Company Summary

| Broker Name | CXM |

| Registered in | United Kingdom |

| Year(s) of establishment | 2015 |

| Regulations | FCA and FSC |

| Trading Instruments | Cryptos, Energy, Forex, Indices, Baskets, Metals, US/EU Stocks |

| Account Types | Cent, ZERO, FIX API, Standard, and ECN |

| Minimum Initial Deposit | $5 |

| Maximum Leverage | 1:Unlimited |

| Minimum Spread | 0.0 pips |

| Trading Platform | MT4 & MT5 |

| Deposit and withdrawal method | More than 10, including 1-2 Pay, 5Pay, AwePay, DNB, FasaPay, Help2Pay, Local Banks |

| Customer Service | support@cxmdirect.com;Marketingmarketing@cxmdirect.com;Sales sales@cxmdirect.com |

CXM Review Information

CXM is a UK-based brokerage established in 2015. With a range of account types, including Cent, ZERO, FIX API, Standard, and ECN, and a minimum deposit of just $5, CXM provides flexibility and competitive spreads starting from 0.0 pips. The broker offers unlimited leverage and SWAP-free trading. Trading is facilitated on MT4 & MT5 platforms, and investors can benefit from competitive trading conditions.

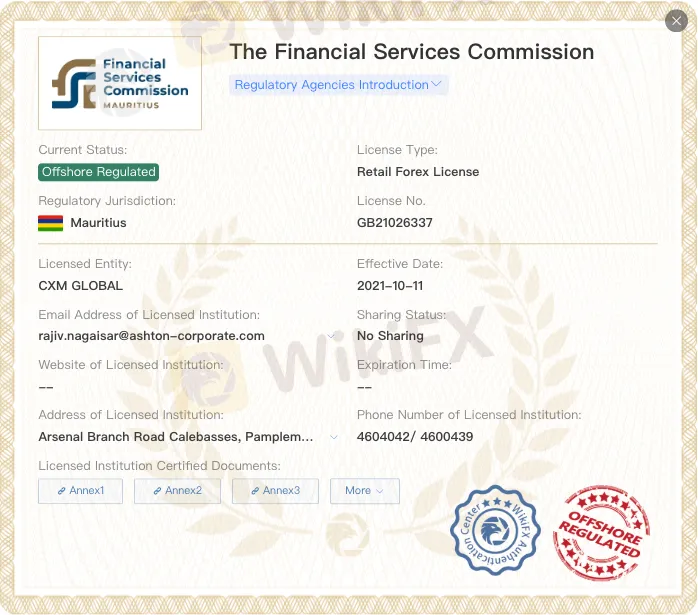

Regulatory Status

CXM is regulated by both the Financial Services Commission (FSC) of Mauritius, holding an offshore Retail Forex License (License No. GB21026337), and the UK Financial Conduct Authority (FCA), authorized under a Financial Services license (License No. 966753).

The FSC provides offshore regulatory oversight suitable for global forex operations, while the FCA is one of the worlds most stringent and reputable financial regulators, offering a higher level of consumer protection, transparency, and compliance standards, particularly for UK and EU clients.

Market Instruments

CXM offers over 200 CFD instruments across 8 asset classes, providing exceptional trading conditions.

Account Types

CXM offers a range of accounts with flexible deposit requirements and leverage options, supporting various instruments like FX, Metals, CFDs, Cryptos, and Stocks. All accounts allow EAs, scalping, and hedging, with no overnight swap fees or trading restrictions.

| Cent | ZERO | FIX API | Standard | ECN | |

| Starting Deposit | $10 | $1,000 | $50,000 | $50 | $100 |

| Instruments | FX, Metals, CFDs, Stocks | FX, Metals, CFDs, Cryptos, Stocks | FX, Metals, CFDs, Cryptos, Stocks | FX, Metals, CFDs, Cryptos, Stocks | FX, Metals, CFDs, Cryptos, Stocks |

| Overnight Swap Fees | No | No | No | No | No |

| EAs, Scalping, Hedging | Yes | Yes | Yes | Yes | Yes |

| Minimum Lot Size | 0.01 Lots FX | 0.01 Lots FX | 0.01 Lots FX | 0.01 Lots FX | 0.01 Lots FX |

| Margin Call / Stop Out | 50% / 30% | 50% / 30% | 50% / 30% | 50% / 30% | 50% / 30% |

| Max Leverage | 1:2000 | 1:1000 | 1:300 (FX, Gold, Silver) | 1:Unlimited | 1:Unlimited |

| Managed Accounts/Copy Trading | Yes | Yes | No | Yes | Yes |

| Min Order Distance | 0 | 0 | 0 | 0 | 0 |

| Trading Restrictions | No | No | No | No | No |

CXM Platform

CXM provides both MT4 and MT5 platforms, available for desktop, mobile, and web use, offering convenient trading experience across multiple devices.

| Platform | Available for | Download Links |

| MT4 Platform | Desktop, Laptop, Mobile | |

| Linux OS | ✔️ | |

| Windows | ✔️ | |

| Android | ✔️ | |

| Web Terminal | ✔️ | |

| iOS | ✔️ | |

| MAC OS | ✔️ | |

| QR Codes | ✔️ | |

| MT5 Platform | Desktop, Mobile | |

| Windows | ✔️ | |

| Android | ✔️ | |

| iOS | ✔️ | |

| Web Terminal | ✔️ | |

| QR Codes | ✔️ |

Deposit & Withdrawal

CXM offers 15 deposit methods and 13 withdrawal methods, with different currencies, processing times, and minimum amounts.

| Method | Currencies (Deposit) | Processing Time (Deposit) | Commission (Deposit) | Minimum Amount (Deposit) |

| 1-2 Pay | THB | 0 | 0 | 100 |

| 5Pay | VA VND, F2F VND, VA MYR, VA MYR LD, F2F MYR, F2F MYR LD, C2C USDT | 0 | 0 | 100-30000 |

| AwePay | IDR, VND, VA IDR | 0 | 0 | 40-100000 |

| DNB | LAK, MMK, KHR, KHR USD | 0 | 0 | 5-94000 |

| FasaPay | USD | Instant | 0 | 15 USD |

| Help2Pay | - | - | - | - |

| Local Banks | MYR, IDR, VND, THB | Instant | 0 | 15 USD |

| Nexus | BTC, BCH, ETH, USDC, XRP, USDT TRC, USDT ERC, LTC | 0 | 0 | 5-100 |

| OmPay | IDR, IDR QRIS, VND, MYR, MYR FPX, MYR LD, MYR FPX LD, SGD, THB | 0 | 0 | 50-100000 |

| Other Cryptos | BTC, ETH, BCH | 1 Working Day | 0 | 100 USD equivalent |

| Payment Asia | PHP | 0 | 0 | 2500 |

| Perfect Money | USD | Instant | 0 | Contact Account Executive for details |

| USDT (Tether) | USDT (Tether) | 1 Working Day | 0 | 100 USD equivalent |

| Method | Currencies (Withdrawal) | Processing Time (Withdrawal) | Commission (Withdrawal) | Minimum Amount (Withdrawal) |

| 1-2 Pay | THB | 0 | 0 | 100 |

| 5Pay | VA VND, VA MYR, VA MYR LD, F2F MYR, F2F MYR LD, F2F VND | 0 | 0 | 40-30000 |

| AwePay | VND, MYR | 0 | 0 | 40-100000 |

| DNB | LAK, MMK, KHR, KHR USD | 0 | 0 | 5-94000 |

| FasaPay | USD | 1 Working Day | 0 | 15 USD |

| Help2Pay | MYR, VND, IDR VA | 0 | 0 | 50-300000 |

| Local Banks | MYR, IDR, VND, THB | 1 Working Day | 0 | 15 USD |

| Nexus | BTC, BCH, ETH, USDC, XRP, USDT TRC, USDT ERC, LTC | 0 | 0 | 5-100 |

| OmPay | IDR, IDR VA, VND, MYR, MYR LD, SGD, THB | 0 | 0 | 50-100000 |

| Other Cryptos | BTC, ETH, BCH | 1 Working Day | 0 | 100 USD equivalent |

| Payment Asia | PHP | 0 | 0 | 2500 |

| USDT (Tether) | USDT (Tether) | 1 Working Day | 0 | 100 USD equivalent |