongside a web contact form, I found the lack of detailed, accessible information on their website worrying. In my view, for a firm involved in financial advisory and investment, this limited online presence can make troubleshooting, getting timely assistance, or understanding the firm’s procedures much more difficult. As an active trader, I rely on prompt and clear communication, especially if issues arise during trading hours; with GEX, I felt uncertain whether I would receive adequate support if I ever encountered a technical or account problem.

Additionally, I could not find any reliable information regarding the actual trading platform or its stability. There are no technical specifications or user testimonials detailing the experience of executing trades, handling downtimes, or even what platforms (like MT4 or proprietary solutions) are offered. For me, this is a significant drawback—when I cannot verify the reliability or performance of a platform, or even if one is available, it’s impossible to gauge if my trades and funds would be properly handled.

Given all these factors, I personally exercise extra caution. Reliable customer support and robust platforms are nonnegotiable for my own trading operations, and both elements appear uncertain or lacking with GEX. This, combined with the absence of regulation, makes it difficult for me to justify entrusting them with my business or capital. I strongly advocate for a careful, critical approach and, if you value responsive support and stable platforms, I would consider these significant downsides.

Moshiheya

1-2年

Could you break down the total trading costs involved when trading indices such as the US100 on GEX?

Based on my careful review of GEX, it’s important to highlight that, as of now, there is a concerning lack of transparent information regarding their trading conditions and costs—especially for popular indices like the US100. As a trader with a strong focus on risk management and transparency, I was unable to find any published details on typical spreads, commissions, overnight financing rates, or other associated trading costs for index products through official GEX channels.

The absence of regulation is a critical issue that directly impacts the reliability of any cost-related claims. From my experience, brokers that are not subject to oversight often do not provide clear fee structures, which makes it exceedingly difficult for traders like myself to properly evaluate the true cost of entering or maintaining trades. This lack of clarity means that hidden fees or unfavorable pricing could exist, posing additional risks to one’s capital.

Furthermore, the limited and vague information available on their website, as well as no specific mention of instruments such as indices, significantly undermines confidence in what to expect regarding transaction expenses. Given these factors, I cannot provide a breakdown of total trading costs for the US100—or any index—on GEX. For me, this lack of transparency and oversight is a red flag, and I would exercise extreme caution before considering any trading activity with GEX.

Broker Issues

Fees and Spreads