Company Summary

| Morrison Review Summary | |

| Founded | 2002 |

| Registered Country/Region | Australia |

| Regulation | Regulated by ASIC |

| Market Instruments | Cash equities, equity options, warrants, ETFs, XTBs, LICs, LITs, and Tracers |

| Demo Account | ❌ |

| Trading Platform | Iress, TradeCentre, TradeFloor, Refintiv, Bloomberg Terminal |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Phone: 1300 130 545 | |

| Email: contactus@morrisonsecurities.com | |

| Address: Suite 38.01, Level 38, Australia Square Towers, 264 George Street, Sydney, NSW 2000 | |

Morrison Securities Pty Limited is a multifaceted financial services provider. Operating with a license from Australian regulatory bodies since 2002, it offers many trading platforms that offer various trading interfaces, including both proprietary and third-party solutions.

Here is the home page of this brokers official site:

Pros and Cons

| Pros | Cons |

| Regulated by ASIC | Unclear fee structure |

| Multiple trading platforms | |

| Various ways to contact them | |

| Financial services provided |

Is Morrison Legit?

Morrison is regulated by the Australian Securities and Investments Commission (ASIC), with Straight Through Processing (STP), No. 241737.

| Regulatory Status | Regulated |

| Regulated by | Australia |

| Licensed Institution | Morrison Securities Pty Limited |

| Licensed Type | Straight Through Processing (STP) |

| Licensed Number | 241737 |

What Can I Trade on Morrison?

Morrison connects to major exchanges in Australia for seamless execution. They are a member of the ASX, Cboe Australia, NSX, and SSE Exchanges. They offer cash equities, equity options (both single stock and index at Level 1 and Level 2), warrants, ETFs (Exchange Traded Funds), XTBs (Exchange Traded Bonds), LICs (Listed Investment Companies), LITs (Listed Investment Trusts), and Tracers (Cboe Australia US stocks - Transferable Custody Receipts).

| Trading Instruments | Supported |

| Cash equities | ✔ |

| Equity options | ✔ |

| Warrants | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| Investment trusts | ✔ |

| Stocks | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

Financial Services

Morrison also offers financial services including financial advisers, wealth managers, active traders, fund managers, and fintech platforms,which provides APIs for integration and development of customized fintech applications.

Account

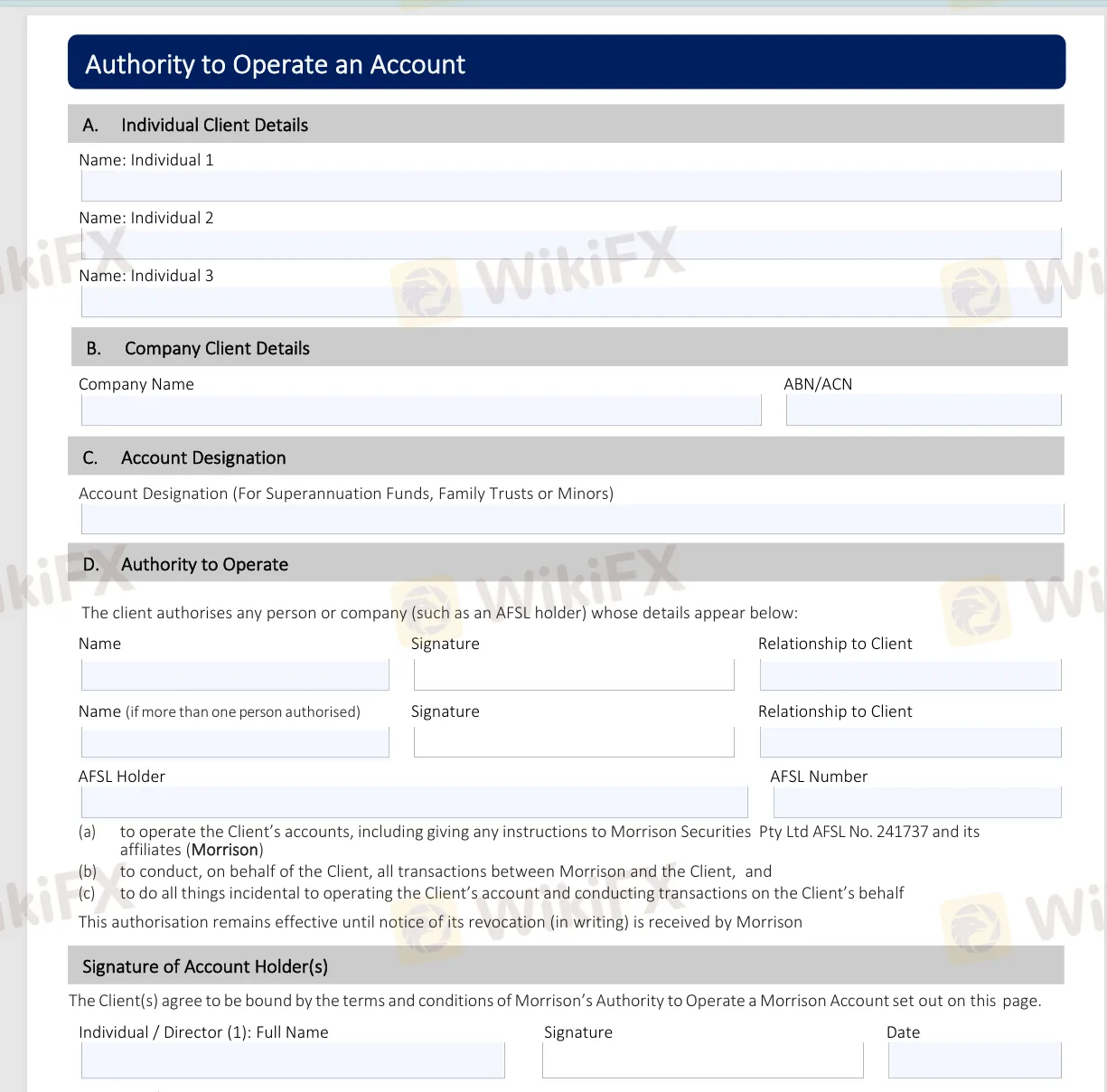

To open an account with Morrison, complete the necessary account maintenance forms available on their website. These forms include the Account Name Amendment Form, Authority to Operate an Account, Change of Contact Details, Income Direction, Direct Debit Request, and the 100 Point ID List. Once filling in these forms, send them to accounts@morrisonsecurities.com.

Trading Platform

Morrison offers various trading platforms including software for order placement, creating watchlists, viewing client portfolios, and advanced charting packages. They support:

| Trading Platform | Supported Components |

| Iress | Viewpoint, Web, Pro versions |

| TradeCentre | Bourse Analyser, TC Web, TC Wealth |

| TradeFloor | Options trading and risk management |

| Refintiv | Eikon platform |

| Bloomberg Terminal | EMSX |

Moreover, if you have your own preferred platform, They offer compatibility through FIX, Webservices, and APIs.