公司簡介

| Invesco 評論摘要 | |

| 成立年份 | 1995 |

| 註冊國家/地區 | 美國 |

| 監管機構 | FSA |

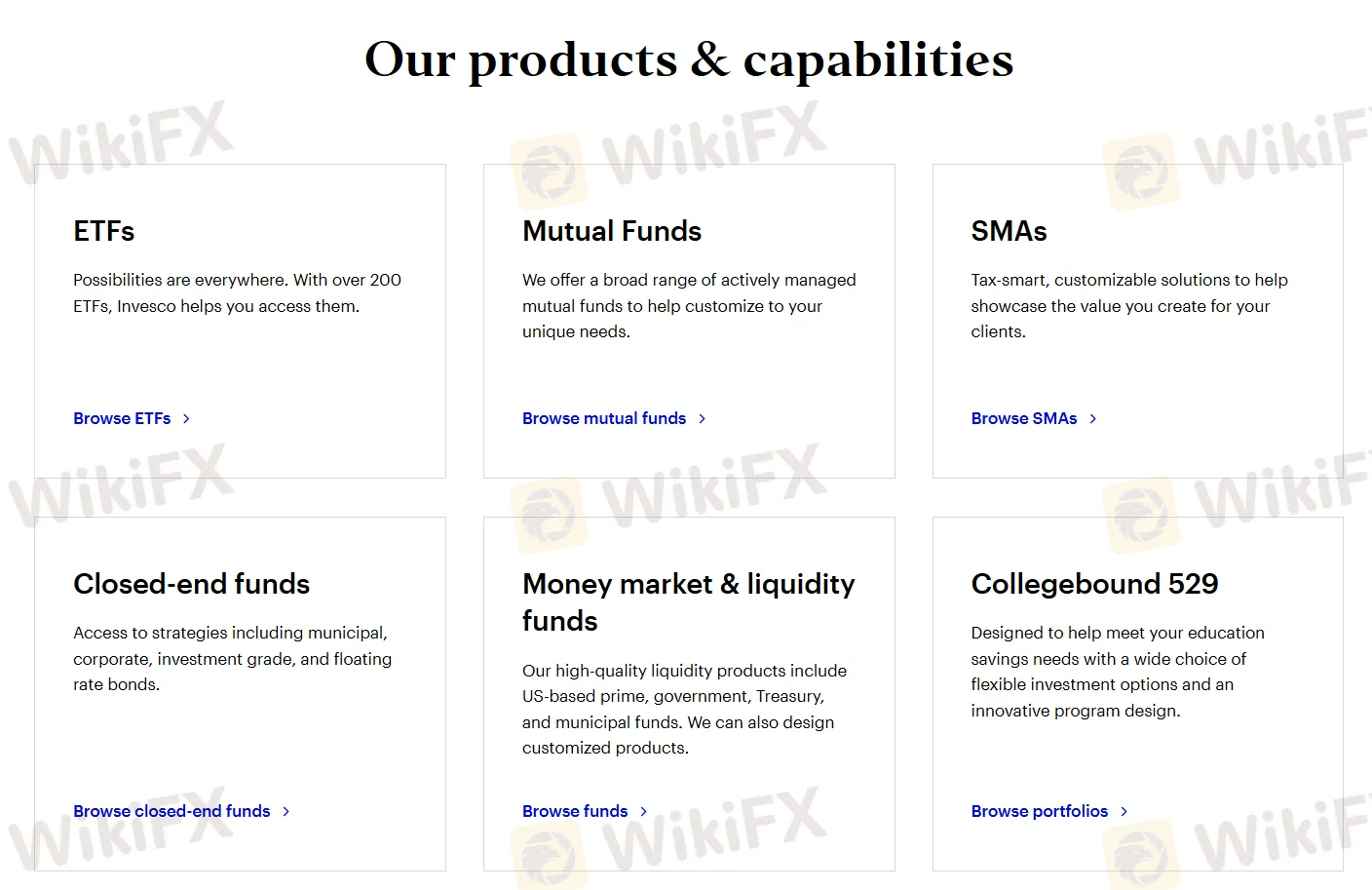

| 產品和服務 | ETF、主動管理的共同基金、SMAs、封閉式基金、貨幣市場和流動性基金,以及Collegebound 529計劃 |

| 客戶支援 | 美國 (800) 959-4246國外 (713) 626-1919Invesco 投資者專線 (800) 246-5463封閉式基金 (800) 341-2929週一至週五,上午7:00至下午6:00,中部時間 |

Invesco 資訊

Invesco 是一家受FSA監管的知名全球投資管理公司。該公司提供多樣化的金融產品和服務,包括ETF、共同基金、SMAs、封閉式基金、貨幣市場基金和529計劃,提供標準和定制的投資解決方案,並提供便捷的帳戶管理工具。

優點和缺點

| 優點 | 缺點 |

|

|

|

|

Invesco 是否合法?

Invesco 擁有由日本金融服務局(FSA)頒發的零售外匯牌照,牌照號碼為関東財務局長(金商)第306号。

產品和服務

Invesco 提供多種金融產品和能力,包括ETF、主動管理的共同基金、SMAs、封閉式基金、貨幣市場和流動性基金,以及Collegebound 529計劃,滿足各種投資需求和客戶類型。該公司提供現成和可定制的解決方案。

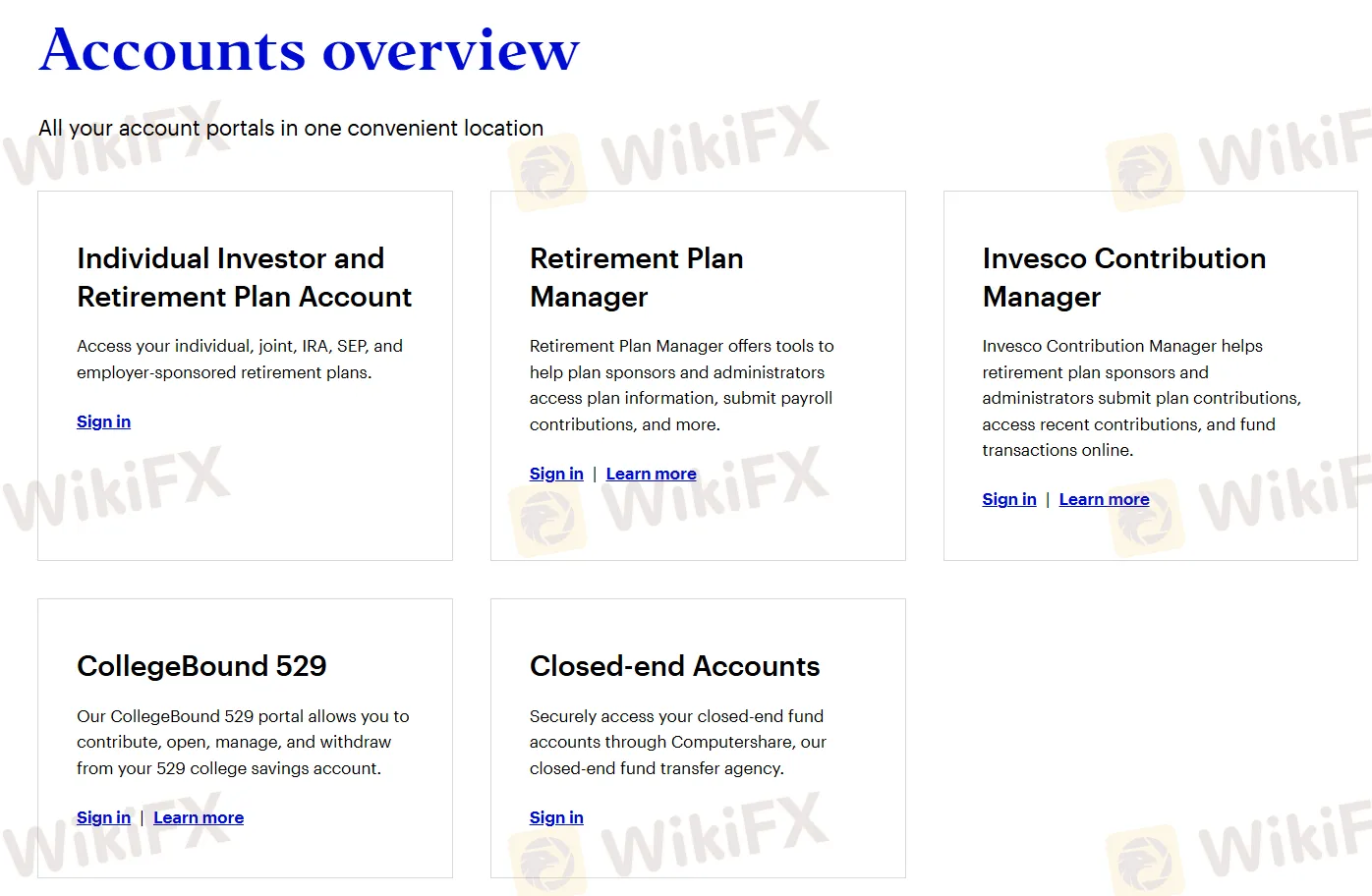

帳戶概覽

Invesco 提供個人投資者和退休計劃帳戶的訪問,為退休計劃贊助商和管理員提供工具,提供管理Invesco貢獻的平台,訪問CollegeBound 529帳戶,以及安全訪問封閉式帳戶。