Company Summary

| KGI Asia | Basic Information |

| Company Name | KGI Asia |

| Founded | 1997 |

| Headquarters | Hong Kong |

| Regulations | SFC |

| Tradable Assets | Wealth products (mutual funds, fund MIP, bonds, structured products, insurance, MPF, stocks MIP), global stocks, warrants & CBBCs, IPO subscription, grey market trading, futures, options, HK stock options, ETFs, shares, bonds |

| Account Types | Securities trading account, futures and options trading account |

| Commission | For stock trading services, commission rates range from 0.25% to 0.5% with minimum fees. Additional fees and levies apply. |

| Deposit Methods | Cheque deposit, internet banking, ATM, phone banking, bank transfer, PPS services |

| Trading Platforms | Mobile trading platforms (KGI Asia Power Trader, KGI Key), online trading platforms (WebTrade), desktop trading platforms (WebTrade - Professional Version, eFO SP / SO Online) |

| Customer Support | Online form, phone, fax, email |

| Education Resources | Provides information on various financial products and risk disclosure |

| Bonus Offerings | HK$950 Welcome Reward, $0 platform fee for US fractional shares trading |

Overview of KGI Asia

KGI Asia is a prominent financial brand operating in the Asia region since 1997. It offers a comprehensive range of services including wealth management, brokerage, investment banking, fixed income, and asset management. With strong support from its parent companies, KGI Securities Company Limited and China Development Financial Holding Corporation, KGI Asia has established a strong presence in Taiwan, Hong Kong, Singapore, Indonesia, and Thailand, serving corporate, institutional, and individual clients across Asia.

KGI Asia is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring its legitimacy and regulatory compliance. The company provides a diverse range of trading instruments, including wealth products, global stocks, securities, futures and options, and more. Multiple account types and trading platforms are available for investors' convenience.

Is KGI Asia Legit?

Yes, KGI Asia is regulated by the Securities and Futures Commission (SFC) of Hong Kong, with its license number ADW991.

Pros and Cons

| Pros | Cons |

| Diverse range of trading instruments | No CFD and forex trading |

| Regulated by SFC | Lack of specific information on spreads |

| Multiple account types | Lack of transparency on account minimums and leverage |

| Multiple trading platforms |

Trading Instruments

| Product | KGI Asia | IG Group | Just2Trade | Forex.com |

| CFDs | No | No | No | Yes |

| Forex | No | Yes | No | Yes |

| Indices | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Cryptocurrencies | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Shares | Yes | Yes | No | No |

| Options | Yes | Yes | Yes | Yes |

| Spread Betting | No | Yes | No | No |

| Stocks | Yes | No | Yes | Yes |

| ADRs | No | No | Yes | No |

| Bonds | Yes | No | Yes | No |

Account Types

KGI Asia offers different types of accounts, including securities trading accounts and futures and options trading accounts. The procedures for opening these accounts involve submitting required documents and completing application forms. Existing clients can apply for futures and options accounts through a streamlined process.

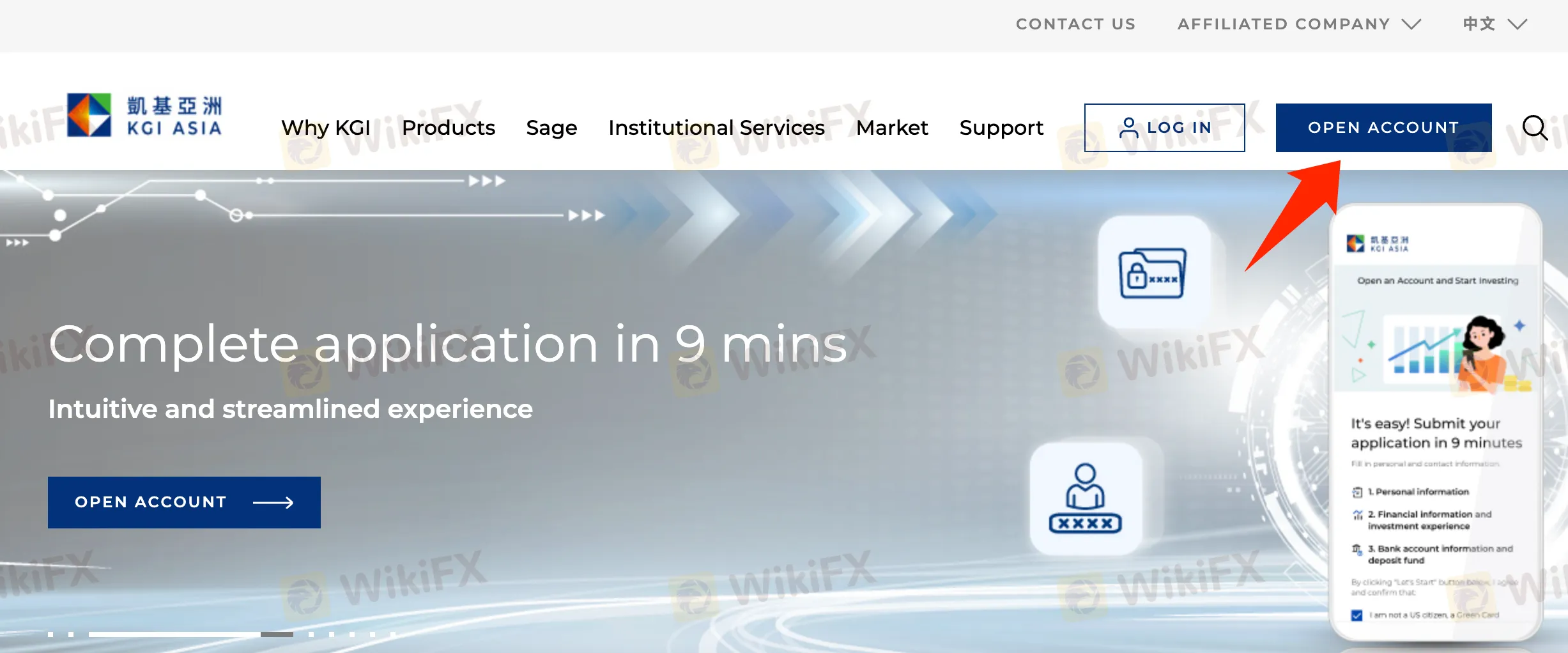

How to Open an Account?

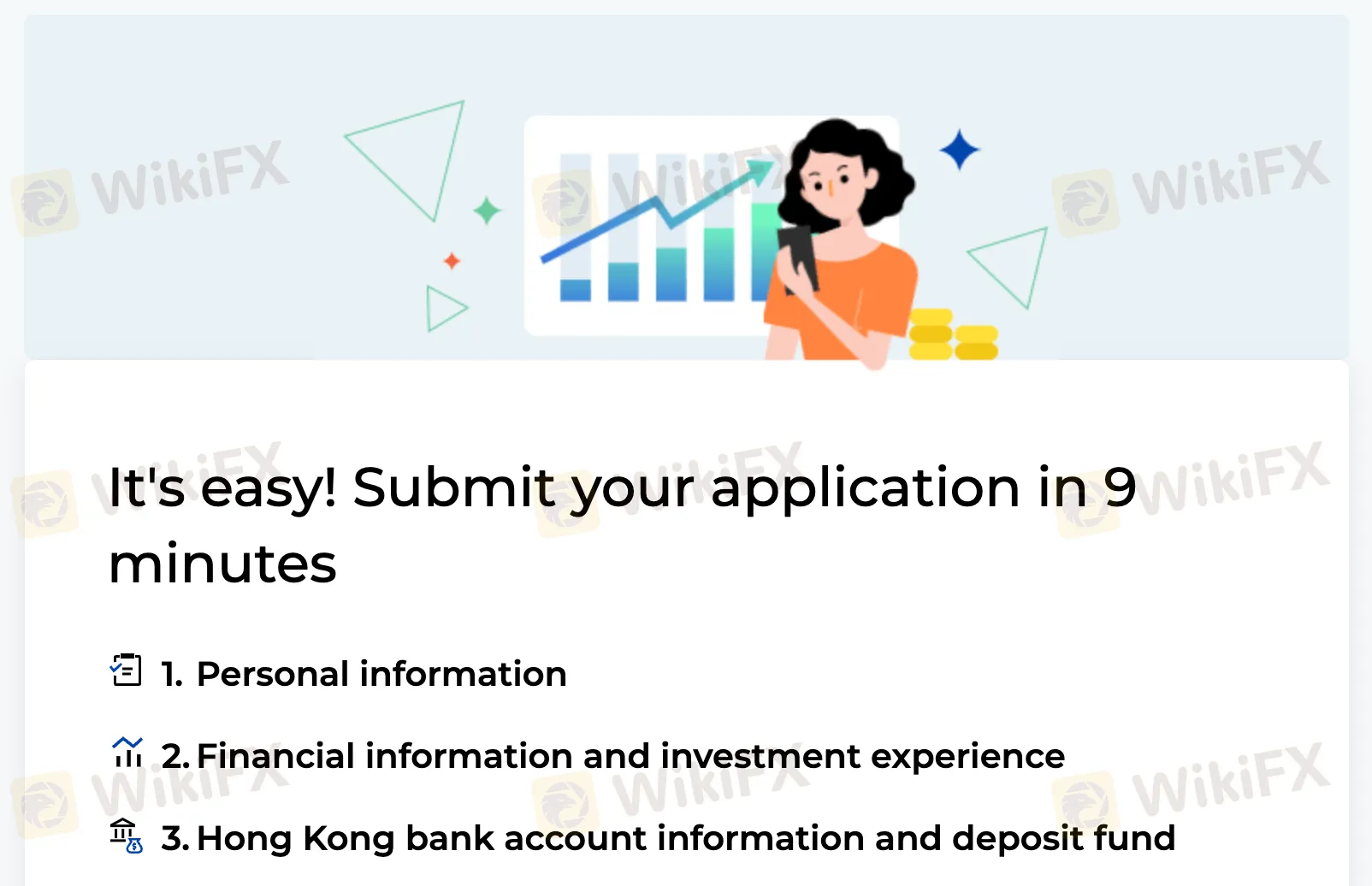

To open an account with KGI Asia and start investing, follow these steps:

Get start: Visit the KGI Asia website. Look for the “OPEN ACCOUNT” button on the homepage and click on it.

Personal Information: Provide your personal information, including your full name, contact details, and identification document. This can be your Hong Kong ID card, national ID, or passport.

Financial Information and Investment Experience: Share your financial information, such as your income, employment status, and investment experience. This helps KGI Asia understand your financial background and investment preferences.

Hong Kong Bank Account Information and Deposit Fund: Provide details of your Hong Kong bank account, including the account number and bank name. You will also need to deposit funds into this account to initiate your investment activities.

Please ensure you have the following original documents ready:

Identification Document: Prepare a copy of your Hong Kong ID card, national ID, or passport.

Residential Address Proof: Provide a recent utility bill or bank statement issued within the last 3 months to verify your residential address.

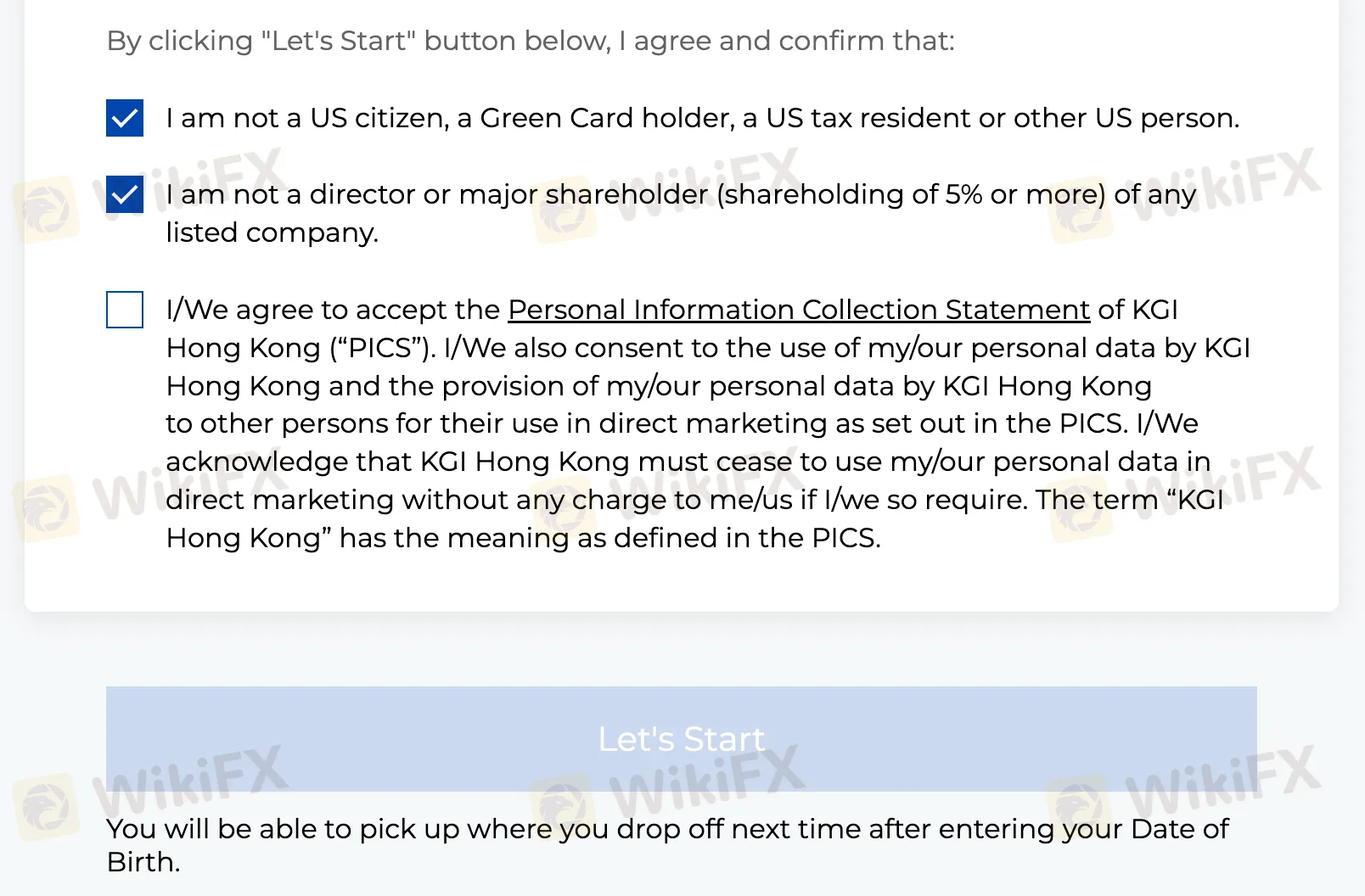

Before proceeding, carefully review and agree to the terms and conditions set by KGI Asia. This may include confirming that you are not a US citizen, a Green Card holder, a US tax resident, or any other US person. You will also need to confirm that you are not a director or major shareholder (holding 5% or more) of any listed company.

By clicking the “Let's Start” button, you acknowledge and agree to the Personal Information Collection Statement (PICS) of KGI Hong Kong. The PICS outlines how your personal data will be collected, used, and shared, including for direct marketing purposes. You have the option to opt-out of direct marketing at any time without any charge.

Once you have entered your Date of Birth, you can save your progress and resume the application at a later time. This feature allows for convenience and flexibility during the account opening process with KGI Asia.

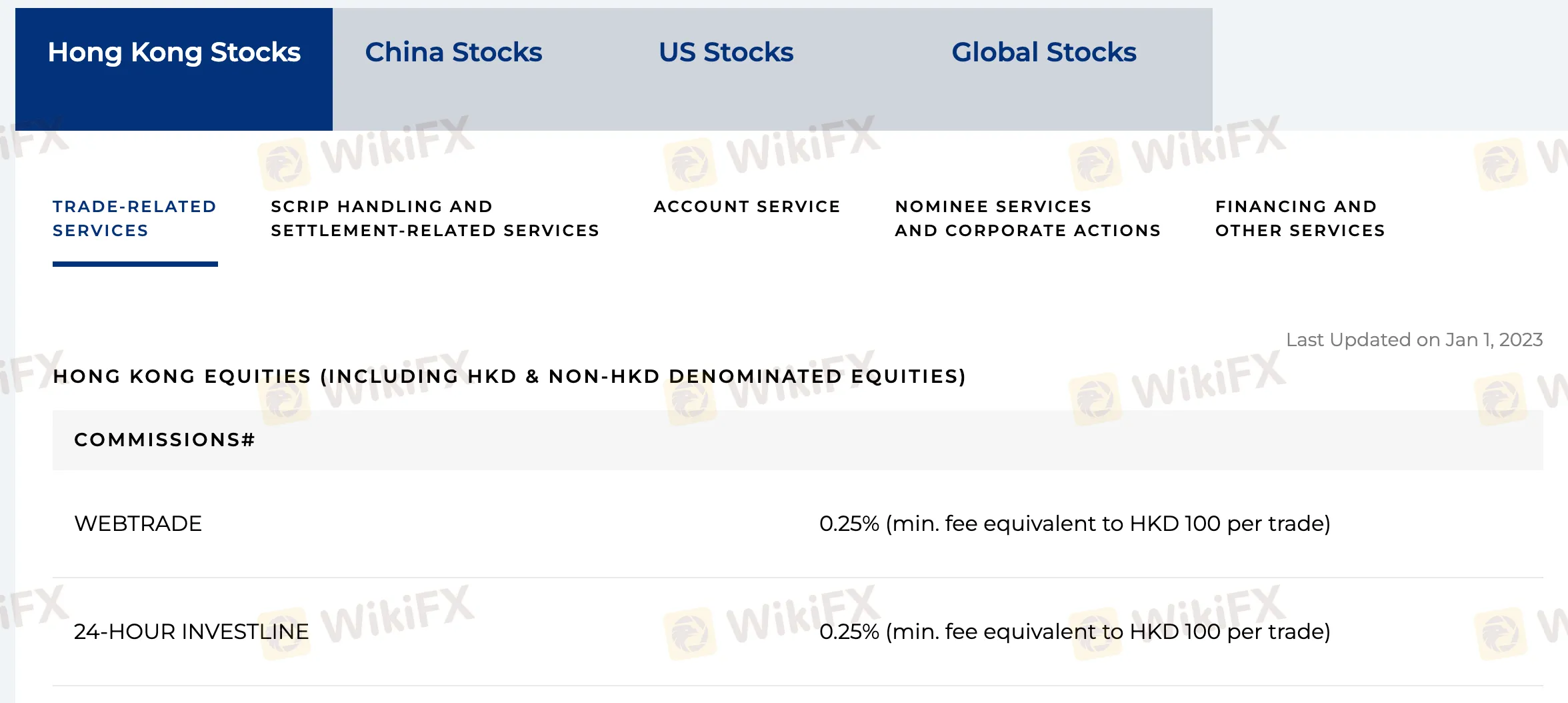

Commissions and Fees

Commissions and fees at KGI Asia are applicable to various services and products offered. Here is a summary of the commissions and fees structure:

Stock Trading Services: The commission rate for web-based trading, 24-Hour InvestLine, NASDAQ Hong Kong, iShares, and grey market trades is 0.25% with a minimum fee equivalent to HKD 100 per trade. Short sell and buyback transactions have a commission rate of 0.5% with a minimum fee equivalent to HKD 200 per trade.

Exchange Fees and Levies: Additional fees and levies include stamp duty of 0.13% on gross consideration, SFC transaction levy of 0.0027% on gross consideration, Financial Reporting Council transaction levy of 0.00015% on gross consideration, HK trading fee of 0.00565% on gross consideration, and settlement fees of 0.005% on gross consideration (minimum fee equivalent to HKD 3; maximum fee equivalent to HKD 300).

Financial Transaction Tax: A financial transaction tax of 0.2% applies to the transaction amount for buyers, including those listed in Hong Kong with headquarters in France.

IPO Subscription Fees and Charges: IPO subscription fees include a subscription fee of HKD 100 for HKD-denominated equities and RMB 100 for RMB-denominated equities. A brokerage fee of 1.00% is also applicable, along with SFC transaction levy, HK trading fee, and Financial Reporting Council transaction levy.

Deposit & Withdraw Methods

KGI Asia provides several options for depositing and withdrawing funds from your trading account.

Deposit Options:

Securities & Stock Options Fund Deposit: KGI Asia allows you to deposit funds for securities and stock options trading through various methods, including cheque deposit, internet banking, ATM, phone banking, and Standard Chartered Hong Kong branch. The cut-off time for fund deposits is subject to each bank, and if the deposit is made before the cut-off time, the funds will be credited to your account by the next working day.

HSBC Bill Payment Service: This service enables you to transfer funds online from HSBC or Hang Seng Bank accounts to your KGI Asia trading account. To use this service, you need to register your KGI Asia account number and select “KGI Asia Limited” from the payee list under the bill payment category. The deposited funds will be credited to your account on the next working day.

PPS Services: If you have a PPS account, you can deposit HKD into your KGI Asia trading account using PPS on the internet or by phone. The funds will be available for use on the next business day.

Bank Accounts: You can deposit funds into KGI Asia Limited by bank transfer or cheque deposit through several banks, including HSBC, Bank of China (Hong Kong), Hang Seng Bank, and Standard Chartered Bank (Hong Kong). Each bank has its own account name and account number for different currencies.

Withdrawal Options:

HKD Withdrawal: To withdraw Hong Kong Dollar (HKD) funds, you need to complete and submit the online Fund Withdrawal form before the cut-off time, which is 13:40 (HKT) for KGI Asia. You can choose to withdraw funds via Electronic Funds Transfer (EFT) or by cheque, depending on the receiving bank. Cheque withdrawals are available for Bank of China (Hong Kong), Hang Seng Bank, HSBC, and Standard Chartered Bank (Hong Kong).

Processing Time and Fees:

The processing time for fund deposits depends on the method used and the cut-off time of the respective banks. Generally, if the deposit is made before the cut-off time, the funds will be credited to your account by the next working day. The cut-off time for each bank and payment method should be confirmed with the bank directly.

Trading Platforms

KGI Asia offers a range of trading platforms designed to cater to different investment needs and preferences. Here's an overview of the trading platforms available:

1. Mobile Trading Platforms:

- KGI Asia Power Trader: A mobile trading platform that allows users to get quotes and trade Hong Kong, US, Shanghai, and Shenzhen stocks anytime and anywhere. It offers convenience and flexibility for investors who prefer trading on their mobile devices.

- KGI Key: A token used for 2-factor authentication, generating offline passwords for KGI Asia's mobile applications. It enhances security and ensures safe access to the mobile trading platforms.

2. Online Trading Platforms:

- WebTrade: KGI Asia's online trading system accessible through a web browser. It provides trading services for various assets, including HK Stocks, US Stocks, Taiwan Stocks, China A shares, and Mutual Funds. Investors can conveniently access market information and execute trades using this platform.

3. Trading Platforms (Desktop Versions):

- WebTrade - Professional Version: An online platform designed specifically for trading Hong Kong stocks. It offers streaming quotes and advanced trading features, allowing users to monitor real-time market movements and execute trades efficiently.

- eFO SP / SO Online: This platform caters to futures and options trading, including index options and global futures. It provides a comprehensive set of tools for analyzing market trends and executing trades effectively.

These trading platforms cater to different needs and preferences, providing a range of functionalities and features for investors to trade on their preferred devices, whether it's mobile, online, or desktop.

Customer Service

KGI Asia offers customer service support through various contact channels. Clients can submit their inquiries or suggestions through an online form on the website, providing their contact details, preferred contact time, and the services they are interested in. They can also find answers to common questions in the FAQ section.

For more direct assistance, clients can reach out to KGI Asia's Hong Kong Head Office via telephone, fax, or email. The 24-hour InvestLine is available for general inquiries, while separate hotlines are provided for after-hours futures trading on the Hong Kong Stock Exchange and for general inquiries and complaints. Customer service operates from Monday to Friday, 09:00 - 18:00 HKT, excluding public holidays.

Contact Information:

Hong Kong Head Office:

- Address: 41/F Central Plaza, 18 Harbour Road, Wanchai, Hong Kong

- Tel: 24-hour InvestLine: (852) 2878-5555

- HKEx After-Hours Futures Trading Hotline: (852) 2878-5500

- General Enquiries / Complaint: (852) 2878-6888

- Fax: (852) 2878-6800

- Email: info@kgi.com

KGI Asia strives to provide prompt and helpful customer service, offering various avenues for clients to reach out and receive assistance with their financial needs.

Trading Tools

KGI Asia offers a variety of trading tools to assist its clients in their trading activities. These tools include Comprehensive News and Exclusive Reports, which provide the latest information on IPOs, enabling traders to stay updated on recent and upcoming offerings.

Market Insight is another tool that delivers current market updates, helping traders make decisions in line with market trends. KGI Asia Commentary provides in-depth analysis of the Hong Kong stock market, supporting traders in making informed choices by offering valuable insights.

The Latest Research Reports provide comprehensive analysis on markets, sectors, and individual stocks, allowing traders to identify investment opportunities based on well-researched information.

Warrant and CBBC Commentary offers commentary and insights specifically focused on Warrants and CBBCs, along with detailed market analysis and news. This tool aids traders in understanding these financial instruments and making informed trading decisions.

Promotion

KGI Asia is currently offering a promotion that includes a HK$950 Welcome Reward for eligible participants. This Welcome Reward serves as an incentive for new clients to join KGI Asia and take advantage of its services.

In addition, KGI Asia is also providing a special promotion of $0 platform fee for trading US fractional shares. This promotion allows clients to trade fractional shares of US stocks without incurring any platform fees, making it more accessible and cost-effective for investors interested in diversifying their portfolios with US stocks.

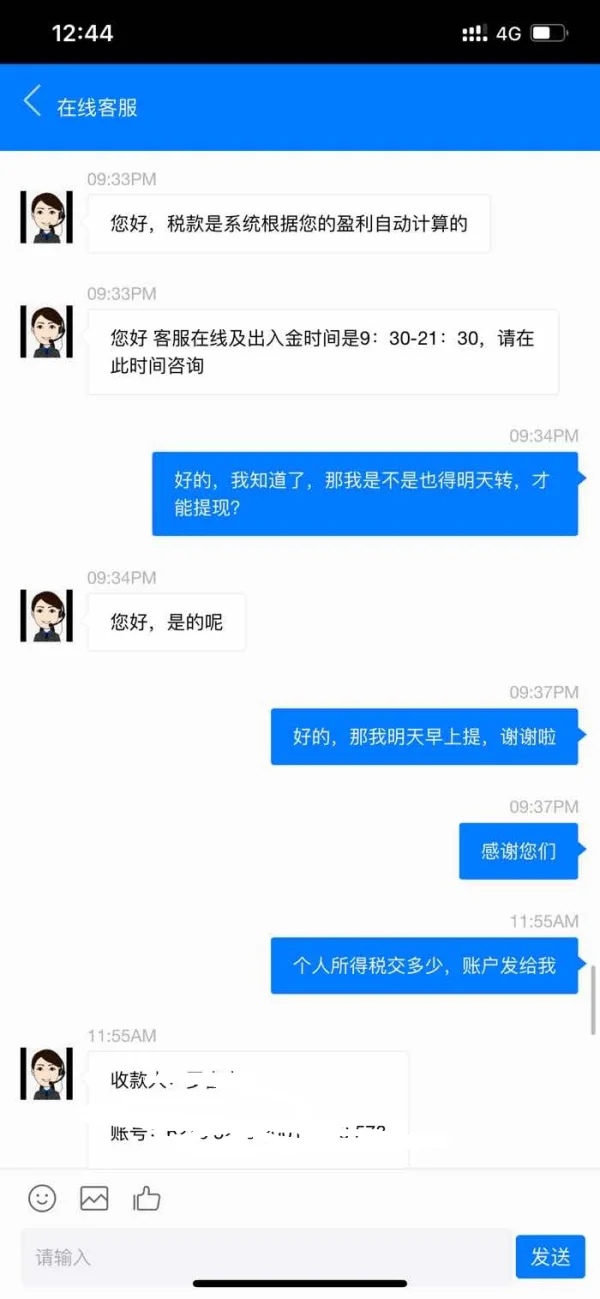

一搏跆拳道馆

Hong Kong

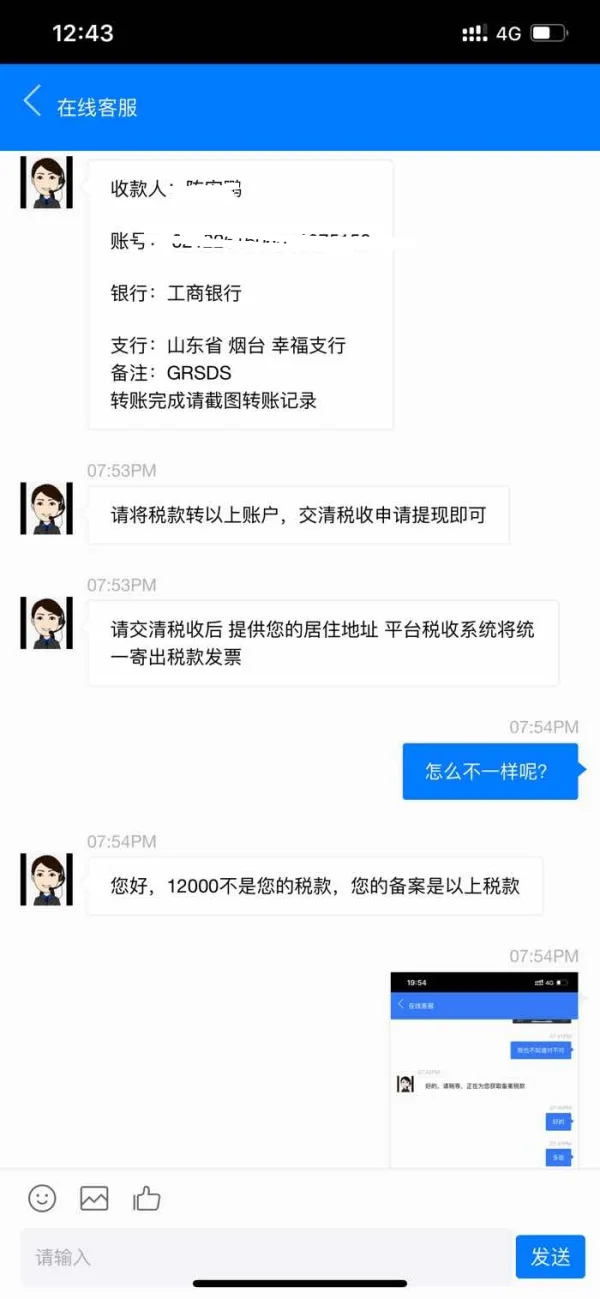

Deposited ¥250,000. My account balance plus the profit is over ¥1,600,000. Have to pay personal income tax before withdrawing funds.

Exposure

FX3052352045

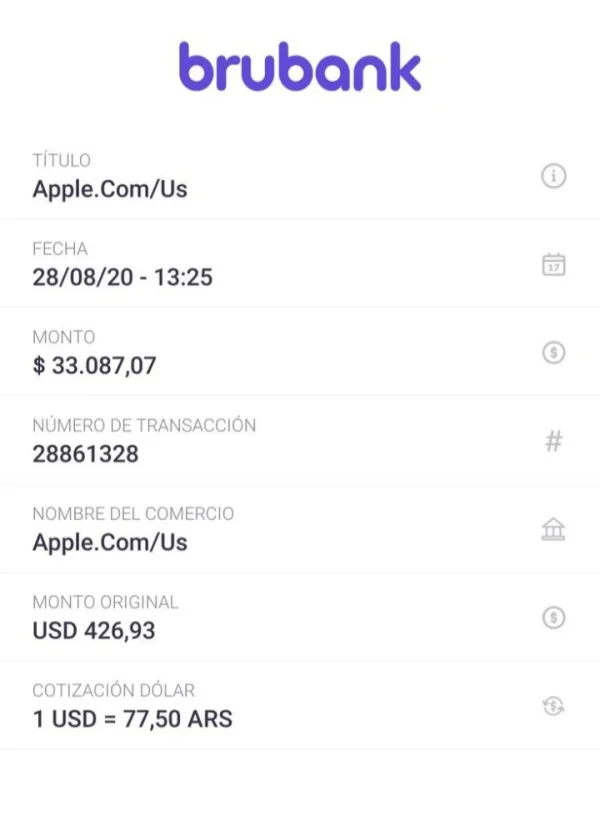

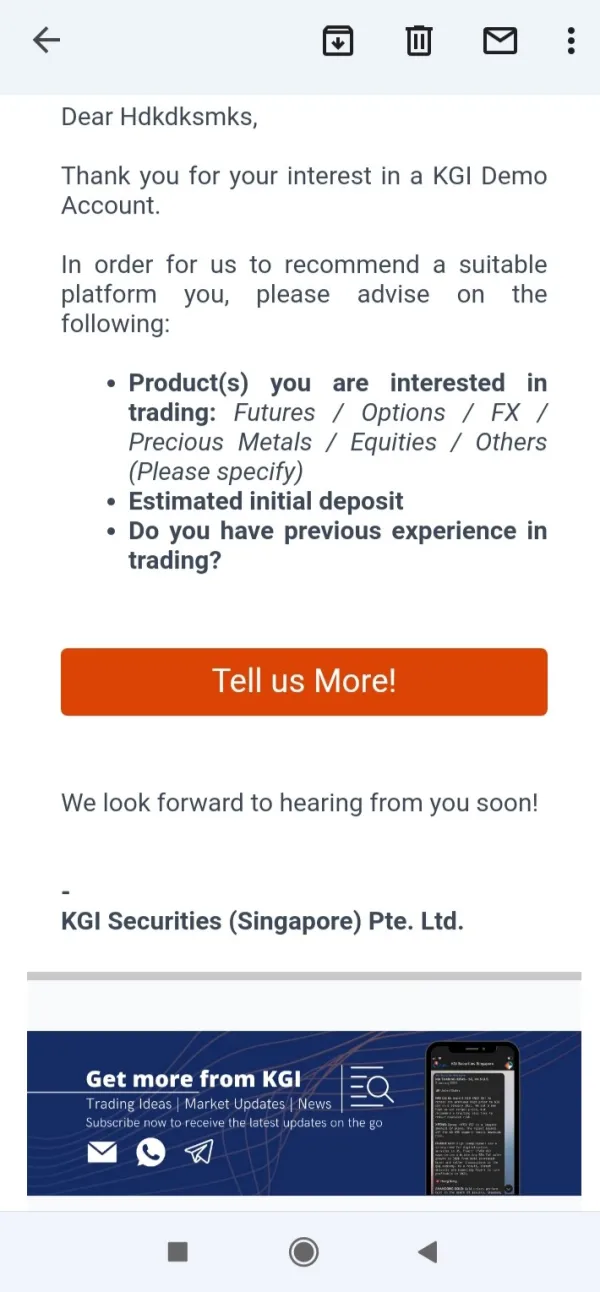

Argentina

I deposited $426 and gained more than $3000. They rejected my withdrawal as the pictures showed.

Exposure

FX1398449580

United States

KGI Asia offers a wide range of financial products and services, including wealth management, stocks, bonds, insurance, mutual funds, etc., aiming to provide investors with a comprehensive range of investment options. The website also provides real-time market data and analytical tools to help investors make informed investment decisions. In addition, KGI Hong Kong's trading platform is easy to use, simple to operate, fast execution, and customer service is very professional and efficient.

Positive

用笑宣泄悲伤

Australia

KGI Asia is a complete scam company. They use various means to attract you to deposit. After you deposit, their purpose is achieved, and their attitude towards you suddenly changes!

Neutral