NAGA

Germany

Germany

Time Machine

Check whenever you want

Download App for complete information

Exposure

2 pieces of exposure in totalNAGA · Company Summary

| NAGA Review Summary | |

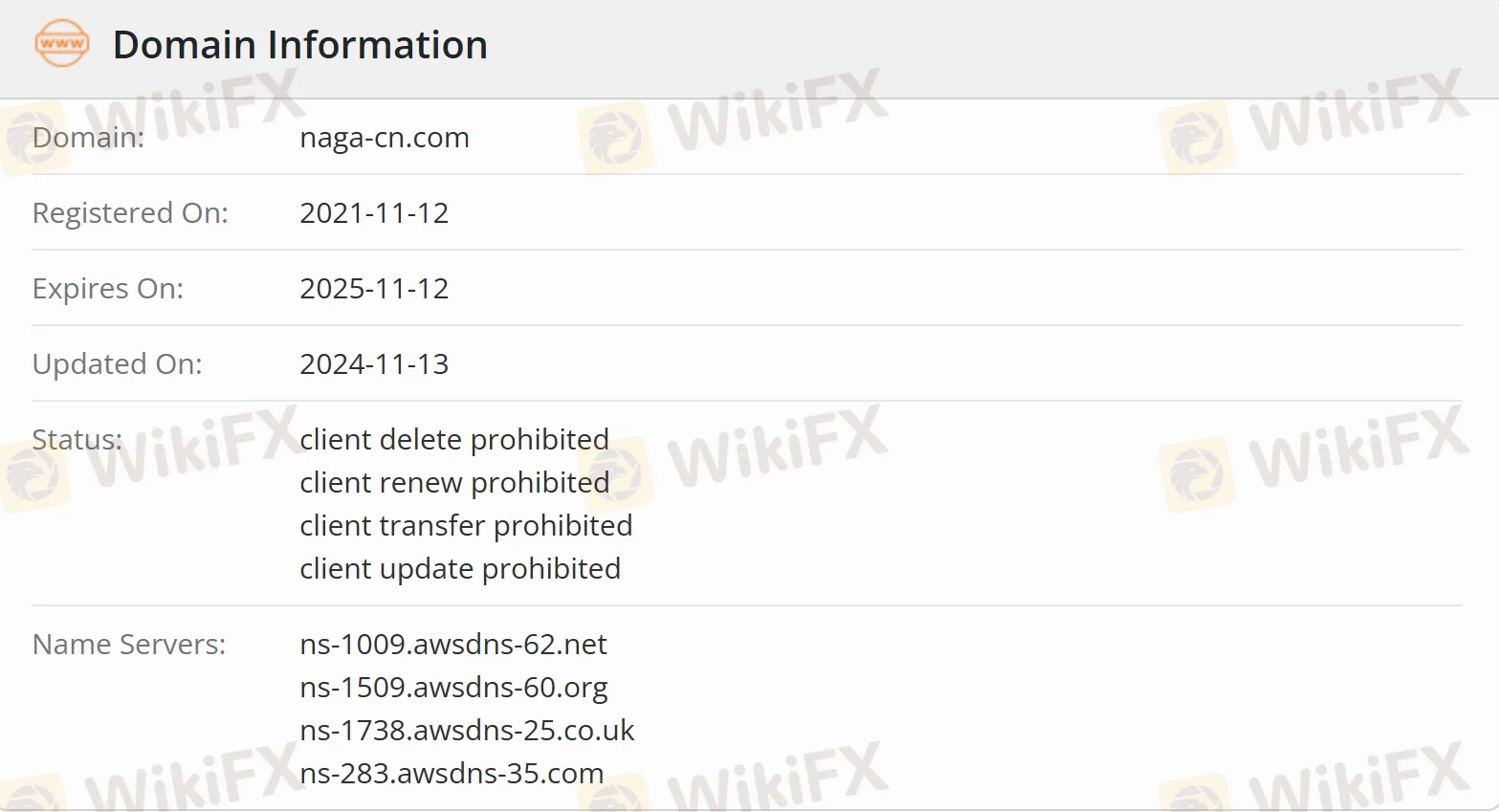

| Founded | 2021 |

| Registered Country/Region | Germany |

| Regulation | CYSEC/FSA (Suspicious Clone) |

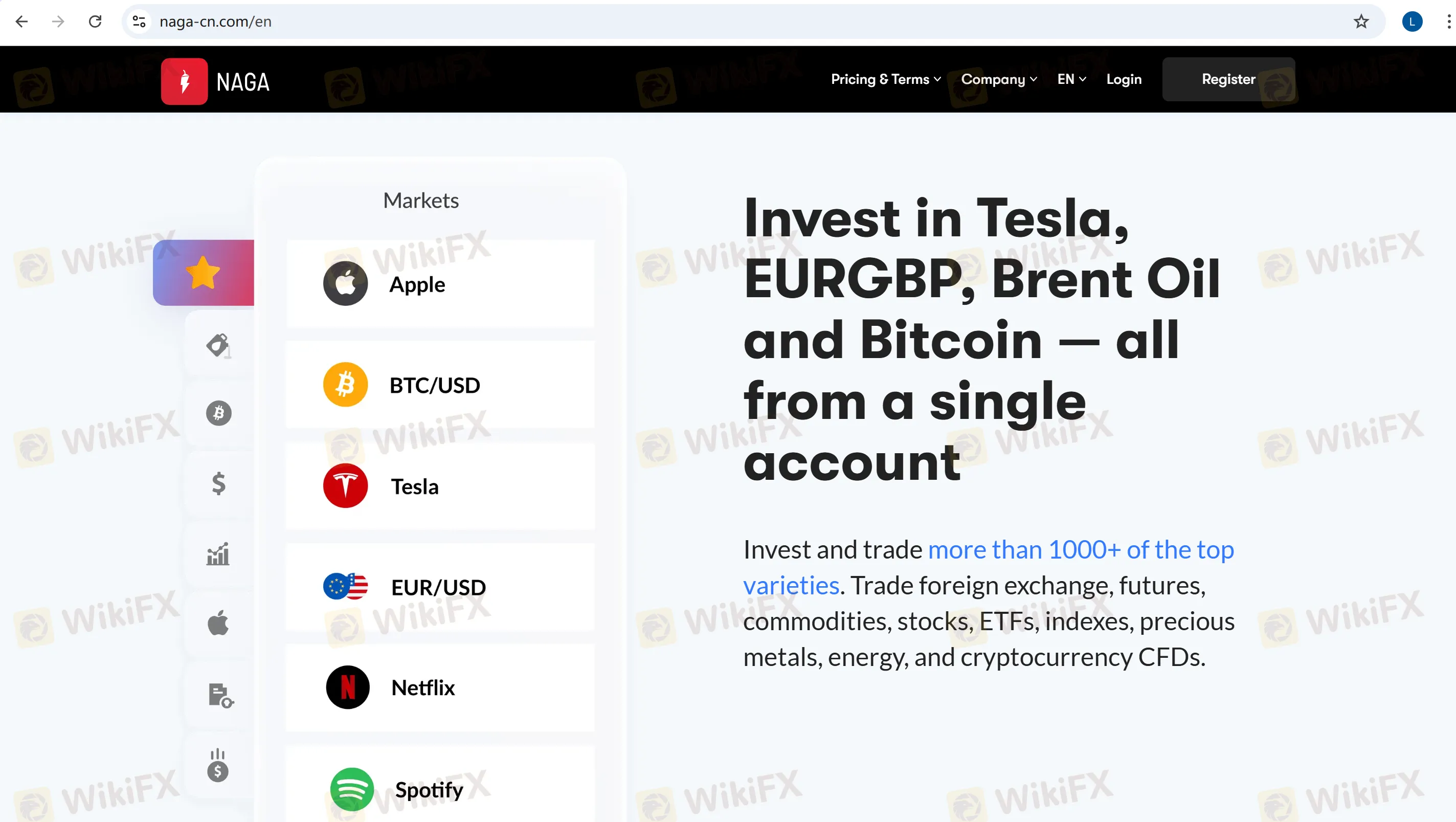

| Market Instruments | 1,000+, Forex, Commodities, Stocks, Cryptocurrency CFDs, Precious Metals, Futures, ETFs, Indexes, Energy |

| Demo Account | / |

| Leverage | Up to 1:500 |

| EUR/USD Spread | From 1.5 pips (Silver/Gold account) |

| Trading Platform | MT4 |

| Social Trading | ✅ |

| Minimum Deposit | 1,300 RMB |

| Customer Support | Email: chinasupport@naga.com |

NAGA Information

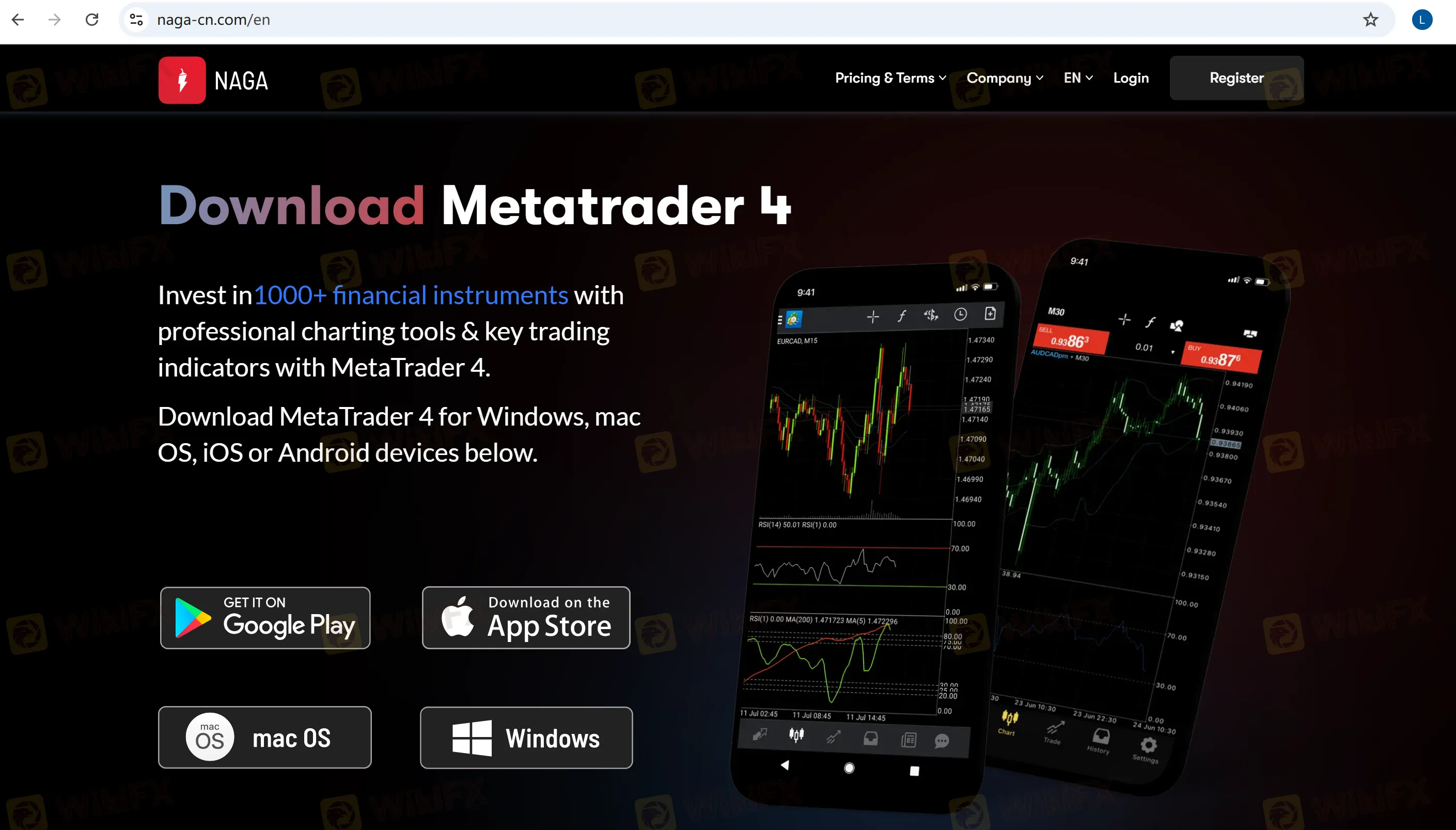

NAGA is a fintech company headquartered in Germany. The platform focuses on social trading and cryptocurrency trading, supporting trading of over 1,000 financial instruments covering markets such as forex, stocks, cryptocurrency CFDs, ETFs, etc. It provides the MetaTrader 4 (MT4) trading terminal, enabling real-time trading across multiple devices (Windows, macOS, iOS, Android).

Pros and Cons

| Pros | Cons |

| Over 1,000 trading instruments | Suspicious clone CYSEC and FSA licenses |

| Multiple account types | High initial deposit requirement |

| MT4 available | Limited payment options |

| No direct contact channel |

Is NAGA Legit?

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Cyprus Securities and Exchange Commission (CYSEC) | Suspicious Clone | Νaga Markets Europe Ltd | Cyprus | Market Maker (MM) | 204/13 |

| The Seychelles Financial Services Authority (FSA) | Suspicious Clone | NAGA Capital Ltd | Seychelles | Retail Forex License | SD026 |

What Can I Trade on NAGA?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrency CFDs | ✔ |

| Precious Metals | ✔ |

| Futures | ✔ |

| ETFs | ✔ |

| Indexes | ✔ |

| Energy | ✔ |

| Bonds | ❌ |

| Options | ❌ |

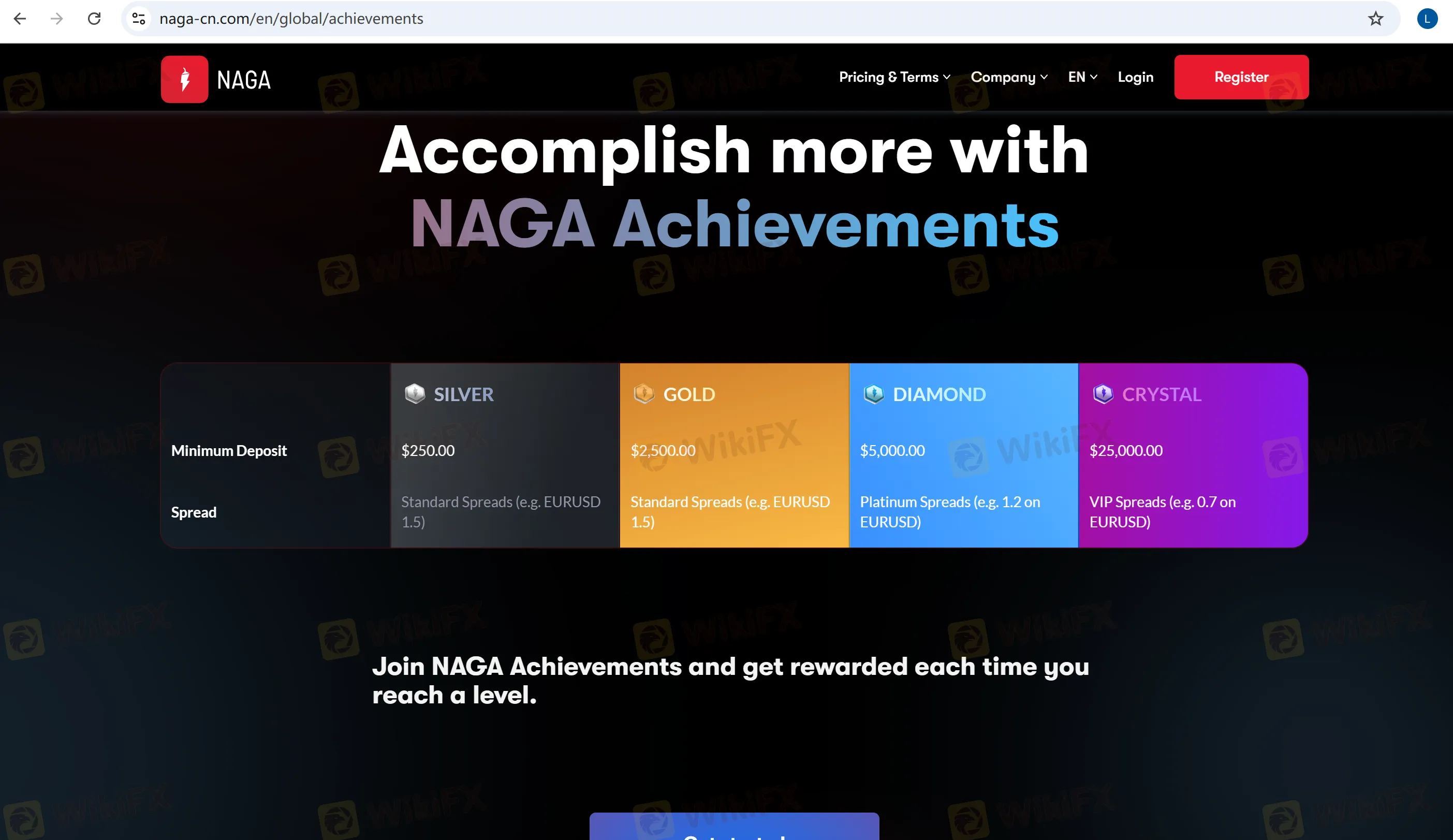

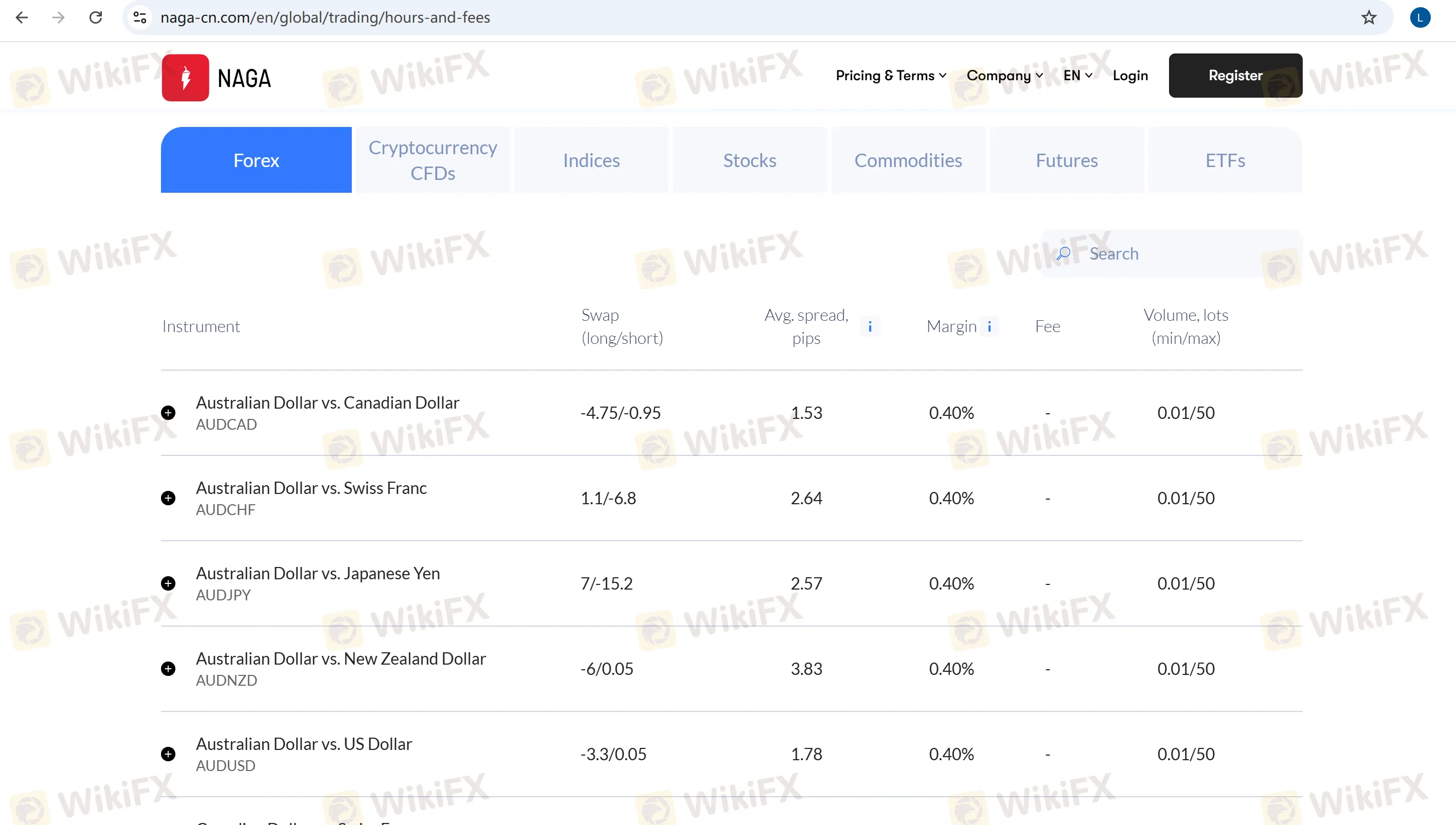

Account Type & Spreads

| Account Type | Minimum Deposit | EUR/USD Spread |

| Silver | 250 USD | Standard, from 1.5 pips |

| Gold | 2,500 USD | |

| Diamond | 5,000 USD | Platinum, from 1.2 pips |

| Crystal | 25,000 USD | VIP, from 0.7 pips |

Leverage

For AUD/USD, AUD/CAD, etc. The margin ratio is 0.40%, corresponding to a leverage of 1:250.

For CAD/CHF, the margin ratio is 0.20%, corresponding to a leverage of 1:500.

Please note that high leverage can amplify not only profits but also losses.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | mac OS, Windows, Android, iOS | Beginners |

| MT5 | ❌ | / | Experienced traders |

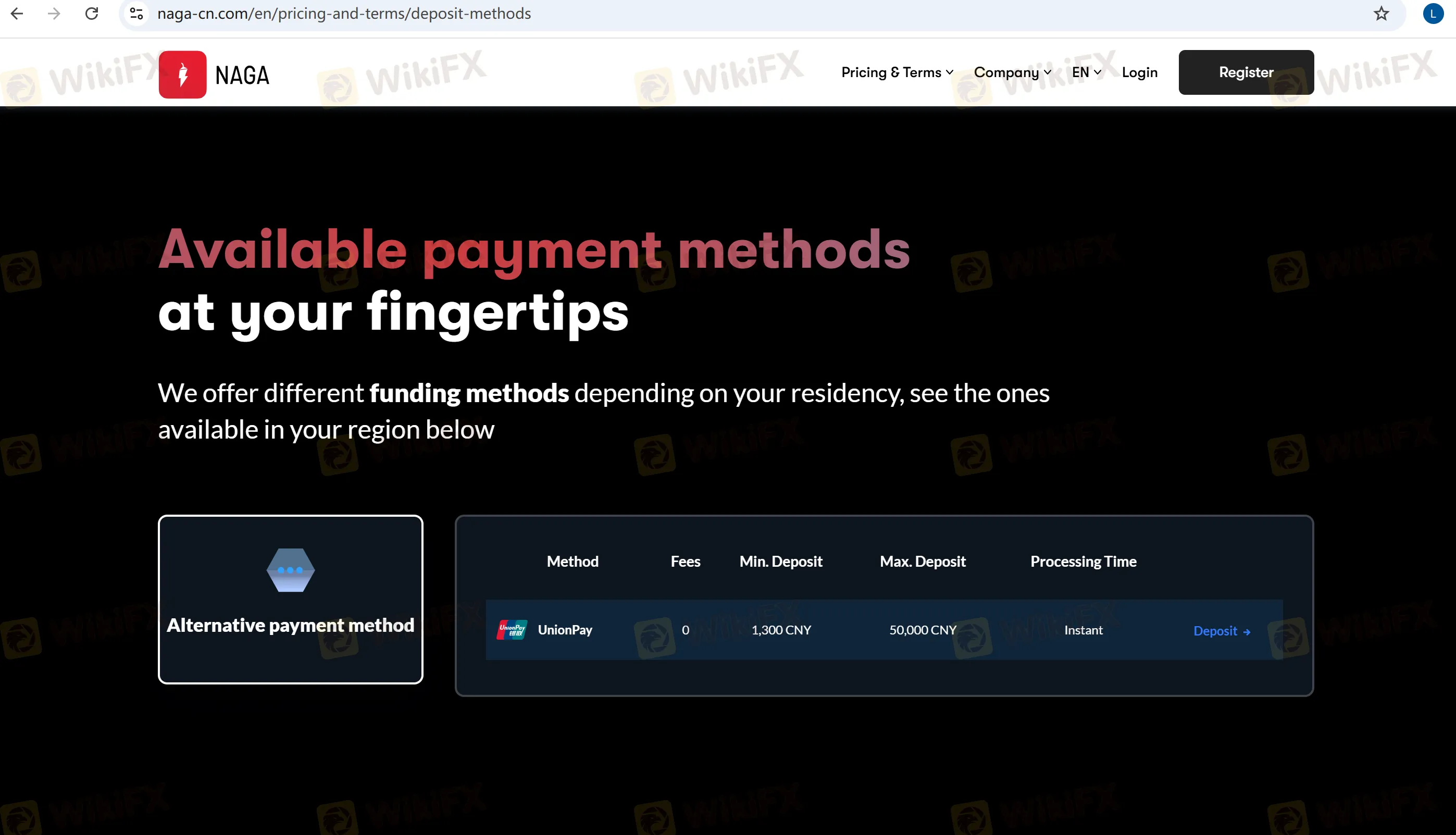

Deposit and Withdrawal

Deposit via UnionPay is supported, with a minimum of 1,300 RMB and a maximum of 50,000 RMB. It is free of charge, and funds are credited instantly.

News

NewsNAGA to Launch Crypto Exchange in March, January Revenue Hits Record

Hamburg-headquartered NAGA Group AG (XETRA: N4G) is taking another major leap into the crypto industry and is set to launch its cryptocurrency exchange on March 7, 2022.

WikiFX

WikiFX

NewsNAGA Secures Another €34 Million as Growth Capital

The company will use the funds in financing global growth and enhanced marketing measures.

WikiFX

WikiFX