Company Summary

| Mayfair (MFG) Review Summary | |

| Founded | 15-20 years |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Products & Services | Securities and futures brokerage, investment, financial advisory, and lifestyle management |

| Trading Platforms | EX Trader, SPTrader, Auton, SPTrader, OATS.NET |

| Minimum Deposit | N/A |

| Customer Support | Phone, fax |

What is Mayfair?

With a strong focus on exemplary and customized wealth and asset management solutions, Mayfair caters to individuals, institutions, and corporations.

Through its comprehensive range of services, Mayfair assists clients in achieving their unique financial goals and aspirations. By entrusting their portfolios to the careful management of Mayfair directors, clients can focus on their own pursuits without the constant need to monitor and manage their financial matters. As a regulated entity, Mayfair is governed by SFC.

If you are interested, we encourage you to proceed with reading the forthcoming article, which will comprehensively evaluate the broker from multiple perspectives and present you with concise and well-structured information. The article will conclude by offering a brief summary that will give you a complete overview of the broker's main attributes.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

- Regulated by SFC: Mayfair is regulated by the Securities and Futures Commission (SFC) which adds legitimacy to their operations and offers a degree of security to traders.

- Multiple trading platforms and mobile apps: Mayfair offers a variety of different trading platforms and mobile apps, giving traders a range of options to choose from based on their preferences and requirements.

- A range of services and products: Mayfair provides a comprehensive range of services and products, including forex trading, options trading, and more, catering to the needs of a diverse range of traders.

Cons:

- Complex fees items: Customers may find Mayfair's fee structure complex and difficult to understand, which can be off-putting for those who are not familiar with the pricing models used by brokerage firms.

- No social media presence: Mayfair has no significant presence on social media, which can be a disadvantage considering the importance of social media in the modern era of marketing and customer outreach.

Is Mayfair Safe or Scam?

Mayfair is subject to regulation by the Securities and Futures Commission (SFC) with License No. AMV148. The SFC is an independent regulatory body established in 1989 to oversee the securities and futures markets in Hong Kong.

It is essential for traders to understand that all investments carry a certain degree of risk. It is advisable for individuals to conduct their own research and carefully evaluate their options before making any investment decisions.

Products & Services

Mayfair offers a range of products and services in the fields of securities and futures brokerage, investment, financial advisory, and lifestyle management. Here are five of their main offerings:

- Securities and futures brokerage services:

Mayfair provides brokerage services for securities and futures trading. They have a platform that allows clients to trade a variety of financial instruments, including stocks, bonds, options, and futures contracts.

- Investment products:

Mayfair offers various investment products to cater to different client needs. These products may include mutual funds, exchange-traded funds (ETFs), fixed income instruments, and alternative investments like private equity and hedge funds. They may also offer tailored investment solutions based on clients' risk tolerance and investment goals.

- Financial advisory services:

Mayfair provides financial advisory services to help clients manage and grow their wealth. Their team of financial advisors can offer personalized advice on investment strategies, asset allocation, retirement planning, and tax planning.

- Lifestyle management:

In addition to financial services, Mayfair offers lifestyle management services, which can include assistance with concierge services, travel planning, event organization, personal shopping, and luxury asset management. These services aim to enhance clients' lifestyles and provide comprehensive support beyond traditional financial offerings.

- Other related services:

Mayfair may also provide additional services such as research and analysis reports, market insights, educational resources, and access to exclusive investment opportunities. They may have dedicated client support channels to address inquiries and provide ongoing assistance.

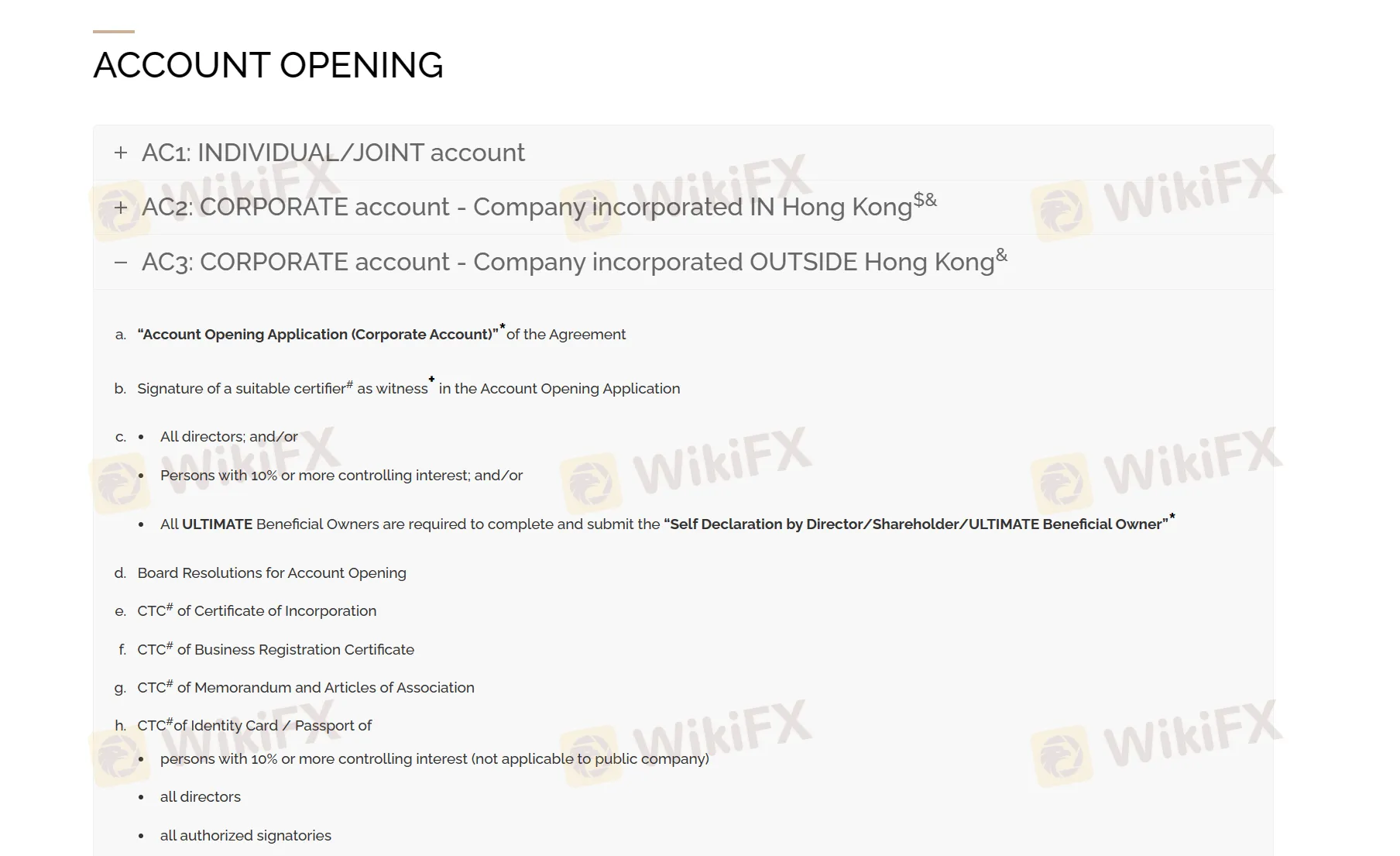

Accounts

Mayfair offers three types of accounts, Individual, Joint, and Corporate.

Individual Account:

This account is ideal for a single person who wants to invest in different financial instruments such as shares, bonds, and mutual funds.

Joint Account:

This account is suitable for two or more people who want to invest together in different financial instruments. To open a joint account with Mayfair, you'll need to provide some personal information for each person on the account, their social security number, and contact details.

Corporate Account:

This account is intended for businesses or organizations that want to invest in different financial instruments.

Mayfair offers accounts for investing in a range of financial instruments, and the process of opening an account are provided on the website. Traders can visit the website and look through the details:

https://www.mafgl.com/brokerage/account-opening/#1515113894475-76e10ee1-f963

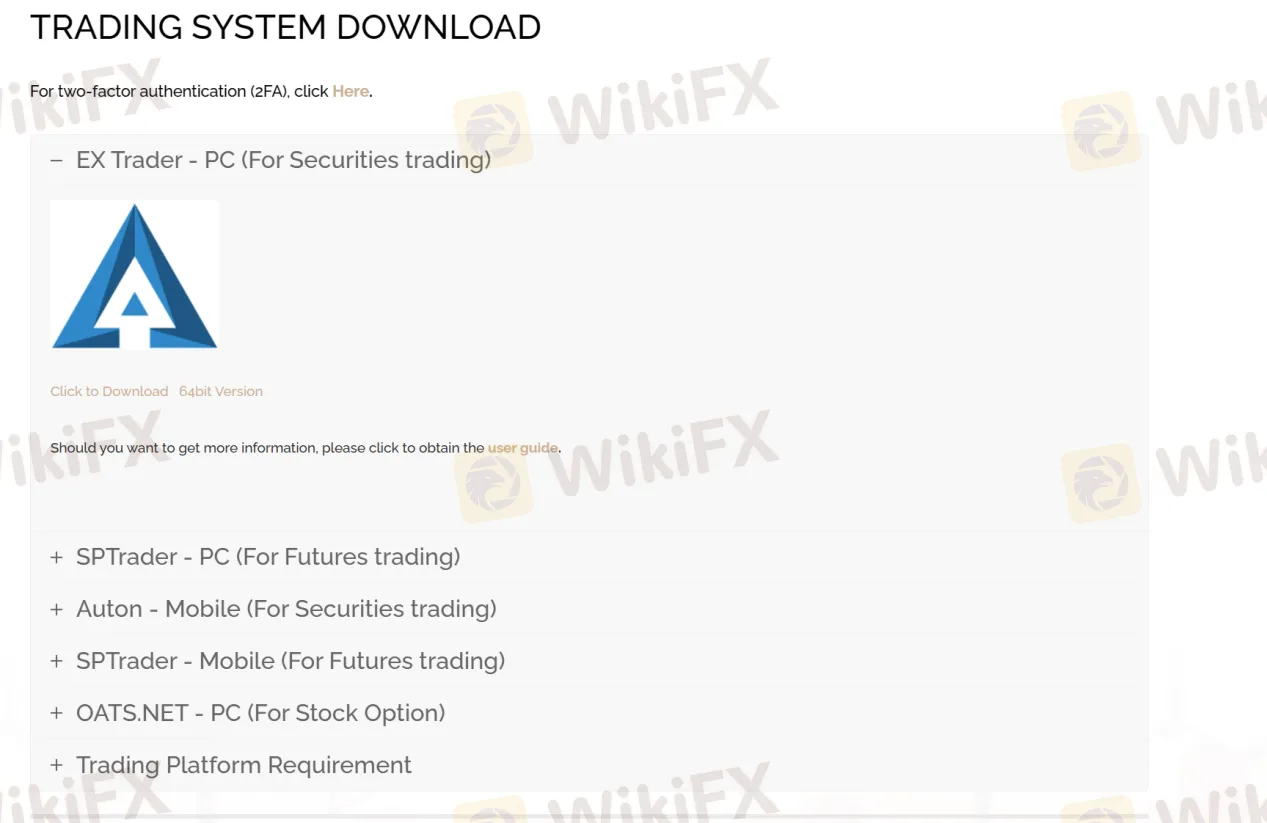

Trading Platforms

Mayfair offers a range of trading platforms for its clients to execute trades across various products such as securities, futures, and stock options. These platforms are designed to offer traders an efficient and user-friendly experience.

EX Trader

EX Trader, available for PC, is primarily used for securities trading. It is a downloadable application that offers advanced features such as real-time market data, customizable charts, and analytical tools to aid in trade decision-making. The platform also offers access to a range of research reports and news updates to keep traders informed of the latest developments in the markets.

SPTrader

SPTrader is another trading platform available for PC and mobile devices that is tailored specifically for futures trading. This platform offers traders a wide range of futures products, including indexes, commodities, and currency futures, among others. It provides real-time prices, customizable charts, and a suite of technical analysis tools to help traders make informed trading decisions.

Auton

Auton is a mobile application designed for securities trading on the go. It is compatible with both iOS and Android devices and provides access to real-time market data, charts, and news updates. Traders can execute trades, place orders, and manage their portfolio from their phone, making it an ideal platform for those who are frequently on the move.

The SPTrader mobile app

The SPTrader mobile app is another platform designed for futures trading. It offers traders access to real-time prices, customizable charts, and analytical tools to assist with trade execution. The mobile trading app is available for both iOS and Android devices.

The OATS.NET platform

Lastly, the OATS.NET platform is designed specifically for stock option trading. It is a downloadable application that provides real-time market data and analytical tools to assist traders with trade execution. The platform also features a suite of risk management tools to help traders manage their portfolios effectively.

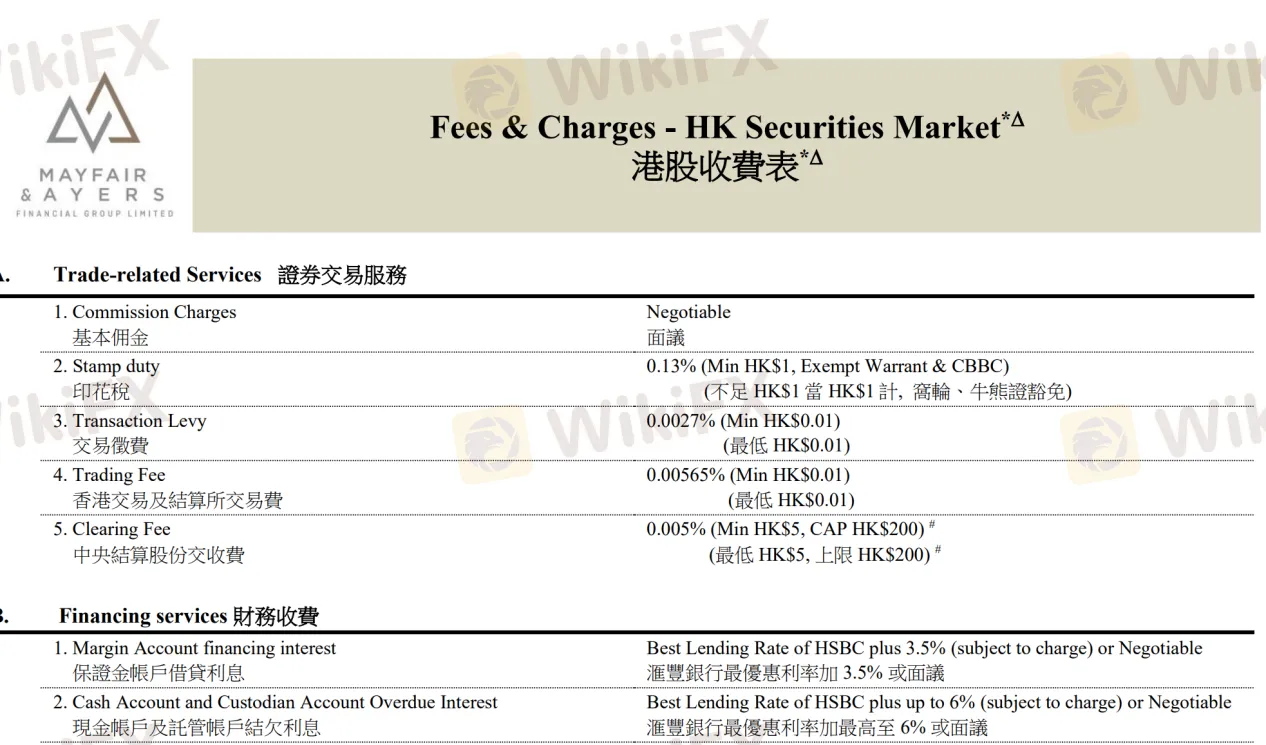

Fees

Mayfair charges different items including trade-related services, financing services, account maintenance, scrip handling and settlement- related services and so on. Each item contains different commissions, interest, fees and so on. It is advisable for traders to visit the Mayfair website to review the specific details of each service.

The code as follows:

https://www.mafgl.com/wp-content/uploads/2023/01/Fee-Charges-20230101.pdf

Deposits & Withdrawals

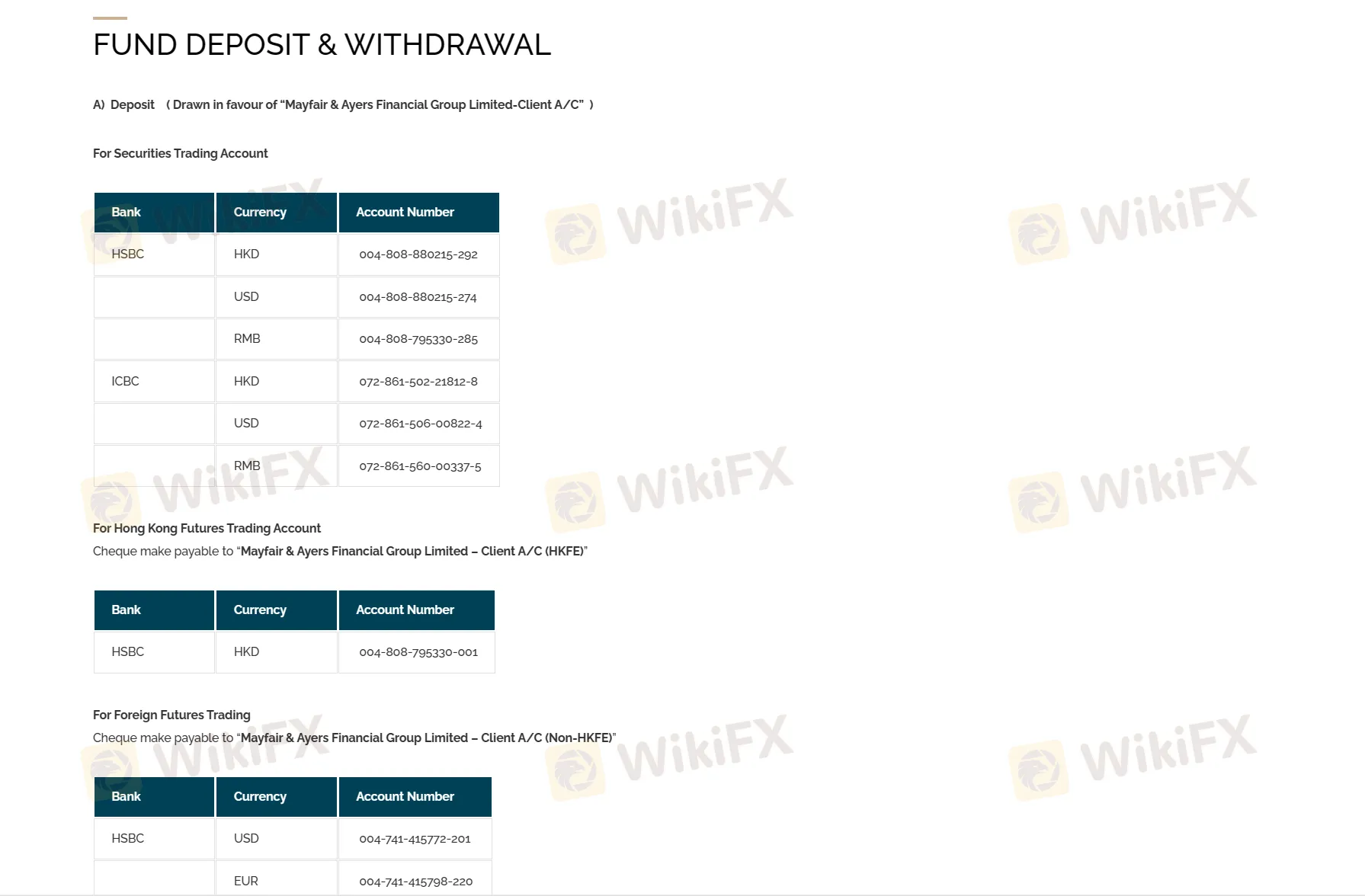

For Deposit:

Mayfair offers convenient deposit methods for their clients' various trading accounts. Clients can make deposits by direct credit into any of the accounts maintained with the designated banks. When making a deposit, clients should indicate their trading account number and account name on the deposit slip.

For Withdrawal:

Mayfair provides a withdrawal service for clients who wish to withdraw funds from their securities or futures accounts. To initiate a withdrawal, clients must send a completed withdrawal form to Mayfair's Customer Services Unit at (852) 3192 1121 before the stated deadlines: 12:00 noon for securities account and 10:30 am for futures account, Hong Kong time, on a business day.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +852 3192 1100

Fax: +852 2810 9892

Address: 25/F, Henley Building, 5 Queens Road Central, Hong Kong

Furthermore, Mayfair offers a dedicated section on their website called “Frequently Asked Questions” or FAQ, which is specifically designed to aid their clients by providing answers to commonly asked questions and offering relevant information. The purpose of the FAQ section is to address the typical queries and concerns that investors might have regarding Mayfair's services, procedures, and available investment opportunities. By providing this resource, Mayfair aims to ensure transparency and provide clear and comprehensive information to their clients, thereby empowering them to make informed decisions.

Conclusion

In conclusion, Mayfair is an esteemed financial institution known for its well-connected and dedicated teams of professionals. They offer a comprehensive range of customized wealth and asset management solutions to individuals, institutions, and corporations. It is governed by SFC in Hong Kong.

Overall, Mayfair & Ayers combines its trusted reputation, experienced professionals, and comprehensive suite of financial services with strict regulatory compliance to deliver exceptional wealth and asset management solutions to its clients.

Frequently Asked Questions (FAQs)

| Q 1: | Is Mayfair regulated? |

| A 1: | Yes. It is regulated by SFC. |

| Q 2: | How can I contact the customer support team at Mayfair? |

| A 2: | You can contact via telephone: +852 3192 1100 and Fax: +852 2810 9892. |

| Q 3: | Q: What trading platforms are offered by Mayfair? |

| A 3: | It provides EX Trader, SPTrader, Auton, SPTrader, and OATS.NET. |

Risk Warning

Online trading carries substantial risk, and it's possible to lose all of your invested capital. It can not be appropriate for all traders or investors, so it's crucial to fully comprehend the risks involved. Additionally, the information presented in this review can change as the company updates its policies and services, and the date when this review was created is also important to consider. As a result, it's recommended that readers always check the latest information directly with the company before making any decisions. The reader is responsible for using the information provided in this review.