公司簡介

| Concord Securities Group 檢討摘要 | |

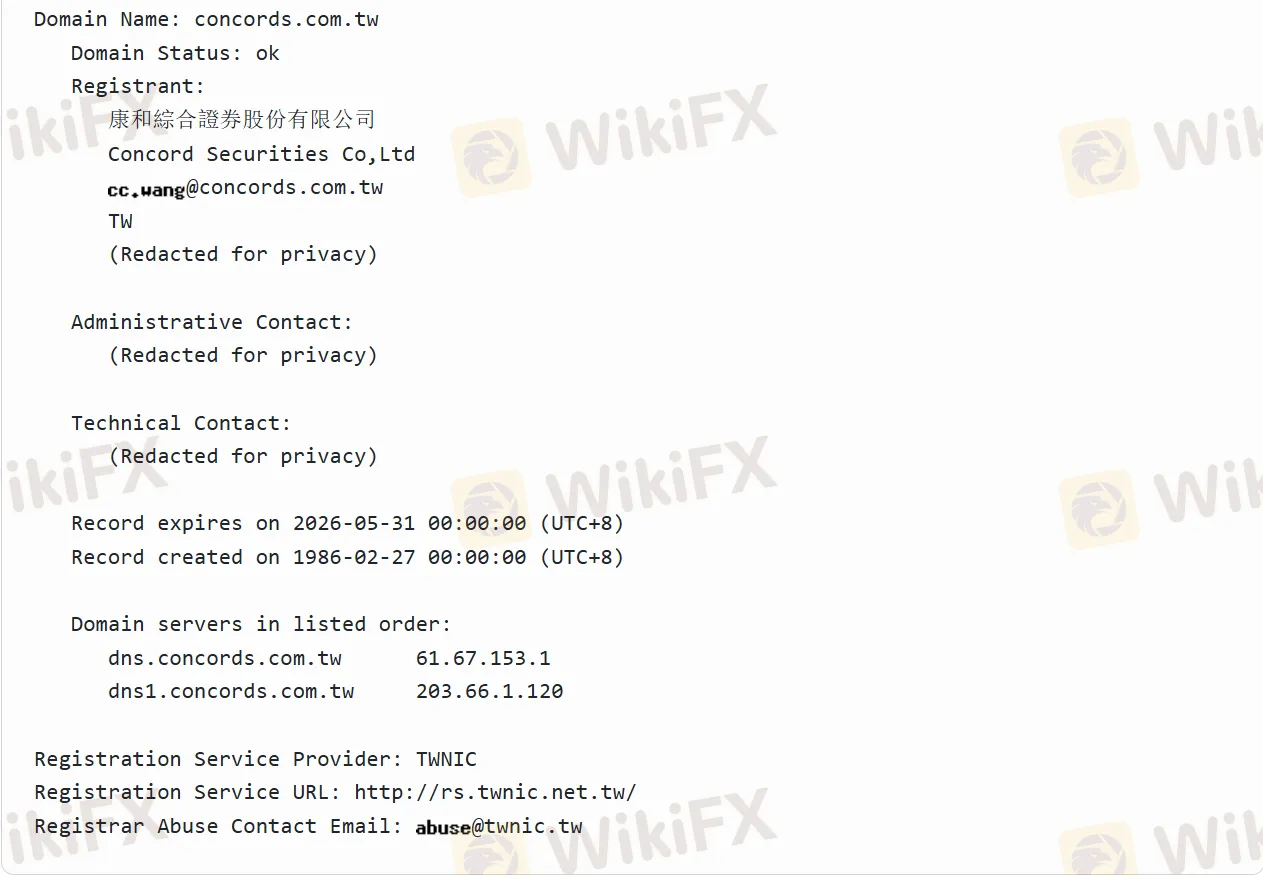

| 成立日期 | 1986-02-27 |

| 註冊國家/地區 | 中國、台灣 |

| 監管 | 受監管 |

| 市場工具 | 固定收益產品、債券、股票、衍生品、認股權證和ETF |

| 交易平台 | 77 證券線上服務(電腦、平板電腦和智能手機) |

| 客戶支援 | (886-2) 8787-1888 |

| service@6016.com | |

Concord Securities Group 資訊

Concord Securities Group 是一家歷史悠久的金融服務提供商。它由母公司和幾家專業子公司組成,包括康和證券、康和期貨、康和資本管理、康和保險代理和康和資產管理服務。自1990年成立以來,實收資本為新台幣13.56億元,公司穩健成長,並於1996年在櫃檯市場上市。

該集團致力於提供全面的投資和金融服務,其業務理念圍繞著最大化企業能力、增加利潤和改善員工福利。其企業文化強調誠信、穩定、服務和持續性。

優點和缺點

| 優點 | 缺點 |

| 受監管 | 複雜的企業結構 |

| 廣泛的金融服務 | 高度市場依賴 |

| 超過三十年的運作 |

Concord Securities Group 是否合法?

是的,Concord Securities Group 是一家合法的金融服務提供商,並受台北交易所監管。其執照號碼未公開。它在櫃檯市場上市表明符合某些監管要求。

我可以在 Concord Securities Group 交易什麼?

投資者可以在 Concord Securities Group 交易各種金融工具。這些包括股票,因為該集團提供經紀服務、股票融資交易和外國股票交易服務。此外,還有期貨交易、債券和固定收益產品。此外,該集團還提供與衍生品、認股權證和與ETF等指數相關的產品相關的服務。

| 可交易工具 | 支援 |

| 固定收益產品 | ✔ |

| 債券 | ✔ |

| 股票 | ✔ |

| 衍生品 | ✔ |

| 認股權證 | ✔ |

| ETF | ✔ |