Company Summary

| OSL Review Summary | |

| Founded | 2013 |

| Registered Country/Region | Pakistan |

| Regulation | No regulation |

| Market Instrument | Equity |

| Demo Account | ❌ |

| Trading Platform | OSL |

| Customer Support | Contact form |

| WhatsApp: +92 300 8204 910 | |

| Phone: 922132446744 & 922132446747 | |

| Email: info@osl.com.pk | |

| Address: Regd. Office # 731–732, 7th floor, Stock Exchange Building, Stock Exchange Road, Off I. I. Chundrigar Road, Karachi. | |

OSL Information

OSL is an unregulated firm founded in 2013 in Pakistan. It offers products and services on Equity Brokerage, Online Trading, Back Office, SMS Service, and Email Service. Besides, it uses its own trading platform and does not support MT4 or MT5.

Pros and Cons

| Pros | Cons |

| Various products & services | No regulation |

| Various contact channels | No demo accounts |

| Limited types of payment options |

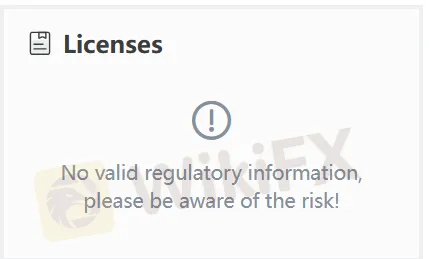

Is OSL Legit?

No. OSL has no regulations currently. Please be aware of the risk!

What Can I Trade on OSL?

| Tradable Instruments | Supported |

| Equity | ✔ |

| Forex | ❌ |

| Commodity | ❌ |

| Indice | ❌ |

| Stock | ❌ |

| Cryptocurrency | ❌ |

| Bond | ❌ |

| Option | ❌ |

| ETF | ❌ |

Trading Platform

OSL offers a trading platform which are available on desktop, mobile, and tablet devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| OSL | ✔ | Desktop, mobile, tablet | / |

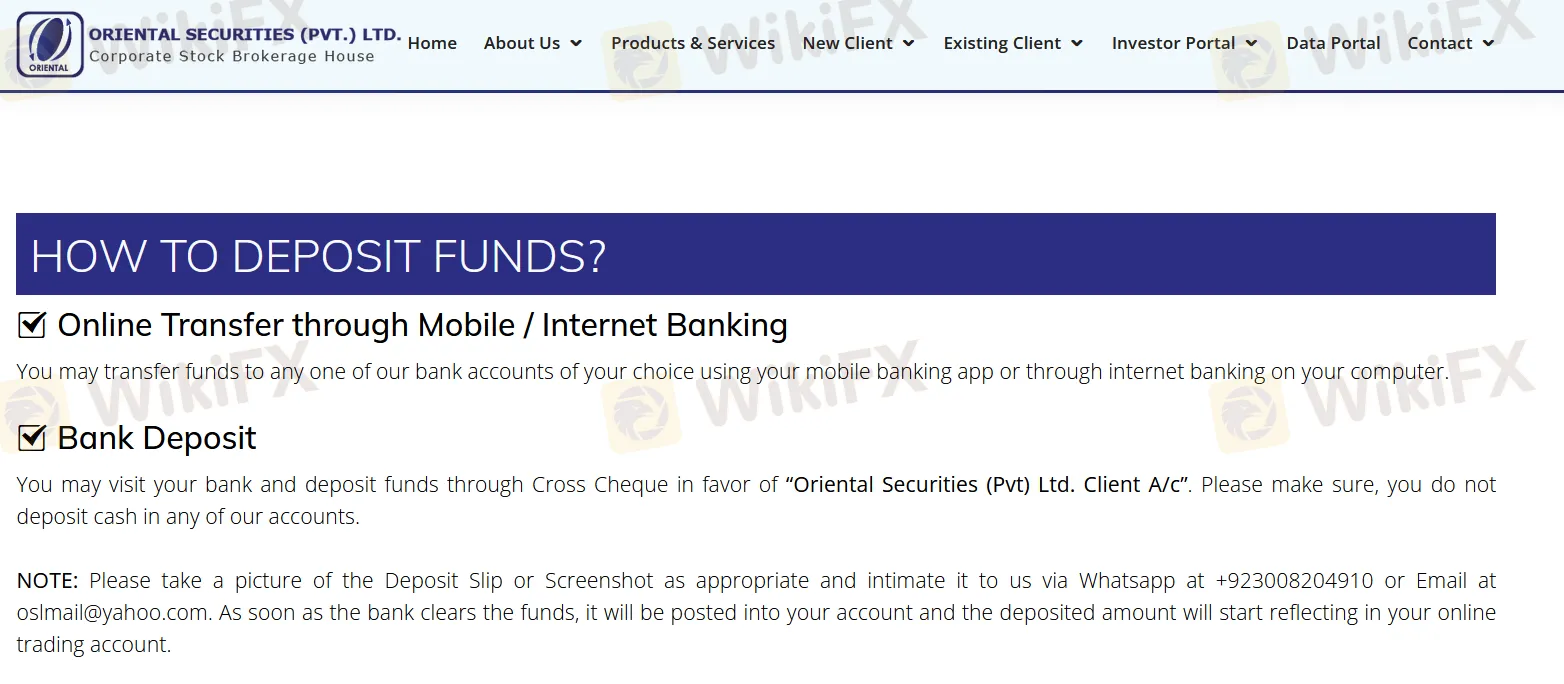

Deposit and Withdrawal

OSL offers two options for funding:

Option 1: Online Transfer via Mobile / Internet Banking

- Transfer to any OSL bank account using mobile or internet banking.

Option 2: Bank Deposit

- Deposit via Cross Cheque payable to:

- “Oriental Securities (Pvt.) Ltd. Client A/c”

- Do not deposit cash into any OSL account.