Company Summary

| WWF Review Summary | |

| Founded | 2016 |

| Registered Country | Cyprus |

| Regulation | Regulated by CySEC (License No. 337/17, Market Maker) |

| Market Instrument | FX |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | EUR 100 |

| Customer Support | Phone: +357 25 366336 |

| Fax: +357 25 355233 | |

| Email: wwf@wise-wolves.com | |

WWF Information

Wise Wolves Finance Ltd, a Cyprus-based financial services firm founded in 2016 and run by CySEC, is under CySEC's regulation. Though it does not permit demo or Islamic accounts, it offers institutional clients a wide range of trading and investment instruments.

Pros and Cons

| Pros | Cons |

| Regulated by CySEC | No demo accounts |

| Broad range of financial instruments | High trading fees |

| Various contact channels | Not suitable for beginners |

| Limited account choices |

Is WWF Legit?

Yes, WWWF is regulated. Its Market Maker license is No. 337/17 from the Cyprus Securities and Exchange Commission (CySEC). However, its former FCA (UK) licence expired on October 15, 2022 and is no longer active.

Products and Services

Through a broad spectrum of financial tools and managed investment services, Wise Wolves Finance Ltd unlocks world financial markets. Its services include structured investment products, FX services, proprietary trading, and order execution.

| Type | Service |

| Main Investment Services | Reception and transmission of ordersExecution of orders on behalf of clientsDealing on own account |

| Ancillary Investment Services | Safekeeping and administration of financial instrumentsGranting credits or loans related to transactionsCapital structure and M&A advisoryForeign exchange services related to investmentInvestment research and analysis |

| Covered Financial Instruments | Transferable securities, Money-market instruments, Units in collective investment undertakings, Derivatives on securities, currencies, interest rates, commodities, etc. Credit derivativesContracts for differences (CFDs) |

| Product Types | FX Options (Put, Call), Shares, Sovereign Bonds, Corporate Bonds, Depositary Receipts, ETFs and ETCs, Deliverable and Non-Deliverable FX Options |

Account Type

Wise Wolves Finance Ltd offers a single type of live brokerage account for institutional and professional clients. There is no demo or Islamic (swap-free) account available. All account openings require document submission and approval from a client manager.

WWF Fees

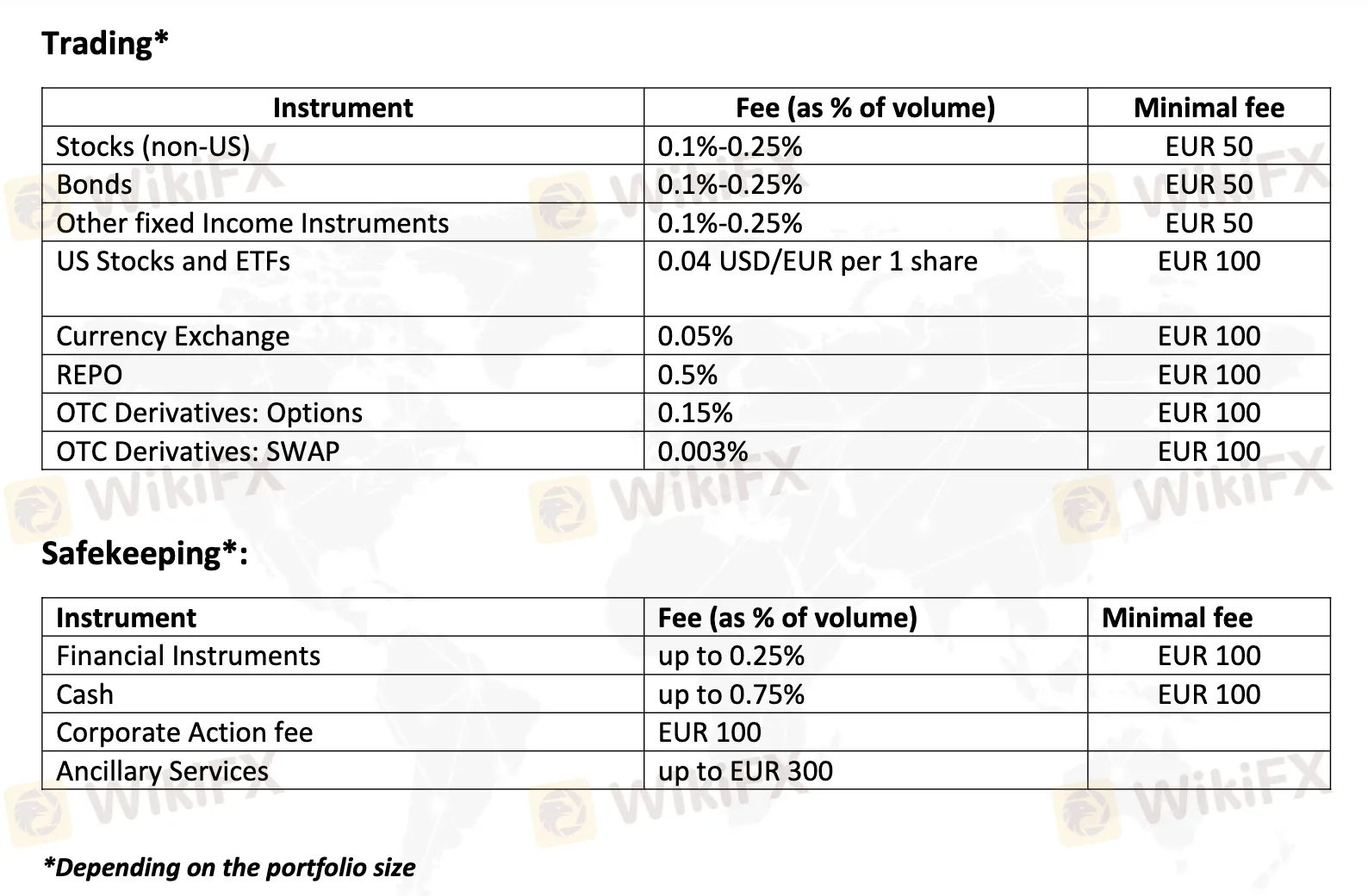

Wise Wolves Finance Ltd charges moderately high fees compared to typical retail brokers, especially for minimum charges across trading and safekeeping services.

| Service Type | Fee (as % of volume) | Minimum Fee | Remarks |

| Stocks (non-US), Bonds | 0.1% – 0.25% | EUR 50 | Competitive percentage, high minimum |

| US Stocks & ETFs | 0.04 USD/EUR per share | EUR 100 | Fixed per-share model |

| Currency Exchange | 0.05% | EUR 100 | Standard rate, but high flat minimum |

| OTC Derivatives | 0.003% – 0.15% | EUR 100 | Generally low % but minimum still applies |

| Safekeeping – Instruments | Up to 0.25% | EUR 100 | Tiered based on portfolio |

| Safekeeping – Cash | Up to 0.75% | EUR 100 | Higher than typical for cash holdings |

| Corporate Action | Fixed | EUR 100 | Flat rate, common for institutional clients |

| Ancillary Services | Fixed | Up to EUR 300 | No detailed breakdown |

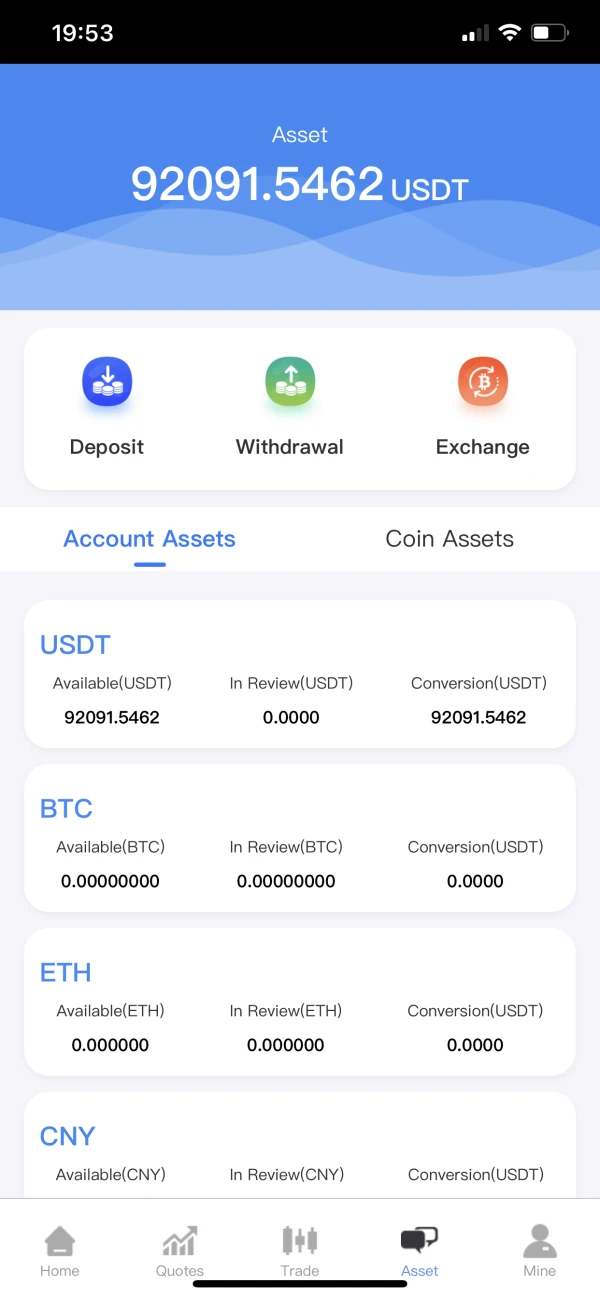

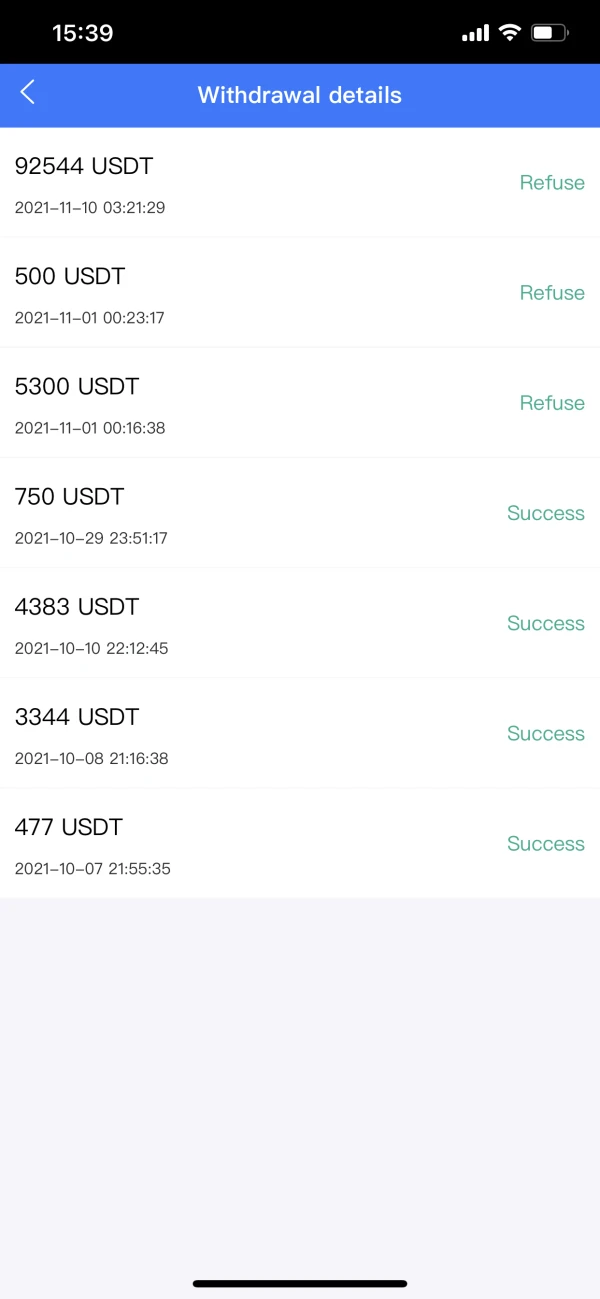

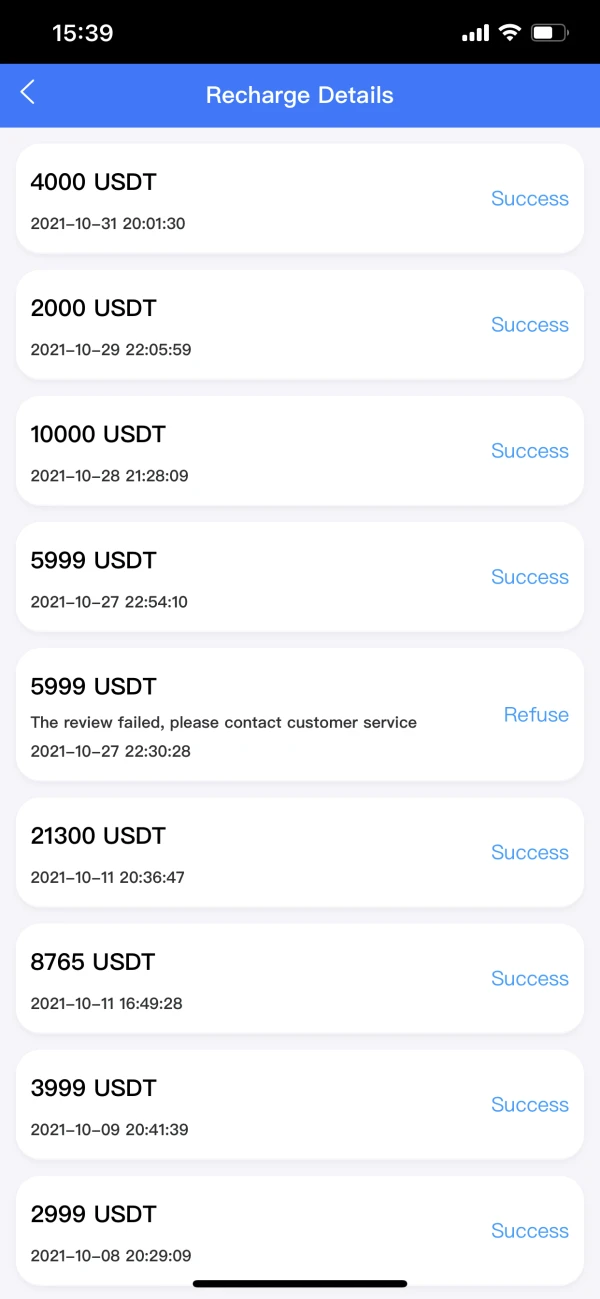

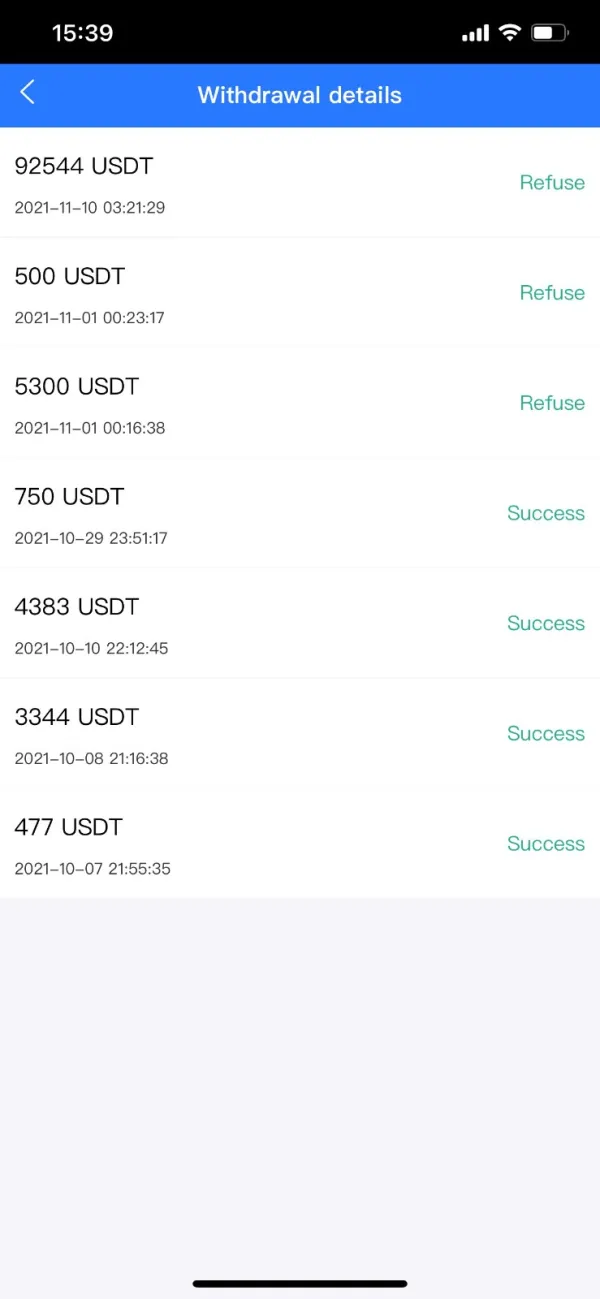

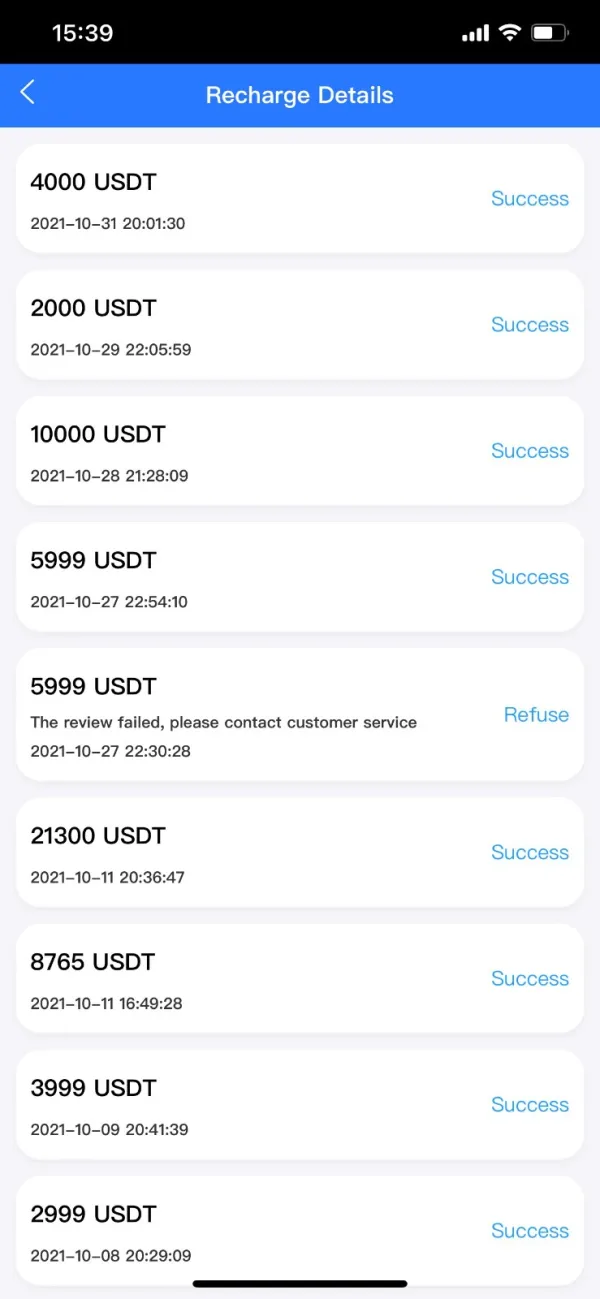

FX3125782471

Vietnam

I cannot access the app anymore. My current balance was 92091 USDT. They didn’t allow withdrawals. Be careful with scammers.

Exposure

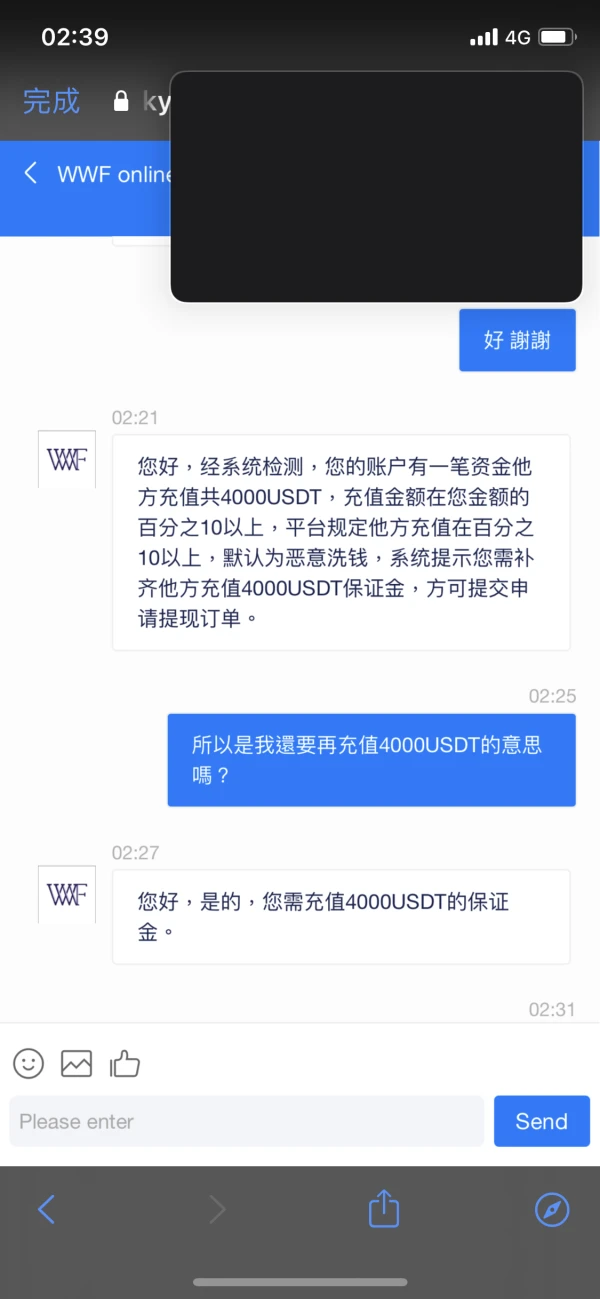

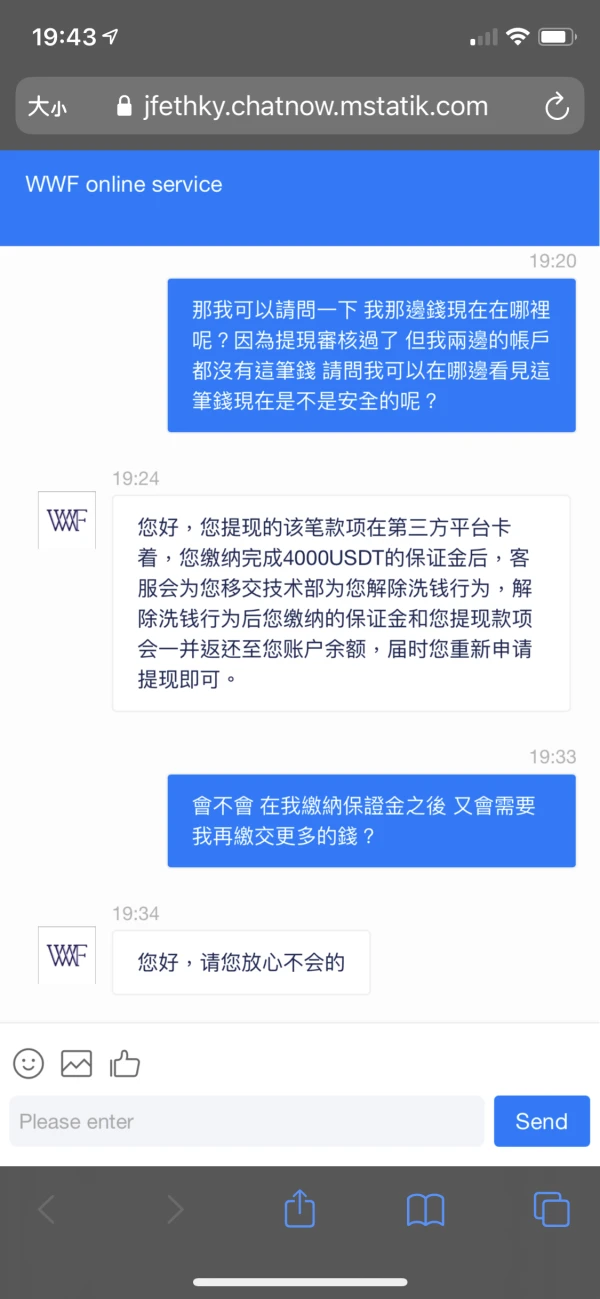

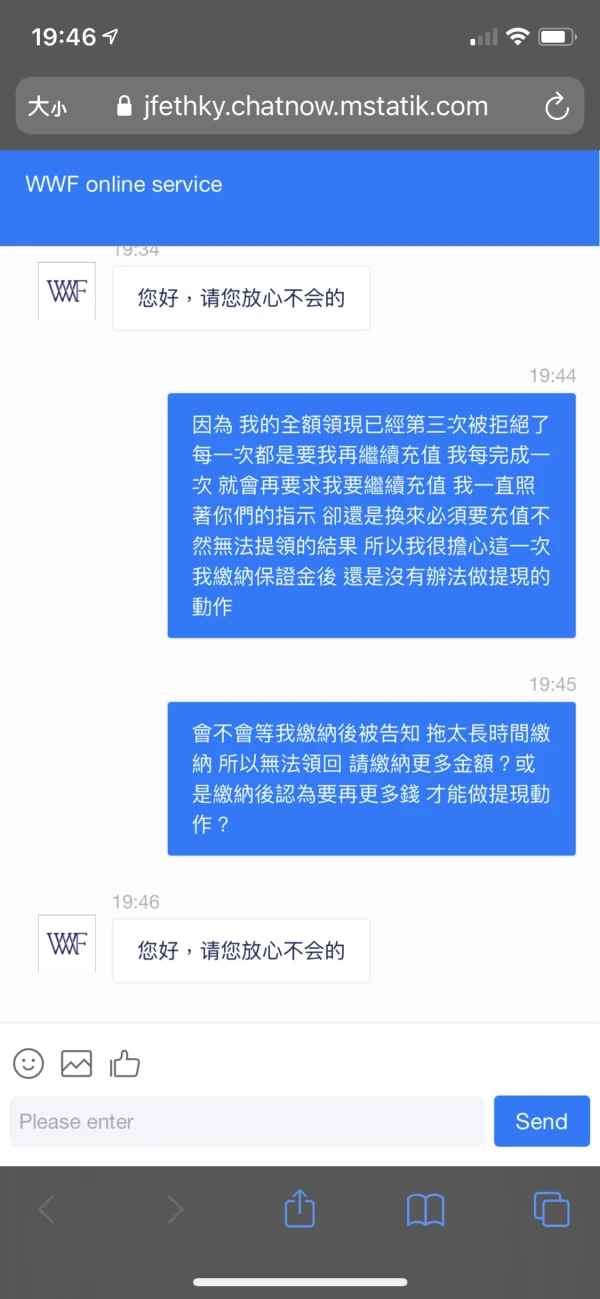

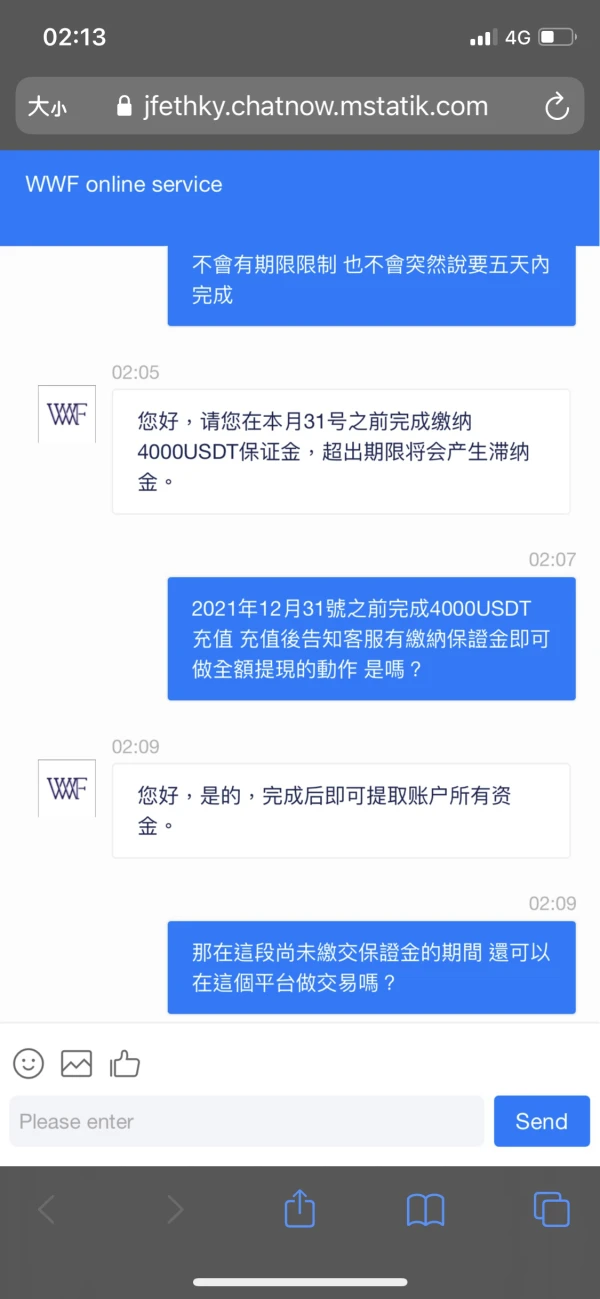

朱婉菁

Taiwan

At the beginning, someone recommended me to use. After operate for several times, I found that the cash can be withdrawn, but then after participating in the bonus activity, things followed one after another and the withdrawal was rejected. At the end , I was told that someone else deposit 4000 and suspected money laundering and required a margin of 4000USDT. The customer service said that it can be paid in batches. When I paid the 1665USDT and needed to pay the remaining amount, I couldn't contact the customer service anymore. I realized that my money might not be available to withdraw...

Exposure

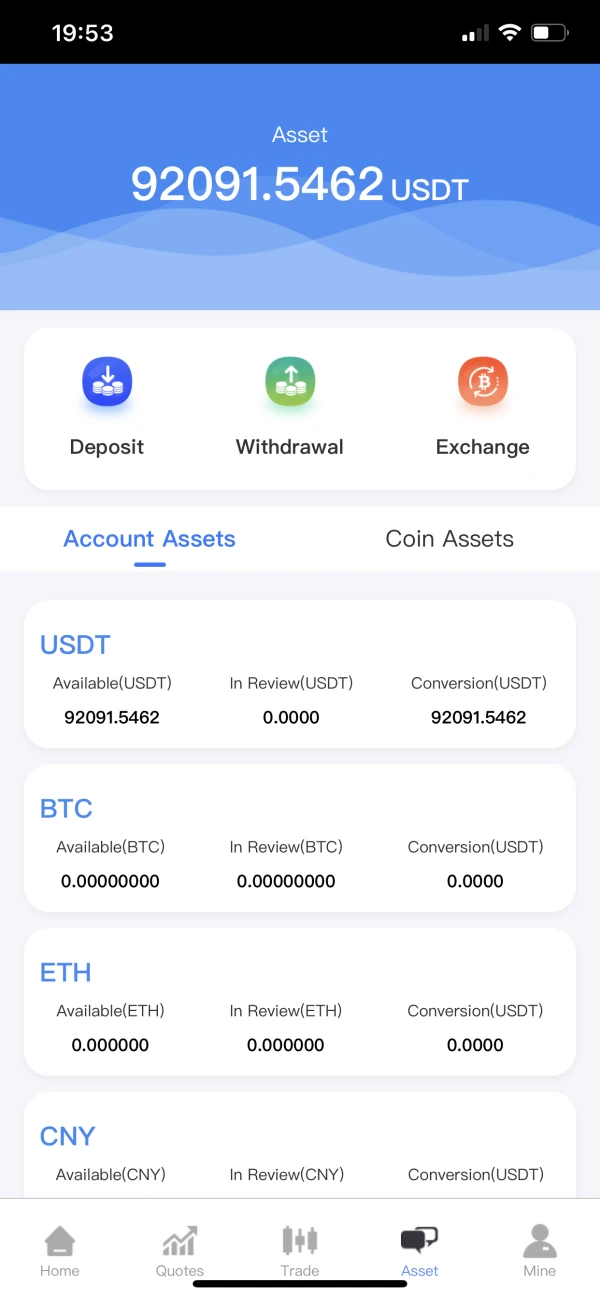

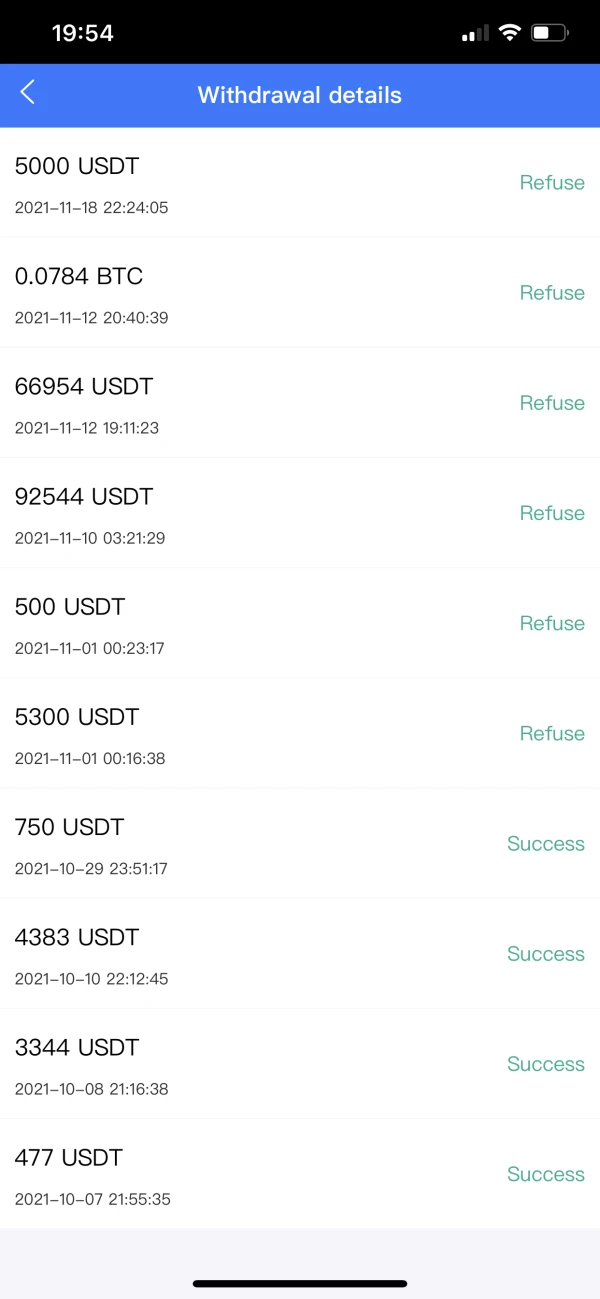

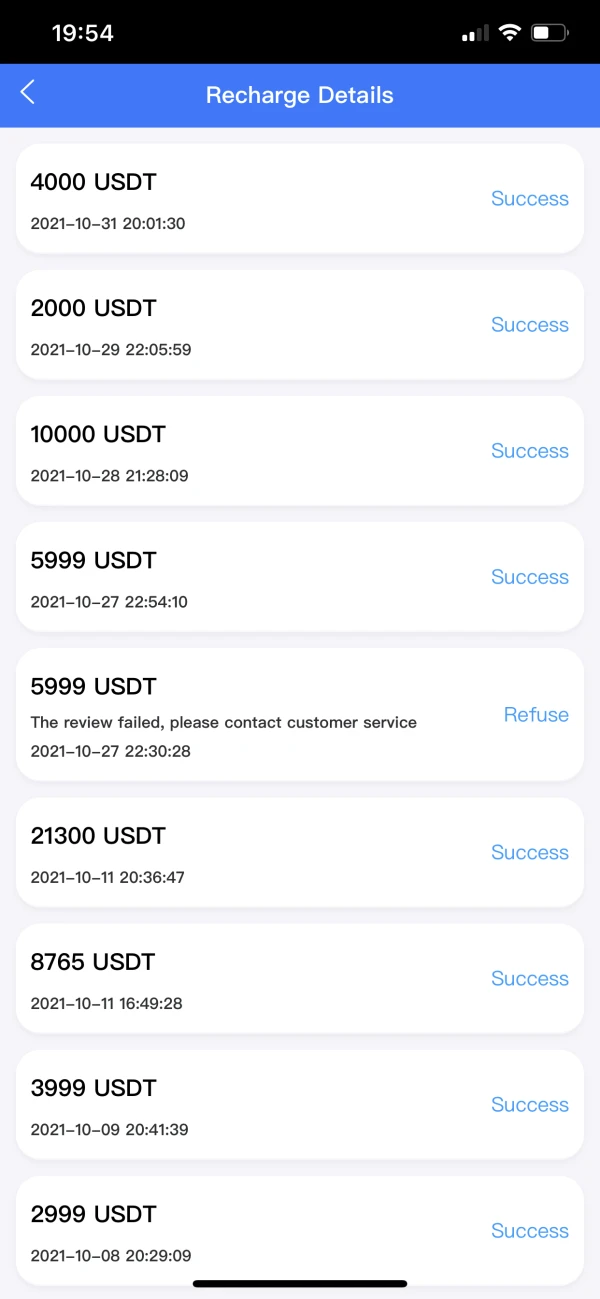

FX3125782471

Vietnam

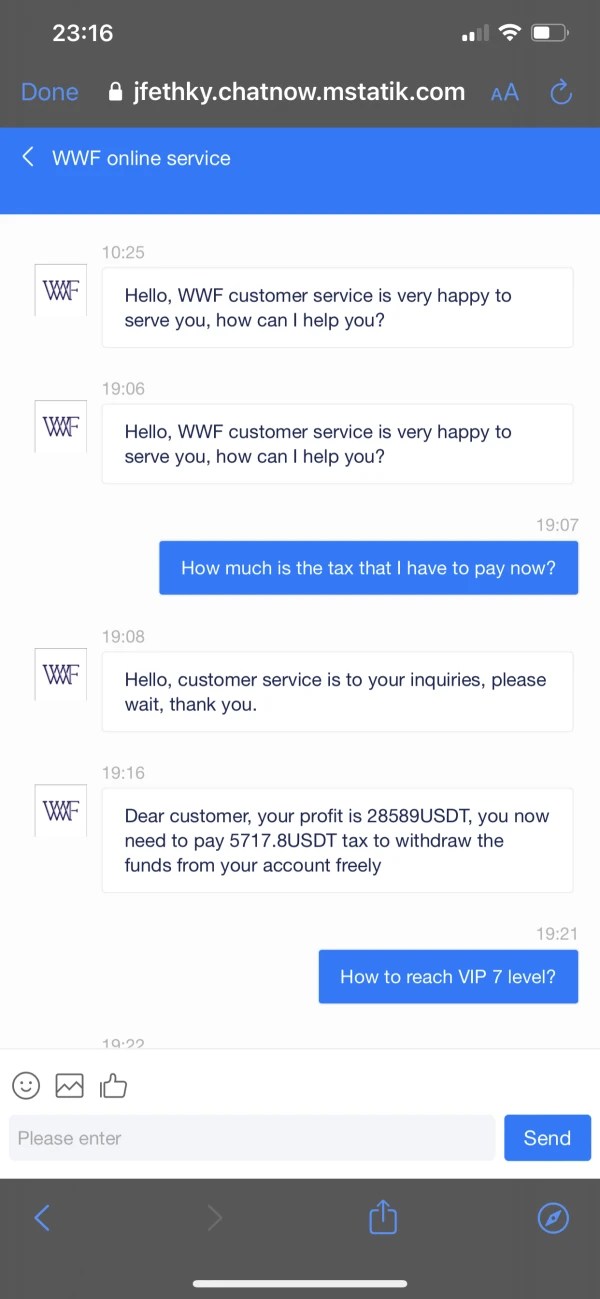

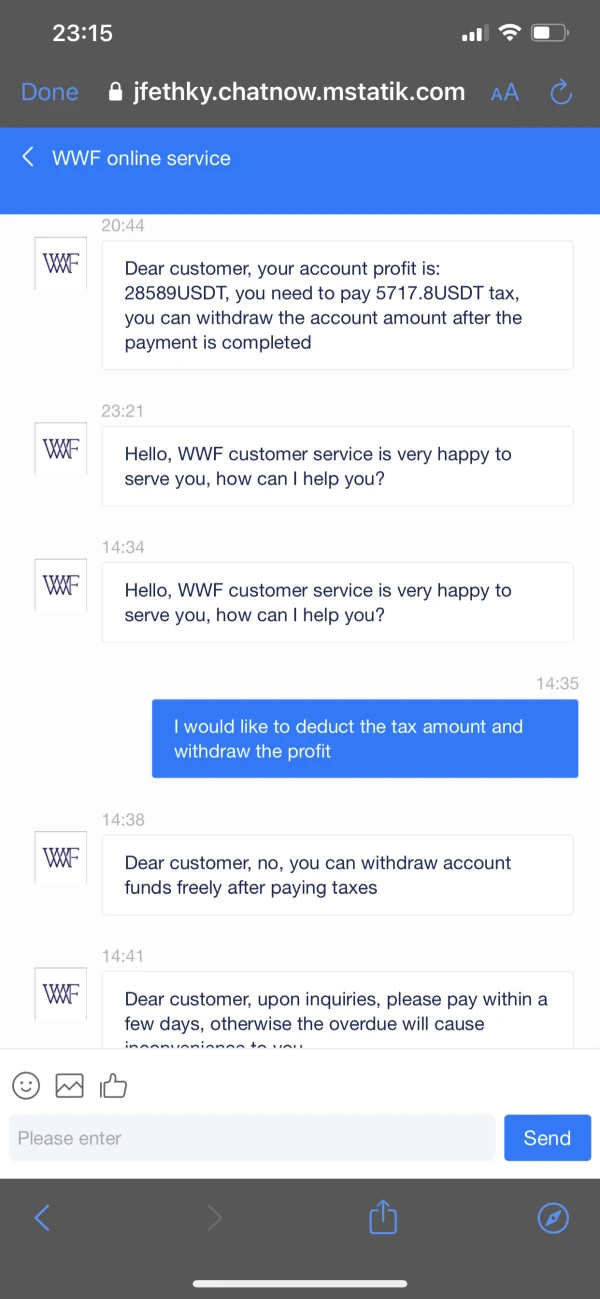

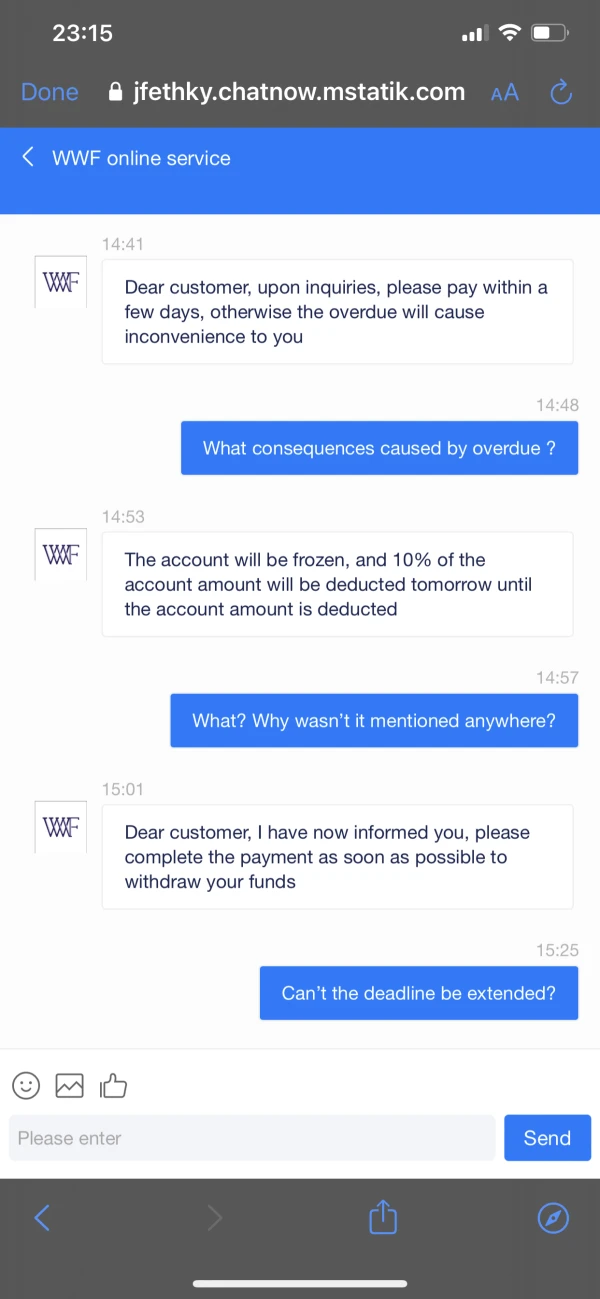

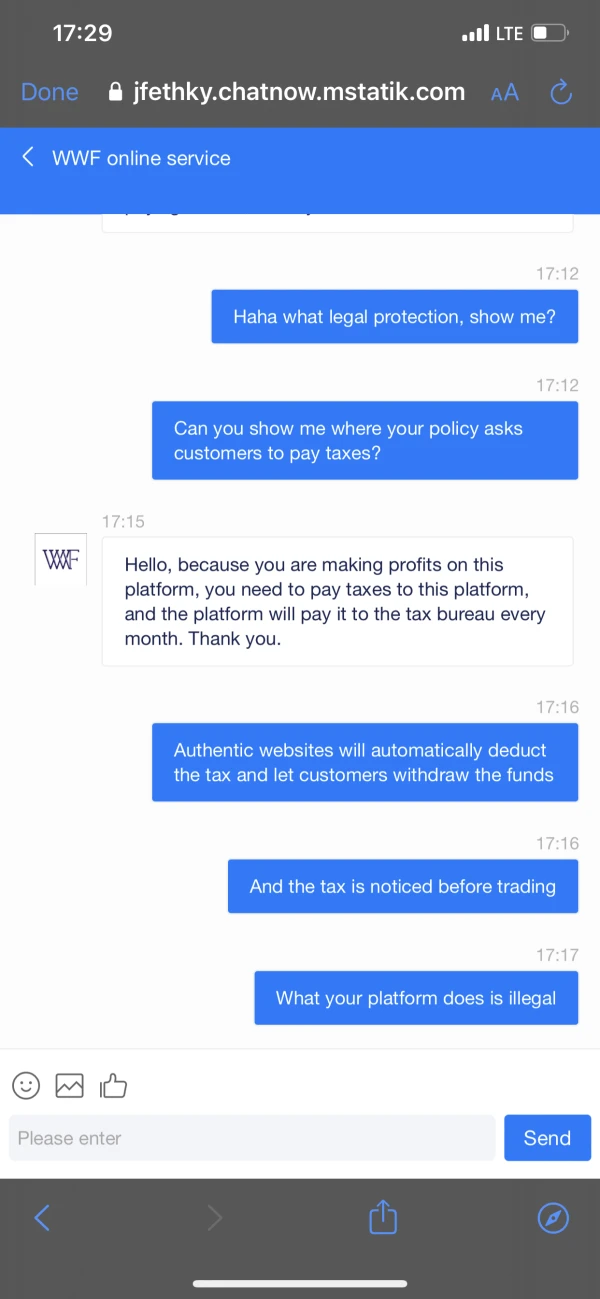

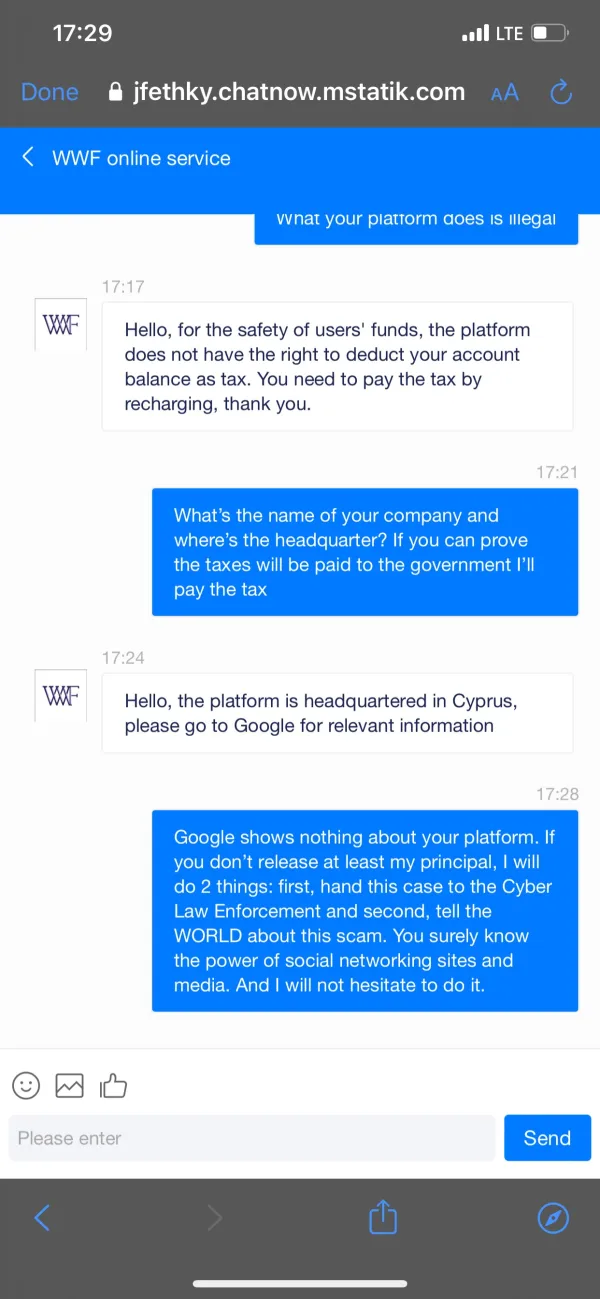

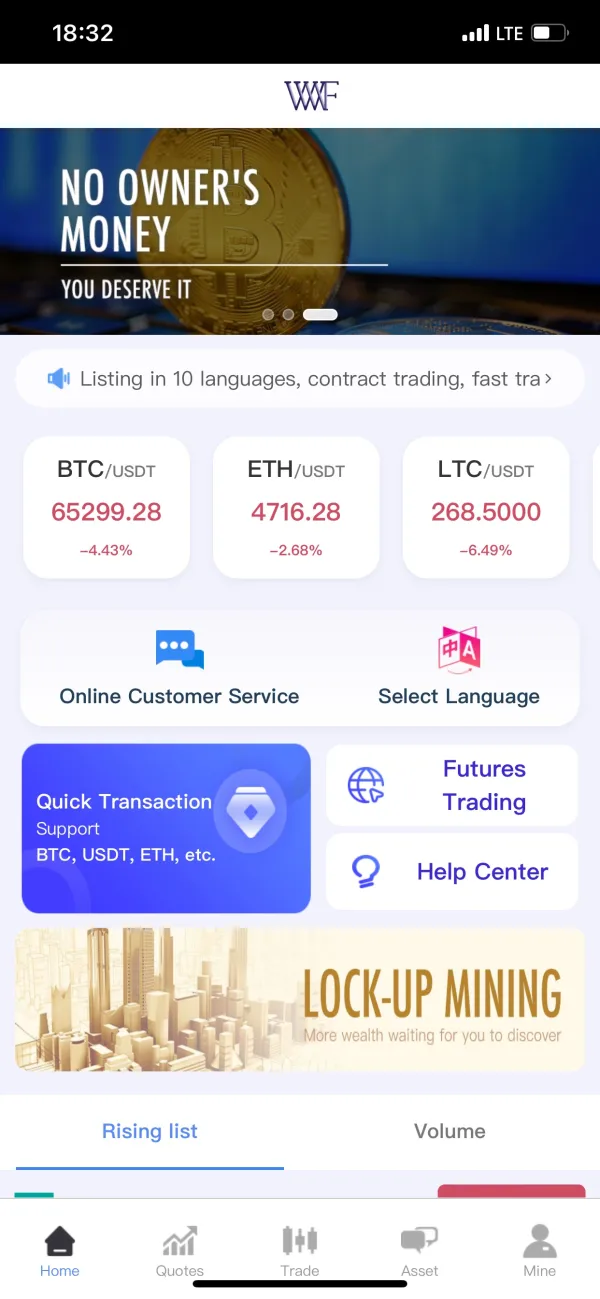

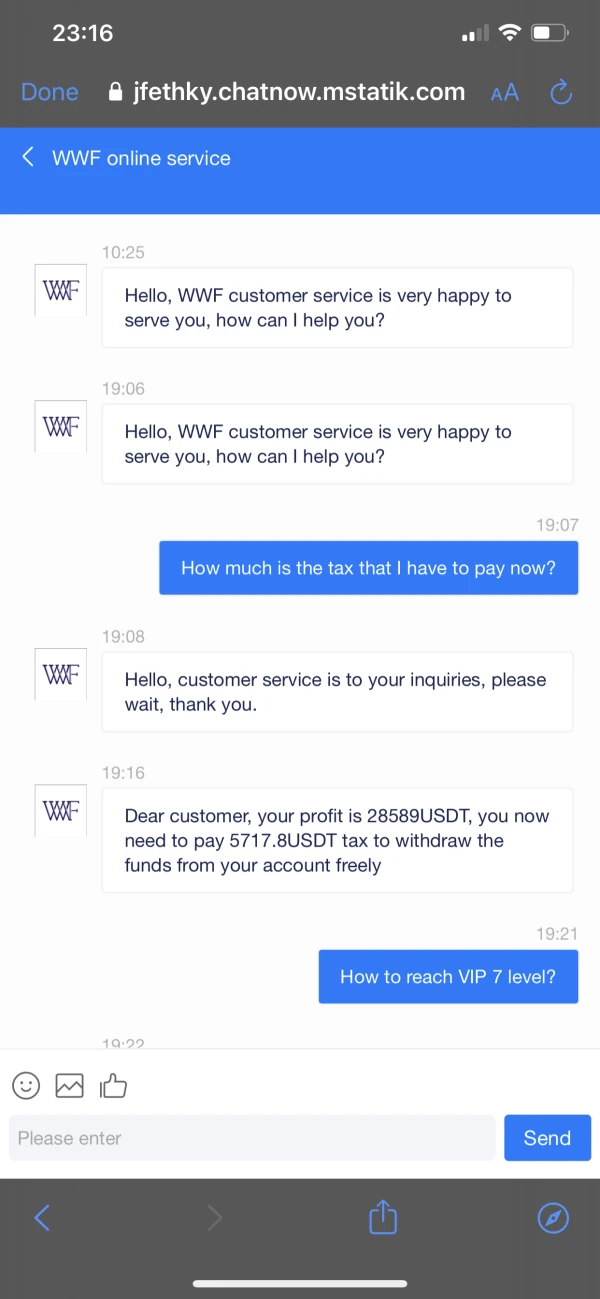

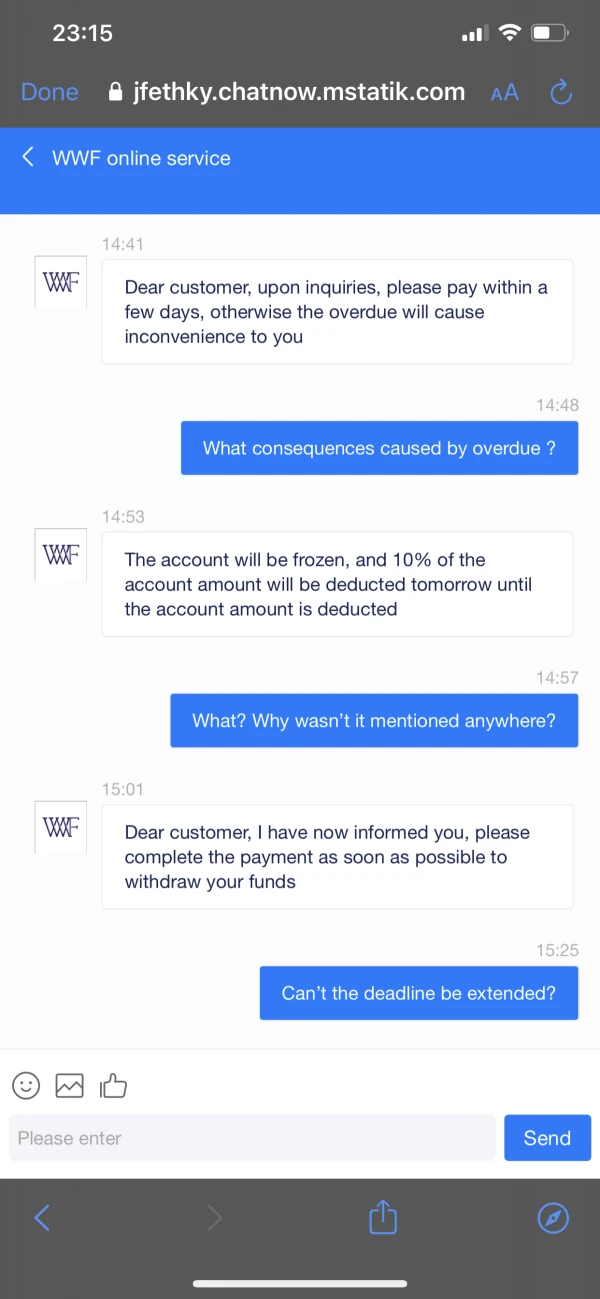

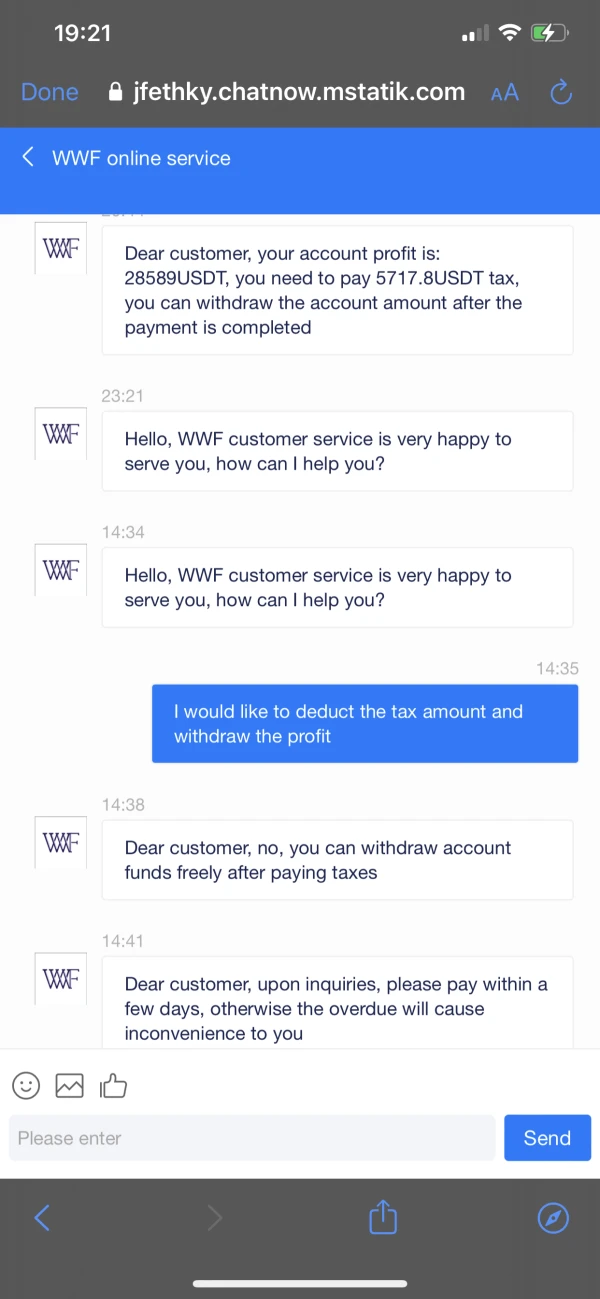

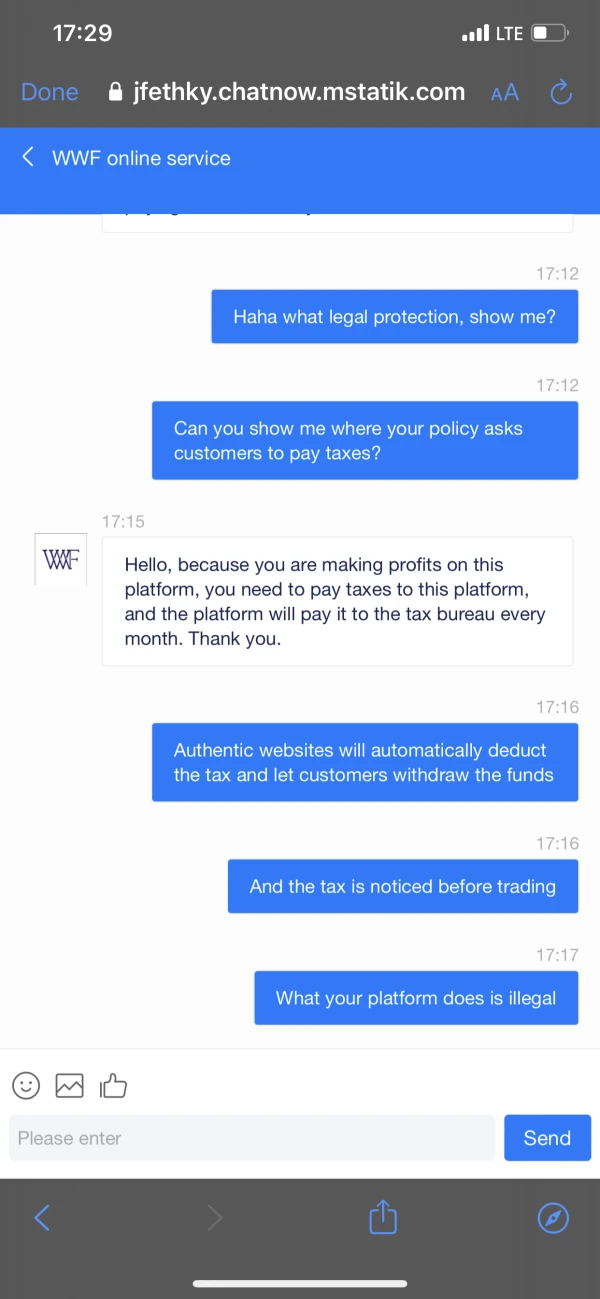

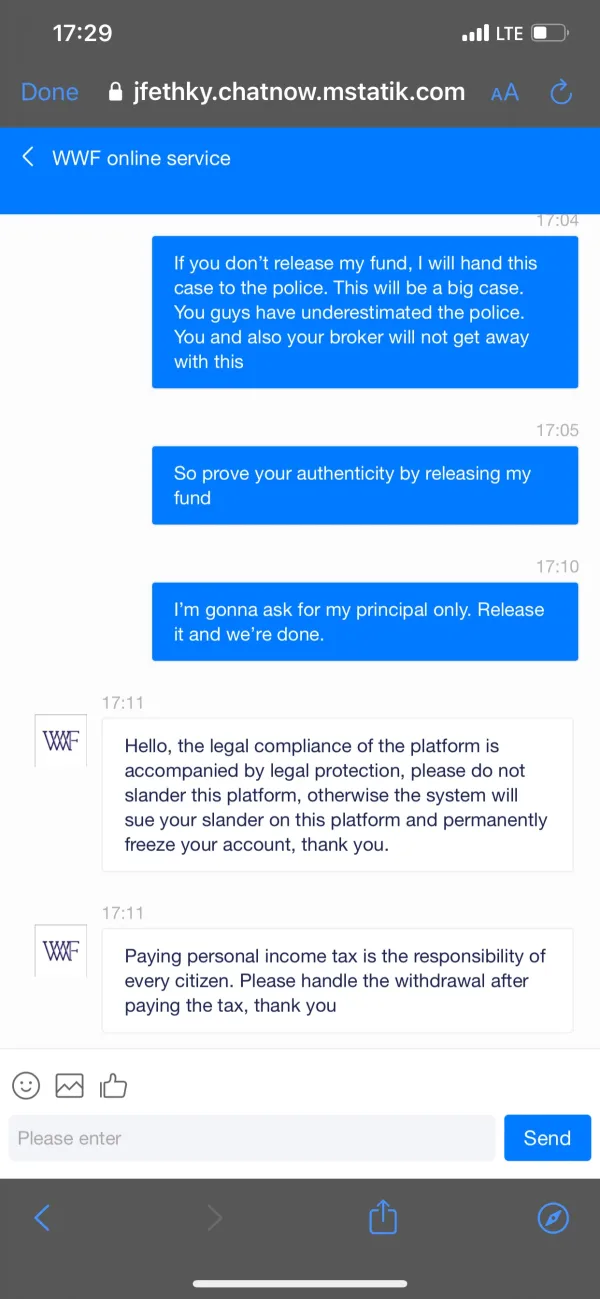

This guy induced me to invest in this WWF app. After a few successful withdrawals with a small amount, I have deposited a total of 66954 USDT, but after making profit of more than 28000 USDT, the app blocked withdrawal and asked me to pay 20% tax. I asked for proof of tax payment, but customer service replied very crookedly and now they have frozen my account. The current balance is 92091 USDT. Be careful with the person with the nick in the photo and this scam app! #WWFscam, #WWF, #scam #romancescam

Exposure

Kaung Khant Aung

New Zealand

I was initially impressed with Wise Wolves Finance and found their website to be professional and informative. However, I came across a few negative reviews from people claiming to have been scammed by them, which left me feeling skeptical. While I have not personally invested with Wise Wolves Finance, the mixed reviews and lack of clear information about their regulatory status have left me hesitant to do so.

Positive

FX1369279165

United Kingdom

I received an ad for WWF on social media, claiming to be a reliable company. What I saw, however, was accusations made by many victims against it. fraud company! I would definitely not invest here.

Positive

FX2211981857

Taiwan

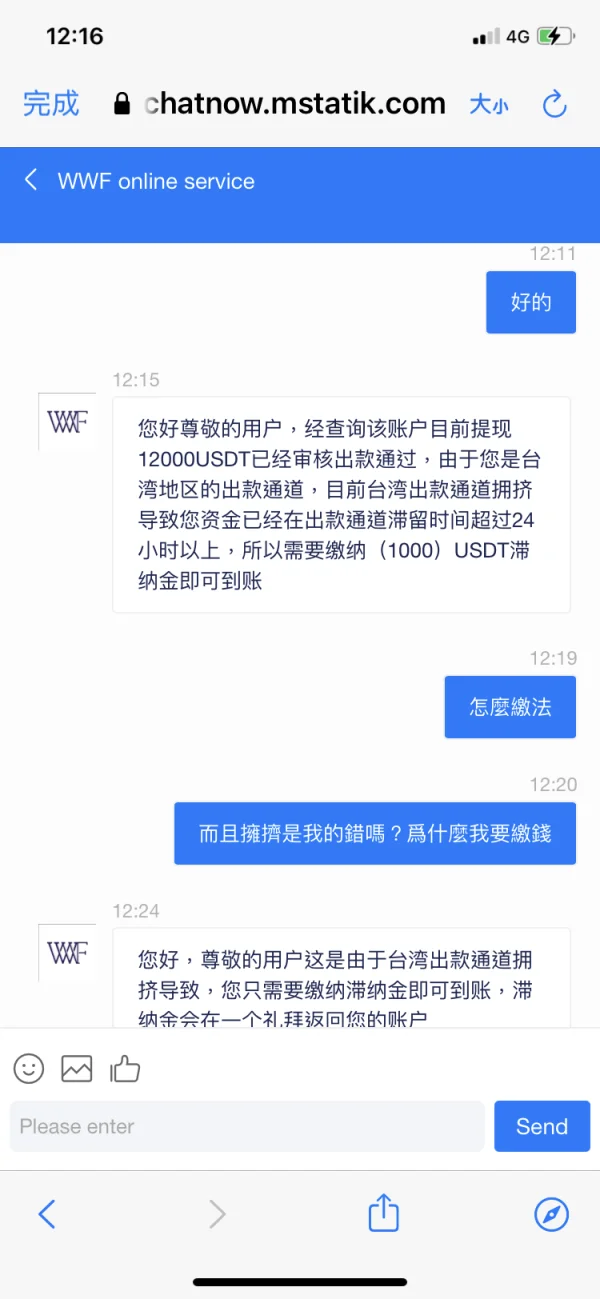

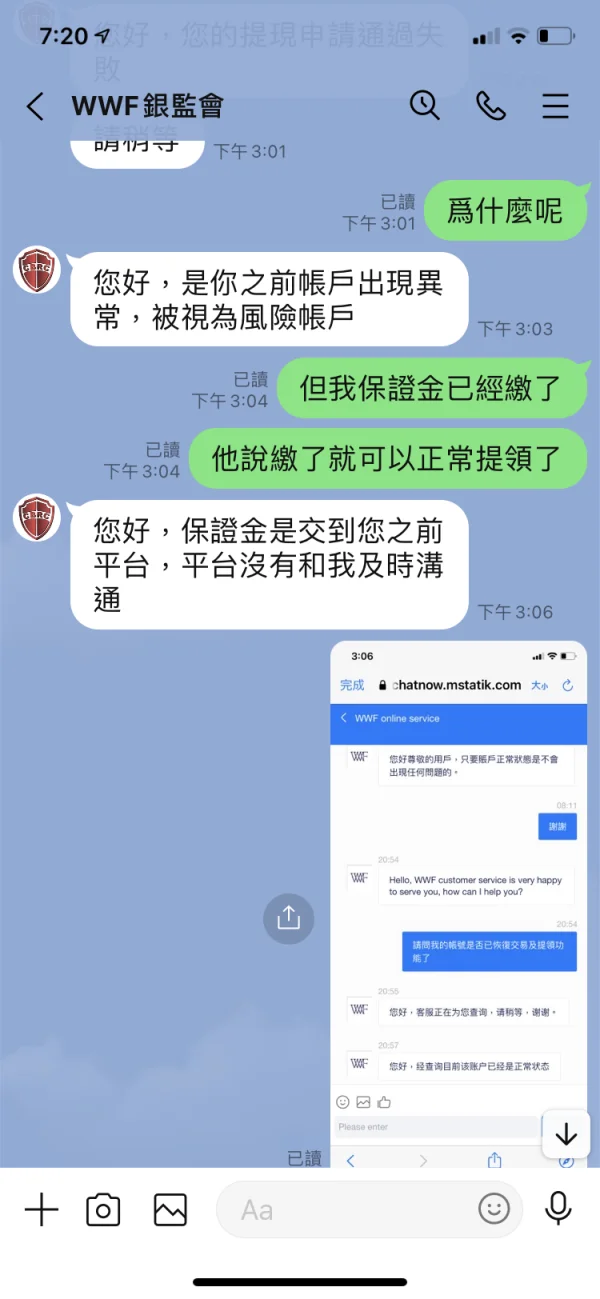

At the beginning, my friend introduced me to this and then told me that there was a bonus activity, but I did not have enough money that time so my friend deposit 1,600 dollars for me. After that, my account could not be withdrawn. After asking the customer service, he said that it was considered as malicious money laundering due to deposit by other people and ask me to make up the money. After completing the amount, it is also impossible to withdraw cash. I wans Informed that the account was temporarily frozen because of malicious money laundering and 10% margins fee of the deposit is required. After the payment is completed, the withdrawal is successful but not received. After inquiring, the customer service said that it is required to pay late fee due to the crowded Taiwan channel. Then, they gave me a line of BRC and said that it was a representative of the Banking Regulatory Commission in Taiwan. After the contact, they said that I need to pay 20% of the deposit for margin and another 5% for tax. I didn’t receive anything after finishing that. I asked the person of BRC and he gave me a phone number from the Financial Supervision and Administration Commission and said that he had arranged a withdrawal. If I did not receive it, I should contact Chen. The phone number is real but there is no more response when I asked his extension and his full name.

Exposure

FX3125782471

Vietnam

I have loaded into this scam application totaling nearly 67000 USDT and all withdrawals have been rejected. Don't be fooled by this app! ! ! I will post until I get my money back! ! ! ! !

Exposure

FX1855511657

Vietnam

I was lured into this scam by a Chinese. After several successful withdrawals, I was persuaded to put all my money into this fake application. This guy even insisted that I should use a credit card, borrow money from friends and so on, throwing everything into this. I lost to these scammers because they rejected all my withdrawal requests due to not paying taxes even if it was never mentioned anywhere. They said that taxes can only be paid by deposit. Now they just closed the chat with my customer service. They just want to steal your money, don't be fooled!

Exposure

honey91688

Philippines

THIS WWF PLATFORM TURN ME INTO HELL ! it’s a fake! & customer service cannot be contacted anymore, someone introduced me about this platform , & believing me that this platform for short term investment , suddenly now shut down, my fund cannot be withdrawn because customers services asking me to recharge it before withdrawal process , but I won’t do it because why I need to do that , this is not supposed the platform rules.

Exposure

rj99412

Taiwan

He was talking with you every day for two weeks will let you take your guard down and think that you have met true love. In the middle of knowing that you are disgusted with investment, you will not take the initiative to mention it. After two weeks, he will tell you not to save money stupidly for future investment. This is the first time he gives you a taste of the sweetness. The second time 150,000 your funds go in is the beginning of falling into hell. The recharge activity starts to ask you to recharge. After recharging to 600,000, you still can’t withdraw, saying that you need to get 600,000 to get promoted. Only gold members can withdraw cash. After arriving, I want to withdraw the full amount. I said that the amount is too high and I need to pay 240,000 yuan to the China Banking Regulatory Commission before I can get back the full amount. The other party will continue to instigate me to go to the bank during this period. Loan, credit card, borrow money from family members, etc., he will also tell you that he helped you borrow the money to help you recharge it, but these are just his methods to make you feel that he is living and dying with you. In fact, he wants you to take out more. At the end I said that he had no money and he was impatient and hung up. So far I can no longer contact people, and my reputation has dropped to the bottom.

Exposure

rj99412

Taiwan

To induce recharge activities, you must complete the recharge before you can withdraw it. After you complete the recharge, it says that there is no cash flow and you can't withdraw it. You need to continue the recharge before you can be promoted to a membership without restrictions. After you are promoted to a membership, you say that because the amount is too large, you need to pay a notary fee before you can recover the money again. The content time is short, It will take several days to raise funds to complete the impossible task.

Exposure