Company Summary

| Head & Shoulders Review Summary | |

| Founded | 1970 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC (Exceeded) |

| Trading Products | Securities, stocks, derivatives, bonds, ETFs, REITs |

| Demo Account | ❌ |

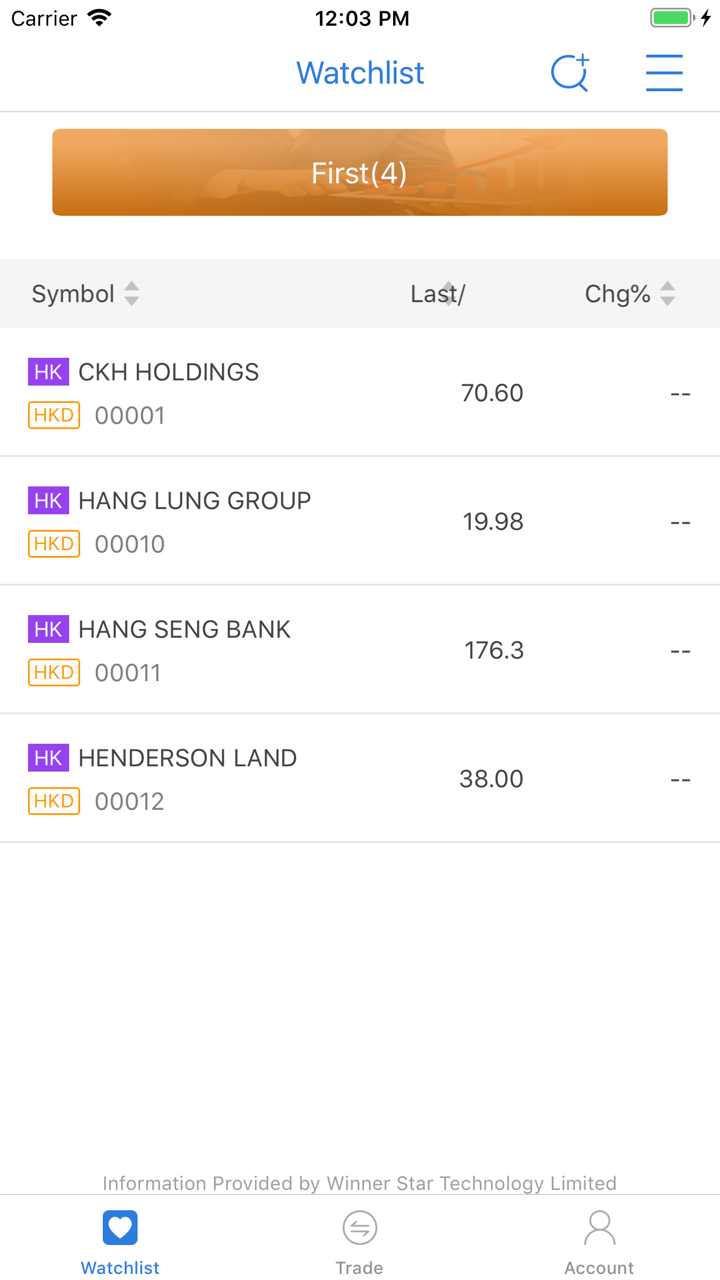

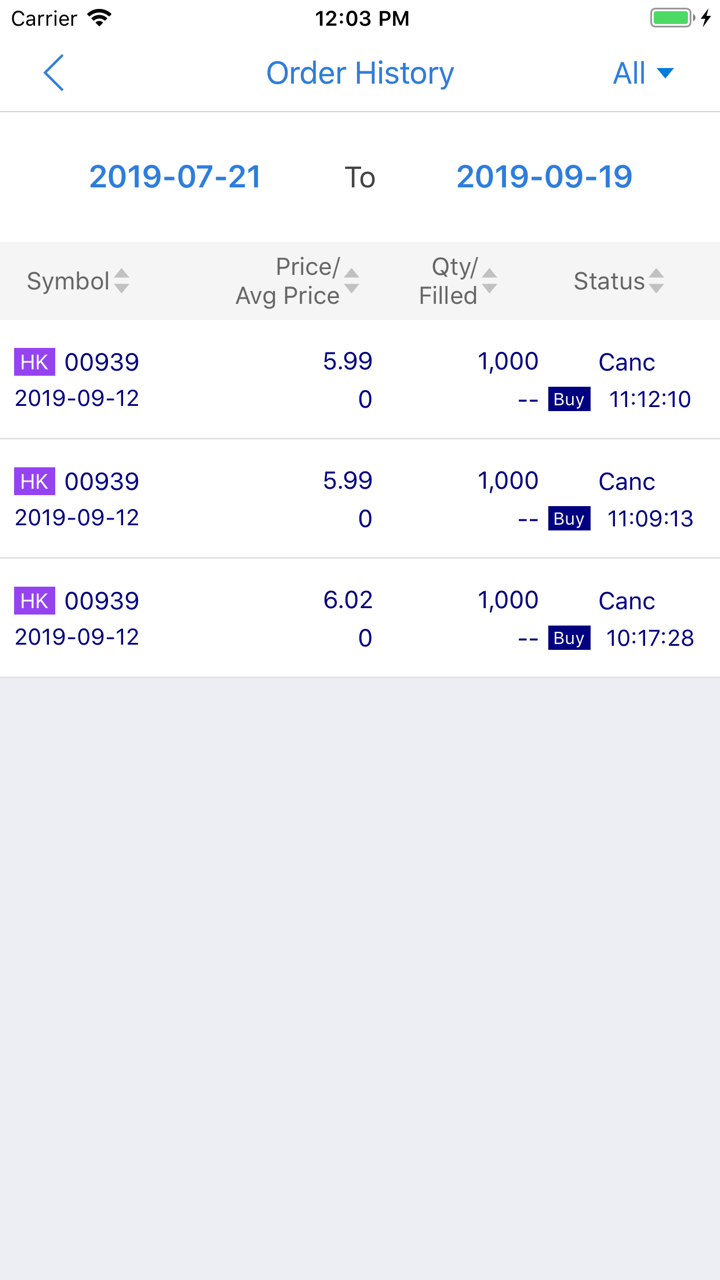

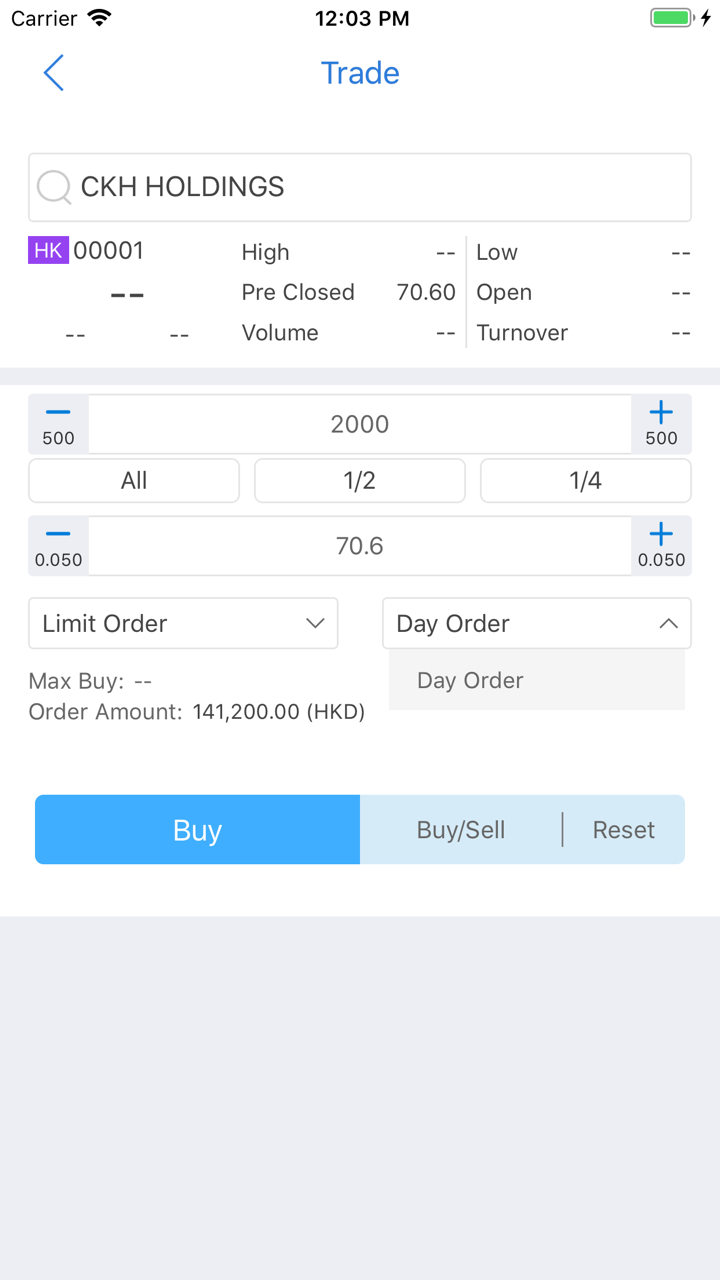

| Trading Platform | Online Trading Platform, AAStocks Real-time Quote, iOS Trading App, Android Trading App, eBrokerKey |

| Minimum Deposit | / |

| Customer Support | General tel: +852 3103-8388 |

| CS hotline: +852 3103-8386 | |

| Fax: +852 3103-8399 | |

| Email: info@headandshoulders.com.hk | |

Head & Shoulders Information

Head & Shoulders Securities Limited, incorporated in 1970 in Hong Kong, is regulated by the Securities and Futures Commission (SFC) under license AFS455, however its current licensing status is “Exceeded.” It provides securities trading and margin financing services for equities, derivatives, bonds, ETFs, and REITs, but does not offer demo or Islamic accounts.

Pros and Cons

| Pros | Cons |

| Long-established (since 1970) | License status currently “Exceeded” |

| Wide product range: stocks, derivatives, ETFs, REITs | No demo account, no Islamic account |

| Multiple trading platforms (web, mobile) | Minimum deposit not clearly mentioned |

Is Head & Shoulders Legit?

Head & Shoulders Securities Limited is a licensed entity controlled by the Securities and Futures Commission of Hong Kong with license number AFS455 for “Dealing in Securities.” However, the current license status is displayed as Exceeded.

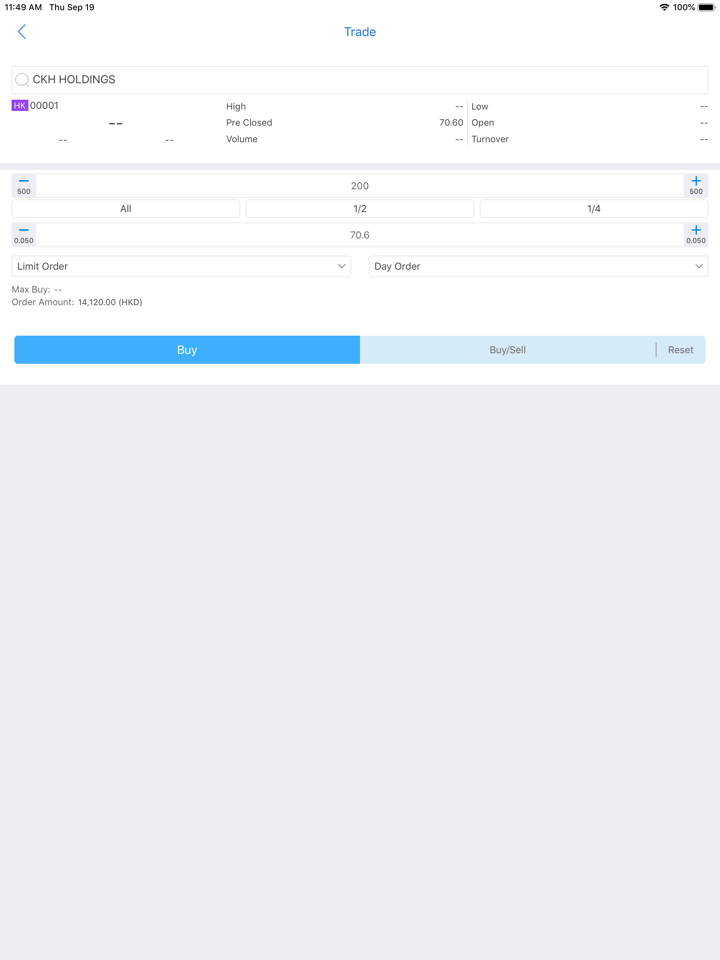

What Can I Trade on Head & Shoulders?

Head & Shoulders Securities Limited offers securities trading and margin financing services, covering stocks, derivatives, bonds, ETFs, and REITs.

| Trading Products | Supported |

| Stocks | ✔ |

| Derivatives (warrants, CBBC) | ✔ |

| Bonds (incl. inflation-linked) | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

| Forex | × |

| Commodities | × |

| Indices | × |

| Cryptocurrencies | × |

| Options | × |

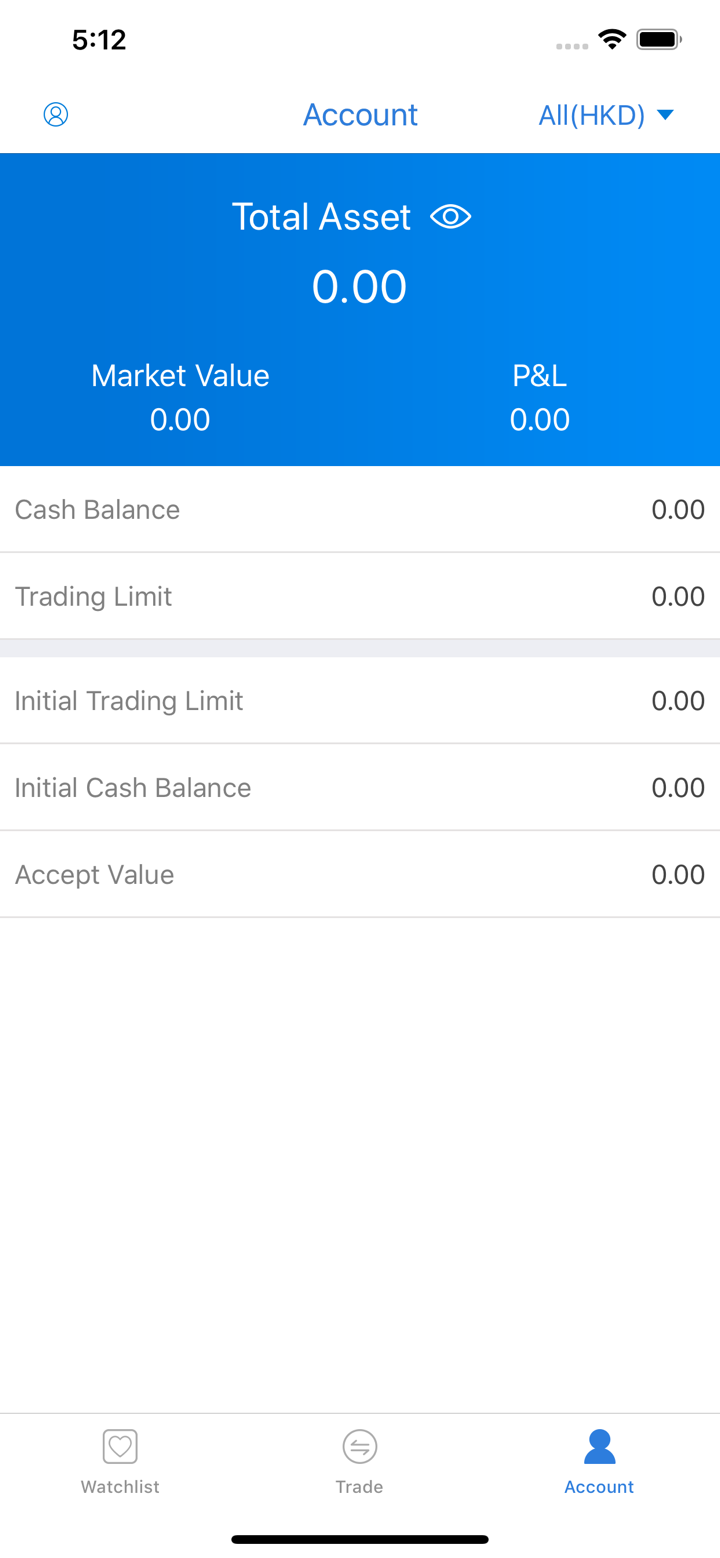

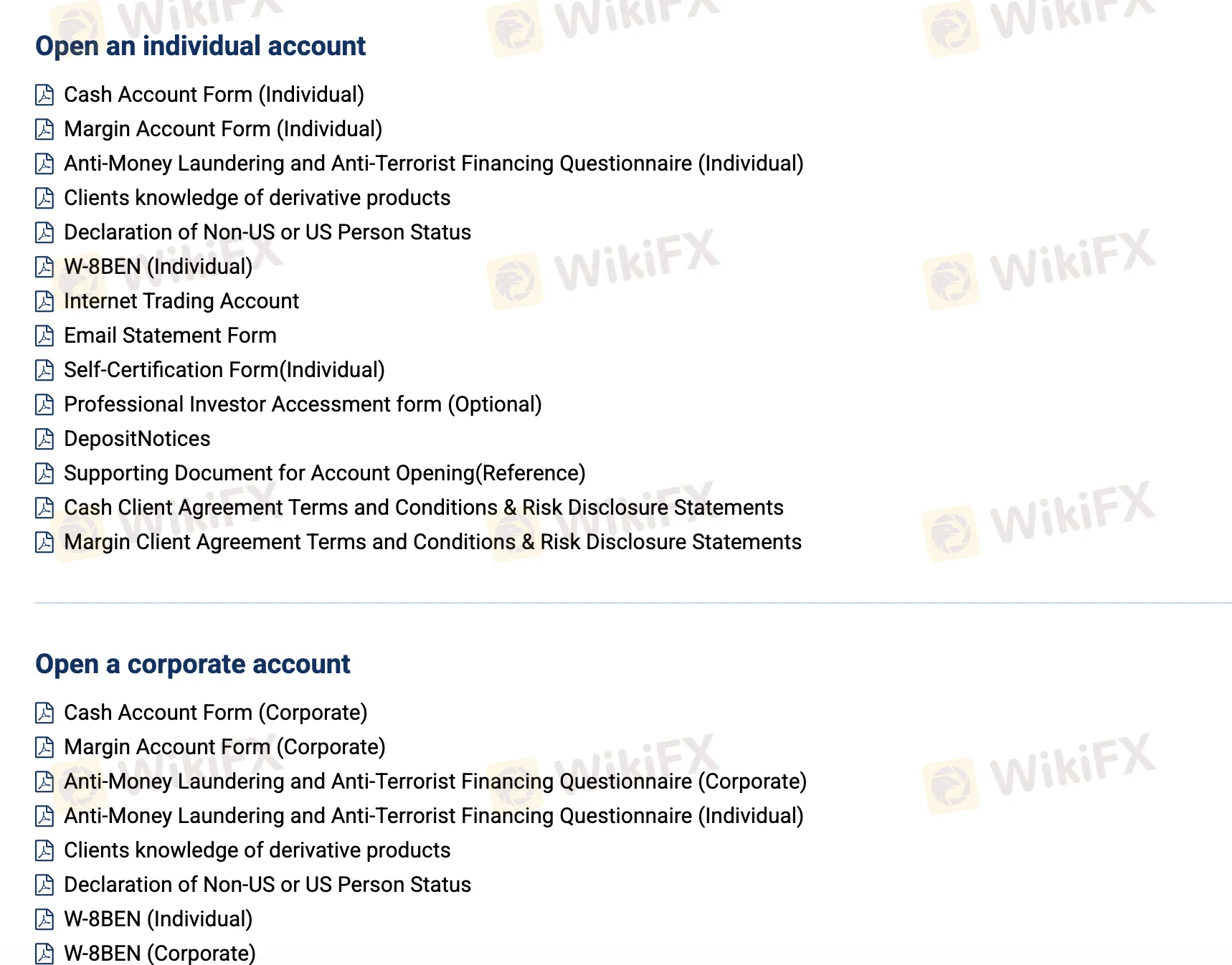

Account Type

Head & Shoulders Securities Limited provides two types of live accounts — cash and margin — to individual and business clients. They do not provide demo or Islamic accounts. Cash accounts are ideal for conservative or inexperienced traders, whilst margin accounts are ideal for experienced traders looking for leverage.

| Account Type | Suitable for |

| Individual Cash Account | Beginners or investors wanting to trade without leverage |

| Individual Margin Account | Experienced traders looking to trade on margin (with leverage) |

| Corporate Cash Account | Companies wanting to trade securities without using leverage |

| Corporate Margin Account | Companies seeking margin financing and leveraged trading |

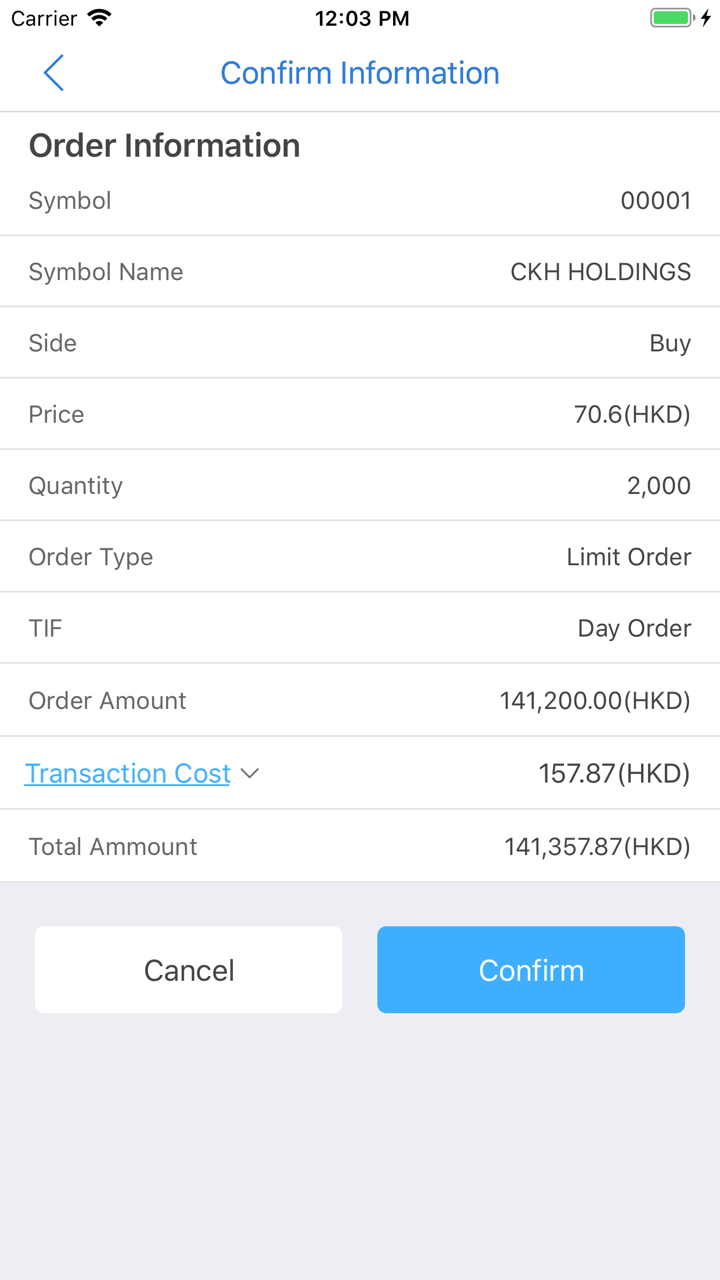

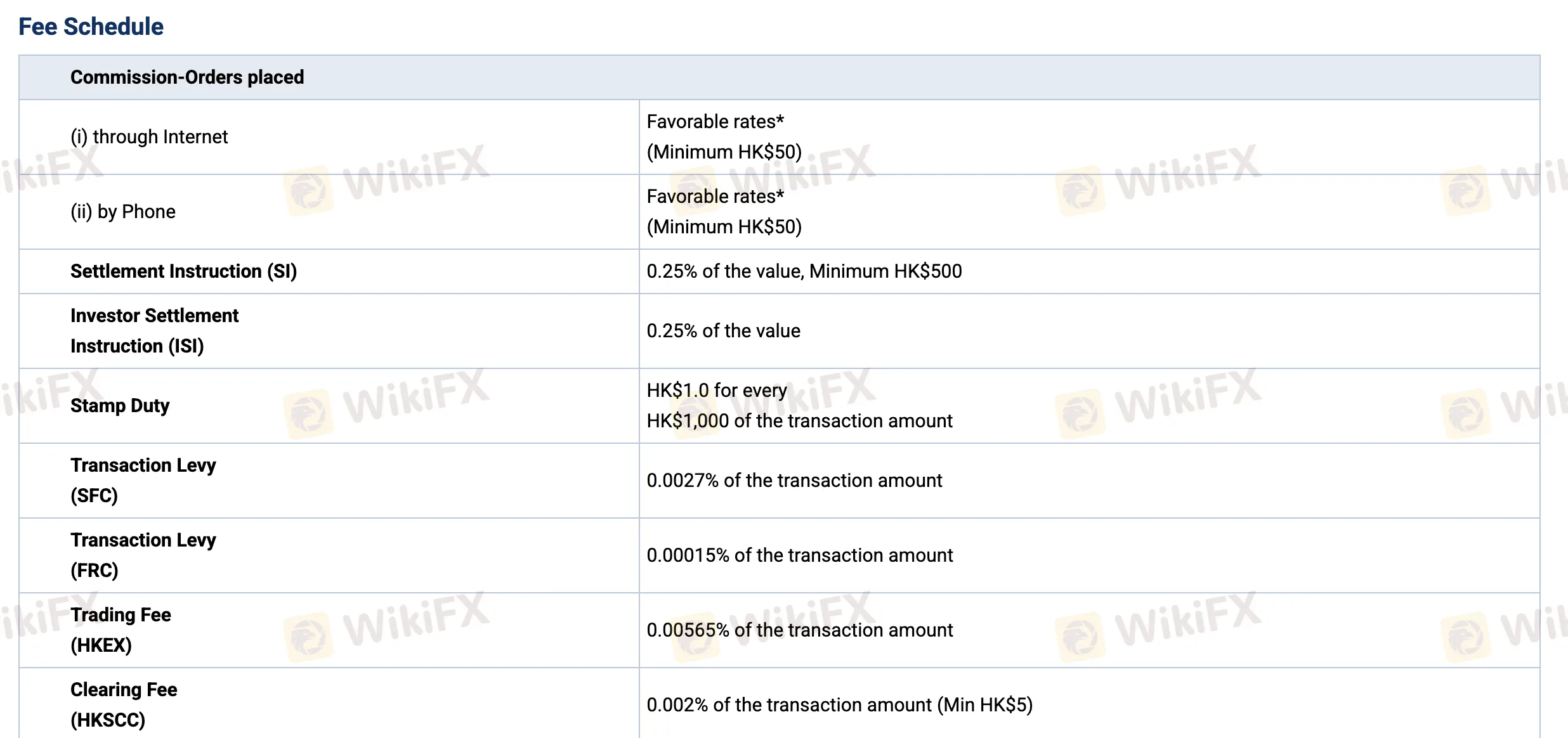

Head & Shoulders Fees

Head & Shoulders Securities Limited imposes costs that are comparable to or somewhat more than certain industry competitors.

| Fee Type | Details |

| Internet Orders | Favorable rates, min. HK$50 |

| Phone Orders | Favorable rates, min. HK$50 |

| Settlement Instruction (SI) | 0.25% of value, min. HK$500 |

| Investor Settlement (ISI) | 0.25% of value |

| Stamp Duty | HK$1 per HK$1,000 of transaction |

| Transaction Levy (SFC) | 0.0027% of transaction amount |

| Transaction Levy (FRC) | 0.00015% of transaction amount |

| Trading Fee (HKEX) | 0.00565% of transaction amount |

| Clearing Fee (HKSCC) | 0.002% of transaction amount, min. HK$5 |

| Physical Stock Deposit | HK$5 per lot (transfer deed stamp duty) |

| Physical Stock Withdrawal | HK$6 per lot |

| Cash Dividend Handling | 0.5% of dividend amount, min. HK$10 |

| Scrip Fee | HK$2.5 per lot (first time) |

| New Issues Handling Fee | HK$50 |

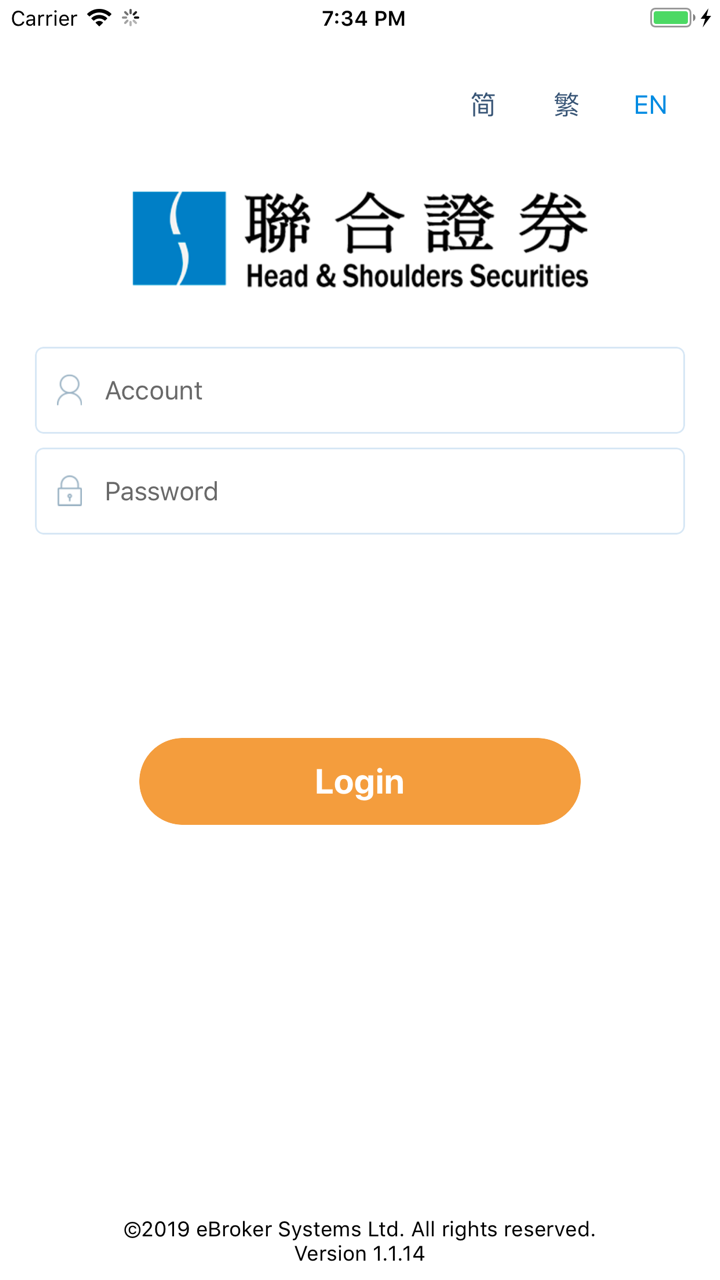

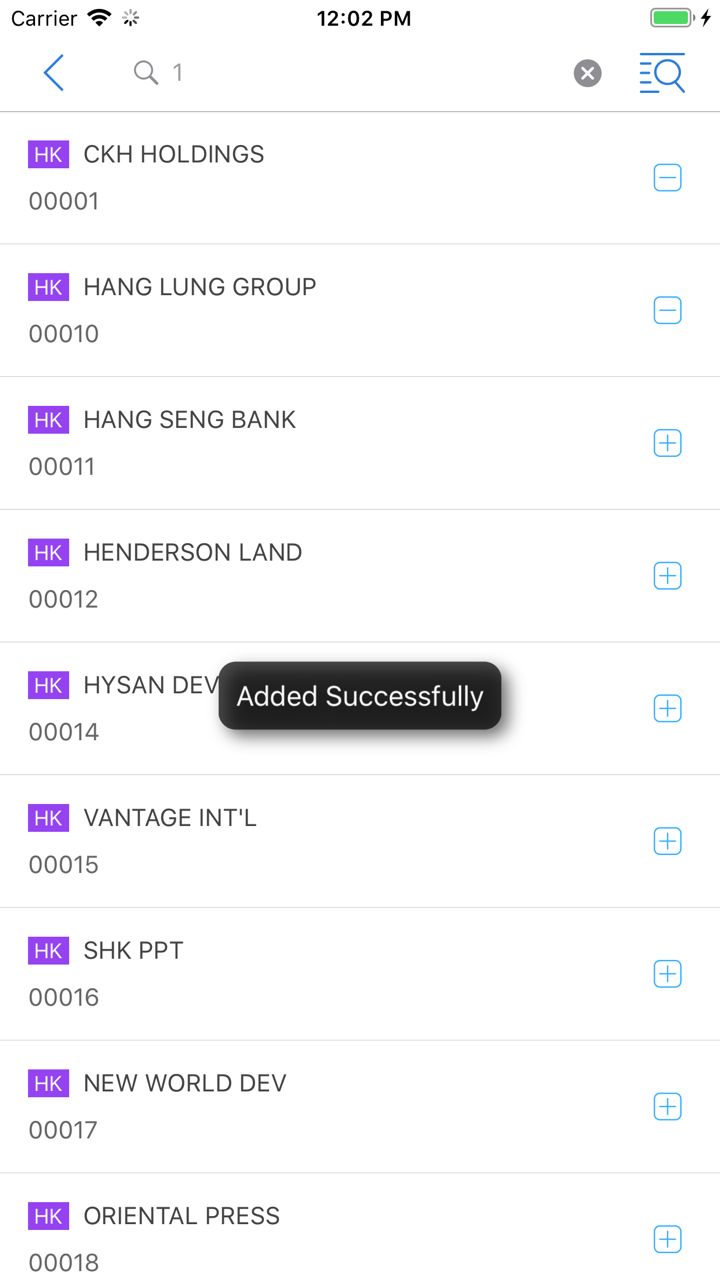

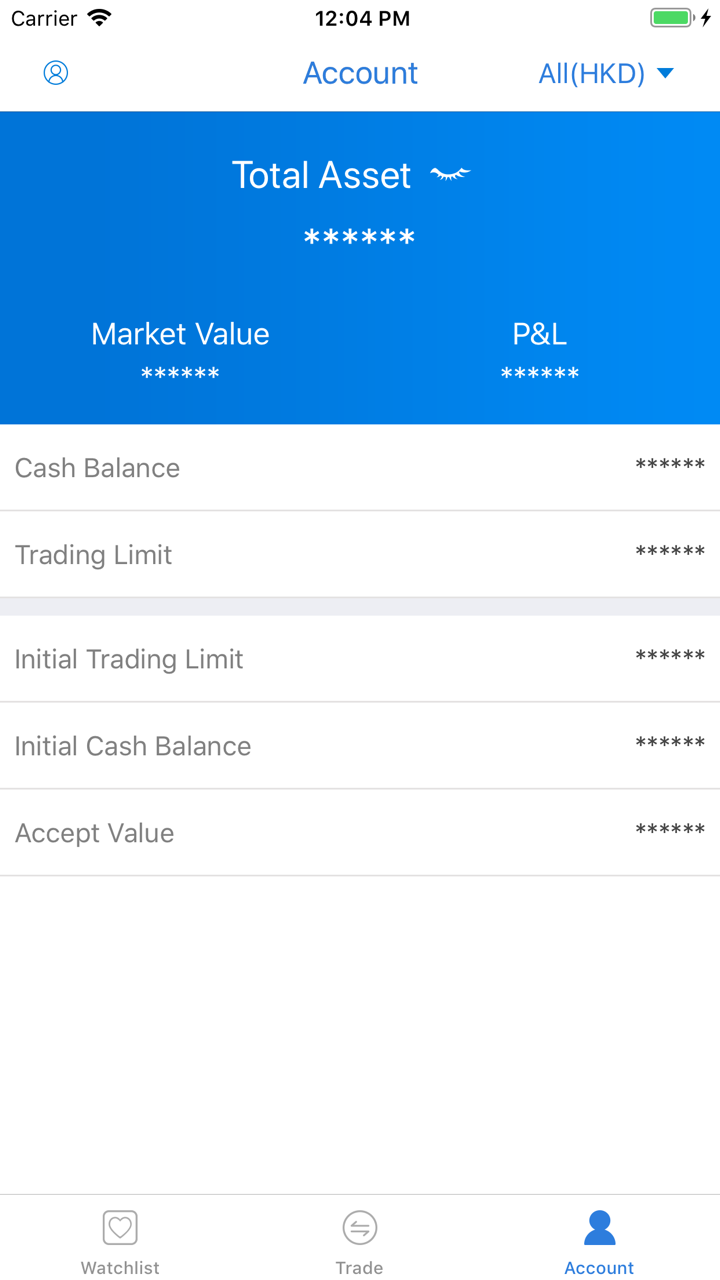

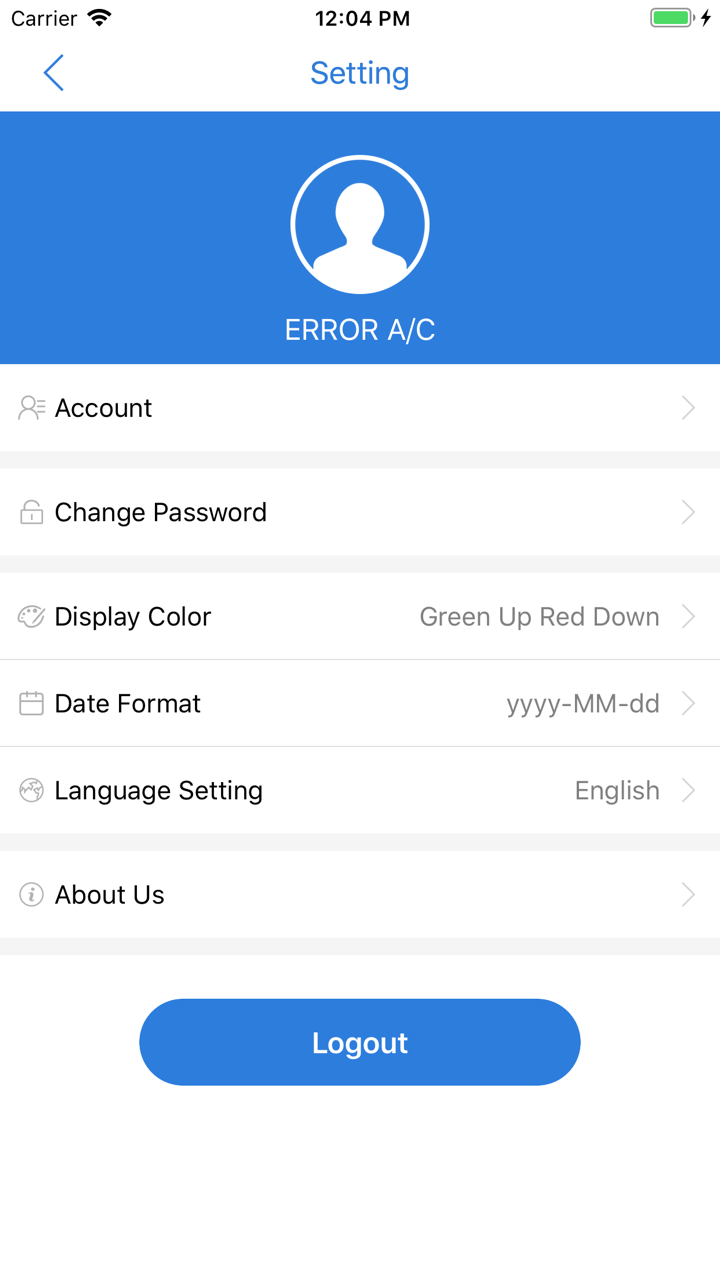

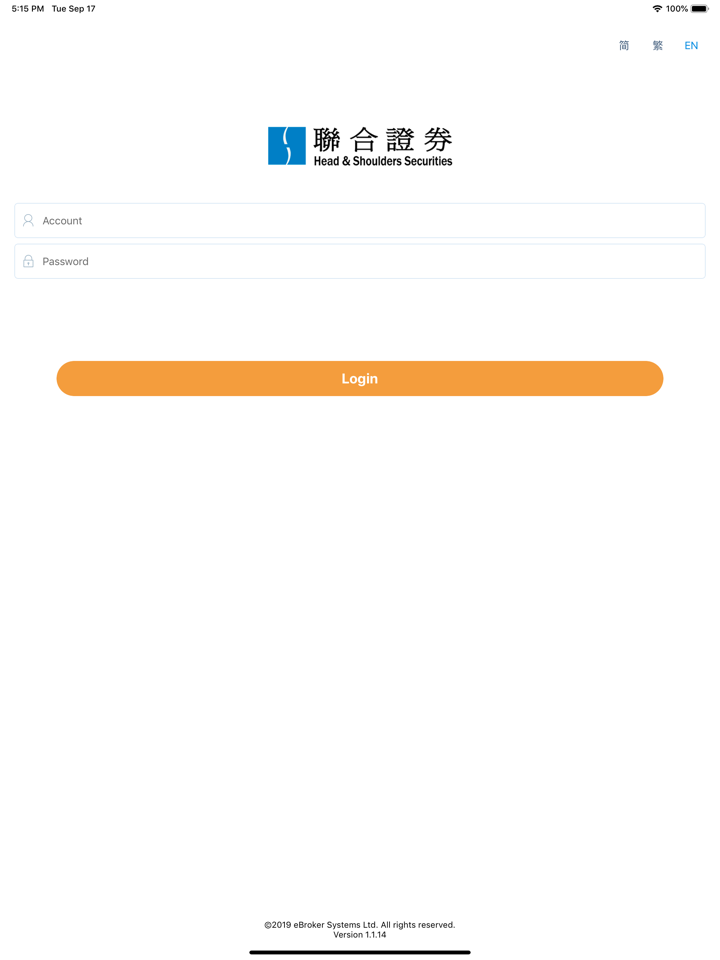

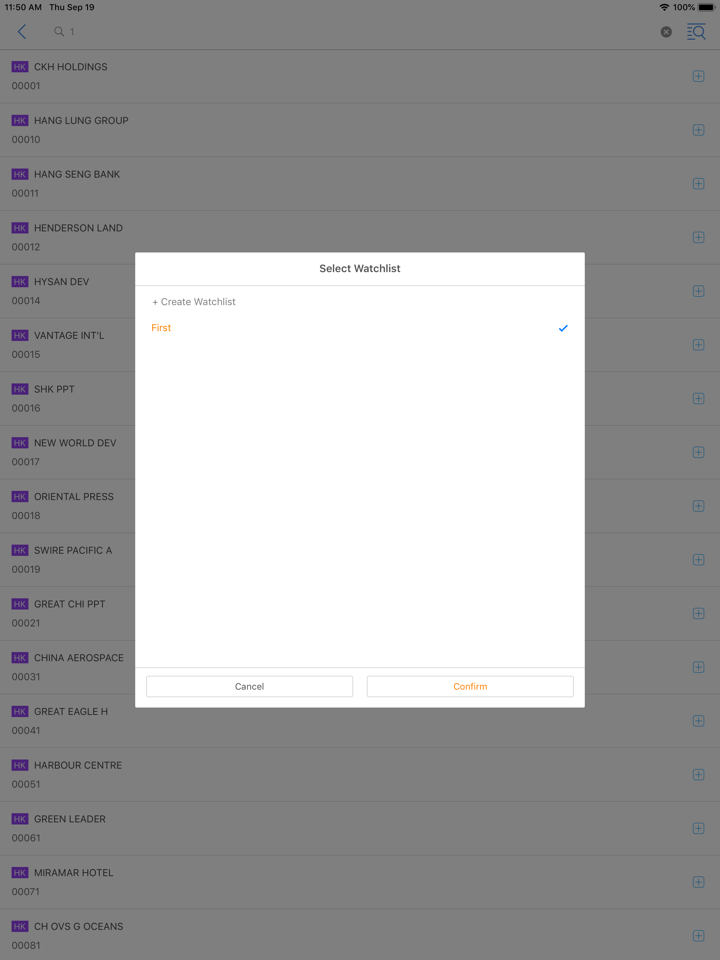

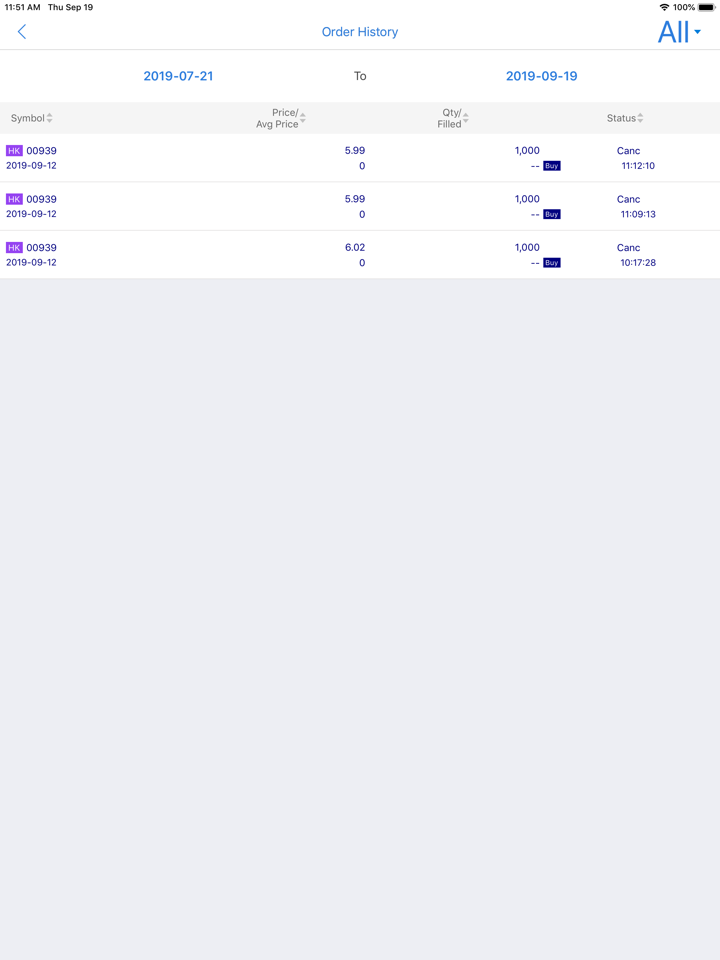

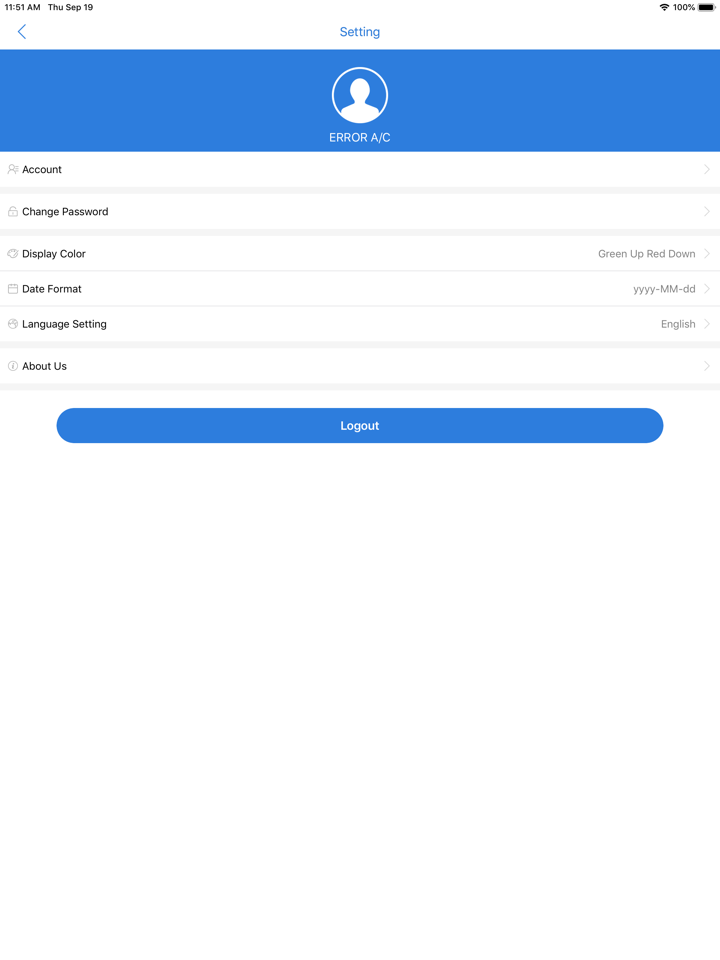

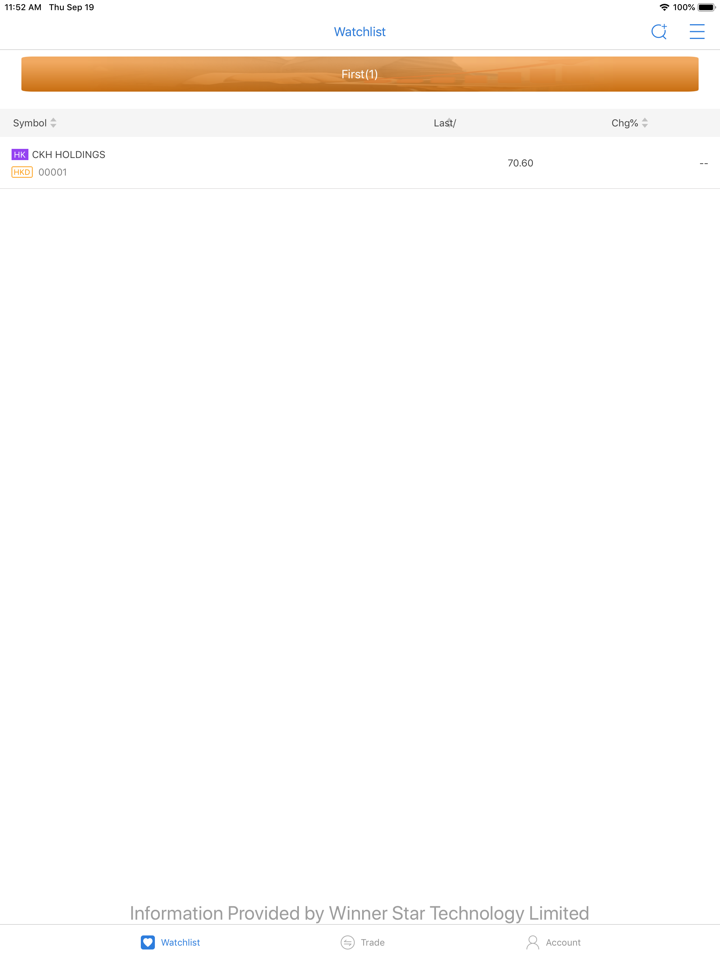

Trading Platform

| Trading Platform | Supported | Devices |

| Online Trading Platform | ✔ | Web |

| AAStocks Real-time Quote | ✔ | Web, Mobile App |

| iOS Trading App | ✔ | iOS |

| Android Trading App (APK) | ✔ | Android |

| eBrokerKey (iOS) | ✔ | iOS |

| eBrokerKey (Android) | ✔ | Android |

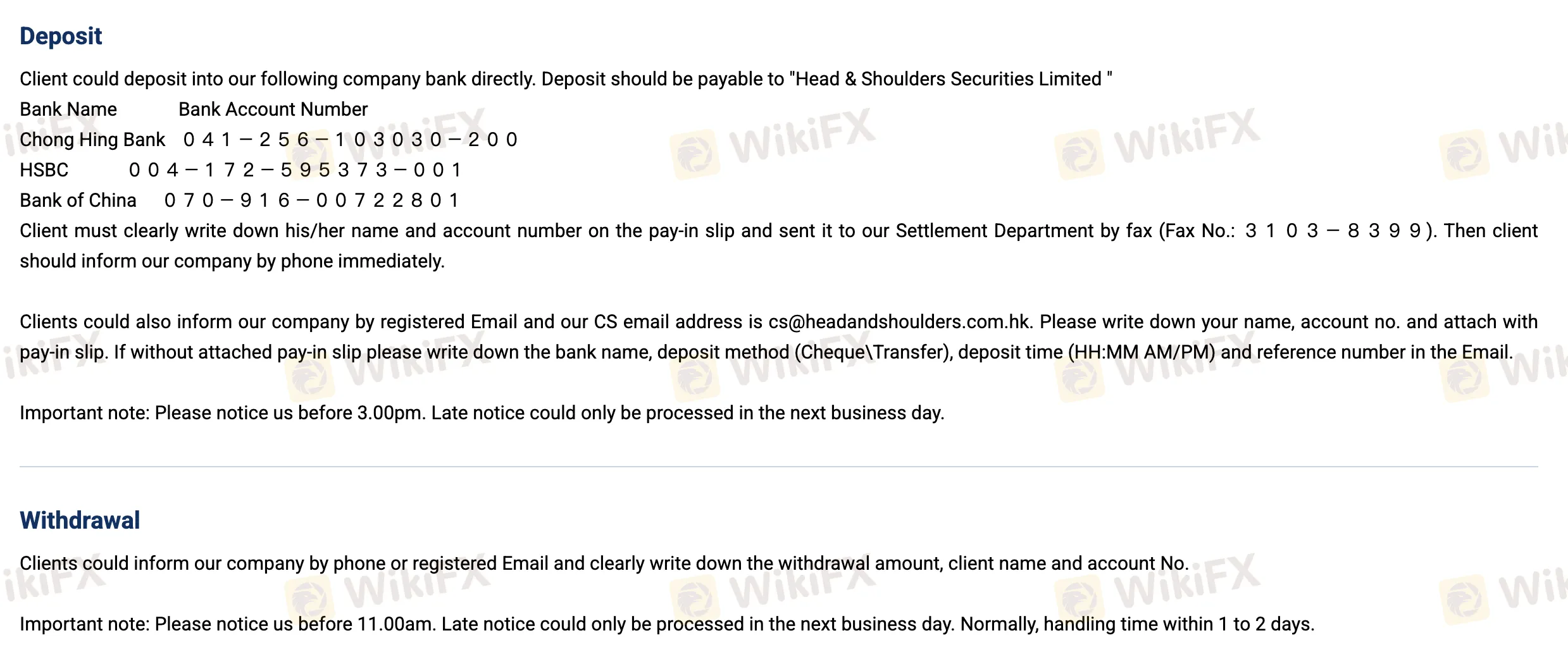

Deposit and Withdrawal

Head & Shoulders Securities Limited does not openly impose deposit or withdrawal fee. The minimum deposit amount is not clearly defined.

| Payment Options | Minimum Amount | Fees | Processing Time |

| Bank Transfer (Deposit) | / | / | Same business day if notified before 3:00 pm; otherwise next business day |

| Bank Transfer (Withdrawal) | 1–2 days if notified before 11:00 am; otherwise next business day |