Company Summary

Company Summary

Company Profile

General Information & Regulation of SBI Securities

SBI Securities was founded in 1988, changed its name to E-Trade Securities Co. in 1999, and launched its Internet service in July of the same year. In 2000, SBI Securities was granted full membership of the Osaka Securities Exchange, and in 2001, its assets increased to 11,501 million yen. In 2003, SBI Securities was granted the integrated trading status of the Nagoya Stock Exchange and became a specific general member of the Tomioka Stock Exchange. In 2006, SBI Securities, as a professional online securities company, exceeded the total number of securities accounts of one million for the first time and changed its name from E-Trade Securities Ltd. to SBI E-Trad Ltd. in July. 2007, SBI E-Trad Ltd. and SBI In 2014, the platform's net securities first consolidated securities account traded over 3 million accounts. In 2010, Net Securities' first consolidated securities account traded more than 5 million accounts. SBI Securities currently hold a retail foreign exchange license (license number: 3010401049814) issued by the Financial Services Agency of Japan.

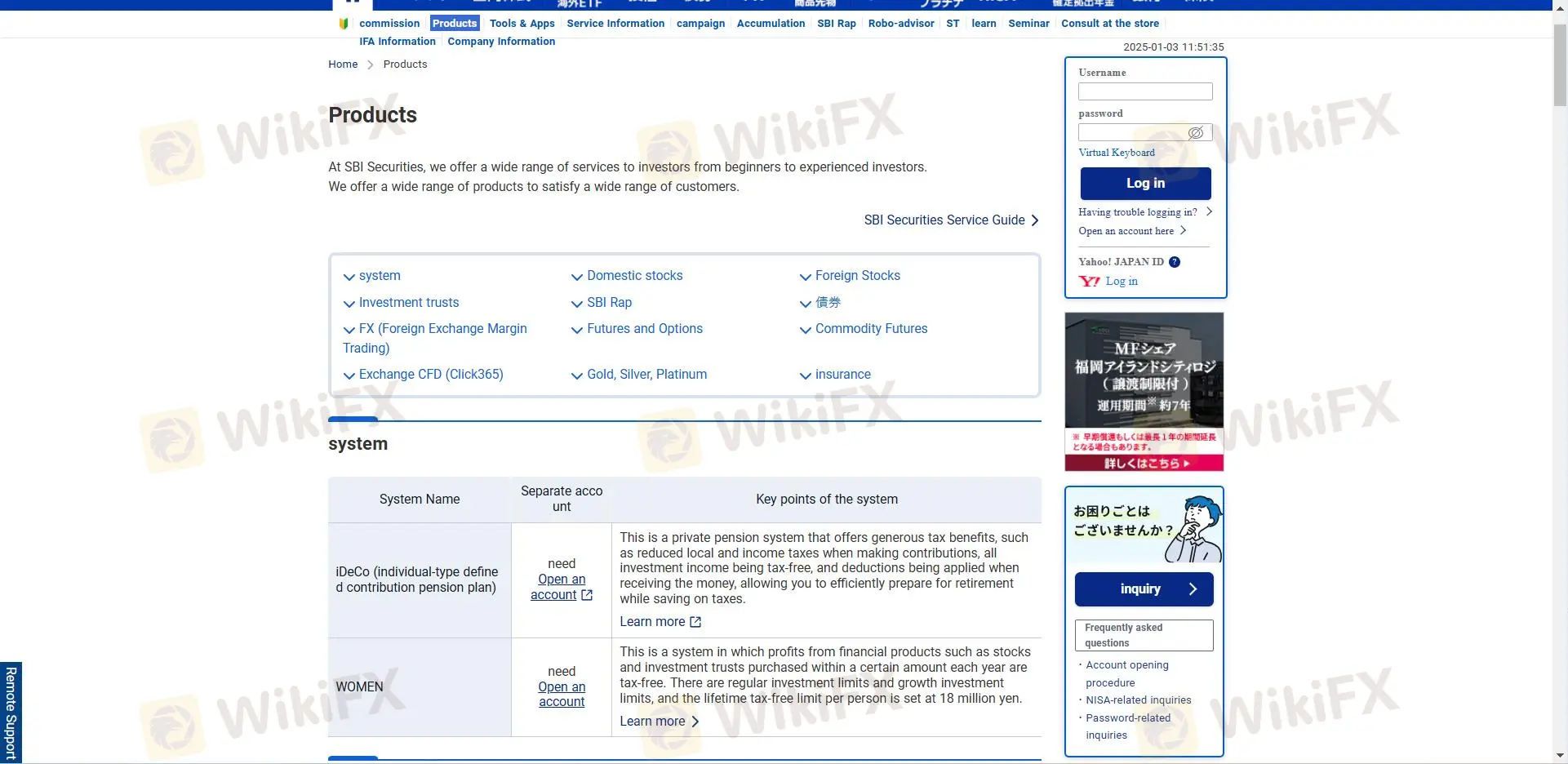

Market Instruments of SBI Securities

SBI Securities provides investors with financial products such as domestic stocks, foreign stocks, investment trusts, bonds, foreign exchange, futures/options, CFDs, gold, silver, warrants, insurance, etc.

Minimum Deposit of SBI Securities

The minimum deposit part remains not fully disclosed on SBI Securities website.

Leverage of SBI Securities

The trading leverage available for forex trading on SBI Securities platform range from 1:1 to 1:25, which is in line with Japanese laws.

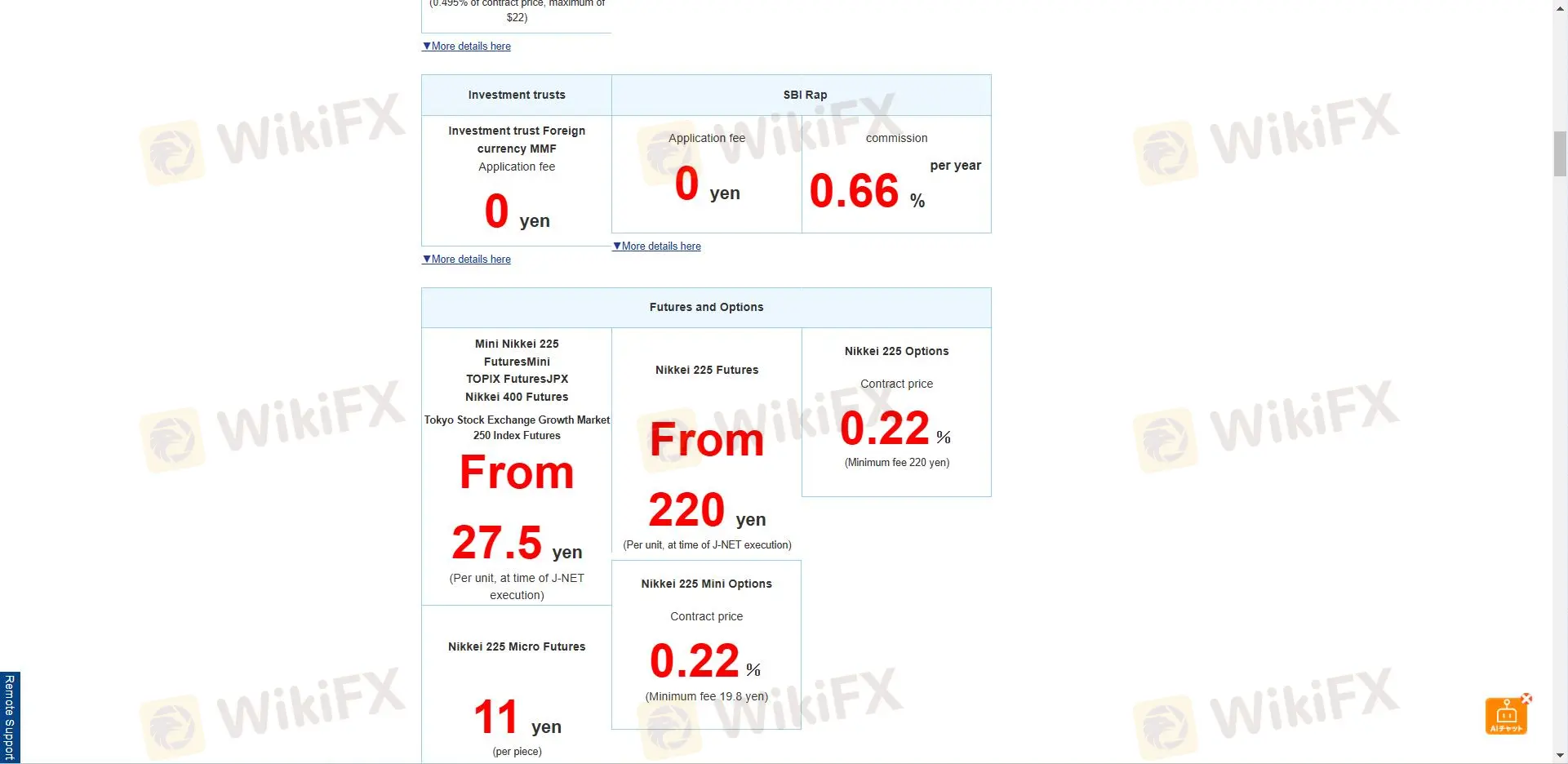

Fees of SBI Securities

SBI Securities has set specific fees for different financial products and displays a clear list of fees. For example, the brokerage fee for Nikkei 225 CFDs is 156 yen per contract. For gold and silver, the brokerage fee is 2.2% of the contract price at the time of purchase, and for warrants, the transaction fee is 0 yen.

Trading Platforms Available of SBI Securities

HYPER SBI provides various investment information functions essential for trading, including an easy-to-use ordering function for beginners. In addition to investment information, there are many functions supporting trading, such as an alert function that informs stock prices and market conditions.

Pros & Cons of HYPER SBI

| Pros | Cons |

| FSA-regualated | The minimum deposit not disclosed |

| Rich trading assets to choose from | Conservative leverage |

| Clear fee structure | |

| Easy to use trading platform | |

zr1

Hong Kong

SBI Securities, as a global business company regulated by Japan for 15-20 years, has shown stability in the retail forex field. Its advantages include a long history and a good regulatory background, which brings a certain level of trust to investors. However, disadvantages may include service limitations based on geographical restrictions and potential high transaction fees, which may affect the investment experience of some customers. Overall, SBI Securities is a trustworthy securities company with room for improvement.

Neutral

zr2

Hong Kong

Advantages: This platform provides comprehensive online trading services, supporting real-time market quotes, trade execution, and market analysis. The system is stable, funds are secure, and users can start trading quickly. Customer service responds promptly, can solve problems in a timely manner, and supports multiple languages, making it very convenient to use. Disadvantages: Compared to other platforms, the commission is slightly higher. The mastery of professional tools such as the quantitative strategy editor is more difficult, which may affect trading efficiency. The Chinese version of research reports may sometimes have delays, and some contracts lack detailed Chinese versions.

Neutral

a

Hong Kong

Advantages: This platform provides comprehensive online trading services, supporting real-time market quotes, trade execution, and market analysis. The system is stable, funds are secure, and users can start trading quickly. Customer service is responsive, able to promptly resolve issues, and supports multiple languages, making it very convenient to use. Disadvantages: Compared to other platforms, the commission is slightly higher. The mastery of professional tools such as the quantitative strategy editor can be challenging, which may affect trading efficiency. The Chinese version of research reports may sometimes experience delays, and some contracts lack detailed Chinese versions.

Neutral

好运连连55

Hong Kong

The services provided by SBI are generally satisfactory, and most importantly, it is a secure company that will not deceive investors.

Positive

FX1243896738

United Kingdom

This company seems to be very safe, but unfortunately I am not Japanese. For one thing, I can't read their website. On the other hand, I am worried that I will encounter problems when trading and contacting customer service.

Neutral

虎头蛇尾

Hong Kong

I have only traded foreign exchange currency pairs on this platform, the spread is pretty narrow, and the trading environment is good, but the leverage is a bit conservative, not suitable for scalpers and professional traders. The lack of live customer support is also a drawback.

Neutral

哦哦URL魔图

Peru

The services provided by SBI are generally satisfactory. Most importantly, it is a safe company that will not scam you out of your money.

Positive

十指丶紧扣°

Hong Kong

SBI Securities’s official website is way too complex, I cannot easily find what I want. Although many investors prefer this broker, I would rather not to invest with it.

Neutral

夏35216

Hong Kong

I have deposited my initial capital. Can't wait to see what happens!

Positive