公司簡介

| 第一證券 評論摘要 | |

| 成立年份 | 1985 |

| 註冊國家/地區 | 美國 |

| 監管 | 無監管 |

| 市場工具 | 美國股票、ETF、期權、共同基金 |

| 模擬帳戶 | ❌ |

| 交易平台 | 第一證券 網頁平台、手機應用程式(iOS 和 Android)、OptionsWizard 工具 |

| 最低存款 | $0 |

| 客戶支援 | 電話(美國免費):1-888-889-2818 |

| 電話(台灣免費):00801-856-958 | |

| 電話(中國免費):400-685-8589 | |

| 電話(國際):+1-718-888-2158 | |

| 電郵:service@firstrade.com / support@firstrade.com | |

| 微信:第一證券-1985(週一至週五 8:00–18:00 EST) | |

| 傳真:+1-718-961-3919 | |

第一證券 資訊

第一證券 成立於1985年,總部設於美國,是一個線上證券交易平台,為股票、期權、ETF 和共同基金提供零佣金交易。儘管為新手和有經驗的投資者提供用戶友好的平台和稅收優惠的IRA,但並未受到美國任何主要金融機構的監管。

優缺點

| 優點 | 缺點 |

| 股票、ETF、期權和基金零佣金 | 無監管 |

| 無帳戶閒置費或最低存款要求 | 無伊斯蘭帳戶 |

| 提供免費工具如OptionsWizard | 僅限於美國市場 |

第一證券 是否合法?

第一證券 是一家 未受監管的經紀商。儘管在美國註冊,但缺乏來自美國主要金融機構(包括證券交易委員會(SEC)或金融業監管局(FINRA))的任何正式監管許可。

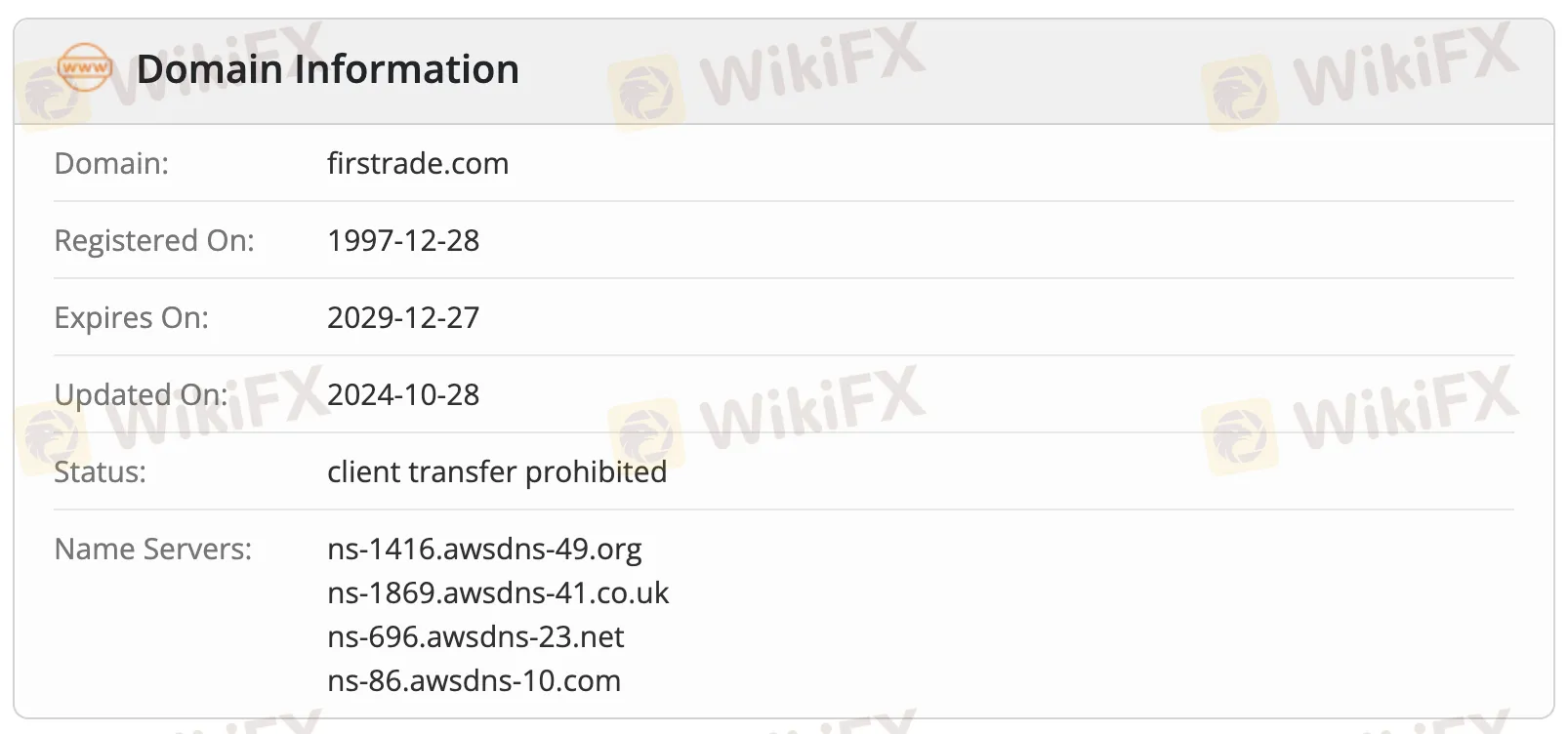

WHOIS 域名數據顯示,官方域名 firstrade.com 於1997年12月28日首次註冊。最後更新日期為2024年10月28日,到期日為2029年12月27日。該域名目前處於“客戶轉移禁止”狀態,這表示未經許可無法將其轉移到另一個註冊商。

我可以在 第一證券 交易什麼?

第一證券 提供一個免佣金交易平台,涵蓋多種投資產品,包括美國股票、ETF、期權和共同基金。投資者可以在不支付標準交易費用的情況下建立和分散投資組合。

| 交易工具 | 支援 |

| 美國股票 | ✔ |

| ETF | ✔ |

| 期權 | ✔ |

| 共同基金 | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

帳戶類型

第一證券 提供兩種主要的活動帳戶,一個用於投資,一個用於退休。它沒有模擬帳戶或不允許掉期的伊斯蘭帳戶。這些帳戶非常適合新手和有經驗的用戶,他們希望在美國市場投資時獲得稅收優惠。

| 帳戶類型 | 特色 | 適合對象 |

| 投資帳戶 | 個人或聯合帳戶,用於投資股票、ETF、期權等。 | 一般投資者 |

| 退休帳戶(IRA) | 傳統、羅斯或轉移IRA,用於稅收優惠的退休儲蓄。 | 長期退休儲蓄者 |

第一證券 費用

第一證券 的費用遠低於行業標準,是美國股票和期權交易者中最實惠的經紀商之一。無最低存款或閒置費,提供共同基金、期權、ETF和股票的免佣金交易。

交易費用

| 交易產品 | 佣金 | 合約費 | 備註 |

| 股票 | ❌ | – | 完全無佣金 |

| ETF | ❌ | – | |

| 期權 | ❌ | ❌ | 無每合約費用 |

| 共同基金 | ❌ | – | 包括前端負載和無負載基金 |

| 債券和CD | 淨收益基礎 | – | CD:主要市場$30 |

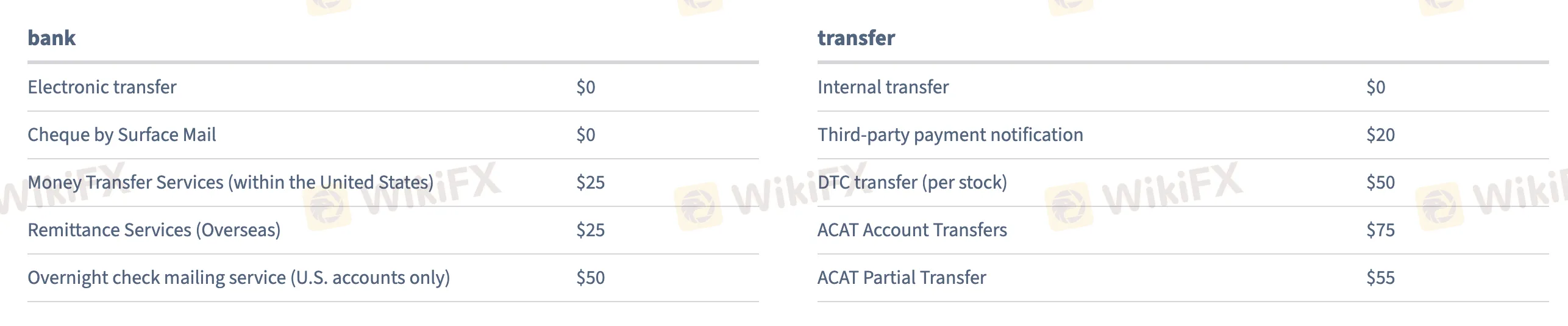

非交易費用

| 費用 | 金額 |

| 帳戶維護 | ❌ |

| 閒置費 | ❌ |

| 電子帳單/轉帳 | ❌ |

| 美國電匯 | $25 |

| 國際電匯 | $25 |

| 隔夜支票(僅限美國) | $50 |

| ACAT帳戶轉移(全額) | $75 |

| ACAT部分轉移 | $55 |

| 第三方支付通知 | $20 |

| 外國股票交易/轉移 | $75 |

| 退休帳戶設立/結束 | ❌ |

| ADR費用 | $0.01–$0.05 每股 |

交易平台

| 交易平台 | 支援 | 可用設備 |

| 第一證券 網頁平台 | ✔ | PC, Mac(網頁瀏覽器) |

| 第一證券 手機應用程式 | ✔ | iOS, Android |

| OptionsWizard 工具 | ✔ | 網頁,與主要應用程式整合 |

存款和提款

第一證券 不收取正常提款或存款的任何費用。然而,某些服務,如海外轉帳或快速支票交付,則需要支付費用。無最低存款要求,因此新手可以輕鬆開始投資。

| 付款方式 | 最低金額 | 存款費 | 提款費 | 處理時間 |

| ACH轉帳(銀行連結) | $0 | ❌ | ❌ | 1–3 個工作天 |

| 電匯(國內) | $0 | ❌ | $25 | 1–2 個工作天 |

| 電匯(國際) | $0 | ❌ | $25 | 3–5 個工作天 |

| 郵寄支票(僅限美國) | $0 | – | $0(標準),$50(加急) | 標準或隔夜遞送 |

| 內部帳戶轉帳 | $0 | ❌ | ❌ | 1 個工作天 |