公司簡介

| IFIC Bank 評論摘要 | |

| 成立年份 | 1999 |

| 註冊國家/地區 | 孟加拉 |

| 監管 | 無監管 |

| 產品 | IFIC Aamar Bhobishawt、Pension Savings Scheme (PSS)、PSS-Joma、Special Notice Deposit (SND)、IFIC Corporate Plus、Fixed Deposits、Monthly Income Scheme (MIS) 和外幣存款產品 NFCD |

| 平台/應用程式 | IFIC 數碼銀行應用程式 |

| 客戶支援 | 電話:09666716250 |

| 傳真:880-2-44850205 | |

| 電郵:info@ificbankbd.com | |

| 地址:IFIC Tower, 61 Purana Paltan, Dhaka-1000 | |

IFIC Bank 資訊

IFIC Bank 成立於1999年,總部位於孟加拉,提供多種儲蓄和收入產品,並配備便利的數碼銀行應用程式。該銀行提供多種帳戶類型和具競爭力的存款利率,但目前尚未受到監管。

優缺點

| 優點 | 缺點 |

| 提供多種存款和收入產品 | 無監管 |

| 多種帳戶類型 | |

| 提供便利的數碼銀行平台 |

IFIC Bank 是否合法?

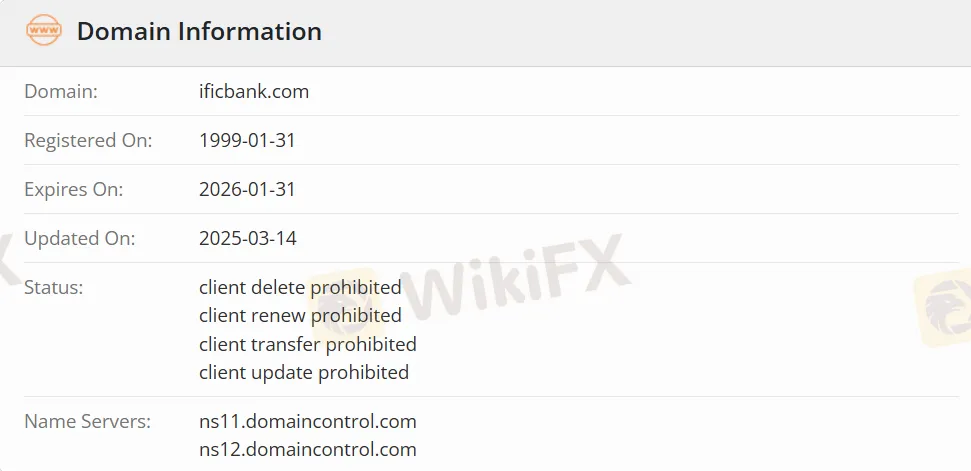

IFIC Bank 未受監管。其域名 ificbank.com 於1999年1月31日註冊,將於2026年1月31日到期。

IFIC Bank 產品

IFIC Bank 提供總共七種存款和收入產品,分別為 IFIC Aamar Bhobishawt、Pension Savings Scheme (PSS)、PSS-Joma、Special Notice Deposit (SND)、IFIC Corporate Plus、Fixed Deposits、Monthly Income Scheme (MIS) 和外幣存款產品 NFCD。

| 產品 | 支援 |

| IFIC Aamar Bhobishawt | ✔ |

| Pension Savings Scheme (PSS) | ✔ |

| PSS-Joma, Special Notice Deposit (SND) | ✔ |

| IFIC Corporate Plus | ✔ |

| Fixed Deposits | ✔ |

| Monthly Income Scheme (MIS) | ✔ |

| NFCD | ✔ |

帳戶類型

IFIC Bank提供總共六種戶口類型:IFIC Aamar 戶口、IFIC Shohoj 戶口、IFIC Freelancer 戶口、IFIC Women Banking、普通儲蓄戶口(包括學生戶口)和活期戶口。

交易平台

IFIC Bank的交易平台是IFIC數碼銀行應用程式,支援Android設備(可在Google Play上獲得)和蘋果iOS設備(可在App Store上獲得)。

| 交易平台 | 支援 | 可用設備 |

| IFIC數碼銀行應用程式 | ✔ | Android, iOS |

存款和提款

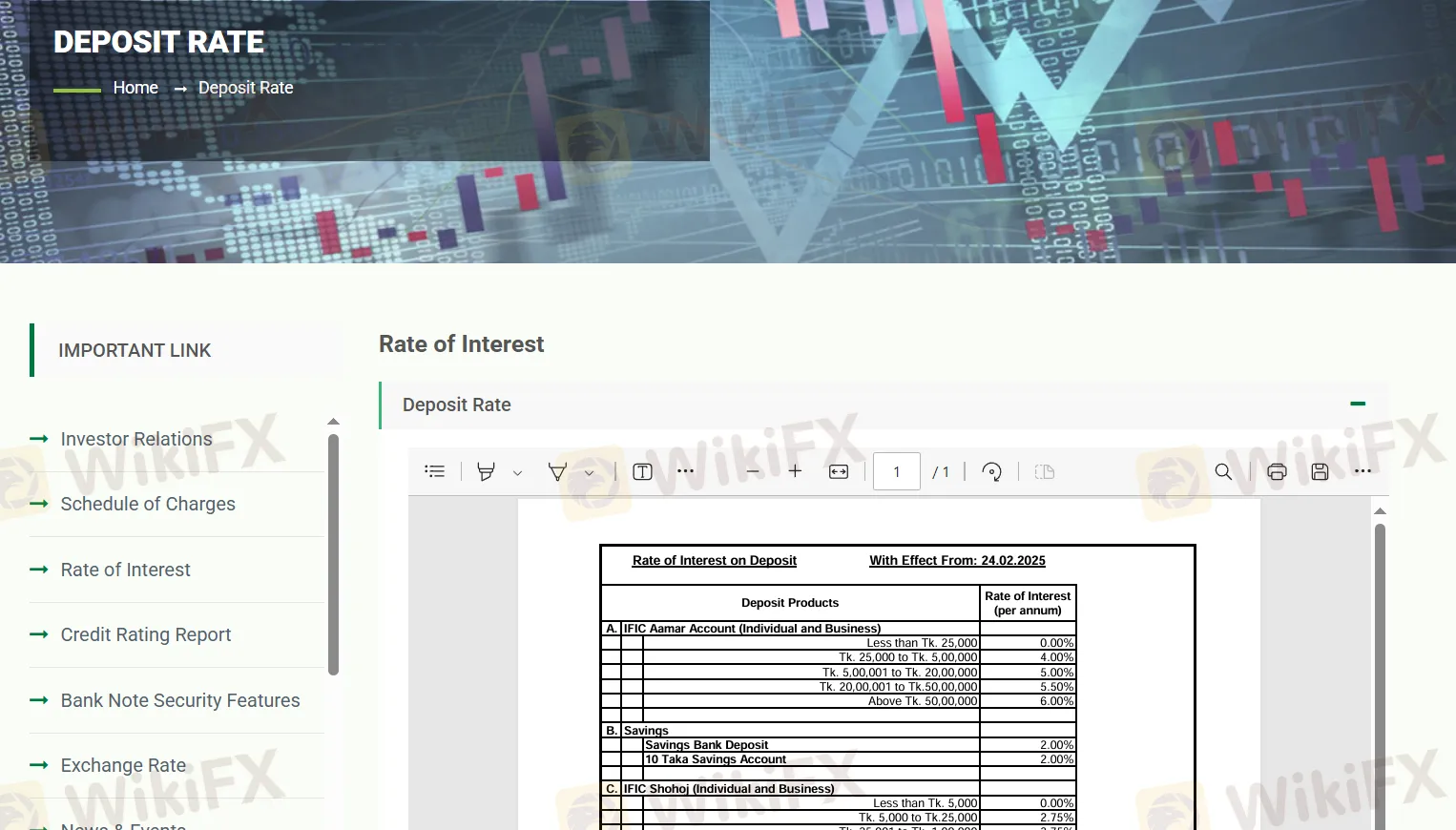

“IFIC Aamar Bhobishawt”儲蓄計劃提供每年10%的年利率,並設有每月分期付款,為期1至10年的不同稅前到期回報提供不同利率;適用的稅率為10%和15%。同時,“Pension Savings Scheme (PSS)”提供7.75%的年利率,而“PSS-Joma”則提供8.00%。普通儲蓄戶口的利率為2%,而“IFIC Shohoj”戶口根據結餘提供2.75%至4.25%的分層利率。特別通知存款(SND)和“IFIC Corporate Plus”戶口也提供分層利率,最高可達5%。

對於定期存款,1個月期提供9.5%的利率,而3個月或以上期限則提供固定的10.5%利率。月收入計劃(MIS)分別為1年、2年和3年的期限提供11%、11.5%和12%的利率。外幣存款則適用不同的利率。