Company Summary

| Apex Trader Funding Review Summary | |

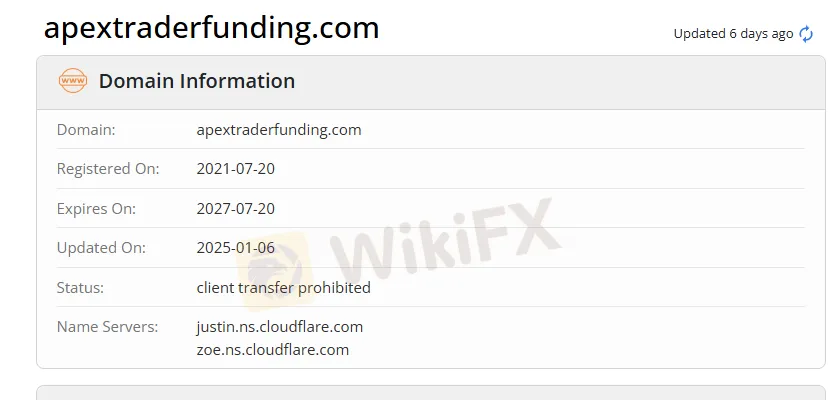

| Founded | 2021 |

| Registered Country/Region | China |

| Regulation | No regulation |

| Market Instruments | Futures,stocks |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Mobile app,web |

| Minimum Deposit | / |

| Customer Support | 24/7 customer support |

| Contact form | |

| Adress:Apex Trader Funding Inc.2028 E. Ben White Blvd Ste 240 -9873Austin, TX 78741 | |

| Tel:1-855-273-9873 | |

Apex Trader Funding was founded in 2021, registered in China, currently unregulated, offers Futures, Stocks trading.

Pros and Cons

| Pros | Cons |

| Trading is available on holidays | Unregulated |

| Lack of instruments | |

| Demo account unavailable | |

| MT4/MT5 unavailable | |

Is Apex Trader Funding Legit?

No. Apex Trader Funding is no regulation. Please be aware of the risk!

What Can I Trade on Apex Trader Funding ?

It provide futures and stocks.

| Tradable Instruments | Supported |

| Futures | ✅ |

| Stocks | ✅ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for 适合何种类型交易者 |

| Mobile app | ✔ | / | / |

| Online trading platform | ✔ | / | / |

| MT4 | ❌ | / | Beginner |

| MT5 | ❌ | / | Experienced |