Mansuber007

1-2年

What is the usual timeframe for a Citadel Securities withdrawal to reach a bank account or e-wallet?

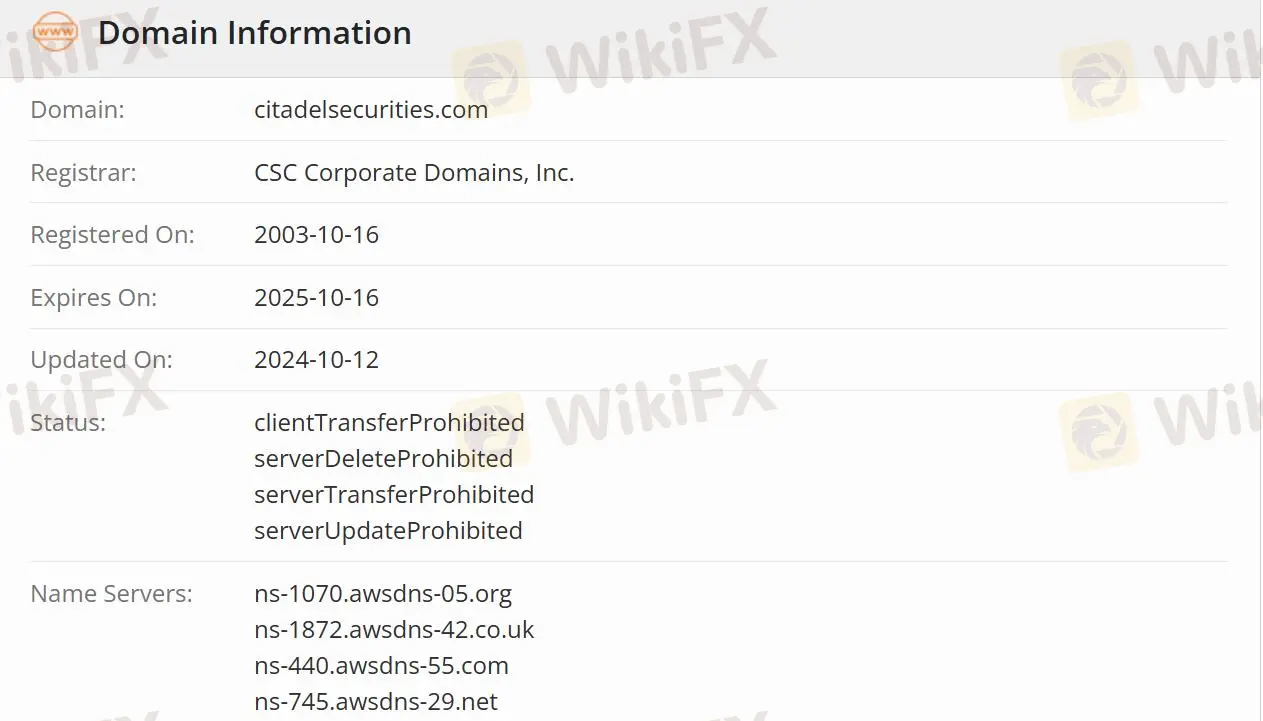

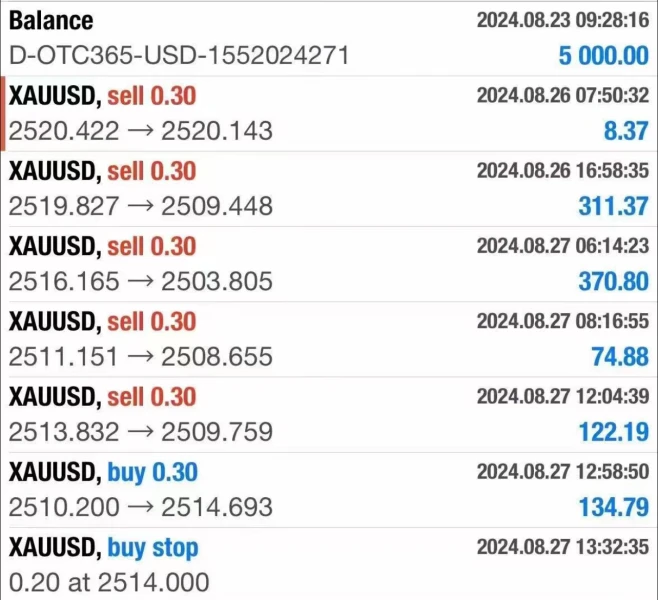

In my experience as a trader evaluating brokers, the safety and reliability of fund withdrawals are absolutely crucial for trust. When it comes to Citadel Securities, I found that the platform is acknowledged for having all necessary regulations in place, particularly being authorized by the Securities and Futures Commission of Hong Kong. This level of oversight gives me some confidence in the operational integrity and process transparency, including how withdrawals are handled.

Although specific withdrawal timeframes aren't detailed, the available information and the review from a user reinforce that Citadel Securities supports a variety of deposit and withdrawal channels and is recognized for the stability and reliability of these processes. For me, this often means timelines are comparable to industry standards for regulated entities, which typically range from one to several business days, depending on the method used and any banking intermediaries involved. However, I always approach such expectations cautiously—delays can occur due to compliance checks or bank processing times.

Given their regulatory status and user feedback mentioning efficient account opening and reliable transactions, I would reasonably expect withdrawals to most bank accounts or e-wallets to be processed efficiently, though I never assume anything immediate. Whenever I consider using a new broker, I confirm current withdrawal procedures directly, as individual circumstances and regional banking practices can affect outcomes.

Broker Issues

CITADEL Securities Citadel 證券 Deposit

Withdrawal

Yousef47

1-2年

Could you share a comprehensive overview of Citadel Securities’s fee schedule, covering both commissions and spreads in detail?

Based on my research and personal experience with Citadel Securities, I find that detailed information regarding their specific fee schedule—including commissions and spreads—is notably absent from public resources and not transparently outlined on their official materials. From what I can determine, Citadel Securities primarily functions as a market maker, specializing in providing liquidity across major financial products like equities, options, fixed income, and FX, rather than catering directly to individual forex or retail clients. Their operations are more institutional, focusing on serving large banks, brokers, and other significant players.

Given their regulated status in Hong Kong under the SFC and their longstanding presence in global markets for over 15 years, I am reasonably confident that their fee structures would conform to industry standards, especially as they pertain to institutions. However, for clients like me who are used to seeing transparent tables of retail commissions and pip spreads at other brokers, this lack of clarity is a concern. In my experience, brokers who target institutional flows often incorporate costs differently—through slightly wider spreads, exchange fees, or negotiated commission agreements—rather than through the fixed retail models I'm accustomed to.

Because fee terms at such institutional-focused firms are typically tailored and not standardized, I would approach Citadel Securities with caution if considering them for direct retail trading. For anyone in my position, I recommend engaging directly with their client service team to obtain explicit and up-to-date disclosures on any fees, spreads, and trading costs before opening an account or executing any trades. As always, understanding and confirming the total cost of trading is essential for risk management and long-term success.

Broker Issues

CITADEL Securities Citadel 證券 Fees and Spreads

Moshiheya

1-2年

Which trading platforms are offered by Citadel Securities? Do they support MT4, MT5, or cTrader?

Based on my thorough review of Citadel Securities, I could not find any indication that this firm offers popular retail trading platforms such as MT4, MT5, or cTrader. From my experience, Citadel Securities is best known as a market maker and liquidity provider, primarily serving institutional clients rather than catering to individual or retail traders who typically use platforms like MetaTrader or cTrader. Their regulated status in Hong Kong and longstanding operational history add to their credibility, but it's important to recognize that their business model focuses more on dealing in futures contracts and providing solutions in equities, options, fixed income, and FX markets.

For traders like me who place a high value on direct platform access and user-friendly interfaces, the absence of information concerning MT4, MT5, or cTrader is a significant consideration. In my view, this suggests that Citadel Securities is not positioned for those seeking conventional online trading platforms. Instead, they appear to prioritize large-scale, technology-driven market solutions tailored for financial institutions. If having access to MT4, MT5, or cTrader is critical for your trading approach, it’s prudent to look toward brokers who explicitly advertise and support these platforms. Always verify with the broker directly before making any commitments, and ensure their services align with your specific trading needs.

Broker Issues

CITADEL Securities Citadel 證券 Leverage

Platform

Account

Instruments

Prash_007

1-2年

How do Citadel Securities' swap fees (overnight financing costs) stack up against those offered by other brokerage firms?

Having traded with a variety of global brokers over many years, I’ve learned to pay close attention to swap fees—overnight financing costs can have a significant impact on long-term trading profitability. In the case of Citadel Securities, according to the available information, they are a major market maker operating in equities, options, fixed income, and FX, and are regulated by the Securities and Futures Commission of Hong Kong. However, concrete details about their swap fee schedule are not prominently disclosed in their public materials.

From my perspective, this absence of published swap rates means I cannot definitively compare their fees to those offered by other brokerage firms known for transparent pricing in forex products. In my experience, reputable brokers typically make their overnight rates easily accessible, as it supports traders’ ability to manage costs and risk. Given their institutional focus and broad asset coverage, it is reasonable to expect Citadel Securities to offer swap fees competitive with established players; however, without clear published figures, I would approach with cautious optimism. Personally, before considering them for active trading that involves holding positions overnight, I would recommend directly contacting their support channels for detailed information about overnight costs. Transparency and predictability in fee structures are vital for risk management, and I always prioritize brokers who provide this clarity.

Broker Issues

CITADEL Securities Citadel 證券 Fees and Spreads