Company Summary

| Point72 Review Summary | |

| Registered | 2010 |

| Registered Country/Region | United States |

| Regulation | SFC |

| Investments | Equities, global macro investments, systematic investments, venture capital |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | LinkadIn, Twitter, Facebook, Instagram, YouTube, Glassdoor |

Point72 Information

Point72 is a global alternative investment firm founded by Steven A. Cohen. It employs discretionary long/short equity, systematic, and macro investment strategies, complemented by a growing private market portfolio. The investment strategies offered include Discretionary Long/Short Equity, Systematic Investing, Global Macro, and Venture Capital & Private Investments.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | No fee information available |

| No direct contact channel |

Is Point72 Legit?

Point72 is a legitimate and compliant global investment firm, regulatedby Securities and Futures Commission of Hong Kong (SFC) under the license number AOB349, and subject to strict regulation. However, it only serves professional investors who meet regulatory requirements.

What Can I Trade on Point72?

Point72's investment strategy services include long/short equity investments. Global macro investments cover fixed income, forex, liquid credit, commodities, derivatives, etc. In addition, Cubist Systematic Strategies provides systematic investments, and Point72 Ventures offers venture capital and growth equity.

| Investment Strategies | Supported |

| Long/short equity investments | ✔ |

| Global macro investments | ✔ |

| Systematic investments | ✔ |

| Venture capital and growth equity | ✔ |

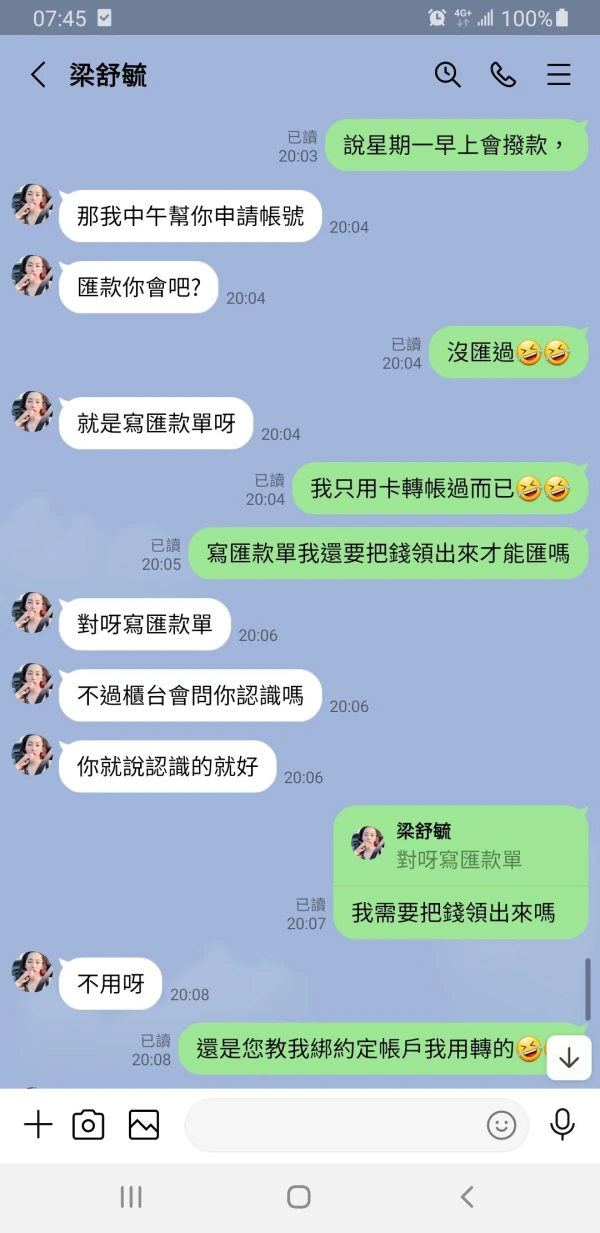

FX1123820651

Peru

The so-called company POINT 72, which operates through the GDCK platform, engages in fraudulent operations as follows: They give you a minimum bonus of $10 to teach you how to trade. Since they manipulate the platform, they make you win by sending entry and exit signals for cryptocurrencies for you to follow. As they make you profit, they then induce you to increase your capital. The advisor or manager, Anna Bansley, is the one who harassed me with messages to deposit more funds. It is worth noting that this person uses many different phone numbers, which I will attach as evidence. The capital you invest appears to grow very rapidly. However, once you have a substantial amount invested, even while following their instructions, you lose all your money in a matter of seconds. I was removed from the group where they issued signals for exposing their modus operandi and have been blocked from all their registered numbers. The total capital invested was approximately $15,000 USD between May and August of this year (2025). I am attaching one of the many deposit receipts as proof.

Exposure

FX3845532432

Peru

The broker Point72 through the GDCK pro platform does not allow transferring cryptocurrencies to Binance.

Exposure

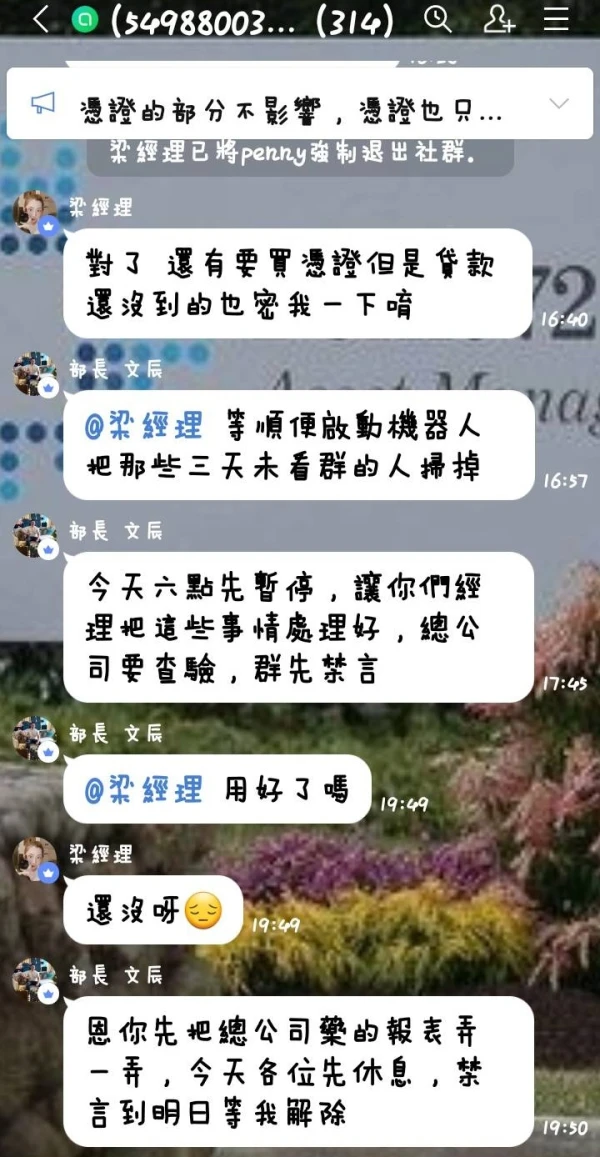

王兆雲

Taiwan

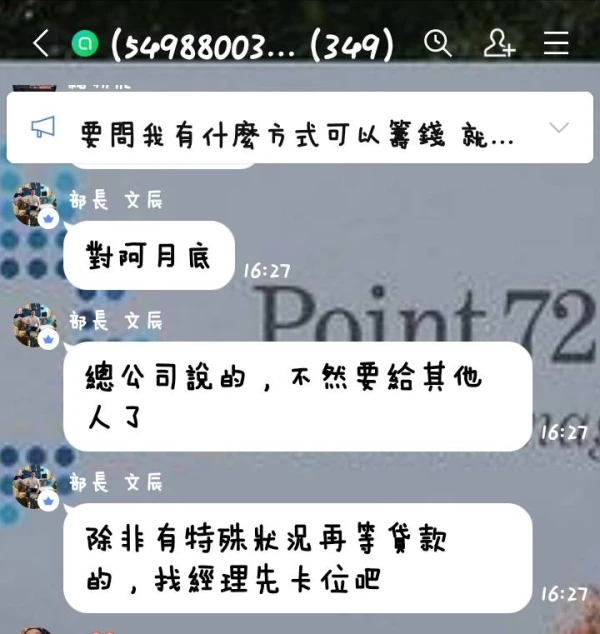

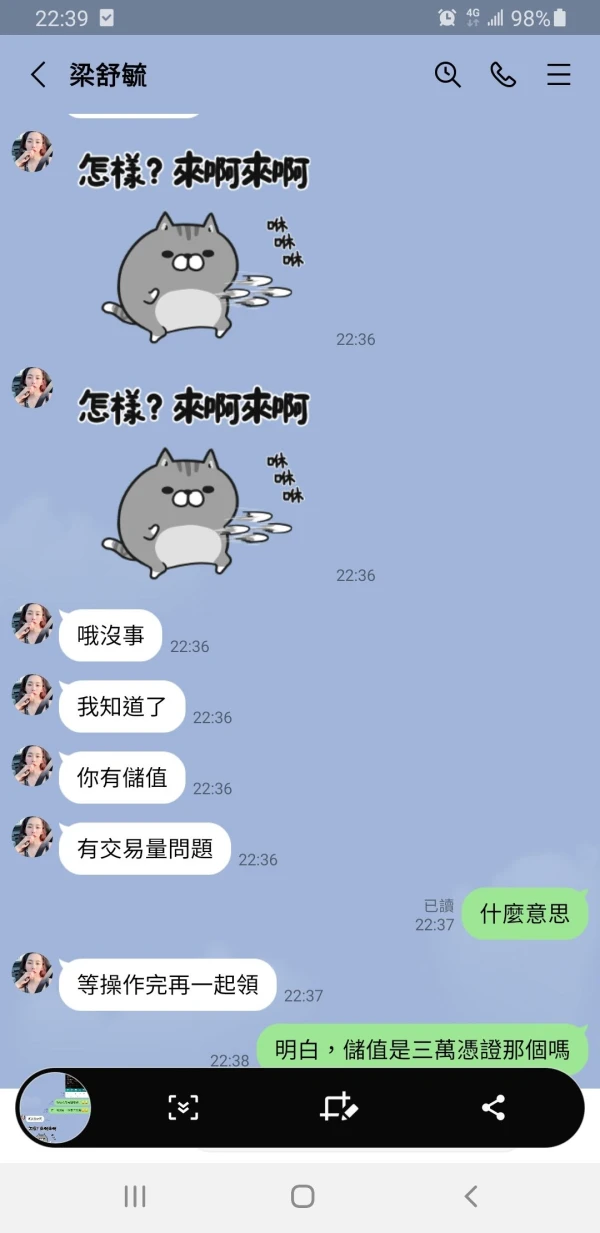

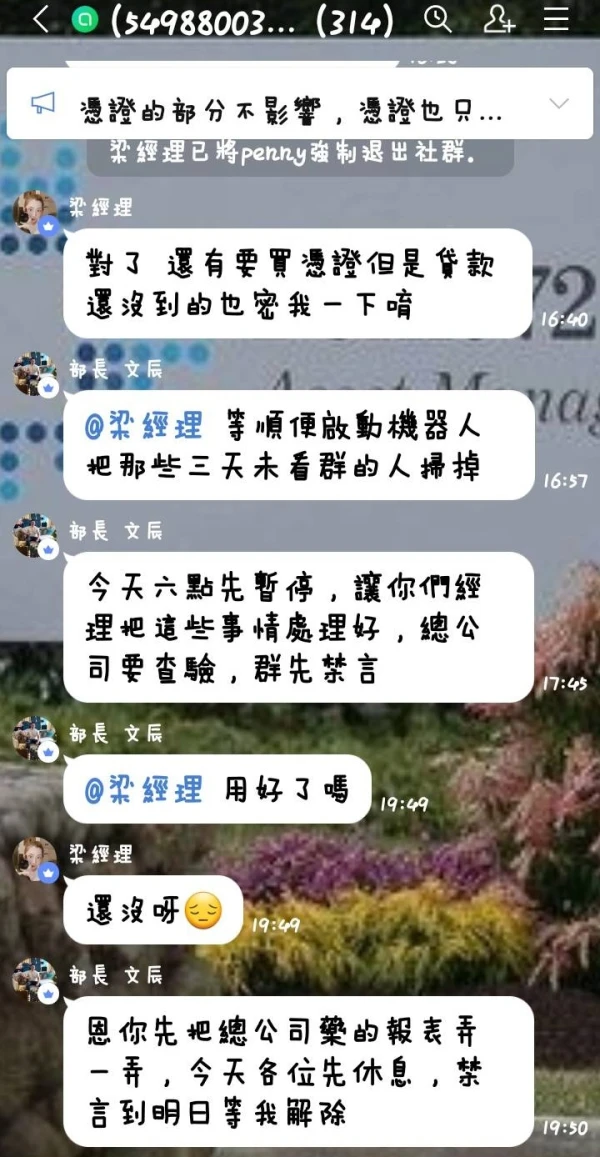

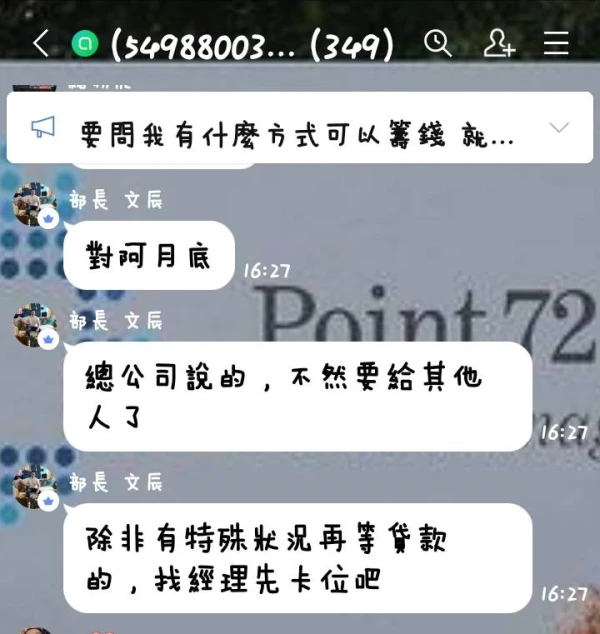

They added you on Facebook and pretended to be a company in Taiwan. They chatted in the group and persuaded you that they were real company. Beware of this scam.

Exposure

健乐

Tunisia

Point72 is a well-known hedge fund management company with rich investment experience and a strong professional team. Their website provides a wealth of investment information and resources, including the latest market news, data, and research reports. In addition, they provide some educational resources to help novice investors better understand and master investment knowledge and skills. In conclusion, Point72 is a very trustworthy and noteworthy investment institution.

Positive

陳王馬杰

Hong Kong

The content of this company's website is quite thin, without any regulatory information, and I have seen several people have been scammed. Danger! The only thing that might appeal to me is that it's been around for over 15 years, but that's nothing compared to security.

Positive

李惟

Taiwan

Someone cheated people in the name of American Bohao research company. They cheated me 100000 yuan.

Exposure

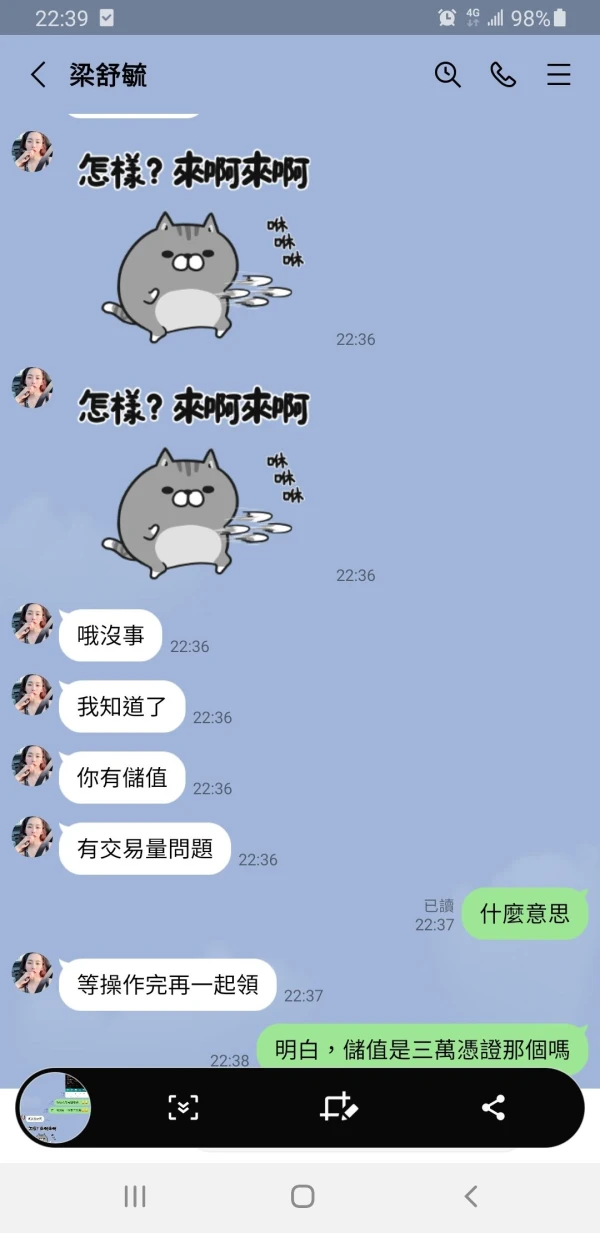

王兆雲

Taiwan

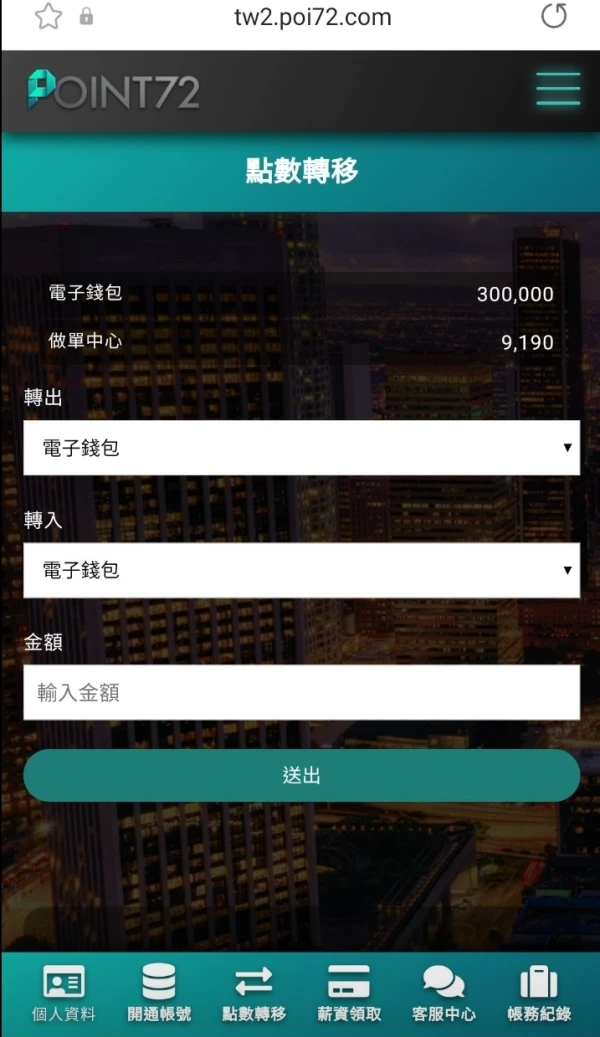

I deposited $1000 and wanted to withdraw when it increased to $2000. But the withdrawal was canceled. It changed website several times. Beware.

Exposure