Company Summary

| MITSUI Review Summary | |

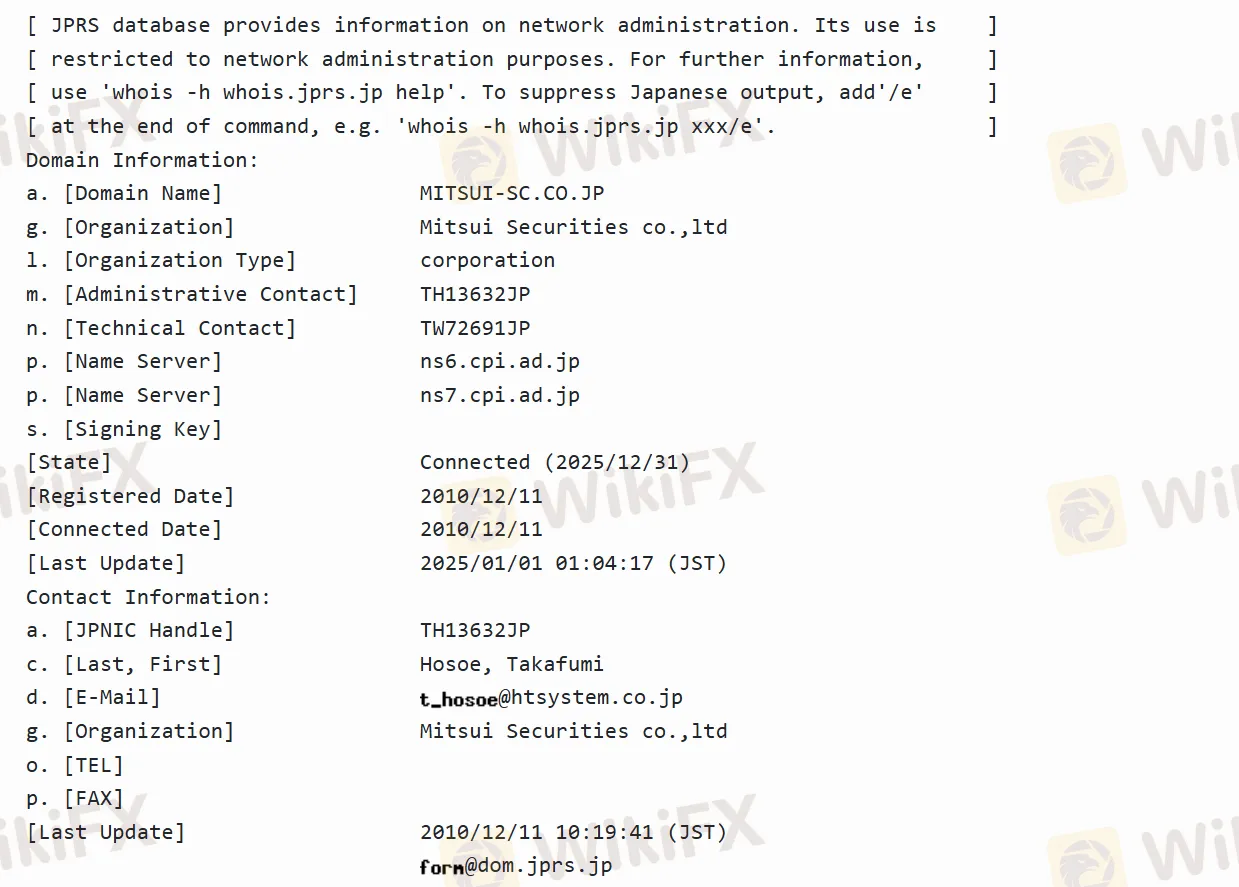

| Founded | 2010/12/11 |

| Registered Country/Region | Japan |

| Regulation | Regulated |

| Market Instruments | Investment Trusts, Bonds, Stocks, and Insurance Products |

| Customer Support | Tel. 0776-22-2680 |

| Fax: 0776-26-5662 | |

MITSUI Information

Mitsui SC Co., Ltd. is a well-known securities company headquartered in Japan. The company has a long history. It was established in March 1945 (the 20th year of Showa) and celebrated its 85th anniversary in July 2024. Its headquarters are located in Fukui City, Fukui Prefecture, and it has multiple branch offices in places such as Takefu City and Obama City. It is engaged in a wide range of financial commodity trading businesses, including investment trusts, bonds, stocks, and insurance products.

Pros and Cons

| Pros | Cons |

| Regulated | Limited global influence |

| Centered in the local area | Language barrier (mainly in Japanese) |

| Various financial products | |

| Educational and community support |

Is MITSUI Legit?

Yes, Mitsui-SC is a legitimate financial institution. It is registered as an operator of a financial commodity trading business. This limited company is supervised by the Financial Services Agency, and its registration number is No. 14, issued by the Director of the Hokuriku Finance Bureau (Financial Commodities Business).

What Can I Trade on MITSUI?

At Mitsui & Co. Securities, customers can trade a wide variety of financial instruments, including stocks, such as domestic listed stocks from various Japanese markets like Tokyo, Nagoya, Fukuoka, and Sapporo, as well as foreign stocks. There are also investment trusts, such as equity funds (e.g., One Pure India Equity Fund), bond funds (e.g., some Australian bond funds), real estate investment trust funds (e.g., World REIT Selection in Asia), and asset composite funds (e.g., Nissay Australia High Dividend Stock Fund). Domestic and foreign bonds, as well as insurance products, are also available for trading.

| Tradable Instruments | Supported |

| Investment Trusts | ✔ |

| Bonds | ✔ |

| Stocks | ✔ |

| Insurance Products | ✔ |

MITSUI Fees

MITSUI's fees are divided into stock trading fees, investment trust fees, and account management fees. In stock trading, if the contract value does not exceed 217,392 yen, the commission is 2,750 yen (including tax). For amounts exceeding this, the maximum commission is 1.265% of the contract value (including tax). When purchasing stocks through fundraising, only the purchase price needs to be paid.

Each investment trust has its own fees, including sales commissions and trust management fees. The specific fees vary depending on the fund. Finally, the custody account management fee is waived.