公司簡介

| KKJSEC 檢討摘要 | |

| 成立年份 | 1986 |

| 註冊國家/地區 | 印度 |

| 監管 | 無監管 |

| 服務 | 股票和衍生品、商品、保險、首次公開募股 |

| 模擬帳戶 | ❌ |

| 交易平台 | ODIN(Financial Technologies)、COMTEK(後勤辦公室) |

| 客戶支援 | 一般:info@kkjsec.com |

| 投訴:grief@kkjsec.com | |

| 管理:nikhil@kkjsec.com | |

| 首席主管:Nikhil Jalan 先生 - 手機:+91 9833915980 | |

KKJSEC 資訊

成立於1986年,總部設於印度的 KKJSEC 提供一系列金融服務,包括共同基金、保險、商品、BSE/NSE股票和衍生品交易。旨在為當地的零售和機構客戶提供服務,透過ODIN和COMTEK系統提供交易服務。然而,它缺乏印度證券交易委員會(SEBI)的監管。

優缺點

| 優點 | 缺點 |

| 悠久的運營歷史 | 無監管 |

| 廣泛的金融服務範疇,包括股票和存管 | 不提供模擬帳戶 |

| 提供後勤辦公室訪問和線上交易工具 |

KKJSEC 是否合法?

否,KKJSEC 沒有受到監管。它成立於印度,但並未獲得任何印度金融機構,包括印度證券交易委員會(SEBI)的監管許可。

域名kkjsec.com的最近修改日期為2025年4月11日,註冊日期為2005年4月23日。域名的到期日期為2028年4月23日。它使用ns1.cp-ht-10.webhostbox.net和ns2.cp-ht-10.webhostbox.net作為主機名稱伺服器。

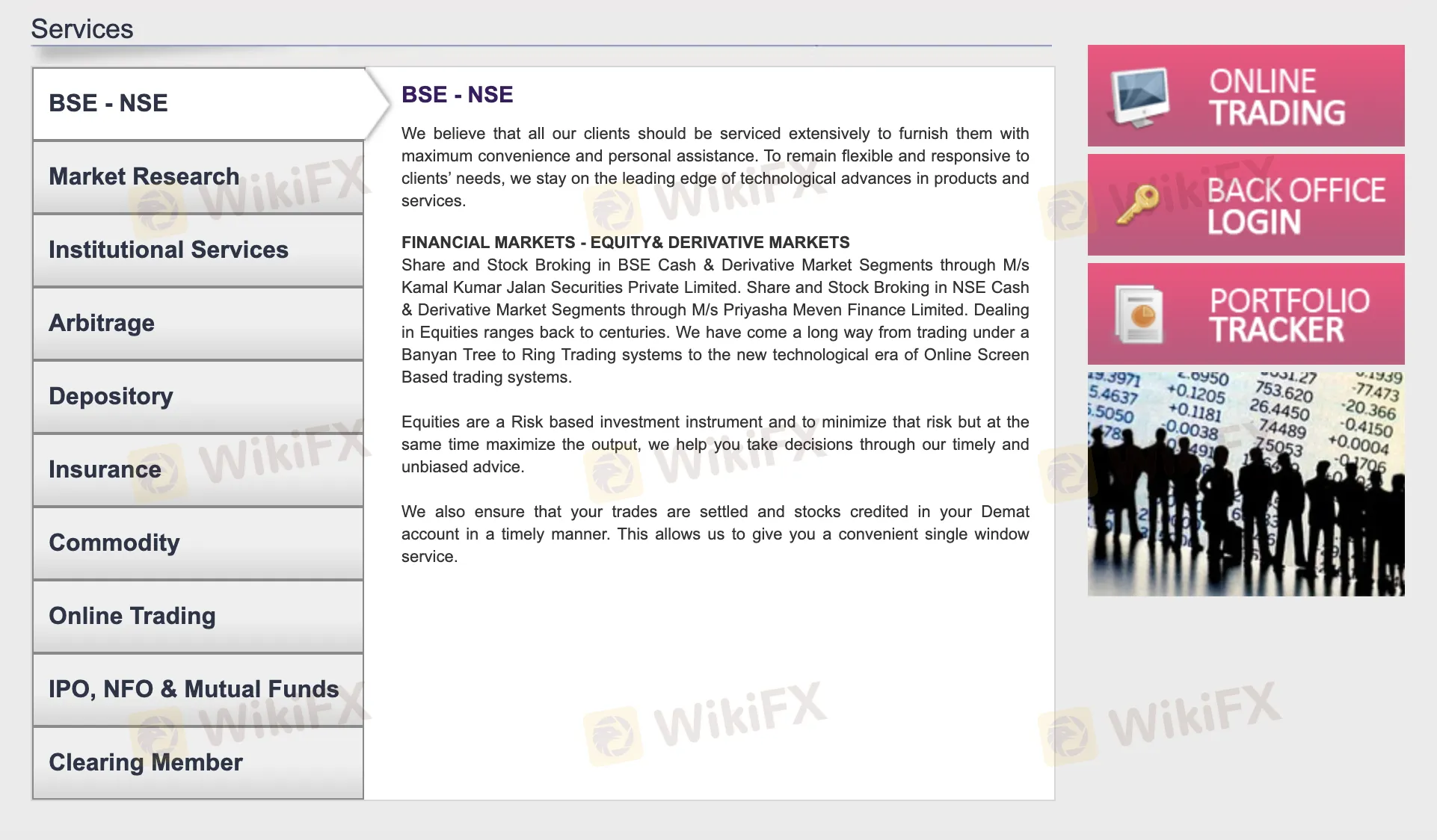

KKJSEC 服務

網上交易、商品、保險、存管服務、以及股票和衍生品交易僅是KKJSEC提供的眾多金融服務之一。通過其子公司,使在BSE和NSE交易所進行交易變得更加容易。

| 服務 | 特色 |

| BSE - NSE 交易 | 在BSE和NSE市場進行股票和衍生品交易 |

| 市場研究 | 市場分析和研究服務 |

| 機構服務 | 為機構客戶提供定制的金融服務 |

| 套利 | 套利交易策略 |

| 存管服務 | 股份存管帳戶服務和股票結算 |

| 保險 | 保險產品和諮詢 |

| 商品交易 | 在商品市場進行投資 |

| 網上交易 | 用戶便利的網上交易平台 |

| IPO、NFO和共同基金 | 與首次公開募股、新基金優惠和共同基金投資相關的服務 |

| 結算會員 | 結算服務,確保及時交易結算 |

交易平台

KKJSEC提供了由ODIN驅動的網上交易平台,使用戶能夠安全獨立地進行交易。還包括了由COMTEK提供支援的後勤辦公室,用於檢查交易報告和分類帳。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| ODIN(金融科技) | ✔ | 桌面、網頁 | 希望更多控制直接交易輸入的活躍交易者 |

| E-BackOffice(COMTEK) | ✔ | 網頁 | 需要即時訪問分類帳和交易摘要的投資者 |