Company Summary

| TD Review Summary | |

| Founded | 1998 |

| Registered Country/Region | Canada |

| Regulation | No Regulation |

| Products & Services | Chequing and savings accounts, credit cards, mortgage options, personal investing, borrowing, online investing and trading, personalized wealth advice |

| Platform/App | TD App |

| Customer Support | English: 1-800-983-8472, French: 1-800-983-8472, Mandarin: 1-877-233-5844 |

TD Information

TD is an online trading firm that offers comprehensive personal banking services, including credit cards, mortgages, and various investing options accessible via its user-friendly TD App. However, it is not regulated by any financial authorities currently.

Pros and Cons

| Pros | Cons |

| Various personal banking services | Unregulated platform |

| Unclear fee structure |

Is TD Legit?

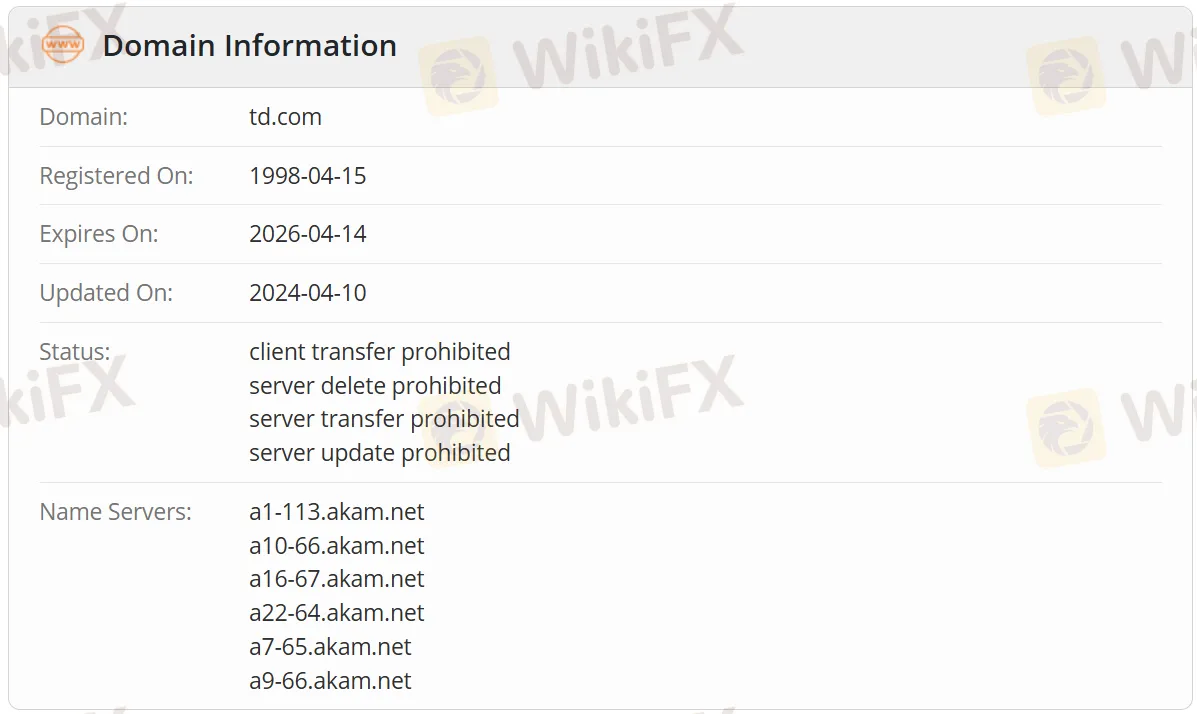

No. TD is an unregulated platform. The domain name td.com was registered on WHOIS on April 15, 1998, and expires on April 14, 2026. Its present status is “client transfer prohibited, server delete/transfer/update prohibited.”

Products and Services

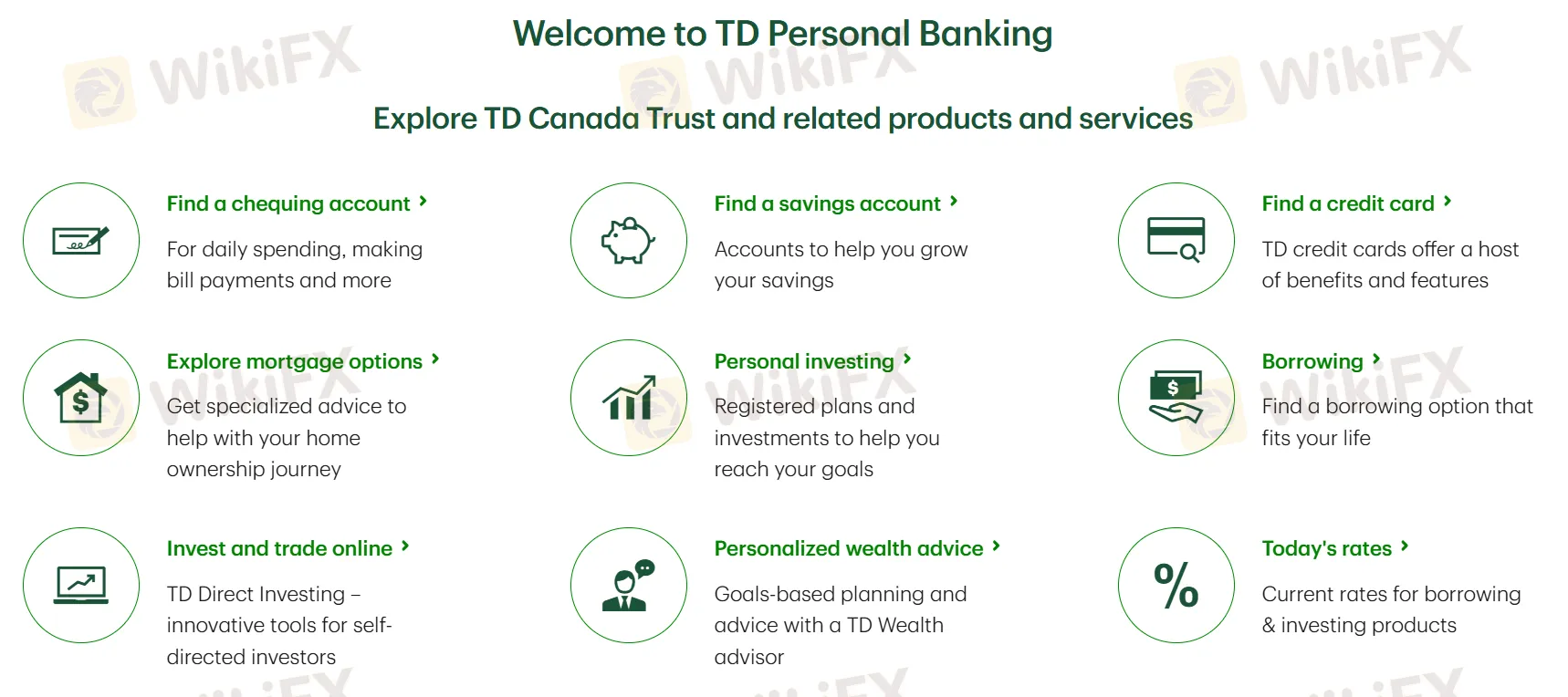

TD offers products and services including chequing and savings accounts, credit cards, mortgage options, personal investing, borrowing, online investing and trading, personalized wealth advice, etc.

Platform/App

| Platform/App | Supported | Available Devices |

| TD App | ✔ | Apple, Android |